|

市場調查報告書

商品編碼

1645145

非洲設施管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Africa Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

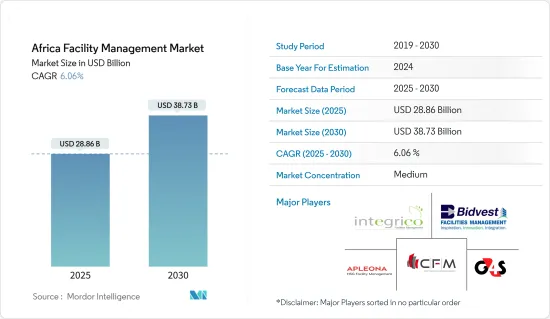

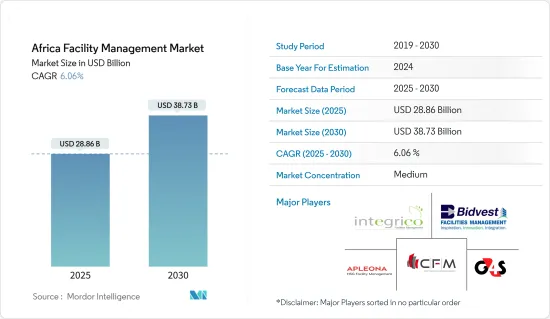

非洲設施管理市場規模預計在 2025 年為 288.6 億美元,預計到 2030 年將達到 387.3 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 6.06%。

設施管理還包括旅行預訂、廢棄物、安全、給排水、空調維護、行李服務、裝飾和整修。基礎設施活動的成長是設施管理市場佔有率較高的最重要因素。上述領域的需求持續成長,帶動新基礎建設和整體市場成長。

主要亮點

- 設施管理系統服務供應商是各種設備(包括高壓和低壓設備)的工程師、維修人員和安裝人員。設施管理需要多種技能,包括災難準備、計劃管理、領導力和策略導向。非洲設施管理解決方案用於改善資源和組織資產管理。

- 該市場成長的主要驅動力是對第三方設施管理服務、基礎設施投資和私營部門支出的需求不斷成長。鑑於非洲聯盟《2063年議程》對基礎設施的投資和區域連結性的改善,非洲的人口成長、經濟活力和快速都市化也有望創造機會。

- 儘管外國直接投資成長緩慢,但非洲大陸的許多參與者正在擴大其地理覆蓋範圍。主要例子包括標準銀行等南非公司向奈米比亞擴張,以及埃塞俄比亞航空為重振非洲大陸陷入困境的航空公司而進行的戰略投資和合作。

- 然而,預計市場擴張將受到營運成本和區域基礎設施缺乏的阻礙。缺乏投資興趣阻礙了南非的經濟活動。由於該地區經濟發展緩慢,滲透率較低,因此本地參與者比以往任何時候都更重要。與綜合設施管理相比,這些提供者提供單一和多項配套服務。預計該地區的長期商機將來自於政府的基礎設施發展措施和國際支援行動,從而改善該地區設施管理的成長前景。

- 預計 COVID-19 將影響非洲國家的設施管理市場。由於中國作為非洲主要貿易夥伴,非洲也將感受到新冠肺炎疫情的負面影響。由於中國關閉港口和製造設施,對非洲商品的需求下降。中國進口商以港口限制為由取消採購或降低價格。加上人們對衛生的興趣日益濃厚以及成本不斷上升,預計設施管理市場的成長將在短期至中期內受到限制。為了滿足對設施管理日益成長的需求,疫情過後人們對清潔度、維護程序和通風等一系列問題的認知有所提高。

非洲設施管理市場趨勢

基礎設施發展持續為 FM 供應商帶來新的機會

- 非洲最大的用戶是住宅、商業、工業和公共基礎設施部門。未來的領域包括石油和天然氣公司、金融機構以及體育和醫療設施。此外,市場買家的意識不斷增強,正在鼓勵工廠管理領域的營運商採用適當的定價。

- 零售和房地產等發展中產業對綠建築的重視程度不斷提高,預計將刺激該地區設施管理外包的成長。例如,南非房地產開發商 Growthpoint Properties 承諾為所有新建辦公大樓提供至少四星級的南非綠色建築委員會星級評定,並提高其環境性能。

- 該商場的開發商也承諾建造綠建築。例如,最近,非洲購物中心和零售空間開發商Novare 股權 Partners申請綠色認證,以吸引知名的非洲零售商Shoprite Holdings和Pick n Pay在尚比亞首都盧薩卡建設大北購物中心(Great North Mall)。只需花費很少的額外成本,購物中心就可以安裝節能功能,預計可減少近 40% 的能源成本。

- 非洲天氣變化無常,容易發生嚴重洪水和長期乾旱。此外,南部非洲的複雜問題受到各種社會、環境、經濟和政治因素的影響。因此,促進成長和提高生活品質的需求推動著永續基礎設施的發展,同時也增加了對綜合設施管理的需求。

