|

市場調查報告書

商品編碼

1644816

亞太地區設施管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

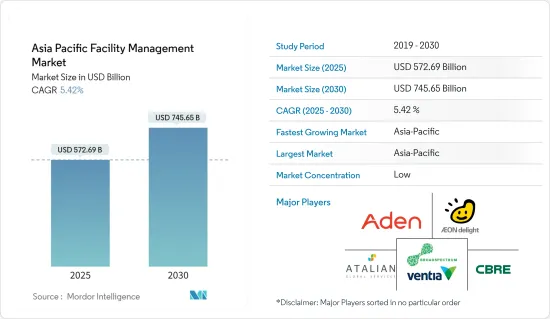

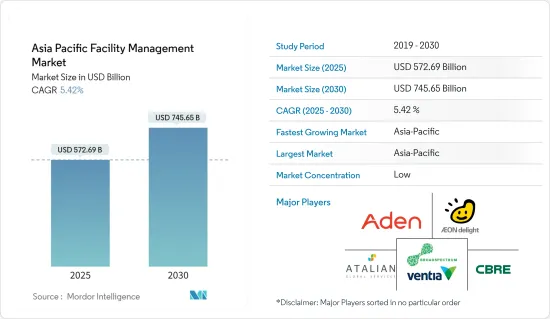

亞太地區設施管理市場規模預計在 2025 年為 5,726.9 億美元,預計到 2030 年將達到 7,456.5 億美元,預測期內(2025-2030 年)的複合年成長率為 5.42%。

隨著商業建築服務從 2024 年到 2029 年的成長,合約的全球化和服務的整合預計將支持 FM 行業,尤其是商業建築行業的成長。預計亞太市場將快速成長。

主要亮點

- 亞太地區各國政府正大力投資建設和基礎建設。基礎設施建設的三個主要組成部分是結構工程、新建築建設和現有設施的翻新。但該公司處於理想的位置,可以從世界各地的基礎設施發展中獲益。行業趨勢正在推動大多數設施管理服務、現有建築的展示和升級的市場不斷擴大。

- 此外,由於長期合約對技術採用影響不大,亞太地區一些領先的設施管理服務供應商擔心設施服務所需的高額初始投資。

- 在工業和城市發展的推動下,該地區的設施管理服務市場正在擴大。都市化進程的加速導致商業化進程的加快,進而減少了各個公司辦公室的維護需求,增加了提高生產力的需求,從而導致了市場的成長。

- 然而,網路安全和安保措施限制了業務擴展。該產業受到網路犯罪集團和安全漏洞日益嚴重的威脅,導致信任受損、市場成長放緩。此外,在該領域,政府部門正在尋求與建築管理提供者簽訂長期合約。對於尋求長期合約的運動員來說,這可能是一個很大的障礙。

亞太地區設施管理市場趨勢

商業領域可望強勁成長

- 由商業服務機構建造和占用的辦公室,例如資訊和通訊技術以及工業設備製造商的公司辦公室。該國的商業領域市場在提供基本設施、室內設施、商業建築、裝飾和管理方面的重要性日益增加。

- 預計不斷成長的需求將推動商業房地產和建築業的成長。例如,根據新加坡統計局的數據,截至 2023 年第二季度,正在建設中的房地產面積為 568 平方米。

- 商業終端使用者部分主要包括提供商業服務的服務供應商所使用的辦公大樓,例如製造商辦公室、資訊科技和通訊公司以及其他第三方。因此,在商業建築裝修、必要的內部設備和管理的全面供應方面,本地零售市場變得更加重要。

- 商業設施需要進行房地產會計、合約管理、租賃管理、採購管理等多種業務,因此需要聘請專家。因此,市場為商業設施提供了成長機會,預計這一趨勢將在 2024 年至 2029 年間持續強勁。

- 該市場為供應商提供了大量機會來實施和營運各種基於物聯網的設施管理解決方案,從而推動在中國建造更聰明的建築。這是因為越來越多的人對使用物聯網和智慧建築技術感興趣。此外,由於行業供應商商業敏銳度的提高和不同行業經濟的多樣化,該地區對設施管理服務的需求預計會增加。

日本可望創下最快市場成長

- 由於事件和事故頻繁,日本的設施管理行業越來越重視更高水準的建築維護和災害防備的必要性。由於關鍵功能和設施的經濟高效維護的複雜性,許多公司將這些業務外包給設施服務提供者。

