|

市場調查報告書

商品編碼

1644587

馬來西亞設施管理:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Malaysia Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

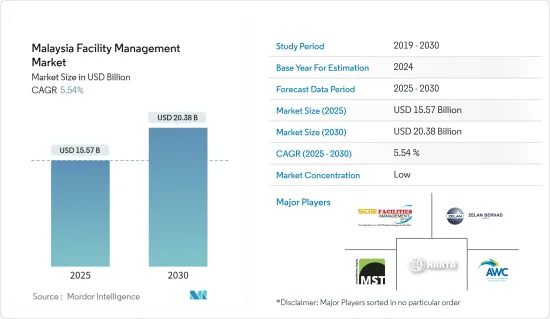

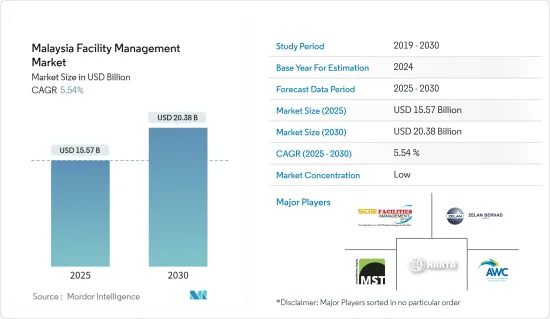

馬來西亞設施管理 (FM) 市場規模預計在 2025 年為 155.7 億美元,預計到 2030 年將達到 203.8 億美元,預測期內(2025-2030 年)的複合年成長率為 5.54%。

設施產業的興起和對外包非核心功能的日益關注預計將推動馬來西亞設施管理服務市場的發展。此外,政府有關安全措施的法規和有關採用環保實踐的環境問題預計將推動市場發展。

馬來西亞以其設施管理服務外包市場的成熟度和先進性而聞名。當地小型企業注重單一合約和單一服務解決方案。儘管如此,該地區的設施管理行業仍透過與 AWC Berhad、SDE Facilities Management Sdn Bhd 等主要供應商簽訂合併合約來營運,涵蓋許多國家和地區。但區域動態意味著,將設施管理與企業房地產結合的選擇比以往任何時候都多。

此外,設施管理 (FM) 包括監督組織實體基礎設施和協調整體職場環境的管理策略和策略。這種方法有助於組織標準化服務並簡化業務。

在非核心職能外包趨勢日益盛行的背景下,過去十年來,一些國內服務供應商大力擴大業務範圍,以滿足日益成長的設施管理需求。這種民族特性使得該國在創造性利用設施管理和企業房地產方面具有巨大的潛力。

就最終用戶需求而言,公共部門對馬來西亞設施管理市場的貢獻主要由有限的政府資源驅動,迫使政府持續外包所需的設施管理服務。

市場上已飽和,有許多維護公司提供類似的服務並競爭合約。由於在確定哪家公司獲得合約方面競爭激烈,某些維護公司的服務品質可能會下降。

設施管理公司受到了 COVID-19 疫情的影響。人們行動自由的限制導致許多客戶現場的計劃工作和活動水準減少。疫情封鎖已對 AWC Berhad 和 MST Facilities Sdn Bhd 等主要市場參與者造成衝擊。

馬來西亞設施管理市場趨勢

數位技術的興起正在推動設施管理市場的發展

馬來西亞的數位轉型旨在將馬來西亞定位為東南亞的數位中心,從而推動了馬來西亞對資訊和通訊技術 (ICT) 領域美國技術的需求。

馬來西亞致力於建置5G生態系統、建築數位基礎設施、衛星寬頻、網路和智慧自動化。這為美國公司快速提供網路安全和數位技術提供了機會。

此外,馬來西亞位於該地區的中心位置,可以快速進入其他新興市場,基礎設施強大、連結性強、經濟穩定。據馬來西亞政府稱,ICT是市場上成長最快的產業之一,到2025年將貢獻該國GDP的22.6%。

由於預算限制,馬來西亞企業以前並不重視網路安全。然而,全球疫情迫使更多企業數位化,增加了對網路安全解決方案的需求,以減少組織漏洞。

預防性維護對於維護管理至關重要,因為它可以在設備故障之前保持良好狀態。該策略一旦實施,將產生大量的維護和營運資料。馬來西亞政府和資產維護的資料由馬來西亞公共工程部保管。

軟 FM 觀察成長

軟 FM 服務通常可以使建築物對居住者更加舒適、愉悅和安全。 Soft FM 服務包括場地維護、景觀美化、餐飲服務(包括自動販賣機和飲水機)、害蟲防治、清潔、廢棄物管理、停車和工作空間管理。

