|

市場調查報告書

商品編碼

1644538

中國設施管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

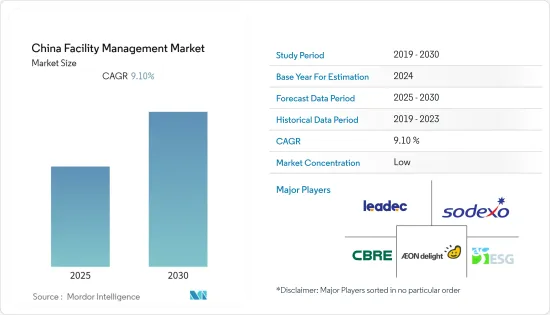

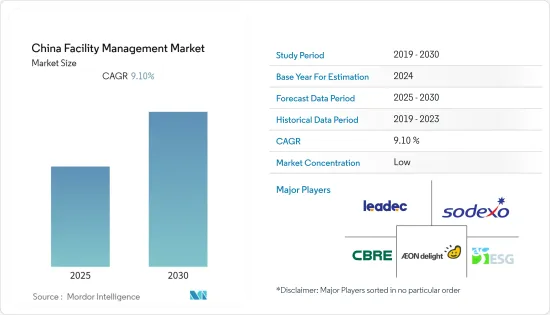

預計預測期內中國設施管理市場複合年成長率將達到 9.1%。

主要亮點

- 據中國設施管理服務供應商China Shine稱,在持續的都市化、外包滲透和占地面積不斷擴大的推動下,設施管理市場預計將出現顯著的成長。

- 隨著生活條件的改善和可支配收入的增加,中國業主和管理者要求更全面、高品質的物業管理服務。根據中國國家統計局的數據,2021年中國居民人均可支配所得中位數為2,9975元。

- 該國的設施管理服務在各個產業部門都有很高的需求,過去幾十年來經歷了顯著的成長。例如,根據中國國家統計局的數據,2022年3月,全國工業總產值年增5%。

- 此外,與其他已開發經濟體和新興經濟體相比,中國的外包滲透率較低,這是限制中國受訪市場成長的主要因素之一。

- 中國是受此次疫情影響最嚴重的主要國家之一。儘管該國在控制病毒方面取得了顯著進展,但疫情對該國經濟產生了重大影響。例如,根據中國國家統計局的數據,4月製造業採購負責人指數為50.8,比3月下降1.2%。

- 工業、製造業和設施業是設施管理服務的主要消費者,也是該國早期受到嚴重影響的產業。然而,隨著情況逐漸正常化,預計設施管理市場國內需求將呈現成長趨勢。

中國設施管理市場趨勢

建設活動增加推動成長

- 過去二十年,中國建設產業經歷了長足的發展。該國建築業的成長主要歸功於工業和商業建築業,這是該國經濟的主要支柱之一。例如,根據中國國家統計局的數據,工業部門是中國經濟的最大股東,佔32.6%。

- 設施管理在任何商業或工業設施的建設過程中和建設後都發揮著至關重要的作用。對建築物進行適當且定期的維護有助於減少停機時間並使設施運作,這對於任何商業或工業設施都至關重要。

- 2022年1月,中國住宅及城鄉建設部報告稱,中國建築業將與整體經濟同步成長,對國內生產總值(GDP)的貢獻率將維持6%。政府已採取多項舉措支持建築業的持續成長。

- 例如,2022年1月,中國政府發布了國內建築業新的五年發展計畫。預計這些發展將為該國設施管理市場的成長帶來更多機會。

醫療支出成長推動需求

- 十多年來,中國的醫療保健領域經歷了重大轉型。隨著人口老化的快速發展,預計預測期內醫療保健產業將呈現成長趨勢。

- 設施管理服務在醫療保健環境中發揮至關重要的作用,直接影響患者體驗並提高臨床護理效率。市場上的一些供應商越來越關注這一領域。例如,索迪斯提供廣泛的醫療設施管理服務,如手術室清潔和儀器消毒,以及殘障人士、復健、精神病和臨終支援服務。