- 隨著日本物聯網技術的快速應用,設施管理的數位化變得越來越複雜,國內外對門禁解決方案的需求都在成長。

- 此外,雖然降低工業設施生產線相關成本的需求日益增加,但能夠處理複雜設施操作的專業人員卻十分短缺。

- 日本貨運代理面臨人手不足,並且正在努力維護老化的設施,包括他們自己的建築物和空調和照明系統等設備。隨著全國生活水準的提高,對具有先進安全功能且更易於管理的建築的需求也日益成長。預計這一趨勢在未來將變得更加明顯,尤其是在都市區。

亞太地區設施管理產業概況

亞太地區設施管理市場分散且競爭激烈,參與者規模各異。隨著企業繼續進行策略性投資以應對當前的經濟放緩,預計該領域將出現大量的合作、併購。該領域的客戶使用 FM 服務來促進其業務運作。該市場有重要的解決方案和服務供應商,包括Group Italian、Aeon Delight、Broadspectrum、Aden Group和CBRE。

- 2024年2月,世邦魏理仕發布了每間可用客房收益(RevPAR)預測,顯示在團體業務、入境入境旅行和傳統一次性業務需求改善的推動下,2024年將繼續穩步成長。 CBRE 預測 2024 年 RevPAR 將成長 3.0%,這項成長預測預示著住宿業將持續復甦。

- 2023 年 12 月,CPG Corporation 的計劃管理子公司 PM Link Pte Ltd 與 Air Squire Pte Ltd 簽署了一份為期三年的合作備忘錄 (MoU),以加快建築環境的數位轉型步伐。作為合作備忘錄的一部分,合作領域將包括共同開發和實施數位化施工監控技術,例如 360° 現場文件工具,以提高整個建築價值鏈的業務效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 中國加大對醫療基礎建設和醫療設施建設的投資

- 商業建築的建築資訊模型 (BIM) 要求與日俱增

- 市場限制

- 資料外洩和安全威脅日益增多

第6章 市場細分

- 設施管理類型

- 內部設施管理

- 外包設施管理

- 整合性機構管理(IFM)

- 其他

- 按服務

- 硬體設施管理

- 軟設施管理

- 按最終用戶

- 商業設施

- 設施

- 公共/基礎設施

- 產業

- 其他

- 按國家

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 泰國

第7章 競爭格局

- 公司簡介

- Aden Group

- Aeon Delight Co. Ltd(Aeon Co. Ltd)

- Group Atalian

- Broadspectrum(Ventia)

- CBRE

- C&W Facility Services Inc.

- Commercial Building Maintenance Corp.

- Jones Lang LaSalle IP Inc.

- Nippon Kanzai Co. Ltd

- CPG Corporation

- OCS Group Limited

第8章投資分析

第 9 章:未來趨勢

The Asia Pacific Facility Management Market size is estimated at USD 572.69 billion in 2025, and is expected to reach USD 745.65 billion by 2030, at a CAGR of 5.42% during the forecast period (2025-2030).

Contract globalization and integration of services are expected to support growth in the FM sector, particularly in the commercial building sector, given the growth in commercial building services between 2024 and 2029. Rapid growth is projected for the Asia-Pacific market.

Key Highlights

- Governments throughout Asia-Pacific are making major investments in construction and infrastructure. Three main components of infrastructure development are structural engineering, the construction of new buildings, and the renewal of current facilities. However, the company is in an ideal position around the world to benefit from infrastructure improvements. The industry's propensity drives most facility management services, presentations, and market expansion for upgrading existing buildings.

- In addition, since long-term contracts have a minimal impact on technology adoption, there are a few concerns among some of the major facility management service providers in Asia-Pacific with high initial investment in facilities services.

- The size of the facility management services market in the region has grown and is driven by industrial and urban development. In the context of urbanization, there has been an increase in commercialization that results in increased demand for improved productivity due to lower maintenance requirements at different corporate offices, which are leading to market growth.

- However, network safety and devising security issues are limiting business expansion. In this area, confidence has been undermined, and market growth slowed as the threat from cybercrime groups grows and security breaches occur. Moreover, longer-term contracts were requested from construction management undertakings by the government sector in this area. This may act as a significant barrier to athletes seeking long-term contracts.

Asia Pacific Facility Management Market Trends

The Commercial Segment is Expected to Witness a Major Growth

- Offices built or occupied by business services, such as corporate offices of information and communication technologies and industrial equipment manufacturers. The importance of decoration and management has increased in the country's business sector market, given the provision of essential equipment and interior facilities and commercial buildings.

