|

市場調查報告書

商品編碼

1640333

亞太地區人力資源管理軟體市場:佔有率分析、產業趨勢和成長預測(2025-2030 年)Asia-Pacific Workforce Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

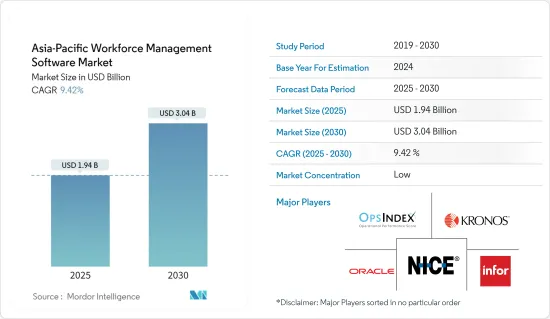

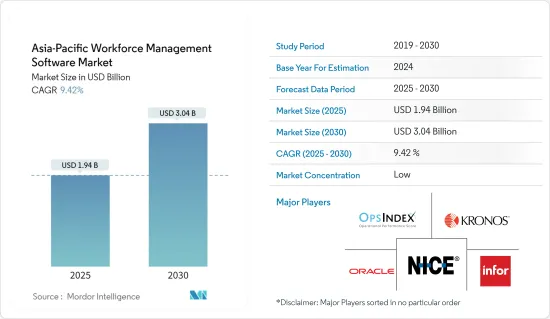

亞太地區人力資源管理軟體市場規模預計在 2025 年為 19.4 億美元,預計到 2030 年將達到 30.4 億美元,預測期內(2025-2030 年)的複合年成長率為 9.42%。

透過有效管理工作計畫、業務流程、人事費用和人才管理,人力資源管理軟體在提高組織績效方面發揮著至關重要的作用。

主要亮點

- 亞太地區是世界領先的商品生產區之一,部分原因在於其作為主要出口區的地位。一系列產品在印度、中國、韓國、印尼、日本和澳洲生產。該地區被譽為技術純熟勞工的寶庫。眾所周知,這裡生產軟體、汽車、食品製造、藥品、化妝品、機械、服飾和許多其他產品。就生產和先進能力而言,勞動力非常重要。

- 自動化流程的普及使得員工轉向自助服務技術。這些技術在維持指揮鏈的同時,也提高了職場的透明度和溝通能力。

- 人工智慧在人力資源管理軟體領域的應用也變得越來越廣泛。許多公司正在使用人工智慧來減少招聘、僱用、規劃和追蹤時間等耗時的任務。

- 該地區擁有數百萬醫生、工程師、技術人員等。為了將如此大量受過教育的工人轉變為熟練的勞動力,需要一個管理系統。生產力是任何組織成功的關鍵。企業和產業都在努力降低成本、提高生產力並簡化業務流程。為了實現這一目標,我們正在採用更為複雜的技術。

- 軟體即服務評估的重點是根據您目前的痛點衡量功能集,並找到與供應商的良好匹配。然而,實施新的人力資源管理軟體可能是一個昂貴且耗時的過程,必須毫不拖延地進行,才能充分實現任何組織所尋求的利益。

- COVID-19 指出了各個領域 WFM 解決方案的重要性,尤其是對醫療保健工作者而言。強調了保持護理人員參與度的良好做法的必要性,為醫療保健部門提供了一系列 WFM 解決方案,同時還為安排任務、預測體檢和提供全職護理(而非兼職人員)提供支持。排班和準時人員配備也很重要。

亞太地區人力資源管理軟體市場趨勢

雲端運算正在不斷壯大

- 銀行、保險和金融服務業正走向客戶友善、服務導向的環境,傳統的分店業務業務正被上門服務所取代。上門銀行概念的興起,導致該領域人手短缺,原因是日程繁忙,時間不足,加上市場競爭加劇,為了避免失去領先地位,管理變得至關重要。

- 如今,上門服務和家庭銀行服務的範圍已經遠遠超出了傳統的現金提領和DD請求;它現在涵蓋了從添加帳戶持有人、驗證身份(KYC)、收集文件、接收現金/支票到接受新客戶的所有內容。

- 該行業的人力資源管理軟體解決方案提供了多種改變遊戲規則的優勢,可實現無縫運作並確保成功管理勞動力,這對於實現客戶滿意度至關重要。

- 產業面臨的主要問題之一是缺乏及時的可追溯性,而市場上供應商提供的解決方案(例如 Deliforce 的銀行銷售追蹤軟體)並未解決此問題。以 Deliforce 的銀行銷售追蹤軟體為例。管理層可以使用該軟體來即時追蹤現場的所有勞動力。

