|

市場調查報告書

商品編碼

1644771

日本設施管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

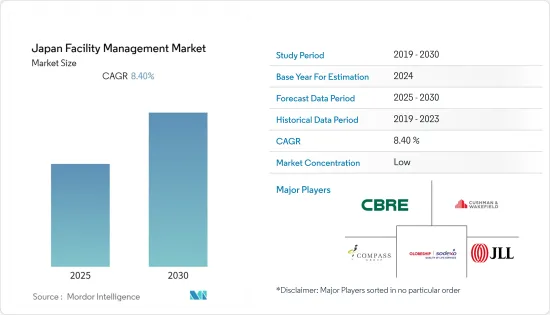

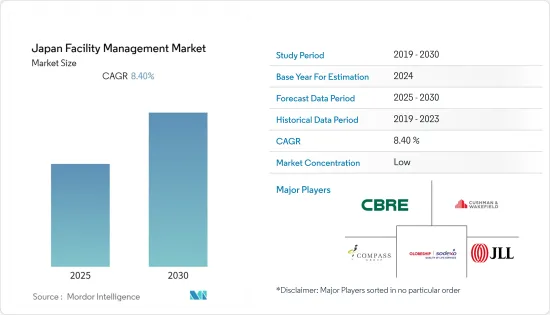

預計預測期內日本設施管理市場的複合年成長率將達到 8.4%。

日本增加基礎建設支出被認為是 FM 市場成長的主要驅動力之一。此外,對最佳化流程和提高能源效率的日益關注也是設施管理市場發展的主要驅動力。

此外,房地產、製造業、零售業和公共部門是該國基礎設施成長較快的行業領域。上述行業構成了設施管理解決方案的主要最終用戶,因為將營運設施的資料與其他業務應用程式整合的需求日益增加。

該地區的設施管理行業由跨洲和跨國界的大型供應商提供的綜合合約推動,而較小的本地參與者則專注於單一合約和單一服務解決方案。但考慮到全部區域正在發生的動態,以新的方式利用設施管理和企業房地產的機會越來越多。

設施管理 (FM) 包括管理組織的建築物、基礎設施以及組織內職場環境的整體和諧的管理方法和技術。該系統使組織的服務標準化並簡化了流程。過去十年,該地區營運的幾家服務供應商一直致力於擴大其影響力,以利用日益成長的設施管理需求,特別是考慮到最近外包非核心業務的趨勢。此外,考慮到日本的整體趨勢,日本以創新方式利用設施管理和企業房地產的機會正在增加。

日本已採取多項措施吸引投資和遊客,以幫助該國從新冠肺炎疫情的影響中恢復過來。國際貨幣基金組織(IMF)將日本2022年經濟成長率預測上調至2.4%。

日本設施管理市場趨勢

綜合FM顯示出強勁的成長率

隨著多個行業從使用單一的 FM 外包模式轉向能夠大規模滿足所有客戶核心需求的整合服務模式,市場正在發生模式轉移。此外,隨著新技術改變組織的工作方式,整合性機構管理已成為智慧建築和職場環境的關鍵。

對於各種供應商而言,IFM 已被用於簡化和高效的工作和任務管理。與獨立的相關人員和多次監督所有任務相比,這個概念主要減少了需要管理的合約、團隊和資源的數量,並提供了所有管理相關任務的單一、整合的視圖。

IFM 為您提供更高的視覺性,幫助您有效地管理團隊、降低營運成本、更快地回應請求、減少員工停工時間並專注於整體情況。與 IFM 服務提供者合作還可以更輕鬆地跨多個站點和服務實施大規模變更。

日本市場的趨勢是從單一服務轉向捆綁服務,再轉向整合性機構管理方法。這將增加所提供的服務範圍並延長合約期限,提高附加價值,提高品質並促進規模經濟。對於需要專業知識的外包服務的需求也不斷增加。

此外,不同的供應商正在透過各種合約擴大業務。例如,2022年4月,日本管材株式會社簽署股份轉讓協議,收購JTB Asset Management 40%的股份。

商務用終端用戶部分預計將佔很大佔有率

商業部門是日本設施管理市場中佔有較大佔有率的主要部門之一。預計日本在新冠疫情後 GDP 的強勁成長將對受訪市場產生正面影響。商業領域的成長歸因於日本快速的基礎設施發展以及對飯店、零售店、購物中心和辦公大樓的需求不斷成長。