在當前的市場情況下,由於全國各地的計劃日益複雜,設施管理公司將高級清潔服務定位為其業務的成長部分。軟 FMS 服務的一些主要優勢包括高效的廢棄物管理、適當的辦公室安全以及滿足勞動力需求。

物聯網的應用正迅速成為軟體服務設施管理中一股重要力量。物聯網提供連續、即時的資料流,以促進決策並最佳化各個工業領域的工作流程。外包公司正變得越來越重要,這些公司專注於提供個人化的附加價值服務,例如實用可靠的風險管理,包括當地勞動法和 HSE 管理。這是推動軟服務設施管理市場成長的另外兩個因素。

此外,新冠肺炎疫情也成為變革的催化劑,特別是在設施管理和服務提供方式方面。隨著組織在各個領域的發展,FM服務供應商的角色也變得更具策略性和長期性,需要仔細考慮並進行相應的規劃。

馬來西亞設施管理產業概況

馬來西亞設施管理市場細分化,公司規模各異。隨著各組織繼續進行策略性投資以抵消目前正在經歷的經濟放緩,預計該市場將見證多起聯盟、合併和收購。該地區的客戶正在採用 FM 服務來提高其業務營運的便利性。該市場由主要解決方案服務供應商組成,例如 AWC Berhad、MST Facilities Sdn Bhd、Harta Maintenance Sdn Bhd、Zelan AM Services Sdn Bhd 和 SDE Facilities Management Sdn Bhd。

2023 年 1 月,AWC Bhd 宣布已與兩家印尼公司 PT Gema Karya Manunggal 和 PT Prasarana Danoes Cemerlang 簽署了合作備忘錄。這些公司將與 AWC 合作探索馬來西亞和印尼的石油和天然氣產業前景以及機場和港口基礎設施。

2022 年 4 月,西澳大利亞珀斯著名的辦公室租賃和物業管理公司 Sheffield Property Pty Ltd. 和 Sheffield Asset Management Pty Ltd. 被 Cushman & Wakefield 收購。此次收購增強了 Cushman & Wakefield 在澳洲和亞太地區本已強大的綜合商業房地產平台。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對設施管理產業的影響

第5章 市場動態

- 市場促進因素

- FM 商品化程度不斷提高

- 增加基礎建設投資

- 數位技術的興起正在推動設施管理市場的發展

- 市場限制

- 利潤率下降和宏觀環境持續變化

第6章 市場細分

- 按設施管理類型

- 公司設施管理

- 外包設施管理

- 單調頻

- 捆綁 FM

- 整合調頻

- 依產品類型

- 硬體維修

- 軟調頻

- 按最終用戶

- 商業的

- 設施

- 公共/基礎設施

- 工業的

第7章 競爭格局

- 公司簡介

- AWC Berhad

- MST Facilities Sdn Bhd.

- Harta Maintenance Sdn Bhd

- Zelan AM Services Sdn Bhd

- SDE Facilities Management Sdn Bhd

- SYREFL Holdings Sdn Bhd

- UDA Dayaurus Sdn. Bhd.

- JLL Property Services (Malaysia) Sdn Bhd

- Sepadu Group

- TH Properties Sdn Bhd

第8章投資分析

第 9 章:未來趨勢

The Malaysia Facility Management Market size is estimated at USD 15.57 billion in 2025, and is expected to reach USD 20.38 billion by 2030, at a CAGR of 5.54% during the forecast period (2025-2030).

The rise of the institutional sector and the increasing emphasis on outsourcing non-core functions are anticipated to propel the Malaysian market for facility management services. In addition, government regulations on safety precautions and environmental concerns about adopting green practices are expected to drive the market.

Malaysia is well-known in the markets where facility management services are outsourced for their sophistication and progress. Small local businesses focus on single contracts and single-service solutions. Still, the region's facility management industry operates with integrated contracts from significant vendors like AWC Berhad, SDE Facilities Management Sdn Bhd, etc., covering many countries and borders. Yet, there are more alternatives than ever to combine facility management and corporate real estate due to regional dynamics.

Moreover, facility management (FM) encompasses management strategies and tactics for overseeing an organization's physical infrastructure and coordinating its overall work environment. This method helps an organization standardize its services and streamline its operations.

With the trend favoring the outsourcing of non-core functions, several service providers in the nation have strongly emphasized expanding their presence over the past ten years to profit from the rising demand for facility management. Given the national characteristics, the country has seen an increase in the potential for utilizing facility management and corporate real estate creatively.

Regarding end-user demand, the public sector's contribution to the Malaysian facility management market is primarily fueled by the government's limited resources, forcing it to continuously outsource necessary facility management services.

Many maintenance companies that offer similar services and compete for contracts have saturated the market. Certain maintenance companies may see a decline in service quality due to the severe competition determining which firm receives the contract.

