|

市場調查報告書

商品編碼

1640645

拉丁美洲勞動力管理軟體:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)LA Workforce Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

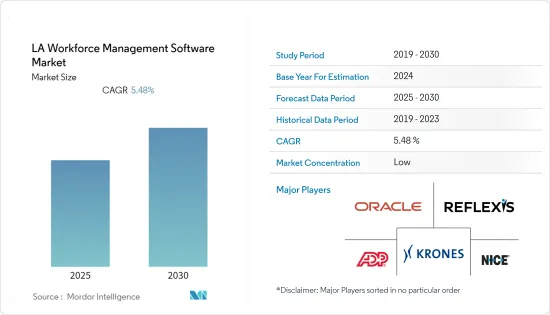

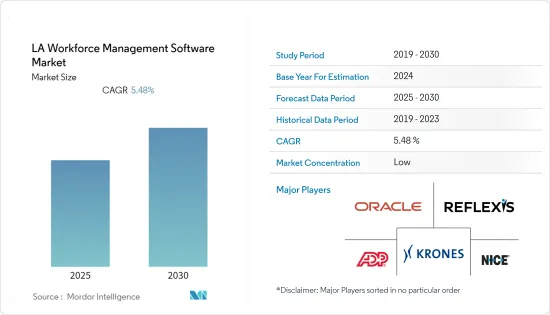

預計預測期內拉丁美洲勞動力管理軟體市場複合年成長率將達到 5.48%。

主要亮點

- 由於 SaaS 日益普及,拉丁美洲勞動力管理市場預計將經歷溫和成長。隨著提供高效服務的競爭日益激烈,該地區的組織正在轉向雲端運算進行勞動力管理,以減少傳輸即時資料所需的時間。

- 雲端處理是拉丁美洲成長最快的技術之一,這得益於 SaaS 和 IaaS 的日益普及。巴西和墨西哥等國家憑藉其龐大的連網消費者數量,在該地區雲端運算成長方面處於領先。為了尋求競爭優勢,企業正在尋找控制成本和更有效處理資料的方法。

- 儘管面臨經濟危機,但過去十年來,該地區中產階級消費者對服務的需求增加了 50%,促使企業擴大客戶服務業務並採用雲端服務。

- 雲端服務已成為拉丁美洲企業的必備工具。此外,雲端運算為本地企業提供了獨特的優勢,使得其在不斷成長的市場中變得越來越重要。雲端服務價格低廉,也能幫助組織達成技術進步。

拉丁美洲勞動力管理軟體市場趨勢

零售和消費品佔據最大市場佔有率

- 拉丁美洲是美國最大的出口地區之一,同時也向世界其他地區出口許多產品。巴西、阿根廷和哥倫比亞等國家正經歷人口成長放緩,但勞動力卻在成長。

- 零售和消費品預計將透過由外部和內部現場服務提供者、司機和店內員工組成的混合多元化勞動力來獲得更多的控制權和可見性。預計該行業將在客戶需求、就業和技術變革方面快速成長和發展。

- 消費品和零售業必須應對諸如時間和考勤管理、員工培訓、勞動力分析、調度最佳化和預測等複雜挑戰。透過適當利用可用資源,可以用勞動力管理解決方案來解決這些複雜性。巨量資料的力量有助於實現這些資源,並為預測、員工任務管理和預算管理提供行動解決方案。

- 軟體系統可協助您追蹤訂單、存量基準和交貨。在各個製造業中,它還有助於建立材料清單、工作指示和其他與生產相關的文件。持有勞動力管理軟體系統的公司可以避免缺貨和庫存過剩。它是一種比電子表格更準確、更先進的庫存資料最佳化工具。

墨西哥佔有最大市場佔有率

- 根據Trading Economics預測,到2021年終,墨西哥的GDP預計將達到1.17兆美元。墨西哥經濟規模龐大、多元化且強勁,其中石油業、美國匯款、出口、農業、採礦業、旅遊業和工業活動在其成長中發揮最重要的作用。

- IT 公司的收入不斷增加、熟練勞動力不斷增加以及出口不斷增加,導致對勞動力管理軟體的需求激增。此外,根據世界銀行的預測,2021年墨西哥熟練勞動人口將超過540億。這增加了對高效勞動力管理系統的需求。

- 隨著遠距工作在墨西哥勞動力中越來越受歡迎,人力資源負責人正在將人工智慧工具納入他們的日常業務中。像 peopleHum 這樣的公司提供可自訂的調查和民意調查等工具來幫助領導者了解員工的動態。

拉丁美洲勞動力管理軟體產業概況

拉丁美洲人力資源管理市場高度分散,參與者包括 Infor、Oracle、Sierra Data Systems、ADP、Kappix、Krones Incorporated 和 Atoss Software AG。這些公司正在透過大量研發投資來擴大其市場,以實現拉丁美洲人力資源管理市場的永續性數位化。

- 2021年4月,國際薪資核算解決方案Deel在墨西哥正式啟動營運,這是其在拉丁美洲的第一個國家。該平台提供薪資管理和合規性,並幫助公司建立團隊和利用全球勞動力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 物聯網 (IoT) 和雲端基礎的解決方案的日益普及推動了市場擴張

- 中小企業擴大採用分析解決方案和 WFM 將推動市場成長

- 市場挑戰

- 實施和整合問題阻礙市場

第6章 市場細分

- 按類型

- 勞動力調度和勞動力分析

- 考勤管理

- 績效與目標管理

- 缺勤和休假管理

- 其他軟體(疲勞管理、任務管理等)

- 依部署方式

- 本地

- 雲

- 按最終用戶產業

- BFSI

- 消費品和零售

- 車

- 能源與公共產業

- 衛生保健

- 製造業

- 其他最終用戶產業

- 按國家

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

第7章 競爭格局

- 公司簡介

- Active Operations Management International LLP

- NICE Systems Ltd

- Oracle Corporation

- Infor Group

- Kronos Incorporated

- Reflexis Systems Inc.

