|

市場調查報告書

商品編碼

1684005

美國農藥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)US Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

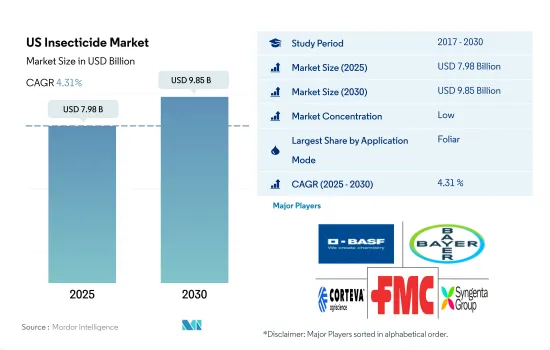

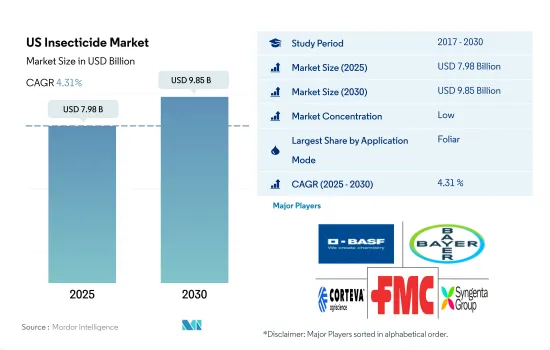

美國殺蟲劑市場規模預計在 2025 年為 79.8 億美元,預計到 2030 年將達到 98.5 億美元,在市場估計和預測期(2025-2030 年)內以 4.31% 的複合年成長率成長。

葉面噴布是施用殺蟲劑預防和治療的常見且有效的方法。

- 除了氣候變遷之外,害蟲也對該國的農業部門造成了重大破壞。全國各地的農民採用各種各樣的策略,其中噴灑化學農藥是控制蟲害和提高植物生產力最有效的方法。根據作物種類、害蟲及其有效性,農民採用不同的施用農藥方法。

- 在所有施用方法中,葉面噴布殺蟲劑佔據美國殺蟲劑市場的大部分佔有率,到 2022 年將達到 56.5%。這是一種傳統而有效的控制葉面害蟲的方法,透過直接針對害蟲,快速殺死它們來減少其種群數量。在預計預測期內,這種應用模式在美國殺蟲劑市場的複合年成長率將達到 4.7%。

- 殺蟲劑種子處理是第二大市場佔有率領域。它也是成長最快的應用方式,因為它可以有效控制小麥和玉米等主要作物的土壤害蟲,並減少未來生長階段的農藥使用。預計該應用模式的市場複合年成長率為 4.9%。

- 穀類種植者根據作物的生長階段和病蟲害情況採用各種噴灑方法。種植這些作物的農民大多採用葉面噴灑殺蟲劑。

- 這兩種噴灑方法對於消滅破壞作物的害蟲都是有效的。預計預測期內(2023-2029 年),美國殺蟲劑市場將以 4.6% 的複合年成長率成長。

美國殺蟲劑市場的趨勢

害蟲壓力的增加推動了該國對殺蟲劑的需求

- 2017 年至 2022 年,美國每公頃農藥消費量大幅增加了 17.1%。這一大幅成長是由於多種因素影響了該國農藥的使用,包括集約化農業實踐的擴展和某些地區害蟲壓力的增加。

- 因害蟲造成的農作物損失和產量下降是農民最擔心的問題。例如,美國重要田間作物之一小麥,產量從2018年的320萬克/公頃下降到2021年的297.82萬克/公頃,主要原因是病蟲害等因素。作物產量的下降對糧食安全構成了重大威脅,必須使用殺蟲劑來減少害蟲造成的損害。

- 入侵昆蟲和病原體導致殺蟲劑使用需求的增加。據估計,這些入侵物種每年造成近 400 億美元的作物和森林產量損失。為了應對這些有害影響,農民被迫使用殺蟲劑來保護作物並減少經濟損失。

- 此外,人們也擔心害蟲對某些殺蟲劑產生抗藥性。隨著時間的推移,害蟲會適應並產生對特定殺蟲劑的抗藥性,從而降低殺蟲劑的有效性。這就需要更頻繁或更高劑量地使用農藥才能達到預期的病蟲害控制水平,從而進一步增加農藥的消費量。

- 因此,預計作物損失增加、產量下降和糧食需求增加將推動美國殺蟲劑市場的成長。

Cypermethrin在控制各種害蟲方面的有效性以及進口關稅的波動推高了價格

- 2022年Cypermethrin價格為每噸21,200美元。由於它能有效控制多種昆蟲,包括蚜蟲、介殼蟲、斑甲蟲、棉鈴蟲、早期斑螟和毛蟲,因此被農業行業廣泛採用。由於其有效性,Imidacloprid成為農民保護農作物免受蟲害、確保豐收的熱門選擇。

- Imidacloprid是一種強效的新菸鹼類殺蟲劑,具有有效的系統性和殘留性。它可以控制多種昆蟲,包括蚜蟲、獵蝽、薊馬、臭蟲、蝗蟲和許多其他破壞作物的昆蟲。Imidacloprid也可用作種子處理劑,保護新生植物免受害蟲侵害。它也常用於控制危害新發芽和長大的幼苗的土壤害蟲。含有Imidacloprid的產品有多種配方,包括液體和固態濃縮物。由於對植物的兼容性高,而且使用量少,因此受到農民的歡迎。 2022 年該活性成分的價格為每噸 17,200 美元。

