|

市場調查報告書

商品編碼

1637894

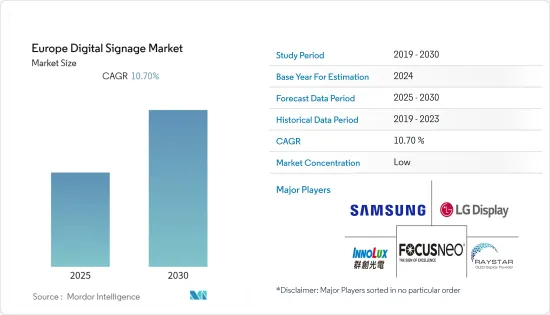

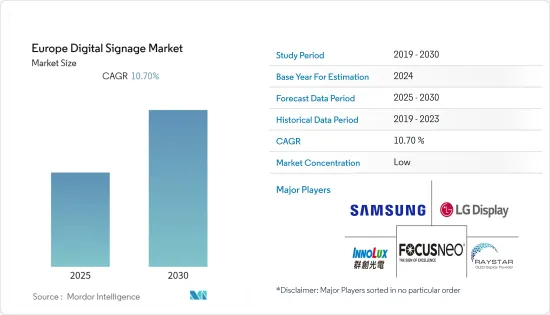

歐洲數位電子看板:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計預測期內歐洲數位電子看板市場的複合年成長率將達到 10.7%。

主要亮點

- 交通網路、公共基礎設施和新商業建築的成長,尤其是在新興經濟體中,為該市場創造了大量機會。數位電子看板應用於所有公共交通系統,以吸引旅途中觀眾的注意力,並為相關旅行者資訊和廣告提供即時位置和情境察覺。此外,數位電子看板正迅速成為許多教育機構的標準,學校和企業園區都部署了數位看板系統。

- 數位電子看板的附加優勢也推動了需求。此外,數位電子看板允許本地供應商更快、更有效地更改其顯示和訊息。而且,它比傳統廣告更容易管理。數位數位電子看板提供即時產品和庫存資訊、互動式資料以及視覺上吸引人的照片和影片。數位電子看板也是一種投資報酬率高的技術。用戶可以透過基於瀏覽器的連結來控制指示牌,並且指示牌可以整合到現有的IT網路中,而無需更換設備。

- 各行業日益成長的需求也推動了數位電子看板技術的創新。例如,Tele2IoT 表示,與使用有限的 LAN 或 WiFi 連線相比,可以透過行動電話網路將內容傳送到顯示器,尤其是在 LAN 或 WiFi 存取受限的地區。利用這些想法,數位顯示器可以放置在任何有行動電話網路的地方。支援 SIM 卡的顯示解決方案還可以降低用戶和最終客戶的成本和複雜性。

- 此外,由於主要零售商和產品供應商增加對線上和廣播廣告的支出,全部區域使用網路的個人數量不斷增加,預計將阻礙市場成長。

- 數位電子看板是減少人群密集場所感染 COVID-19 風險的最佳解決方案之一。這可以透過提供消毒凝膠來教育遊客,透過引導人群來平衡場館內的遊客數量,或引入基於數位的閘道器以避免商店過度擁擠。

歐洲數位電子看板看板市場趨勢

零售業可望佔據主要市場佔有率

- 該地區的零售商正在結合數位工具,在現場發布相關且盈利的材料,並將數位廣告融入其零售店,以創造獨特的店內用戶體驗並推動實際效果。 。據三星稱,53% 的顧客對商店的第一印像是基於其外觀。

- 數位電子看板位看板顯示器用於零售商店顯示廣告、訊息和其他相關內容並傳遞客製化訊息。數位電子看板可使零售商最大限度地發揮訊息的影響力,從而有效率地、盈利進入目標市場。

- 例如,歐洲著名零售商家樂福集團最近改進了店內消費者溝通方式。這家零售巨頭已在比利時的 25 家商店安裝了 150 塊螢幕。該網路還具有整合音訊系統、客製化內容管理系統和整合排隊系統。

- 該地區在零售業的主導地位促使許多主要供應商開發專門針對零售業的解決方案。例如,NEC Display Solutions Europe 剛剛推出了一系列新型大尺寸UHD 顯示器,具有超寬的螢幕寬度和出色的解析度,無論近距離還是遠距離觀看都十分方便。

