|

市場調查報告書

商品編碼

1636471

亞太地區電動汽車電池製造:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia Pacific Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

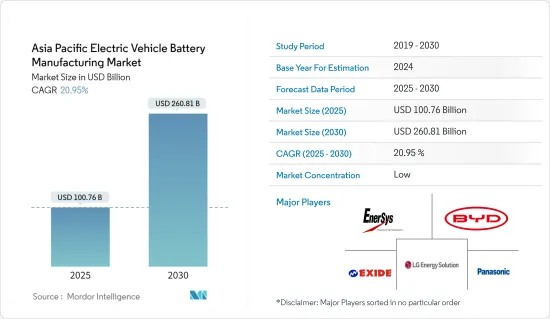

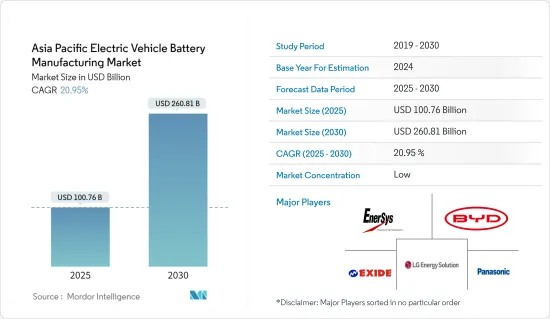

亞太地區電動汽車電池製造市場規模預計到2025年為1007.6億美元,預測期內(2025-2030年)複合年成長率為20.95%,到2030年預計達2608.1億美元。

主要亮點

- 從中期來看,增加投資以提高電池產能和降低電池原料成本預計將在預測期內推動電動車電池製造需求。

- 另一方面,傳統汽車因其高可靠性而銷量增加,預計將在預測期內對電動車電池市場產生負面影響。

- 然而,擴大產能、提高技術進步和降低成本等電動車的長期雄心勃勃的目標預計將在不久的將來為電動車電池製造市場提供重大機會。

- 在預測期內,由於電動車普及率不斷提高,印度成為亞太地區電動車電池製造市場成長最快的地區。

亞太地區電動汽車電池製造市場趨勢

鋰離子電池類型主導市場

- 鋰離子 (Li-ion) 電池徹底改變了電動車 (EV) 市場,並刺激了電池製造的創新。鋰離子電池的關鍵特性,如高能量密度、長循環壽命和快速充電,使其成為當今電動車的選擇。

- 此外,鋰離子二次電池具有優異的容量重量比,這使得它們優於其他技術。鋰離子二次電池往往比其他替代品更昂貴,但市場主要參與者正在增加研發投資和擴大生產,加劇競爭並壓低價格。

- 儘管電動車電池組和電池能源儲存系統(BESS)的平均價格有所上漲,但2023年電池價格仍大幅下降13%至139美元/kWh。據預測,這種下降趨勢預計將持續下去,到2025年將達到113美元/千瓦時,並在2030年進一步降至80美元/千瓦時。

- 在亞太地區,各國政府正在實施政策和獎勵,以促進電動車(EV)的普及並鼓勵增加鋰離子電池的產量。這些政府正在優先考慮研究和開發,以確定具有成本效益且易於獲得的鈷等昂貴稀有材料的替代品。這項策略不僅降低了製造成本,也確保了更永續的供應鏈。

- 例如,2024年5月,中國將投資約60億元人民幣(8.45億美元)開發下一代電動車(EV)電池技術,包括混合模式。 ASSB最尖端科技,透過固體組件增強了傳統鋰離子電池 (LIB) 的性能。與傳統電池相比,它們起火或爆炸的風險較低,並且具有優越的能量密度。這些創新預計將在未來幾年推動對先進鋰離子電池的需求,對該地區的電動車電池製造產生積極影響。

- 此外,鋰離子電池需求的激增正在推動被稱為「超級工廠」的大型生產設施的建立。這些專業設施旨在大量生產電池,確保我們能夠滿足電動車 (EV) 不斷成長的需求。該地區的主要企業推出了多個計劃來加強鋰離子電池製造。

- 例如,2024年2月,BMW宣布計畫在泰國羅勇興建新電池工廠。該公司預計泰國將成為亞太地區電動車電池的主要出口基地,進一步加強該地區的鋰離子電池供應。這些舉措將在未來幾年加速該國的電池生產。

- 因此,這些努力將擴大鋰離子電池的產量,並在預測期內顯著提高電動車電池的產能。

印度正在經歷顯著的成長

- 隨著印度採用更環保的行動解決方案,印度的電動車 (EV) 電池製造市場正在迅速擴大。這一成長是由政府舉措、電動車需求激增以及本地和國際參與者的大量投資所推動的。