- Due to the increasing demand, increasing commercial properties and construction are expected to drive the segment. For example, according to the Singapore Department of Statistics, as of Q2 2023, 568 m2 of properties were under construction.

- The commercial end-user sector is mainly composed of office buildings used by service providers for the provision of business services, such as manufacturers' offices, information technology and telecommunications firms, or other third parties. As a result, the regional retail market has become even more important with regard to the total supply of commercial building decorations, necessary internal fittings, and management.

- Property accounting, contract management, renting, procurement administration, and a number of other services are required in commercial premises, so the need to hire professionals becomes necessary. In view of these factors, there are growth opportunities for the commercial sector in the market, and this trend is expected to continue significantly between 2024 and 2029.

- The market offers vendors a number of opportunities for implementation and operation of various IoT-based facility management that will enable smarter buildings to be built in China. This is because more and more people are interested in using IoT and smart building technologies. The need for facility management services in the area is also predicted to increase due to the rise in business acumen among industry suppliers and the diversification of the economy from different industries.

Japan is Expected to Register the Fastest Growth in the Market

- Due to frequent incidents and occurrences, the Japanese facility management industry has become increasingly focused on the maintenance of buildings at a higher level and the need for disaster preparedness. Various firms are outsourcing these tasks to facility service providers due to the complexity associated with the cost-effective maintenance of crucial functions or sites.

- As the digitalization of facility management becomes increasingly complex with the rapid uptake of Internet of Things technology in Japan, demand for access control solutions is growing both at home and abroad.

- Moreover, while there is a growing need to reduce costs related to production lines in an industrial facility, there is a shortage of human resources in specialized occupations that can handle the operation of complex facilities.

- Japan's freight transport companies are facing shortages of workers and the maintenance of aging facilities, including its own buildings or equipment, such as air conditioning and lighting systems. Demand for buildings fitted with advanced security features that will make them easier to manage has grown as a result of improvements in living standards across the country. This trend, which is projected to become more pronounced in the forthcoming period, has been particularly marked in urban centers.

Asia Pacific Facility Management Industry Overview

The Asia-Pacific Facility Management Market is fragmented and highly competitive, with diverse firms of different sizes. As businesses continue to make strategic investments to counteract the current slowdowns they are experiencing, it is projected that this sector will see a number of partnerships, mergers, and acquisitions. Customers in this area use FM services to make running their businesses easier. Important providers of solutions and services, like Group Italian, Aeon Delight Co. Ltd (Aeon Co. Ltd), Broadspectrum, Aden Group, and CBRE, are present in the market.

- In February 2024, CBRE announced the forecasting revenue per available room (RevPAR) and is willing to continue to grow steadily in 2024, driven by improving group business, inbound international travel, and traditional transient business demand. CBRE forecasts a 3.0% increase in RevPAR growth in 2024, where this projected growth indicates the continued recovery of the lodging industry.

- In December 2023, PM Link Pte Ltd (PM Link), the project management subsidiary of CPG Corporation, signed a Memorandum (MoU) for three years with Air Squire Pte Ltd (Airsquire) to accelerate the pace of digital transformation in the built environment. As part of the MoU, collaboration areas include the co-development and implementation of digital construction monitoring technology, such as 360° site documentation tools, to improve operational efficiency throughout the construction and building value chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Healthcare Infrastructure and the Construction of Healthcare Facilities in the China

- 5.1.2 Requirement of Building Information Modeling (BIM) in Commercial Buildings Addresses the Growth

- 5.2 Market Restraints

- 5.2.1 Increased Instances of Data Breaches and Security Threats

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management Type

- 6.1.1 In-house Facility Management

- 6.1.2 Outsourced Facility Mangement

- 6.1.3 Integrated Facility Management (IFM)

- 6.1.4 Others

- 6.2 By Offerings

- 6.2.1 Hard Facility Mangement

- 6.2.2 Soft Facility Mangement

- 6.3 By End User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Others

- 6.4 By Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Indonesia

- 6.4.6 Thailand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aden Group

- 7.1.2 Aeon Delight Co. Ltd (Aeon Co. Ltd)

- 7.1.3 Group Atalian

- 7.1.4 Broadspectrum (Ventia)

- 7.1.5 CBRE

- 7.1.6 C&W Facility Services Inc.

- 7.1.7 Commercial Building Maintenance Corp.

- 7.1.8 Jones Lang LaSalle IP Inc.

- 7.1.9 Nippon Kanzai Co. Ltd

- 7.1.10 CPG Corporation

- 7.1.11 OCS Group Limited