商業部門涵蓋提供商業服務的辦公大樓,例如製造商、IT 和通訊、金融和保險、房地產和其他服務供應商的公司辦公室。日本各地 IT 產業的興起可能會推動商業產業以及設施管理服務的進一步擴張。

例如,日本的通訊業者正專注於5G部署,這可能會為該地區的設施管理產業創造巨大的商機。例如,2022年4月,Softbank Corporation借款約2.82億美元用於開發5G基地台,旨在進一步加強其在日本的5G網路。Softbank Corporation表示,計畫到2022年3月底,5G網路覆蓋日本90%的人口。

此外,日本佔日本商業領域開發計劃的大多數。此外,牛津大學研究人員的研究顯示,2021年7月舉行的東京奧運將需要154億日圓的巨額投資,成為史上最昂貴的夏季奧運。

東京奧運會讓建設產業受益,新建了 7 個場館,包括耗資 30 億美元的 68,000 個座位的國家體育場,另有 25 個設施正在進行維修。此外,日本正從新冠疫情期間商業建築停頓中迅速復甦,推動受調查市場的成長。

日本設施管理產業概況

日本的設施管理市場高度分散,不同規模的許多參與者競爭激烈。隨著企業不斷投資以抵消其策略上正在經歷的當前經濟放緩,預計該市場將出現大量的併購和聯盟。

2022 年 1 月-世邦魏理仕集團增強了其飯店相關資產的經紀服務。 CBRE Hotels 運用其在飯店和旅館方面的專業知識,為飯店相關資產的買賣提供從策略制定到交易完成的全面解決方案。

2021 年 9 月 - Cushman & Wakefield 部署 Matterport 的 3D虛擬工具,以實現一流的房產估價並增強房產行銷。該虛擬工具以該公司去年與 matterport 簽署的全球協議為基礎,為客戶提供其場所 3D 掃描的承包解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對市場的影響

第5章 市場動態

- 市場促進因素

- 更重視外包非核心活動

- 商業地產領域穩定成長

- 強調綠色實踐和安全意識

- 市場挑戰/限制

- 監管和法律變化

第6章 市場細分

- 按設施管理

- 內部設施管理

- 外包設施管理

- 單調頻

- 捆綁 FM

- 整合調頻

- 按服務

- 硬體維修

- 軟調頻

- 按最終用戶

- 商業設施

- 設施

- 公共/基礎設施

- 工業的

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- Globeship Sodexo

- JLL Japan

- Compass Group,Inc

- CBRE Group Japan

- Cushman & Wakefield

- RISE Corp. Tokyo

- Nippon Kanzai Co

- ISS World

- Aramark Facilities Services

- G4S Facilities Management

- Compass Group

第8章投資分析

第9章:市場的未來

The Japan Facility Management Market is expected to register a CAGR of 8.4% during the forecast period.

The increased spending on the infrastructural aspect in Japan can be cited as one of the major drivers of the growth of the FM market. Moreover, the increasing focus on optimization processes and energy efficiency improvements are the main driving forces for the development of the facility management market.

Along with this, real estate, manufacturing, retail, and the public sector are a few industry verticals that have witnessed high infrastructural growth in the country. These verticals mentioned above constitute the primary end users of facility management solutions, owing to the growing need for integrating data from operational facilities into other business applications.

The region's facility management industry operates with integrated contracts provided by significant vendors across continents and borders, and small local players focus on single contracts and single-service solutions. However, there are increasing opportunities to leverage facility management and corporate real estate in new ways, given the dynamics occurring across the region.

Facility management (FM) includes management methods and techniques for building management, infrastructure management for an organization, and overall harmonization of the work environment in an organization. This system standardizes services and streamlines processes for an organization. Across the last decade, several service vendors operating in the region have been focused on expanding their presence to leverage the increasing demand for facility management, especially with the recent trend favoring the outsourcing of non-core operations. Further, Japan has been witnessing increased opportunities to leverage facility management and corporate real estate in innovative ways, given the dynamics across the country.

Japan has adopted several efforts to attract investment and visitors to aid the country's recovery from the impacts of the Covid-19 epidemic. The International Monetary Fund upped the country's economic growth forecast for 2022 to 2.4%, citing Japan's reaction to the COVID-19 epidemic.