- 隨著印度轉向清潔能源,大力投資電動車已成為許多公司的首要任務。該地區的電動車銷量正在飆升。例如,根據國際能源總署(IEA)的報告,2023年電動車銷量將達到8.2萬輛,比2022年成長70.8%,比2019年成長驚人的119倍。隨著政府最近推出多個計劃和舉措,電動車銷量有望實現更大成長。

- 印度國內和國際公司對電動車電池製造進行了大量投資。這些投資旨在加強該國的電動車基礎設施、減少對石化燃料的依賴並支持永續交通。在政府支持政策和激勵措施的推動下,印度正成為全球電動車領域的重要人物。

- 例如,2024年7月,Ola Electric宣布將投資1億美元興建位於印度泰米爾納德邦的超級工廠第一期工程。該工廠將生產國產鋰離子電池。該公司計劃在明年初之前從目前從韓國和中國進口的電池轉變為自己生產電動車電池。此舉將在未來幾年提高全國的電池產量。

- 此外,印度政府正在推出舉措,以增加電動車(EV)的使用並促進當地電池製造。這些措施包括對電動車購買者的補貼、對製造商的稅收減免以及增加充電基礎設施的投資。

- 例如,印度政府在 2023 年制定了一個雄心勃勃的目標,即到 2030 年使私家車銷量的 30%、商用車銷量的 70%、兩輪和三輪車的 80% 實現電動化。此外,政府還提供每千瓦時 10,000 印度盧比(120 美元)至 15,000 印度盧比(180 美元)的補貼獎勵措施。這些努力不僅會促進電動車的產量和需求,還會增加預測期內該地區對電池製造的需求。

- 因此,這些計劃和措施將增強電動車的需求,進而顯著增加未來幾年電動車電池的製造需求。

亞太地區電動汽車電池製造業概況

亞太地區的電動車電池製造市場已減少一半。主要企業(排名不分先後)包括比亞迪有限公司、LG Energy Solution、Exide Industries Ltd、EnerSys 和松下控股公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 投資增加電池產能

- 電池原物料成本下降

- 抑制因素

- 傳統汽車的高可靠性

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 透過電池

- 鋰離子

- 鉛酸電池

- 鎳氫電池

- 其他

- 依電池形狀分類

- 方形

- 袋型

- 圓柱形

- 搭車

- 客車

- 商用車

- 其他

- 透過促銷

- 電池電動車

- 油電混合車

- 插電式混合動力電動車

- 按地區

- 中國

- 印度

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- Panasonic Corporation

- LG Energy Solution

- EnerSys

- Exide Industries

- Contemporary Amperex Technology Co. Limited

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Samsung SDI

- SK Innovation Co., Ltd.

- Envision AESC

- Gotion High tech Co Ltd

- 其他知名企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

簡介目錄

Product Code: 50003738

The Asia Pacific Electric Vehicle Battery Manufacturing Market size is estimated at USD 100.76 billion in 2025, and is expected to reach USD 260.81 billion by 2030, at a CAGR of 20.95% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising investments to enhance the battery production capacity and the decline in the cost of battery raw materials are expected to drive the demand for electric vehicle battery manufacturing during the forecast period.

- On the other hand, increasing sales of conventional vehicles due to their high reliability is expected to have a negative impact on the EV battery market during the forecast period.

- Nevertheless, the long-term ambitious targets for electric vehicles, such as scaling up production capacity, enhancing technological advancements, and reducing costs, are expected to create significant opportunities for the electric vehicle battery manufacturing market in the near future.

- India is the fastest-growing region in Asia Pacific's electric vehicle battery manufacturing market during the forecast period due to the rising electric vehicle adoption.

Asia Pacific Electric Vehicle Battery Manufacturing Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion (Li-ion) batteries have revolutionized the electric vehicle (EV) market, driving innovations in battery production. Their key attributes, such as high energy density, long cycle life, and swift charging, make them the preferred choice for today's EVs.

- Moreover, lithium-ion rechargeable batteries surpass other technologies due to their excellent capacity-to-weight ratio. Although they tend to be more expensive than alternatives, major players in the market are boosting R&D investments and ramping up production, heightening competition and leading to price reductions.

- Despite rising average battery pack prices for EVs and battery energy storage systems (BESS), 2023 witnessed a significant drop in battery prices to USD 139/kWh, a 13% decline. Projections suggest this downward trajectory will persist, with prices anticipated to reach USD 113/kWh by 2025 and further plummet to USD 80/kWh by 2030, driven by relentless technological and manufacturing progress.

