|

市場調查報告書

商品編碼

1636568

英國充電電池:市場佔有率分析、產業趨勢與成長預測(2025-2030)United Kingdom Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

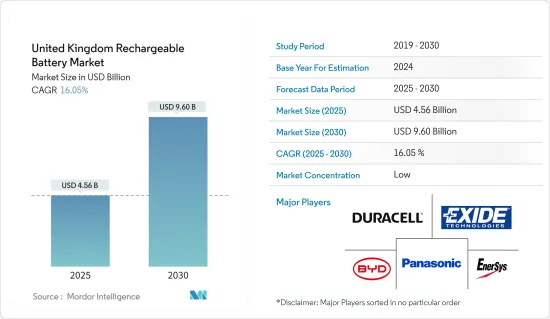

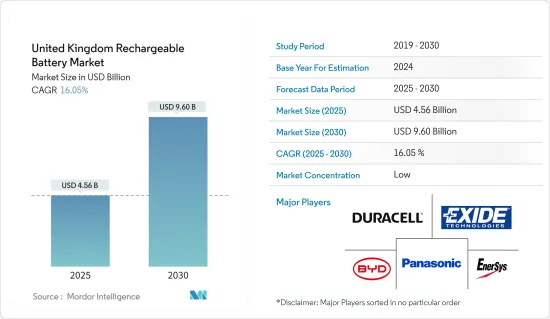

英國充電電池市場規模預估至2025年為45.6億美元,預估至2030年將達96億美元,預測期間(2025-2030年)複合年成長率為16.05%。

主要亮點

- 從中期來看,電動車(EV)普及率的上升和鋰離子電池價格的下降預計將在預測期內推動可充電電池的需求。

- 另一方面,蘊藏量的缺乏可能會嚴重限制英國充電電池市場的成長。

- 智慧型手錶、無線耳機、智慧手環等穿戴式裝置的日益普及預計將在不久的將來為可充電電池市場的參與企業創造巨大的商機。

英國充電電池市場趨勢

鋰離子電池類型主導市場

- 由於其卓越的容量重量比,鋰離子電池比其他技術更受歡迎。此外,使用壽命長、維護成本低、保存期限延長和價格顯著下降等優點進一步推動了英國對鋰離子電池的需求。

- 鋰離子電池傳統上比同類電池更貴,但產業主要企業正在加大投資。對實現規模經濟和加強研發力度的關注加劇了競爭,並顯著降低了鋰離子電池的價格。

- 2023年,鋰離子電池價格跌至139美元/kWh,降幅超過13%。隨著技術創新和製造的不斷進步,預計到2025年價格將進一步降至113美元/千瓦時,並在2030年達到80美元/度。

- 對鋰離子電池的需求正在迅速增加,因為它們在向可再生能源和電動車的轉變中發揮關鍵作用。鑑於太陽能和風能等再生能源來源的間歇性,迫切需要可靠的能源儲存。鋰離子電池在能源儲存系統中發揮重要作用,有助於平衡供需、確保電網穩定。

- 政府在加強國內電池能源儲存能力方面正在取得重大進展。主要公司正在開發旨在提高儲能系統容量的計劃。例如,2024年3月,清潔能源巨頭NatPower集團旗下子公司NatPower UK宣布計劃在全國投資超過100億英鎊(120億美元)用於電池儲存系統。這項雄心勃勃的計劃旨在將電池容量增加 60GWh,並將在英國電網新變電站投資 6 億英鎊(7.66 億美元)作為補充。預計此類業務將在預測期內推動儲能設施中對鋰離子電池的需求。

- 為了壯大鋰離子電池市場,各國政府正大力投資並積極推動可充電鋰離子電池的生產。例如,2023 年 11 月,英國政府宣布投資 5,000 萬英鎊(6,300 萬美元),以加強以鋰離子電池為中心的彈性電池供應鏈,以實現該國雄心勃勃的電動車生產目標。 2030 年電池策略承諾對零排放汽車、電池及其供應鏈提供有針對性的支持,包括未來五年的新資本和研發資金。這些戰略投資和獎勵將加速英國的電池生產並增加對鋰離子電池的需求。