- 此外,零售商可以即時更新用戶互動面板,以反映商店最新的性別和年齡人口趨勢,促銷特定產品,並從螢幕上移除售罄的商品。

比利時佔有最大市場佔有率

- 隨著數位化需求的成長,我們正專注於在比利時尋找數位電子看板解決方案的客戶,特別是在零售業。例如,一家法國跨國零售商在比利時的 25分店實施了全面的店內數位電子看板解決方案,以便讓客戶了解最新的促銷和產品資訊,並管理結帳隊列。

- 本地Scala系統整合商DOBIT基於Scala技術部署和編排了整個網路。

- 同樣,ZetaDisplay 於 2021 年 9 月與荷蘭和比利時肯德基以及全通路 CRM 和訂單管理平台 Booster Agency夥伴關係,在未來 12 個月內為 100 多家肯德基餐廳提供數位電子看板解決方案。此次合作預計將增強肯德基在荷蘭和比利時各地的數位電子看板,包括新店和整修店。每個門市將配備六塊螢幕作為數位菜單板。一些商店正在對面向路人的外向窗口數位螢幕進行測試。

- 此外,比利時擁有 209 家醫院,是世界上最多元化的人口之一(自 2005 年以來增加了 100 萬),人口來自 180 多個國家,使用 108 種語言。該醫院擁有 64,000 張病床,每日有 64,000 名住院患者,平均住院日數約為 6.4 天,因此,在確保患者舒適健康的同時,與患者保持聯繫至關重要。毫無疑問,AZ Sint-Jan Brugge-Oostende AV 就屬於這一類。

歐洲數位電子看板產業概況

歐洲數位電子看板市場較為分散,群創光電、三星電子、東芝泰格歐洲公司和 FocusNeo AB 等全球主要公司佔據硬體市場。同時,各類中小型企業也提供數位電子看板軟體。此外,許多公司作為該領域的專業參與者進入市場,提供特定的產品應用。

- 2022 年 12 月 -數位電子看板位看板解決方案領導者 SpinetiX SA 今天宣布發布其數位看板數位電子看板即服務 (SaaS) SpinetiX ARYA 的新功能,提供超過 250 個資料驅動的與 Elementi、SpinetiX 的整合改進帶有類型Widgets的高階創作軟體。這項創新使 SpinetiX ARYA 保持簡單,同時為最終用戶擴展了創新選擇並為整合商提供了增值利益。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 分銷通路分析

- 產業價值鏈分析

- COVID-19 疫情對市場的影響評估

第5章 市場動態

- 市場促進因素

- 承包解決方案的演變

- 與傳統方法相比,推動情境感知廣告成長的趨勢

- 歐洲數位戶外媒體支出穩定成長,持續促進市場成長

- 市場限制

- 客戶隱私問題

第6章 技術簡介

- 英國數位電子看板解決方案的發展

- 電視牆、4K 和 8K 顯示器、POS 系統和社交媒體的深度整合——有望推動採用的關鍵技術趨勢

第7章 市場區隔

- 按類型

- 硬體

- LCD/LED 顯示器

- 有機發光二極體顯示螢幕

- 媒體播放機

- 投影機/投影螢幕

- 其他硬體

- 軟體

- 服務

- 硬體

- 按最終用戶產業

- 零售

- 運輸

- 飯店業

- 企業

- 教育機構

- 政府

- 其他最終用戶產業

- 按國家

- 英國

- 市場規模和趨勢

- 系統整合商列表

- 德國

- 市場規模和趨勢

- 系統整合商列表

- 法國

- 市場規模和趨勢

- 系統整合商列表

- 義大利

- 市場規模和趨勢

- 系統整合商列表

- 比利時

- 市場規模和趨勢

- 系統整合商列表

- 其他歐洲國家

- 市場規模和趨勢

- 系統整合商列表

- 英國

第8章 競爭格局

- 公司簡介

- 基礎設施提供者

- Samsung Display Solutions(Samsung Electronics Co. Ltd)

- LG Display Co. Ltd

- Innolux Corp.

- FocusNeo AB

- Raystar Optronics Inc.

- Adversign Media GmbH

- OSRAM OLED GmbH

- ST Digital

- Winstar Display Co. Ltd

- Visionbox Co. Ltd

- Leyard Europe Co. Ltd

- 系統整合商列表

- Allsee Technologies Ltd

- SpinetiX SA

- Tata Elxsi Ltd

- Toshiba Tec Europe

- AG Neovo

- Livewire Digital

- signageOS Inc.