Japan Facility Management Market Trends

Integrated FM to exhibit a significant growth rate

There is a paradigm shift in the market as multiple industries are transforming from utilizing a single FM outsourcing type of model to an integrated services model that can meet all customers' core needs on a large scale. In addition, with newer technology transforming the way organizations work, integrated facility management has become the key to smart buildings and work environments.

For Various Vendors, IFM has been away for streamlined and efficient work and task management. The concept has primarily resulted in fewer contracts, teams, and resources to juggle and a single integrated view of all the management-related tasks, in comparison with overseeing each independent stakeholder and every task multiple times.

IFM offers increased visibility that leads to effective management of teams, reduced operation costs, quicker responses to requests, less downtime for employees, and a greater focus on the bigger picture. Implementing large changes across multiple sites and services is also much easier using an IFM service provider.

The trends in the Japanese market are for a progression from single services to bundled services and further toward the integrated facilities management approach. This offers a broad scope of services provided and longer-term contracts, which adds value and drives better quality and economies of scale. Also, this is increasing the demand for outsourced services, where specialist expertise is required.

Moreover, various market vendors are expanding their business operations through various contracts. For instance, in April 2022, NIPPON KANZAI Co. entered into a share transfer agreement to acquire 40% of the shares of JTB Asset Management Co. Ltd.

Commercial End User Sector is expected to hold major share

The commercial segment is one of the prominent segments that contributes a good share in the facility management market in Japan. Japan's resilient GDP growth after the COVID-19 pandemic is expected to positively influence the studied market. The growth of the commercial segment is attributed to the rapid infrastructural development and rising demand for hotels, retail outlets, malls, and office buildings in the country.

The commercial sector covers office buildings occupied by business services, such as corporate offices of manufacturers, IT and telecommunication, finance and insurance, property, and other service providers. The rise in the IT sector across Japan will allow more expansion in the commercial sector along with facility management services.

For instance, the telecom players are focusing on 5G deployments in Japan, which will create significant opportunities for the region's facilities management sector. For instance, in April 2022, Softbank borrowed around USD 282 million to develop 5G base stations, aiming to further strengthen its 5G network in japan. As per Softbank, it will cover 90% of the Japanese population with a 5G network at the end of March 2022.

Moreover, Japan accounts for most of the development projects being undertaken in the country's commercial sector. Moreover, the Tokyo Olympics held in july 2021 saw a massive investment of 15.4 billion, making it the most expensive summer game ever, per a study from University of Oxford researchers.

The construction industry benefitted from the Tokyo olympics as many developments were made, including the 68,000-capacity national stadium and seven other venues for the olympic, costing USD 3 billion, and 25 other facilities were renovated. Further, the country is rapidly recovering from the construction halt of the commercial sector during the COVID-19 pandemic driving the growth of the studied market.

Japan Facility Management Industry Overview

The Japanese Facility Management market is highly fragmented as it is a highly competitive market with the presence of several players of different sizes. This market is expected to experience a number of mergers, acquisitions, and partnerships as companies continue to invest in offsetting the present slowdowns that they are experiencing strategically.

January 2022 - CBRE Group has strengthened its brokerage services for hotel-related assets. With expertise in hotels and ryokans, CBRE Hotels provides comprehensive solutions for selling and purchasing hospitality assets, strategy developments, and closing.

September 2021 - Cushman and Wakefield introduced matterport's 3D virtualization tools for first-class property evaluation and enhanced property marketing. This virtualization tool is based on a global contract that the company signed last year with matterport, which gives the customer a turnkey solution for 3D scanning of the managed facilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Impact Of Covid-19 On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Outsourcing of Non-core Operations

- 5.1.2 Steady Growth in Commercial Real Estate Sector

- 5.1.3 Strong Emphasis on Green Practices and Safety Awareness

- 5.2 Market Challenges/Restraints

- 5.2.1 Regulatory & Legal Changes

6 MARKET SEGMENTATION

- 6.1 By Fcaility Management

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offering

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Globeship Sodexo

- 7.1.2 JLL Japan

- 7.1.3 Compass Group,Inc

- 7.1.4 CBRE Group Japan

- 7.1.5 Cushman & Wakefield

- 7.1.6 RISE Corp. Tokyo

- 7.1.7 Nippon Kanzai Co

- 7.1.8 ISS World

- 7.1.9 Aramark Facilities Services

- 7.1.10 G4S Facilities Management

- 7.1.11 Compass Group