- 鑑於這些發展,鋰離子充電電池的前景在預測期內仍然樂觀。

電動車的普及正在推動市場

- 長期以來,內燃機汽車(ICE)一直佔據市場主導地位。然而,隨著人們對環境的關注日益增加,人們明顯轉向電動車 (EV)。電動車的主流使用鋰離子充電電池,因其能量密度高、重量輕、自放電低、維護要求低而受到青睞。

- 鋰離子充電電池系統為插電式混合動力汽車汽車和電動車提供動力。無與倫比的能量密度、快速充電能力和強大的放電功率使鋰離子電池成為唯一滿足OEM續航里程和充電時間標準的技術。相比之下,鉛基動力電池由於重量重且能效低,不適合全混合動力汽車或電動車。

- 近年來,英國電動車的採用迅速增加。國際能源總署(IEA)報告顯示,2023年純電動車銷量將達31萬輛,較2022年成長14.8%。據預測,未來幾年全部區域的電動車銷量將大幅成長。

- 英國政府推出了多項措施支持電動車(EV)並加速向低碳交通轉型。這些努力正在增加對鋰離子電池的需求。 2023年,政府宣布了一項雄心勃勃的計劃,以提高電動車產量並加速實現零碳排放。

- 英國制定了零排放汽車(ZEV)指令,目標是到 2030 年使 80% 的新車和 70% 的新貨車實現零排放,並在 2035 年實現全面轉型。此外,到2030年,將禁止推出新的汽油車、柴油車和貨車,到2035年,所有新車都必須配備零排放尾管。這些措施不僅將促進電動車的生產和銷售,還將在未來幾年大幅增加對充電電池的需求。

- 該地區的主要企業正在進行大量投資並推出計劃以擴大電動車生產。例如,2023 年 11 月,日產宣布與合作夥伴共同投資 20 億英鎊(25 億美元),在其工廠生產三款電動車車型,包括 Qashqai 和 Juke。此外,日產還撥款 11.2 億英鎊(14 億美元)為其英國工廠和供應鏈準備這些新車型。這些努力支持了鋰離子電池需求的預期激增。

- 鑑於這些努力,很明顯,電動車銷量、充電基礎設施和可充電電池的需求將在預測期內顯著增加。

英國充電電池產業概況

英國充電電池市場已減少一半。主要企業(排名不分先後)包括比亞迪有限公司、金霸王公司、Exide Technologies、EnerSys 和松下控股公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車 (EV) 的擴張

- 鋰離子電池價格下降

- 抑制因素

- 原料蘊藏量不足

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 科技

- 鋰離子

- 鉛酸電池

- 其他技術(NiMh、Nicd 等)

- 目的

- 汽車電池

- 工業電池(用於電源、固定電池(電信、UPS、能源儲存系統(ESS) 等)

- 手提電池(家用電子電器產品等)

- 其他

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Energizer

- Exide Technologies

- Saft Groupe SA

- AMTE Power

- Brill Power

- Eelpower

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 擴大穿戴式裝置的採用

簡介目錄

Product Code: 50004074

The United Kingdom Rechargeable Battery Market size is estimated at USD 4.56 billion in 2025, and is expected to reach USD 9.60 billion by 2030, at a CAGR of 16.05% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) adoption and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the United Kingdom's rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

United Kingdom Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion batteries are outpacing other technologies in popularity due to their superior capacity-to-weight ratio. Further, advantages like longevity, low maintenance, an extended shelf life, and a notable drop in prices are further fueling the demand for lithium-ion batteries in the United Kingdom.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, key industry players have been ramping up investments. Their focus on achieving economies of scale and bolstering R&D efforts has intensified competition, leading to a notable dip in lithium-ion battery prices.

- In 2023, lithium-ion battery prices fell to USD 139/kWh, marking a decline of over 13%. With ongoing technological innovations and manufacturing advancements, projections suggest prices will further drop to USD 113/kWh by 2025 and reach USD 80/kWh by 2030.

- The surging demand for lithium-ion batteries is largely attributed to their pivotal role in the shift towards renewable energy and electric mobility. Given the intermittent nature of renewable sources like solar and wind, there's a pressing need for dependable energy storage. Lithium-ion batteries play a crucial role in energy storage systems, helping to balance supply and demand and ensuring grid stability.