- 在農業生產中,Malathion是一種有機磷酸酯殺蟲劑,用於控制許多作物和飼料作物,以消滅多種害蟲,包括蚜蟲、跳蚤、葉蟬和日本作物。在美國廣泛種植且經常用Malathion處理的五種作物是櫻桃番茄、綠花椰菜、桑葚、蔓越莓和無花果。 2022 年的價格為每噸 12,600 美元。

美國農藥產業概況

美國農藥市場較為分散,前五大公司的市佔率為21.41%。市場的主要企業是:BASF公司、拜耳公司、科迪華農業科技、FMC 公司和先正達集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 有效成分價格分析

- 法律規範

- 美國

- 價值鏈與通路分析

第5章 市場區隔

- 如何使用

- 化學噴塗

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001707

The US Insecticide Market size is estimated at 7.98 billion USD in 2025, and is expected to reach 9.85 billion USD by 2030, growing at a CAGR of 4.31% during the forecast period (2025-2030).

The foliar application mode is a common and effective way of applying insecticides for preventive and curative reasons

- Apart from climate change, insect pests cause major damage to the country's agriculture sector. Farmers in the country are adopting various strategies, among which the application of chemical insecticides has been the most effective in controlling pest infestations and enhancing plant productivity. Farmers are utilizing different application modes for insecticide application based on the crop type, insect pests, and their effects.

- Among all application modes, the foliar application of insecticides holds the majority share in the US insecticide market, amounting to 56.5% in 2022. This is a traditional and effective way of controlling foliar insect pests by directly targeting them, as it reduces their population by killing them with rapid action. During the forecast period, the application mode is projected to register a CAGR of 4.7% in the US insecticide market.

- Insecticide seed treatment is the segment occupying the next largest market share. It is also the fastest-growing application mode as it effectively controls soil-borne pests in major crops like wheat and maize and reduces pesticide usage in future growth stages. The market for this application mode is expected to record a CAGR of 4.9%.

- Grain and cereal crop growers are majorly adopting all application methods in their cultivation based on the crop stage and insect pests, as these crops are more susceptible to insect pests. Foliar insecticide application is majorly adopted by the farmers of these crops.

- All the application methods are effective in their way of usage to control the insect pests causing damage to the crops. The US insecticide market is expected to grow with an estimated CAGR of 4.6% during the forecast period (2023-2029).

US Insecticide Market Trends

Increasing pest pressure is driving the demand for insecticides in the country

- The consumption of insecticides in the United States per hectare experienced a significant increase of 17.1% from 2017 to 2022. This notable surge can be attributed to a variety of factors that have influenced the usage of insecticides in the country, including the expansion of intensive farming practices and increased pest pressures in certain regions.

- Crop losses and yield reduction caused by pests have become a major concern for farmers. For instance, in the case of wheat, one of the significant field crops in the United States, the yield witnessed a decrease from 3,200 thousand g/ha in 2018 to 2,978.2 thousand g/ha in 2021, primarily due to factors such as pest infestations. Such losses in crop productivity pose a significant threat to food security and necessitate the use of insecticides to mitigate the damage caused by pests.

- Invasive insects and pathogens contribute to the need for increased insecticide usage. Crop and forest production losses resulting from these invasive species have been estimated at almost USD 40 billion annually. To combat these detrimental effects, farmers have to resort to insecticides to protect their crops and mitigate economic losses.

- Additionally, the development of resistance among pests toward certain pesticides is a growing concern. Over time, pests can adapt and become resistant to the effects of certain insecticides, rendering them less effective. This necessitates higher application rates or more frequent use of insecticides to achieve the desired level of pest control, further driving up the consumption of these chemicals.

- Therefore, increasing crop losses, reduction of yield, and the growing demand for food are expected to drive the growth of the US insecticide market.

The effectiveness of cypermethrin in controlling various insects and fluctuations in import tariffs are driving its prices

- In 2022, the price of cypermethrin was USD 21.2 thousand per metric ton. It has been widely adopted in the agricultural industry for its effectiveness in controlling various types of insects, including aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its effectiveness has made it a popular choice for farmers seeking to protect their crops from pests and ensure a successful harvest.

- Imidacloprid is a powerful neonicotinoid insecticide with effective systemic and residual properties. It can control a wide range of insects, including aphids, cane beetles, thrips, stink bugs, locusts, and a variety of other insects that damage crops. It is also used as a seed treatment to protect emerging plants from pests and is often used to control soil-dwelling pests that can damage young plants as they germinate and grow. Products containing imidacloprid are sold in various formulations, including liquid and solid concentrates. Due to its plant compatibility and low application rates, it is a popular choice among farmers. The price of this active ingredient was valued at a price of USD 17.2 thousand per metric ton in 2022.

- In agricultural production, malathion is an organophosphate insecticide that is used to control a wide variety of food and feed crops to control many types of insects such as aphids, fleas, leafhoppers, Japanese beetles, and other insect pests on a number of crops. Five crops that are extensively grown in the United States that use malathion frequently are cherry tomato, broccoli, mulberry, cranberry, and fig. It was priced at USD 12.6 thousand per metric ton in 2022.

US Insecticide Industry Overview

The US Insecticide Market is fragmented, with the top five companies occupying 21.41%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219