奈及利亞:預計將大幅成長

- 政府的措施和國際組織的支持正在刺激奈及利亞基礎設施建設的投資。奈及利亞是成長型國家之一。預計這項舉措將增加公共和私營部門的基礎設施支出,為設施管理公司創造擴大市場影響力的機會。

- 此外,在奈及利亞的商業領域,辦公室、購物中心、餐廳和政府大樓等終端用戶正在推動對設施管理服務的需求。此外,旅遊業和房地產行業的快速擴張預計將推動奈及利亞經濟發展。

- 此外,對生態友善建築的日益重視也刺激了市場的成長。此外,EchoStone 計劃與當地銀行合作,到 2023 年在奈及利亞拉各斯建造 182,000 套經濟實惠的環保住宅,為住宅提供更低的利率和更長的貸款期限。

- 另一方面,該地區的設施管理供應商大多為私人公司、小型和中型公司,各自為政,難以達到國際標準,也難以應對因客戶需求多樣化而導致的服務差異化,難以與客戶接軌。對夥伴關係和聯盟的策略方針可以幫助公司獲得競爭優勢並獲得更廣泛的基本客群。

非洲設施管理產業概況

非洲的設施管理市場相當分散,由本地企業和中小型企業組成。 Bidvest Facilities、Apleona、G4S Africa 和 Integrico Private Limited 等領先公司正在採用各種成長策略,如推出新產品、業務擴張、合資企業和夥伴關係,以鞏固其在該市場的地位。

2022年10月,Allied Universal和G4S與殼牌石油簽署了一份合作備忘錄,透過在永續性和安全性方面的全球合作,加速向客戶和員工的永續解決方案過渡。

2022 年 8 月,Massmart 將與 GreenWave Group 和工業科技跨國公司Schneider Electric合作,在未來 18 個月內在其南非所有門市推出 BMS 解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 非洲對 FM 外包的需求不斷成長

- 該地區的基礎設施發展為 FM 供應商帶來了新的機會。

- 私部門投資推動成長

- 市場挑戰

- 營運和成本挑戰仍然是 FM 供應商關注的問題。

第6章 市場細分

- 設施管理類型

- 單一設施管理

- 捆綁設施管理

- 整合性機構管理

- 按最終用戶

- 商業設施

- 基礎設施

- 設施

- 工業

- 其他最終用戶

- 按國家

- 南非

- 埃及

- 奈及利亞

第7章 競爭格局

- 公司簡介

- Bidvest Facilities Management

- Integrico Private Limited

- Apleona GmbH

- Contrack Facilities Management SAE

- G4S Africa

- EFS Facilities Management Africa

- Emdad Facility Management

- Benchmark Facilities Management

- Broll Nigeria

第8章投資分析

第9章 市場機會與未來趨勢

The Africa Facility Management Market size is estimated at USD 28.86 billion in 2025, and is expected to reach USD 38.73 billion by 2030, at a CAGR of 6.06% during the forecast period (2025-2030).

Travel booking, waste removal, security, plumbing and draining, air conditioning maintenance, luggage services, decoration, and refurbishment are also included in the management of facilities. The growth of infrastructure activity is the most important factor that has led to a high market share for facilities management. The demand for the abovementioned sectors continues to grow, resulting in overall market growth as a result of the construction of new infrastructure.

Key Highlights

- The service providers of facility management systems are the engineers, maintenance, and installers of a wide range of devices, such as high voltage equipment or Low Voltage Equipment. A broad range of skills, e.g., readiness for disaster, project management, leadership, and strategic orientations, are part of Facility Management. For the improvement of resource and organizational asset management, Africa Facility Management solutions are applied.

- The major drivers for the growth of this market have been the growing demand for facility management services by third parties, infrastructure investments, and private sector expenditure. The growth of Africa's population, economic dynamism, and rapid urbanization are also predicted to create opportunities for businesses if investment is undertaken in upgrading infrastructure and regional connectivity under the Agenda 2063 of the African Union.

- A number of players in the continent have expanded their geographic scope, even though FDI has been slow to grow. Some of the important examples are South African firms that have entered Namibia, such as Standard Bank, and strategic investments and partnerships by Ethiopian Airlines to revive struggling African airlines throughout Africa.

- However, market expansion is expected to be hampered by difficulties with operating costs and a lack of infrastructure in the region. In South Africa, an insufficient interest in investment is holding back economic activity. As a result of the slow economic development in this area, local players are more important than ever before, and consequently, its penetration rate is low. In comparison to integrated facilities management, these operators offer a single and multi-bundled service. Long-term business opportunities in the region are anticipated to arise from government initiatives and international support actions for infrastructure development, improving growth prospects for facility management in the region.