- SISQUAL

- Workday Inc.

- WorkForce Software LLC

- Blue Yonder Group Inc.

- ServiceMax Inc.

- Kirona Solutions Limited

- 7shifts

- IBM Corporation

- SAP SE

- ADP LLC

- Atoss Software AG

- Mitrefinch Ltd

- Sage Group PLC

- Roubler UK Limited Company

- Tamigo UK Ltd

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 56198

The LA Workforce Management Software Market is expected to register a CAGR of 5.48% during the forecast period.

Key Highlights

- The Latin American workforce management market is expected to witness moderate growth due to the increasing popularity of SaaS. The persistently increasing competition to provide efficient services is encouraging organizations in the region to adopt cloud computing in workforce management to ensure faster time to transfer real-time data.

- Cloud computing is one of the fastest-growing technologies in Latin America, with the increasing deployment of SaaS and IaaS. Countries such as Brazil and Mexico are ahead in terms of cloud growth in the region because of their high numbers of connected consumers. Companies are looking for competitive advantages and ways to ensure efficient cost management and data processing.

- Regardless of the economic crisis, over the last decade, the region has witnessed a 50% increase in the number of services that middle-class consumers demand, resulting in companies scaling up their customer service operations and the adoption of cloud services.

- Cloud services have been among the essential tools for Latin American businesses. Moreover, the cloud is becoming more relevant in growing markets because it provides a unique edge to local businesses. Cloud services are cheaper and also help organizations advance technologically.

Latin America Workforce Management Software Market Trends

Retail and Consumer Goods to Hold the Largest Market Share

- Latin America is one of the biggest exporters to the United States and exports many products to other regions of the world. Countries like Brazil, Argentina, and Columbia have a growing labor force despite the slower population growth.

- Retail and consumer goods are expected to gain more control and visibility with a mixed and diversified workforce consisting of field service providers both externally and internally, drivers, and in-store employees. This vertical is expected to grow and evolve promptly in terms of customer needs, employment, and technological changes.

- For certain complexities, the consumer goods and retail sector needs to focus on attendance and time, employee training, labor analysis, scheduling optimization, and forecasting. These complexities can be solved with workforce management solutions by properly utilizing available resources. The power of Big Data can help these resources be achieved and provide mobile solutions for forecasting, managing tasks of employees, and budgeting.

- The software system helps track orders, inventory levels, deliveries. In various manufacturing industries, it can help generate bills of materials, work orders, and other documents related to production. Companies that possess workforce management software systems avoid outages and overstock. It is an optimizing inventory data tool, which is more accurate and advanced than spreadsheets.

Mexico to Hold the Largest Market Share

- According to Trading Economics, the GDP in Mexico was expected to reach USD 1,170 billion by the end of 2021. Mexico has a large, diversified, and strong economy with its oil sector, remittances from the United States, with exports, agriculture, mining, tourism, and industrial activities playing the most significant roles in its growth.

- The growing revenue and workforce of skilled labor from IT firms and rise in exports have spiked the demand for workforce management software. Further, according to the World Bank, Mexico's total skilled labor force was more than 54 billion in 2021. This increases the need for an efficient workforce management system.

- With increasing support for remote work from the Mexican workforce, HR professionals are embracing AI tools in their daily operations. Companies such as peopleHum offer tools such as customizable surveys and polls to help leaders get a pulse of the workforce.

Latin America Workforce Management Software Industry Overview

The Latin American workforce management market is highly fragmented due to players like Infor, Oracle, Sierra Data Systems, ADP, Kappix, Krones Incorporated, and Atoss Software AG. They are upscaling the market with substantial R&D investments, driving toward the sustainability and digitization of the Latin American workforce management market.

- In April 2021, Deel, an international payroll solution, officially launched operations in Mexico, its first Latin American country. The platform offers payroll management and compliance to help companies build their team and take advantage of the global workforce.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions Expanding the Market

- 5.1.2 Growing Adoption of Analytical Solutions and WFM by SMEs Driving Market Growth

- 5.2 Market Challenges

- 5.2.1 Implementation and Integration Concerns Hindering the Market

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Workforce Scheduling and Workforce Analytics

- 6.1.2 Time and Attendance Management

- 6.1.3 Performance and Goal Management

- 6.1.4 Absence and Leave Management

- 6.1.5 Other Software (Fatigue Management, Task Management, etc.)

- 6.2 Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Consumer Goods and Retail

- 6.3.3 Automotive

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Verticals

- 6.4 Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Argentina

- 6.4.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Active Operations Management International LLP

- 7.1.2 NICE Systems Ltd

- 7.1.3 Oracle Corporation

- 7.1.4 Infor Group

- 7.1.5 Kronos Incorporated

- 7.1.6 Reflexis Systems Inc.

- 7.1.7 SISQUAL

- 7.1.8 Workday Inc.

- 7.1.9 WorkForce Software LLC

- 7.1.10 Blue Yonder Group Inc.

- 7.1.11 ServiceMax Inc.

- 7.1.12 Kirona Solutions Limited

- 7.1.13 7shifts

- 7.1.14 IBM Corporation

- 7.1.15 SAP SE

- 7.1.16 ADP LLC

- 7.1.17 Atoss Software AG

- 7.1.18 Mitrefinch Ltd

- 7.1.19 Sage Group PLC

- 7.1.20 Roubler UK Limited Company

- 7.1.21 Tamigo UK Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219