|

市場調查報告書

商品編碼

1683221

儲糧殺蟲劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Stored Grain Insecticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

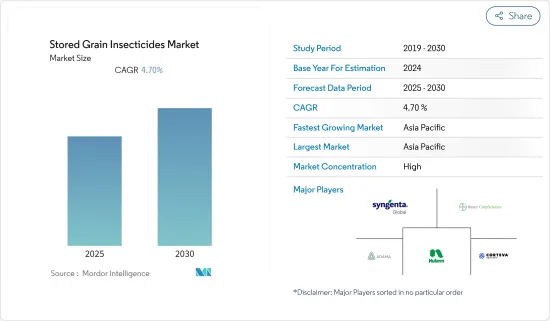

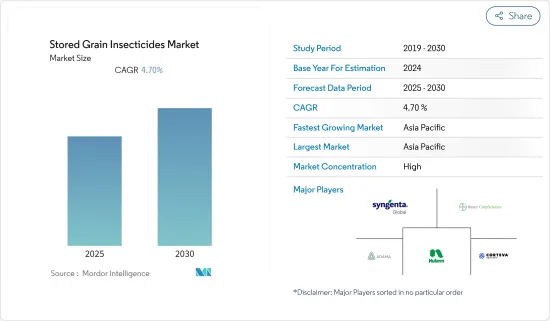

預計預測期內儲存穀物殺蟲劑市場複合年成長率為 4.7%。

收穫後階段持續的市場價格上漲壓力和對減少收穫後損失的日益關注是推動市場成長的關鍵因素。這些國家的許多小農戶缺乏倉儲設施,因此無法儲存剩餘糧食,導致收穫後損失增加。此外,各國政府也越來越重視解決迫在眉睫的糧食儲存危機,並加大資金用於興建高科技糧食儲存筒倉。這可能會增加對昆蟲作物保護劑的需求。席捲全球的疫情導致供應鏈中斷,導致糧食庫存和儲存增加。為了保護儲糧免受蟲害的侵擾,農民對儲糧殺蟲劑的需求越來越大。因此,如果 COVID-19 的影響延續到 2021 年第三季度,除物流行業外,預計全球市場將進一步成長。

儲糧殺蟲劑的市場趨勢

儲糧害蟲-人均損失

每年約有13億噸糧食因害蟲、蟎蟲、囓齒動物和鳥類的侵擾而浪費。使用殺蟲劑是控制筒倉、穀倉和倉庫中的昆蟲和害蟲非常有效的方法。根據聯合國糧食及農業組織(FAO)的數據,已開發國家收穫後農業生產平均損失估計每年約為5%,開發中國家%。人們對減少收穫後損失的興趣日益濃厚,尤其是在印度和中國等新興經濟體,這似乎是研究期間加強倉庫殺蟲劑銷售的一個機會。農藥在貿易過程中必不可少,在檢疫過程中也很重要。這是因為去除一些作物,特別是園藝作物中的有害物質對於提高出口市場的農產品品質至關重要。在這種情況下,使用殺蟲劑進行化學處理是唯一高效的技術。

亞太地區佔市場主導地位

根據糧農組織的報告,印度溫帶作物種植區氣溫上升導致昆蟲活動增加。這導致全國平均氣溫每上升1°C,水稻、玉米、小麥等作物的產量就會損失約10-25%。在印度,最常見的破壞糧食儲存的昆蟲是米象、羊甲蟲、穀蛾和小谷螟/糧食螟/水稻螟。這些災害影響了米、小麥、玉米、高粱、大麥以及其他穀物等多種儲存的糧食。這些昆蟲對儲糧的侵害日益嚴重,進一步擴大了國內儲糧殺蟲劑市場。然而,根據國際稻米研究所的報告,印度儲存穀物農藥的過度使用和濫用正在破壞米和其他穀物的自然控制機制,這就是印度食品安全與農業部對此類農藥的使用實施監管限制的原因。因此,FSSAI 對此類農藥的使用實施了監管限制。這可能會在預測期內在一定程度上抑制市場成長。

儲糧農藥產業概況

儲糧農藥市場競爭激烈,各類中小企業佔相當一部分市場。因此競爭非常激烈。全球大公司之間併購活動的增加也是促進市場整合的重要因素。北美和亞太地區是競爭最激烈的兩個地區。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 依產品類型

- 有機磷酸鹽

- 擬除蟲菊酯

- 生物殺蟲劑

- 其他

- 按應用

- 農場內部

- 非農場

- 出口

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 南美洲其他地區

- 非洲

- 南非

- 非洲其他地區

- 北美洲

第6章 競爭格局

- 最常採用的策略

- 市場佔有率分析

- 公司簡介

- Bayer CropScience AG

- Degesch America Inc.