- Creative Technology Group

- Signagelive

- Daktronics Dr.

- 基礎設施提供者

第9章 主要數位電子看板軟體供應商分析

第10章 投資分析

第 11 章:投資分析市場的未來

簡介目錄

Product Code: 48307

The Europe Digital Signage Market is expected to register a CAGR of 10.7% during the forecast period.

Key Highlights

- The growth in transport networks, public infrastructure, and new commercial buildings, particularly in developing economies, creates more opportunities in this market. Digital signage is being used in and on all modes of public transportation to attract the attention of on-the-go viewers, providing real-time location and context awareness related to traveler information and advertising. Moreover, it is fast becoming a standard in many educational facilities, with schools and corporate campuses facilitating digital signage systems.

- The added benefits of digital signage are also driving its demand. Further, digital signage enables regional vendors to change displays and messages more quickly and effectively. Additionally, it is easy to manage when compared to traditional advertisements. Digital signs offer real-time information on products and availability, interactive data, and visually enticing photos and videos. Also, digital signage technology provides a high return on investments. It lets users control signage from any browser-based link and integrate signage into an existing IT network without replacing equipment.

- The growing demand across various industries also drives innovation in digital signage technology. For instance, according to Tele2IoT, delivering content to displays over cellular networks has become increasingly attractive compared to using limited LAN, and WiFiconnections, especially in areas where access to LAN or WiFi is limited. By empowering such ideas, digital displays can be installed anywhere cellular networks exist. A SIM-enabled display solution can also help reduce the cost and complexity for the user or end customer.

- Moreover, Increasing expenditure by leading retailers and product suppliers on online and broadcast advertisements is expected to hinder market growth, as the number of individuals using the internet across the region is increasing.

- Digital signage is one of the best solutions to reduce the risk of COVID-19 in crowded areas. It can be used for educating visitors, such as providing sanitizing gel or balancing the number of visitors in a venue by directing the crowd and implementing a headcount-based gateway to avoid crowded stores.

Europe Digital Signage Market Trends

Retail Industry is Expected to Hold Significant Market Share

- Retail operators in the area are combining digital tools to publish pertinent and profitable material at their premises and incorporate digital adverts into their retail stores to create a unique in-store user experience to gain an advantage over physical stores. Signage in retail is crucial for the operating vendors since, according to Samsung, 53% of customers base their initial perception of the store on the exterior of the business front.

- Digital signage displays are used in retail establishments to display advertising, information, or other pertinent content to transmit tailored messages. By maximizing the message's impact, digital signage enables retailers to efficiently and profitably reach their target market.

- For instance, the prominent European retail company Carrefour Group recently updated its in-store consumer communications. The retail behemoth installed 150 screens across 25 stores in Belgium; the network also features an integrated audio system, a customized content management system, and integrated queuing.

- Many important suppliers are creating retail-specific solutions due to the region's retail industry's dominance. For instance, NEC Display Solutions Europe just unveiled a new line of large-format UHD displays with enormous screen widths and excellent levels of resolution to allow close-up and distant viewing.

- Moreover, Retailers additionally work on updating user-interactive panels in real-time to reflect the most recent gender or age demographic trends in-store to promote particular items or remove sold-out products from the screen.

Belgium Accounts for the Largest Market Share

- With an increasing demand for digitalization, Belgium is more focused on customer acquisition regarding digital signage solutions, mainly in the retail sector. For instance, to promote the latest promotions and product information to customers and manage queuing at the tills, a French multinational retailer deployed a comprehensive in-store digital signage solution across 25 of its branches in Belgium, with more to follow.

- Local Scala systems integrator DOBIT rolled out and tailored the entire network based on Scala technology, which acts as a central backbone for managing all screens, templates, content, and audio.

- Similarly, in September 2021, ZetaDisplayentered a partnership with KFC Netherlands and Belgium, omnichannel CRM, and the order management platform Booster Agency to deliver digital signage solutions to more than 100 KFC restaurants in the 12 months that followed. This partnership is expected to boost KFC's digital signage, including new and remodelled restaurants across the Netherlands and Belgium. Each restaurant will feature six screens as digital menu boards; tests are underway at several restaurants with external-facing window digital screens aimed at passers-by.