- 政府和公眾不斷增加的醫療保健支出正在創造進一步促進所調查市場成長的環境。例如,根據中華人民共和國財政部的數據,2021年全國一般公共預算支出246,322億元中,醫療支出為19,205億元。

- 尤其是自疫情爆發以來,新醫療設施的投資增加預計也將創造對設施管理服務的需求。例如,2021 年 11 月,全球設計和諮詢公司 B+H Architects 公佈了計劃在中國浙江省嘉興凱益建造一座擁有 500 張床位的醫院的設計圖。

中國設施管理產業概況

隨著許多日本國內外公司進入設施管理市場,競爭日益激烈。為了加強市場影響力,市場上的供應商正在增加對新產品開發和擴張活動的投資。該市場的主要參與者包括 Leadec Industrial Services (Shanghai)、索迪斯中國、世邦魏理仕和 ESG Holdings Limited。

- 2022 年 3 月 - 建築和綜合設施管理公司 Widad Business Group (WBG) 宣布將與中國三一集團合作,在吉打州建立工業化建築系統 (IBS) 聯合製造工廠。

- 2022年2月-阿爾斯通中國合資企業申通龐巴迪(上海)軌道交通車輛維護有限公司宣布,其已獲得上海申通地鐵集團的訂單,為上海地鐵12號線二期、三期計劃的204輛Movia地鐵車輛訂單全生命週期維護服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 商業和工業領域的建設活動快速成長

- 增加對醫療保健領域的投資

- 市場限制

- 外包率下降

第6章 市場細分

- 設施管理類型

- 內部設施管理

- 外包設施管理

- 單調頻

- 捆綁 FM

- 整合調頻

- 按服務

- 硬體維修

- 軟調頻

- 按最終用戶

- 商業的

- 公共利益

- 公共/基礎設施

- 產業

- 其他

第7章 競爭格局

- 公司簡介

- Leadec Industrial Services(Shanghai)Co., Ltd.

- Sodexo China

- CBRE Inc.

- ESG Holdings Limited

- Aeon Delight Co., Ltd.

- Diversey Holdings LTD

- Serco Group Consultants(Shanghai)Ltd.

- China Shine(EQT Investors)

- ISS Group

- Colliers International Property Services Ltd.

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 90621

The China Facility Management Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- Driven by the continued urbanization, outsourcing penetration, and floor area growth, the facility management market is expected to reach a major height, according to China Shine, a facility management service provider in China.

- Property owners and managers in China are increasingly looking for more comprehensive and high-quality property management services, with improving living conditions and rising disposable income in China. According to the National Bureau of Statistics of China, the median per capita disposable income of residents in China was CNY 29,975 in 2021.

- The facility management services in the country are high in demand across the industrial sector that has witnessed significant growth in the last few decades. For instance, according to the National Bureau of Statistics of China, the country's total industrial production grew by 5% in March 2022, compared to the same period of the previous year.

- Moreover, compared to other developed and developing countries, outsourcing penetration is low in China, which is among the key factors restraining the growth of the studied market in the country.

- China is among the leading countries with the highest impact of the pandemic as some of the first few COVID cases were identified in the country itself. Although the country has done a remarkable job of containing the virus, the pandemic has significantly impacted the country's economy. For instance, according to the National Bureau of Statistics in China, the purchasing manager's index for the manufacturing sector stood at 50.8 in April, reporting a decrease of 1.2% from March.

- The industrial, manufacturing, and institutional sectors that are major consumers of facility management services were the highly impacted sectors in the country during the initial phase. However, with the condition moving towards normal, the facility management market is expected to witness an upward trend in demand in the country.