- In the Asia Pacific region, governments are implementing policies and incentives to promote electric vehicle (EV) adoption and stimulate Lithium-ion battery production growth. By prioritizing research and development, these governments seek to pinpoint cost-effective and readily available materials as substitutes for more expensive and scarce ones, such as cobalt. This strategy not only curtails manufacturing costs but also ensures a more sustainable supply chain.

- For example, in May 2024, China is set to invest approximately 6 billion yuan (USD 845 million) into pioneering next-generation battery technology for electric vehicles (EVs), encompassing hybrid models. ASSBs, a cutting-edge technology, enhance traditional lithium-ion batteries (LIBs) with solid components. They boast a reduced risk of fire or explosion compared to conventional batteries and offer superior energy density. Such innovations are poised to boost the demand for advanced lithium-ion batteries in the coming years, positively influencing EV battery manufacturing in the region.

- Furthermore, the surging demand for Li-ion batteries has catalyzed the establishment of large-scale production facilities, dubbed Gigafactories. These specialized facilities are engineered to produce battery cells en masse, ensuring they meet the escalating demand from electric vehicles (EVs). Major companies in the region are launching multiple projects to strengthen their lithium-ion battery manufacturing, anticipating a notable uptick in EV battery demand soon.

- For instance, in February 2024, BMW unveiled plans for a new battery factory in Rayong, Thailand, aiming to bolster the nation's battery supply chains. The company envisions Thailand as its primary export hub for EV batteries throughout the Asia Pacific, further strengthening the region's lithium-ion battery supply. Such initiatives are set to accelerate the country's battery production in the upcoming years.

- Consequently, these endeavors are poised to amplify lithium-ion battery production and substantially boost EV battery manufacturing capacity in the forecast period.

India to Witness Significant Growth

- India's electric vehicle (EV) battery manufacturing market is rapidly expanding as the nation embraces greener mobility solutions. This growth is fueled by government initiatives, a surging demand for electric vehicles, and substantial investments from both domestic and international players.

- As India pivots towards clean energy, the emphasis on electric vehicles has become paramount for numerous companies. EV sales in the region have skyrocketed. For instance, the International Energy Agency (IEA) reported that in 2023, electric vehicle sales reached 82,000 units, marking a 70.8% increase from 2022 and a staggering 119-fold jump since 2019. With the government recently launching multiple projects and initiatives, EV sales are poised for further significant growth.

- India has seen a wave of investments in EV battery manufacturing, both from domestic entities and international firms. These investments aim to strengthen the nation's electric vehicle infrastructure, lessen reliance on fossil fuels, and champion sustainable transportation. Bolstered by supportive government policies and incentives, India is carving out a prominent position in the global EV landscape.

- For example, in July 2024, Ola Electric unveiled a USD 100 million investment for the first phase of its gigafactory in Tamil Nadu, India. This facility will produce indigenous lithium-ion batteries. The company plans to transition to its battery cells for its electric vehicles by early next year, moving away from current imports from Korea and China. Such moves are set to ramp up battery production nationwide in the coming years.

- Additionally, the Indian government has rolled out initiatives to promote electric vehicle (EV) adoption and stimulate local battery manufacturing. These measures encompass subsidies for EV purchasers, tax breaks for manufacturers, and bolstered investments in charging infrastructure.

- As an illustration, the Indian government, in 2023, set ambitious targets: by 2030, they aim for EVs to constitute 30% of private car sales, 70% of commercial vehicles, and 80% of two and three-wheelers. Furthermore, the government is offering subsidy incentives ranging from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180). Such initiatives are poised to not only boost EV production and demand but also amplify the need for battery manufacturing in the region during the forecast period.

- Consequently, these projects and initiatives are set to bolster EV demand and, in turn, significantly elevate the need for EV battery manufacturing in the coming years.

Asia Pacific Electric Vehicle Battery Manufacturing Industry Overview

Asia Pacific's electric vehicle battery manufacturing market is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, LG Energy Solution, Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 High reliability on Conventional Vehicle

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Australia

- 5.5.4 Malaysia

- 5.5.5 Thailand

- 5.5.6 Indonesia

- 5.5.7 Vietnam

- 5.5.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Panasonic Corporation

- 6.3.3 LG Energy Solution

- 6.3.4 EnerSys

- 6.3.5 Exide Industries

- 6.3.6 Contemporary Amperex Technology Co. Limited

- 6.3.7 Tianjin Lishen Battery Joint-Stock Co., Ltd.

- 6.3.8 Samsung SDI

- 6.3.9 SK Innovation Co., Ltd.

- 6.3.10 Envision AESC

- 6.3.11 Gotion High tech Co Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219