- Syngenta AG

- Corteva AgriScience

- Nufarm Ltd

- Douglas Products

- Adama Agricultural Solutions Ltd.

- UPL Limited

第7章 市場機會與未來趨勢

第8章 COVID-19 影響評估

The Stored Grain Insecticides Market is expected to register a CAGR of 4.7% during the forecast period.

Sustaining market pressure for better prices during the post-harvest stage and increasing focus on the reduction of post-harvest losses are the major factors driving the market growth. Lack of storage facilities in many small scale farms across various countries led to the inability to store surplus grains resulting in increased post harvest losses. Additionally, the respective governments are increasingly focusing toward keeping pace with its looming food storage crises and has increased the contribution toward the construction of high-tech grain storage silos. This is likely to augment the demand for insect grain protectants. The prevailing pandemic across the globe has resulted in increased stocking and storage of grains due to the disruption of supply chain. In order to protect the stored grains from pest infestation, farmers tend to demand the stored grains insecticide at an increasing level. Hence apart from logistics sector, the impact of COVID-19 if extended to the third quarter of 2021,the market is further observed to grow across the globe.

Stored Grain Insecticide Market Trends

Stored grain pest- per capita loss

Owing to the infestation of pests, mites, rodents, and birds, around 1,300 million metric ton of food grains are being wasted annually. The use of insecticides is a very effective method to control insects and pests in silos, grain bins, and warehouses. According to Food and Agricultural Organization (FAO), the average production loss of the post-harvest produce is estimated to be around 5% in the developed countries, 7% in industrialized countries, and around 7% in developing countries, annually. The increasing concerns toward reducing post-harvest losses, especially from the emerging economies, such as India and China, seems to be an opportunity, which can enhance the sales of warehouse insecticides during the study period. Insecticides are mandatory for trade processes and are important for the quarantine process, as elimination of toxic substances from few crops, especially horticulture crops, is essential to increase the quality of produce in the export market. In such cases, chemical treatment with insecticides is only the technique available, which works with high efficiency.

Asia Pacific Dominates the Market

According to a report by FAO, insect activity is on the rise because of the increasing temperature in the temperate crop-growing regions of India. This, in turn, is leading to the nationwide losses in the cultivation of crops, such as rice, corn, and wheat, by about 10-25% with per degree Celsius rise in mean surface temperature. The most common insects damaging grain storages in India are the rice weevil, the khapra beetle, the grain moth, and the lesser grain/ hooded-grain/ paddy borer. These affect a host of stored grains ranging from rice, wheat, maize, jowar, barley, and other grains. The increase in infestation of stored grains by such insects is further enhancing the market for stored grain insecticides in the country. However, according to reports by IRRI, the overuse and misuse of stored grain insecticides in India is disrupting the natural control mechanisms of rice and other grains, and hence, the FSSAI has set a maximum regulatory limit to the usage of such insecticides. This is going to deter the growth of the market to some extent in the said forecast period.

Stored Grain Insecticide Industry Overview

The storage grain insecticide market is highly competitive, with various small- and medium-sized companies coining reasonable shares in the world. This has resulted in a very stiff competition. The increasing merger and acquisition activities by the major players in different parts of the world is one of the major factors for the consolidated nature of the market. North America and the Asia-Pacific are the two regions showing maximum competitor activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions and Market Definition

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Organophosphate

- 5.1.2 Pyrethroids

- 5.1.3 Bio-Insecticides

- 5.1.4 Others

- 5.2 By Application type

- 5.2.1 On Farm

- 5.2.2 Off Farm

- 5.2.3 Export shipments

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adapted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer CropScience AG

- 6.3.2 Degesch America Inc.

- 6.3.3 Syngenta AG

- 6.3.4 Corteva AgriScience

- 6.3.5 Nufarm Ltd

- 6.3.6 Douglas Products

- 6.3.7 Adama Agricultural Solutions Ltd.

- 6.3.8 UPL Limited