Facilities management companies were affected by the COVID-19 pandemic. People's freedom of movement was restricted, which led to a fall in project work and activity levels at numerous client sites. The pandemic lockdown harmed major market firms like AWC Berhad, MST Facilities Sdn Bhd, and other businesses.

Malaysia Facility Management Market Trends

The Rise in Digital Technology Drives the Facility Management Market

The demand for American technologies in the information and communications technology (ICT) sector is still driven by Malaysia's digital transformation, which aims to make Malaysia the digital center of Southeast Asia.

Malaysia is concentrating on creating 5G ecosystems, digital infrastructure for buildings, satellite broadband, networking, and smart automation. This gives US businesses a chance to offer cybersecurity and digital technology shortly.

Moreover, Malaysia is conveniently located in the region's center, providing quick access to other developing markets and strong infrastructure, connectivity, and economic stability. According to the Malaysian Government, one of the markets' fastest-growing industries, ICT will contribute 22.6 percent of the nation's GDP by 2025.

Due to budget constraints, Malaysian businesses previously did not place a high priority on cybersecurity. Yet, the worldwide pandemic is forcing more businesses to become digital, driving up demand for cybersecurity solutions to reduce their organizations' susceptibility.

Preventive maintenance is essential to maintenance management because it safeguards the good condition of facilities before they break down. After the strategy is implemented, a sizable amount of data about maintenance and operation will be produced. Data related to Malaysia's government and asset upkeep are preserved by the Malaysian Public Works Department.

Soft FM to Witness the Growth

Soft FM services usually make a building more comfortable, pleasant, and safe for its occupants. Soft FM services include grounds maintenance, landscaping decorating, catering services (including vending machines and water coolers), pest control, cleaning, waste management, car parking, workspace management, etc.

In current market scenarios, Facilities management firms have identified high-level cleaning services as a growth area for their business based on the rising complexity of projects across various parts of the country. Key benefits of Soft FMServices include efficient waste management, adequate office security, catering for the workforce, and many others.

In the administration of soft services facilities, the introduction of the Internet of Things is quickly emerging as a significant force. IoT offers a continuous, real-time data stream that facilitates improved decision-making and work-process optimization across various industry sectors. The importance of outsourcing companies is growing, and businesses are putting more of an emphasis on providing individualized, value-added services like risk management that is both practical and credible, including management of local labor laws and HSE. These are two additional factors fueling the growth of the soft services facilities management market.

Furthermore, the COVID-19 outbreak has acted as a catalyst, especially for change in how facilities are managed, and services are provided. As the organizations are growing within various sectors, they require careful consideration and tailored plans; the role of FM services providers can also become more strategic and long-term based.

Malaysia Facility Management Industry Overview

The Malaysia Facility Management Market is fragmented, with diverse firms of different sizes. This market is anticipated to encounter several partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns that they are experiencing. The clients in this region are employing FM services to increase the ease of their business operations. The market comprises key solutions and service providers, such as AWC Berhad, MST Facilities Sdn Bhd., Harta Maintenance Sdn Bhd, Zelan AM Services Sdn Bhd, and SDE Facilities Management Sdn Bhd.

In January 2023, AWC Bhd announced the signed MOU with two Indonesian companies, PT Gema Karya Manunggal and PT Prasarana Danoes Cemerlang. These companies will work with AWC to explore oil and gas industry prospects and airport and port infrastructure in Malaysia and Indonesia.

In April 2022, Sheffield Property Pty Ltd. and Sheffield Asset Management Pty Ltd., a respected office leasing and property management firm in Perth, Western Australia, were acquired by Cushman & Wakefield. The acquisition reinforces Cushman & Wakefield's comprehensive commercial real estate platform in Australia and the Asia Pacific region, which is already well-established.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Facility Management Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend Toward Commoditization of FM

- 5.1.2 Increasing Investments on Infrastructure Developments

- 5.1.3 The Rise in Digital Technology Drives the Facility Management Market

- 5.2 Market Restraints

- 5.2.1 Diminishing Profit Margins and Ongoing Changes in Macro-environment

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management Type

- 6.1.1 In-house Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offering Type

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AWC Berhad

- 7.1.2 MST Facilities Sdn Bhd.

- 7.1.3 Harta Maintenance Sdn Bhd

- 7.1.4 Zelan AM Services Sdn Bhd

- 7.1.5 SDE Facilities Management Sdn Bhd

- 7.1.6 SYREFL Holdings Sdn Bhd

- 7.1.7 UDA Dayaurus Sdn. Bhd.

- 7.1.8 JLL Property Services (Malaysia) Sdn Bhd

- 7.1.9 Sepadu Group

- 7.1.10 TH Properties Sdn Bhd