- COVID-19 is expected to have an impact on the facilities management market in African countries. Due to China's role as Africa's leading trading partner, the adverse effects of COVID-19 are also felt in Africa. As China has closed its ports and manufacturing facilities, there is a drop in demand for African goods. Chinese importers have canceled their purchases or offered lower prices because of port constraints. It is expected that, together with an increased focus on hygiene and higher cost, market growth for facility management would be limited within the shorter to medium term. In order to meet the growing demand for facility management, there has been increased awareness on a number of matters such as cleanliness, maintenance procedures, and ventilation following COVID.

Africa Facility Management Market Trends

Infrastructural Development Continue to Open Up new Opportunities for FM Vendors

- The biggest users in Africa are the housing, business, industry, and public infrastructure sectors. Oil and gas companies, financial institutions, and sports or healthcare facilities will be the future sectors. In addition, market buyers' increasing awareness has led operators in the field of plant management to adopt an appropriate price.

- The growth of outsourced facility management in the area is expected to be stimulated by increasing emphasis on green construction across developing sectors, such as retail and real estate. For instance, Growthpoint Properties, a South African real estate development company, has promised to provide all new office buildings with at least four stars in the SA Green Building Council's star rating and also enhance their environmental performance.

- The developers of shopping malls have also committed to the construction of green buildings. For example, recently, Novare Equity Partners, a mall and retail space development company across Africa, applied for green approvals to build its Great North Mall at Zambia's capital of Lusaka in order to attract well-known African retailers Shoprite Holdings and Pick n Pay. At little extra cost, resource-saving features have been put into place in the shopping center and are expected to reduce energy costs by almost 40%.

- Due to Africa's exposure to a climate that can be extremely unpredictable, it is more and more frequent that the population suffers severe floods followed by prolonged droughts. In addition, Southern Africa's complexity is caused by a wide range of different social, environmental, economic, and political perspectives. This has led to the development of sustainable infrastructures because of the need for enabling growth and improvement in quality of life while also leading to demand for integrated facility management.

Nigeria is Expected to Witness Significant Growth

- Government initiatives and support from international organizations are driving investments in the infrastructure development of this country. Nigeria has been one of the growth-oriented countries. This initiative is expected to lead to increased infrastructure spending in both state and privately owned sectors, which would provide an opportunity for facility management firms to increase their presence on the market.

- In addition, in the commercial sector in Nigeria, end users such as offices, shopping malls, restaurants, government buildings, and others have increased their demand for facility management services. Moreover, it is anticipated that the rapid expansion of the tourism and real estate sectors will drive Nigeria's economy.

- Moreover, the market's growth is stimulated by a greater emphasis on environmentally friendly buildings. In addition, EchoStone plans to work with local banks so that buyers of homes will be able to access lower interest rates as well as longer loan periods by 2023 when it builds 182,000 affordable, environmentally friendly houses in Lagos, Nigeria.

- On the other hand, the facility management vendors in the region are mostly private and small to medium-sized companies operating in silos, which makes it difficult to meet international standards and deal with the heterogeneity of services due to varied customer needs and face difficulty in customer integration. The strategic approach towards partnerships and alliances might be helpful for companies to gain a competitive advantage and capture a more extensive customer base, which can result in increased growth.

Africa Facility Management Industry Overview

The facility management market in Africa is moderately fragmented due to local players and small to medium-sized firms. The major players, such as Bidvest facilities, Apleona, G4S Africa, and Integrico Private Limited, have adopted various growth strategies, such as new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in this market.

In October 2022, Allied Universal and G4S signed an MOU to accelerate the migration of customers and employees into sustainable solutions through global collaboration in sustainability and security with Shell Petroleum.

In August 2022, Massmart partnered with Green Wave Group and industrial technology multinational Schneider Electric to install BMS solutions in all its South African stores over the next year and a half.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for outsourced FM in Africa

- 5.1.2 Infrastructural development in the region continue to open up new opportunities for FM vendors

- 5.1.3 Investments in the Private sector to drive growth

- 5.2 Market Challenges

- 5.2.1 Operational and Cost-related challenges continue to remain a concern for FM vendors

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management

- 6.1.1 Single Facility Management

- 6.1.2 Bundled Facility Management

- 6.1.3 Integrated Facility Management

- 6.2 By End User

- 6.2.1 Commercial

- 6.2.2 Infrastructural

- 6.2.3 Institutional

- 6.2.4 Industrial

- 6.2.5 Other End-users

- 6.3 By Country

- 6.3.1 South Africa

- 6.3.2 Egypt

- 6.3.3 Nigeria

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bidvest Facilities Management

- 7.1.2 Integrico Private Limited

- 7.1.3 Apleona GmbH

- 7.1.4 Contrack Facilities Management S.A.E.

- 7.1.5 G4S Africa

- 7.1.6 EFS Facilities Management Africa

- 7.1.7 Emdad Facility Management

- 7.1.8 Benchmark Facilities Management

- 7.1.9 Broll Nigeria