China Facility Management Market Trends

Increasing Construction Activities to Drive the Growth

- The construction industry in China has witnessed a significant rise in the past two decades. The growth of the construction sector in the country is primarily attributed to the industrial and commercial building sectors, which are among the major pillars of the country's economy. For instance, according to the National Bureau of Statistics of China, with 32.6%, the industrial sector is the largest shareholder of the country's economy.

- Facility management plays an important role during the construction and the post-construction process of the commercial and industrial facilities, as proper and regular maintenance of the buildings helps the property stay up and running and have less downtime, which is quite essential for commercial and industrial buildings.

- In January 2022, Chinas's Ministry of Housing and Urban-Rural Development reported that the construction industry in the country would grow at the same rate as the general economy and will maintain its 6% contribution to the national GDP. The government has been taking several initiatives to support the continued growth of the construction sector.

- For instance, in January 2022, the government of China unveiled a new five-year development plan for the country's construction industry. Such instances are expected to create more opportunities for the growth of the facility management market in the country.

Increased Healthcare Expenditure to Drive the Demand

- Over a decade, the healthcare sector in China has undergone a major overhaul as the country seems poised to emulate the spending trajectory of other western countries. With the country's population aging rapidly, the healthcare sector is expected to witness an upward growth trend during the forecast period.

- Within the healthcare environment, facilities management services play a critical role, directly impacting the patient experience and provisioning the efficiency of clinical care. Several vendors operating in the market are increasingly focusing on this sector. For instance, Sodexo offers a broad range of healthcare facility management services, such as operating room cleaning and instrument sterilization, along with support services for disability, rehabilitation, psychiatric, and end-of-life setting- whether in a hospital or at home.

- The increasing healthcare spending both by the government and the people in the country is further creating a supportive environment for the growth of the studied market. For instance, According to the Ministry of Finance of the Peoples Republic of China, out of the national general public budget expenditure of CNY 24,632.2 billion, health expenditure was CNY 1,920.5 billion in 2021.

- The growing investments in new healthcare facilities, especially since the pandemic outbreak, are also expected to create demand for facility management services. For instance, in November 2021, the design for a proposed 500-bed hospital in Jiaxing Kaiyi in China's Zhejiang province was unveiled by the global design and consulting firm B+H Architects.

China Facility Management Industry Overview

The Facility Management Market is becoming highly competitive due to several local and global players. To increase their market presence, the vendors operating in the market are increasing their investments in new product development and expansion activities. Some major players operating in the market include Leadec Industrial Services (Shanghai) Co., Ltd., Sodexo China, CBRE Inc., and ESG Holdings Limited, among others.

- March 2022 - Widad Business Group Sdn Bhd (WBG), a construction and integrated facilities management company, announced its collaboration with China-based SANY Group to set up a joint industrialized building system (IBS) manufacturing facility in Kedah.

- February 2022 - Shentong Bombardier (Shanghai) Rail Transit Vehicle Maintenance Co., Alstom's Chinese joint venture, announced that it had been awarded a contract from Shanghai Shentong Metro Group Co., Ltd. (Shanghai Metro) to provide full lifecycle maintenance service for 204 Movia metro cars on Shanghai's Line 12 phase 2 and phase 3 project.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid growth in Construction Activities Across Commercial and Industrial Sector

- 5.1.2 Increasing Investment in the Healthcare Sector

- 5.2 Market Restraints

- 5.2.1 Lower Outsourcing Rate

6 MARKET SEGMENTATION

- 6.1 By Facility Management Type

- 6.1.1 In-House Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offerings

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Leadec Industrial Services (Shanghai) Co., Ltd.

- 7.1.2 Sodexo China

- 7.1.3 CBRE Inc.

- 7.1.4 ESG Holdings Limited

- 7.1.5 Aeon Delight Co., Ltd.

- 7.1.6 Diversey Holdings LTD

- 7.1.7 Serco Group Consultants (Shanghai) Ltd.

- 7.1.8 China Shine (EQT Investors)

- 7.1.9 ISS Group

- 7.1.10 Colliers International Property Services Ltd.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219