- The government is making significant strides in bolstering the country's battery energy storage capacity. Major corporations are rolling out projects aimed at amplifying storage system capacities. A case in point: In March 2024, NatPower UK, a subsidiary of the clean energy giant NatPower Group, unveiled plans to invest over GBP 10 billion (USD 12 billion) in battery energy storage systems nationwide. The ambitious project aims to boost battery capacity by 60 GWh, complemented by an investment of GBP 600 million (USD 766 million) for new substations in the United Kingdom's electricity grid. Such undertakings are poised to elevate the demand for lithium-ion batteries in storage facilities during the forecast period.

- In a bid to bolster the lithium-ion battery market, governments are rolling out substantial investments and actively promoting the production of rechargeable lithium-ion batteries. For instance, in November 2023, the UK government pledged an investment of GBP 50 million (USD 63 million) to fortify a resilient battery supply chain, emphasizing lithium-ion batteries, in alignment with the nation's ambitious EV production goals. The Battery Strategy, set to run until 2030, promises targeted support for zero-emission vehicles, batteries, and their supply chains, including fresh capital and R&D funding over the next five years. Such strategic investments and incentives are poised to supercharge battery production in the United Kingdom, subsequently amplifying the demand for lithium-ion batteries.

- Given these developments, the outlook for lithium-ion rechargeable batteries remains bullish during the forecast period.

Increasing Adoption of Electric Vehicle to Drive the Market

- For a long time, vehicles with internal combustion engines (ICE) dominated the market. However, as environmental concerns grow, there's a notable shift towards electric vehicles (EVs). Predominantly, EVs utilize lithium-ion rechargeable batteries, favored for their high energy density, lightweight nature, minimal self-discharge, and low maintenance needs.

- Lithium-ion battery systems are the driving force behind plug-in hybrids and electric vehicles. Their unmatched energy density, rapid recharge capability, and robust discharge power make lithium-ion batteries the sole technology meeting OEM standards for driving range and charging time. In contrast, lead-based traction batteries fall short for full hybrids or EVs due to their heftier weight and lower energy efficiency.

- In recent years, the United Kingdom has seen a surge in electric vehicle adoption. The International Energy Agency (IEA) reported that in 2023, battery electric vehicle sales reached 0.31 million, marking a 14.8% increase from 2022. Projections indicate a significant uptick in EV sales across the region in the years ahead.

- The United Kingdom government has rolled out multiple policies to champion electric vehicles (EVs) and facilitate a shift towards a low-carbon transportation landscape. These initiatives have bolstered the demand for lithium-ion batteries. In 2023, the government unveiled ambitious plans to boost EV production and expedite the journey towards zero carbon emissions.

- The United Kingdom has set a Zero Emission Vehicle (ZEV) mandate, targeting 80% of new cars and 70% of new vans to be zero-emission by 2030, with a complete transition by 2035. Additionally, a ban on new petrol and diesel cars and vans is slated for 2030, and by 2035, all new vehicles must be zero-emission at the tailpipe. Such measures are poised to not only boost EV production and sales but also escalate the demand for rechargeable batteries in the coming years.

- Leading companies in the region are heavily investing and launching projects to amplify electric vehicle production. For instance, in November 2023, Nissan, alongside its partners, unveiled a GBP 2 billion (USD 2.5 billion) initiative to manufacture three electric car models, including the electric Qashqai and Juke, at their plant. Additionally, Nissan allocated GBP 1.12 billion (USD 1.4 billion) to ready its United Kingdom facilities and supply chain for these new models. Such endeavors underscore the anticipated surge in lithium-ion battery demand.

- Given these concerted efforts, it's evident that EV sales, charging infrastructure, and the demand for rechargeable batteries are set to rise significantly in the forecast period.

United Kingdom Rechargeable Battery Industry Overview

The United Kingdom rechargeable battery market is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Technologies, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electric Vehicle (EV) Adoption

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Exide Technologies

- 6.3.7 Saft Groupe SA

- 6.3.8 AMTE Power

- 6.3.9 Brill Power

- 6.3.10 Eelpower

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

02-2729-4219

+886-2-2729-4219