- 據印度品牌股權基金會稱,到2023會計年度,印度銀行資產將達到約2.9兆美元。在此期間,與私營部門和外資銀行相比,公共部門銀行的資產佔有率最高。

中國佔最大市場佔有率

- 中國是多種商品的最大生產國之一。該地區生產的商品種類繁多,從汽車到軟體、從無人機到食品。勞動力對於生產如此多種類的商品至關重要。預計這也將有助於該地區勞動力管理軟體市場的成長。

- 推動這一快速成長的是越來越多的中小型企業,它們為勞動力軟體及其管理解決方案的開發和採用做出了重要貢獻。

- 此外,中小企業的投資預計將對該地區的成長產生積極影響。由於中國對該地區的成長做出了重大貢獻,中小企業正在投資增加採用雲端基礎的技術解決方案進行勞動力管理。

- 中國是該地區最重要的電子商務市場之一。該領域的就業成長是採用勞動力管理解決方案的主要驅動力。此外,隨著越來越多的新零售商帶著創新理念進入大眾市場領域,勞動力管理的需求也將增加。

亞太地區人力資源管理軟體產業概況

亞太地區的勞動力管理市場高度分散,有 IBM 公司、 Oracle、ADP、Krones Incorporated 和 Workday Inc. 等參與者。這些公司正在透過大量研發投資來擴大其市場,以實現亞太地區人力資源管理市場的永續性數位化。

- 2023 年 12 月,NICE Systems Ltd 宣布完成 LiveVox 的收購。 NICE 市場領先的平台 CXone 與 LiveVox 獨特的 AI 驅動推廣功能相結合,打造出市場上唯一互動中心的平台,為提供卓越的 AI 驅動 CX 奠定了基礎。

- 2023 年 4 月, Oracle宣布更新 Oracle Fusion Cloud Human Capital Management (HCM) 中的員工體驗平台 Oracle ME。最近的發展包括新的人工智慧應用程式,這些應用程式將學習、技能發展和職業流動性融入個人化體驗,實現自我學習、洞察職業發展機會並將技能發展與業務目標相結合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 中小企業擴大採用分析解決方案和 WFM 將推動市場成長

- 勞動力最佳化和雲端基礎的需求推動市場成長

- 市場挑戰

- 實施和整合問題阻礙市場

- 評估新冠肺炎對產業的影響

第6章 市場細分

- 類型

- 勞動力調度和勞動力分析

- 考勤管理

- 績效與目標管理

- 缺勤和休假管理

- 其他軟體(疲勞管理、任務管理等)

- 部署模式

- 本地

- 雲

- 按最終用戶產業

- BFSI

- 消費品和零售

- 車

- 能源和公共產業

- 衛生保健

- 製造業

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 印尼

- 泰國

- 其他亞太地區

- 亞太地區

第7章 競爭格局

- 公司簡介

- Active Operations Management International LLP

- NICE Systems Ltd.

- Oracle Corporation

- Infor Group

- Kronos Incorporated

- Reflexis Systems Inc.

- Workday Inc.

- Blue Yonder Group Inc.

- ServiceMax Inc.

- IBM Corporation

- SAP SE

- ADP LLC

- Sage Group plc

第8章投資分析

第9章:市場的未來

The Asia-Pacific Workforce Management Software Market size is estimated at USD 1.94 billion in 2025, and is expected to reach USD 3.04 billion by 2030, at a CAGR of 9.42% during the forecast period (2025-2030).

By allowing effective administration of work schedules, business processes, labour costs and talent management, workforce management software has an important role to play in improving organisational performance.

Key Highlights

- The Asia Pacific region is one of the world's largest producers of goods, and this is due to its position as a major exporter. Different products are manufactured by India, China, South Korea, Indonesia, Japan, and Australia. The region is known for its skilled labour. It's known for software, cars, food production, medicines, cosmetics, machinery, clothes and many other products produced here. The workforce is very critical in terms of production and advanced capabilities.

- Employees are increasingly using self service technologies, which can be reached from any location and with no major obstacles, as a result of increasing use of automation based processes. Such technologies are enabling more transparency and communication in the workplace, while preserving a chain of command.

- In the field of workforce management software, use of AI is also becoming more widespread. Several businesses are using artificial intelligence to reduce the time consuming tasks, such as recruitment and hiring, planning and tracking times.

- There are millions of physicians, engineers, technicians, etc. in this region. Converting such a large number of educated workers into a skilled workforce requires a management system. The key to success in any organization is productivity. Enterprises and industry are working towards cost reduction, productivity improvement as well as improving business process efficiency. In order to achieve this objective, they adopt more sophisticated technologies.

- The focus of most software-as-a-service evaluation revolves around measuring feature set against any current problem areas and finding a vendor for working well with. However, the implementation of new workforce management software can be an expensive and time intensive process that must be carried out without delay in order to make full use of the benefits which any organisation is seeking.

- COVID-19 has pointed out the importance of WFM solutions in a variety of sectors, especially for healthcare workers. The need for some good practice to keep nursing staff engaged has been highlighted and, while offering the healthcare sector a range of WFM solutions, applications like scheduling tasks and predicting censuses, scheduleting and staffing nurses on time as opposed to parttime workers have also been underlined.