- Further, Belgium is home to 209 hospitals and one of the world's most diverse populations (up by a million since 2005), with more than 180 nationalities and 108 spoken languages. With 64,000 beds, 64,000 admissions each day, and an average stay of about 6.4 days, it's critical to maintain constant contact while maintaining patients' comfort and well-being. Unquestionably, AZ Sint-Jan Brugge-Oostende AV falls under this category.

Europe Digital Signage Industry Overview

The European digital signage market is fragmented with major global players, like Innolux Corp., Samsung Electronics Co. Ltd, Toshiba Tec Europe, and FocusNeo AB, the hardware end of the spectrum is covered. Various medium-sized and smaller players offer software for digital signage at the same time. Additionally, many businesses are entering the market as specialized players in the sector, offering specific product applications.

- December 2022 - SpinetiX SA, one of the leaders in digital signage solutions, has announced the release of new features in its digital signage SaaS (software-as-a-service), SpinetiX ARYA increasing the integration with Elementi, the SpinetiX advanced authoring software with its 250+ data-driven widgets. This innovation expands the creative options of end users while keeping SpinetiX ARYA simple and provides value-added benefits to integrators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Distribution Channel Analysis

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Turnkey Solutions

- 5.1.2 Trends Favoring the Growth of Context-aware Advertising as Opposed to Conventional Modes of Advertising

- 5.1.3 Steady Increase in DOOH Spending in Europe to Continue to Supplement Market Growth

- 5.2 Market Restraints

- 5.2.1 Concerns Over Invasion of Customer Privacy

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Digital Signage Solutions in the United Kingdom

- 6.2 Key Technological Trends Expected to Drive Adoption - Video Walls, 4K and 8K Displays, Deep Integration of POS Systems and Social Media

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Hardware

- 7.1.1.1 LCD/LED Display

- 7.1.1.2 OLED Display

- 7.1.1.3 Media Players

- 7.1.1.4 Projectors/Projection Screens

- 7.1.1.5 Other Hardware

- 7.1.2 Software

- 7.1.3 Services

- 7.1.1 Hardware

- 7.2 By End-user Vertical

- 7.2.1 Retail

- 7.2.2 Transportation

- 7.2.3 Hospitality

- 7.2.4 Corporate

- 7.2.5 Education

- 7.2.6 Government

- 7.2.7 Other End-user Verticals

- 7.3 By Country

- 7.3.1 United Kingdom

- 7.3.1.1 Market Sizing and Trends

- 7.3.1.2 List of System Integrators

- 7.3.2 Germany

- 7.3.2.1 Market Sizing and Trends

- 7.3.2.2 List of System Integrators

- 7.3.3 France

- 7.3.3.1 Market Sizing and Trends

- 7.3.3.2 List of System Integrators

- 7.3.4 Italy

- 7.3.4.1 Market Sizing and Trends

- 7.3.4.2 List of System Integrators

- 7.3.5 Belgium

- 7.3.5.1 Market Sizing and Trends

- 7.3.5.2 List of System Integrators

- 7.3.6 Rest of Europe

- 7.3.6.1 Market Sizing and Trends

- 7.3.6.2 List of System Integrators

- 7.3.1 United Kingdom

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Infrastructure Providers

- 8.1.1.1 Samsung Display Solutions (Samsung Electronics Co. Ltd)

- 8.1.1.2 LG Display Co. Ltd

- 8.1.1.3 Innolux Corp.

- 8.1.1.4 FocusNeo AB

- 8.1.1.5 Raystar Optronics Inc.

- 8.1.1.6 Adversign Media GmbH

- 8.1.1.7 OSRAM OLED GmbH

- 8.1.1.8 ST Digital

- 8.1.1.9 Winstar Display Co. Ltd

- 8.1.1.10 Visionbox Co. Ltd

- 8.1.1.11 Leyard Europe Co. Ltd

- 8.1.2 List of System Integrators

- 8.1.2.1 Allsee Technologies Ltd

- 8.1.2.2 SpinetiX SA

- 8.1.2.3 Tata Elxsi Ltd

- 8.1.2.4 Toshiba Tec Europe

- 8.1.2.5 AG Neovo

- 8.1.2.6 Livewire Digital

- 8.1.2.7 signageOS Inc.

- 8.1.2.8 Creative Technology Group

- 8.1.2.9 Signagelive

- 8.1.2.10 Daktronics Dr.

- 8.1.1 Infrastructure Providers

9 ANALYSIS OF THE KEY DIGITAL SIGNAGE SOFTWARE VENDORS

10 INVESTMENT ANALYSIS

11 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219