Asia-Pacific Workforce Management Software Market Trends

Cloud to Witness Significant Growth

- The banking, insurance industry and financial services has been increasingly moving toward a customer-friendly service-oriented environment where the introduction of doorstep services have taken over the traditional branch banking practices. The emergence of the concept of doorstep banking on the rise resulting in hectic schedules and paucity of time along with the fierce competition in the market in order to ensure that a lead is not gobbled up by the rival company, has made the management of the workforce extremely crucial in the sector.

- At present, the scope of doorstep services or home banking has gone far beyond the traditional cash withdrawal/DD request and now comprises other customized services that range from adding a nominee, verifying identity (KYC), collecting documents, cash/cheque pickups to the opening of a new account and delivering credit cards.

- The workforce management software solutions for the industry offer multiple benefits that can make a significant difference in the sector, offering seamless operations, thereby ensuring the successful management of the workforce, which is crucial for achieving customer satisfaction.

- One of the main problems facing the industry is a lack of timely traceability, and solutions provided by vendors on the market are aimed at addressing this problem, for instance banking sales tracking software from Deliforce. The administration can track the entire field workforce with this software and will be able to do so in realtime.

- According India Brand Equity Foundation, the assets of banks in India amounted to about 2.9 trillion USD in financial year 2023. During this period, public sector banks accounted for the highest share in assets compared to private and foreign sector banks.

China to hold the Largest Market Share

- China's one of the biggest producers of different goods. There are many varieties of goods produced in this region from cars to software, unmanned aerial vehicles as well as food products. The workforce is very important in the production of such a large range of goods. This will also contribute to the growth of the region's labour management software market.

- This rapid growth rate is driven by a more significant number of small and medium sized enterprises, which make an essential contribution to the development and implementation of workforce software and their management solutions.

- Moreover, the investments of SMEs are anticipated to have a positive impact on growth in this region. As China is a major contributor to regional growth, SMEs are investing in increasing the adoption of cloud based and technological solutions for workforce management.

- China is one of the most important e commerce markets in this region. Increasing employment in this sector is a major driver of the adoption of workforce management solutions. The need for workforce management will also increase as more and more new retailers move from novel concepts into the mass market sector.

Asia-Pacific Workforce Management Software Industry Overview

The Asia-Pacific workforce management market is highly fragmented due to the presence of players like IBM Corporation, Oracle, ADP, Krones Incorporated, and Workday Inc. They are upscaling the market with substantial R&D investments, driving toward the sustainability and digitization of the Asia-Pacific Workforce Management Market.

- In December 2023, NICE Systems Ltd has announced the closing of the acquisition of LiveVox. The combination of NICE's market leading platform CXone, with LiveVox's unique AI driven proactive outreach capabilities create the market's only interaction centric platform, the fundamental cornerstone to deliver superior AI driven CX.

- In April 2023, Oracle announced the updation to Oracle ME, the employee experience platform within Oracle Fusion Cloud Human Capital Management (HCM). Recent updates include new AI-powered apps that combine learning, skill development, and career mobility in a personalized experience, enabling self-directed learning, insight into career development opportunities, and skill development aligned with business objectives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth

- 5.1.2 Demand for Optimized and Cloud-Based Workforce to Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 Implementation and Integration Concerns Hindering the Market

- 5.3 Assessment of COVID-19 impact on the industry

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Workforce Scheduling and Workforce Analytics

- 6.1.2 Time and Attendance Management

- 6.1.3 Performance and Goal Management

- 6.1.4 Absence and Leave Management

- 6.1.5 Other Software (Fatigue Management, Task Management, etc.)

- 6.2 Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 End-User Vertical

- 6.3.1 BFSI

- 6.3.2 Consumer Goods and Retail

- 6.3.3 Automotive

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Manufacturing

- 6.3.7 Other End-User Industries

- 6.4 Geography

- 6.4.1 Asia-Pacific

- 6.4.1.1 China

- 6.4.1.2 India

- 6.4.1.3 Japan

- 6.4.1.4 Australia

- 6.4.1.5 South Korea

- 6.4.1.6 Indonesia

- 6.4.1.7 Thailand

- 6.4.1.8 Rest of Asia Pacific

- 6.4.1 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Active Operations Management International LLP

- 7.1.2 NICE Systems Ltd.

- 7.1.3 Oracle Corporation

- 7.1.4 Infor Group

- 7.1.5 Kronos Incorporated

- 7.1.6 Reflexis Systems Inc.

- 7.1.7 Workday Inc.

- 7.1.8 Blue Yonder Group Inc.

- 7.1.9 ServiceMax Inc.

- 7.1.10 IBM Corporation

- 7.1.11 SAP SE

- 7.1.12 ADP LLC

- 7.1.13 Sage Group plc