|

市場調查報告書

商品編碼

1683992

印度農藥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

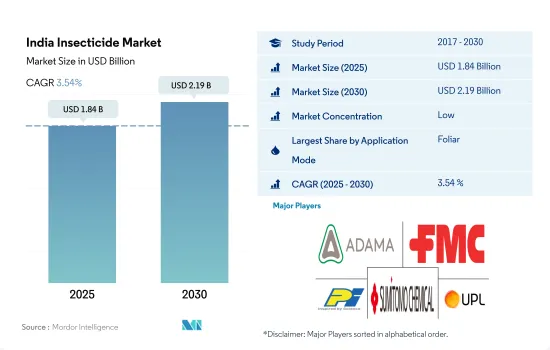

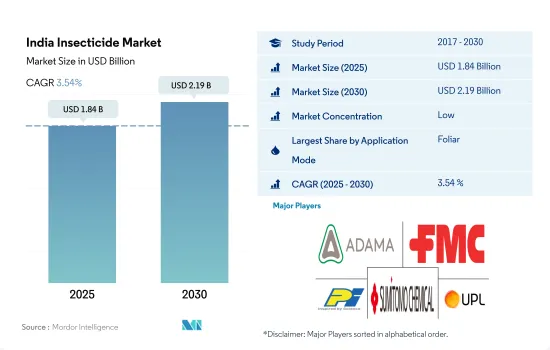

印度農藥市場規模預計在 2025 年為 18.4 億美元,預計到 2030 年將達到 21.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.54%。

葉面噴布是施用預防和治療殺蟲劑的常見且有效的方法。

- 在印度,農業生產中以各種方式使用農藥來控制昆蟲。農民可以透過選擇正確的施用方法來覆蓋特定區域並減少浪費來節省成本。效率的提升可以最佳化農藥的使用,有助於降低農民的投入成本。

- 葉面噴布是農業中施用農藥的主要形式,佔 2022 年農藥施用部分的 57.5%。此方法主要用於穀物和穀類種植,佔據最大的市場佔有率,為 44.6%。葉面噴灑殺蟲劑之所以受歡迎,是因為它們能快速消滅害蟲,這對於有效的害蟲管理至關重要。

- 種子處理是第二大最受歡迎的施用方法,佔該領域的市場佔有率的 16.9%。這主要是因為農民意識到保護種子和幼苗免受害蟲侵害、確保作物最佳生長、最大限度提高產量和減少未來生長階段農藥使用的重要性。

- 噴霧模式市場預計在 2019 年至 2021 年期間的複合年成長率為 2.2%。農民對特定施用模式的偏好取決於目標昆蟲、作物類型、昆蟲階段和設備可用性。世界人口不斷成長以及隨之而來的糧食需求增加使得農業生產力必須提高。因此,預計應用模式部分在預測期內的複合年成長率為 3.8%。

印度農藥市場趨勢

預測期內,保護農作物免受害蟲侵害和提高生產力的需求不斷成長,可能會推動農藥消費

- 印度的農業氣候條件多樣,導致各種昆蟲的盛行。如果不有效處理,臭蟲、尺蠖、黏蟲、蚜蟲和粉蝨等昆蟲會對作物造成嚴重損失。為了保護作物免受害蟲侵害,農民正在增加殺蟲劑的使用。 2021年至2022年,印度每公頃農藥消費量增加了0.5%。印度人均農藥使用量增加,從而提高了每公頃平均農業產量。

- 2022年,印度每公頃農藥消費量為151.9公克/公頃。這是因為種植的作物種類繁多,包括米和小麥等主糧,以及棉花、甘蔗和蔬菜等經濟作物。保護這些作物免受昆蟲侵害對於保持產量非常重要。

- 印度總合173種入侵物種,其中47種已經入侵農業生態系。這些入侵昆蟲導致殺蟲劑的使用量增加。此外,昆蟲對某些殺蟲劑產生抗藥性也是一個問題。隨著時間的推移,昆蟲會進化並對某些殺蟲劑產生抗藥性,從而降低其殺蟲劑效果。為了達到所需的病蟲害防治效果,可能需要增加農藥的噴灑量或使用次數,這將增加農藥的消費量。

- 印度正在尋求擴大農業生產以滿足日益成長的糧食需求。農藥透過保護植物免受害蟲侵害而對提高農業產量起著至關重要的作用。滿足人口的食物需求導致了對殺蟲劑的依賴增加。

殺蟲劑需求的不斷成長是由於害蟲侵襲和作物損失的增加。

- Cypermethrin是一種合成除蟲菊酯,用於控制跳甲、果子狸、蟑螂、白蟻、瓢蟲、蠍子和黃蜂。 2022年的價格為21000美元。在印度,Cypermethrin已由CIBRC登記用於八種特定作物,包括高麗菜、小麥、棉花、稻米、甘蔗、茄子、向日葵和秋葵。

- Imidacloprid是一種新菸鹼類神經活性殺蟲劑。在印度,它可以用作噴霧劑來控制棉花、水稻、甘蔗、芒果、花生、葡萄、辣椒和番茄等各種作物上的吸汁性昆蟲,如薊馬、蚜蟲、千足蟲、小棕蝨和白帶蝨。 2022年印度Imidacloprid價格為17,100美元。

- Malathion是一種有機磷殺蟲劑,2022 年的售價為 12,500 美元。它用於控制蚜蟲、薊馬、蟎蟲、介殼蟲、掃帚蟲、蚯蚓、潛葉蟲、跳蚤、蚱蜢、臭蟲、蛆等。根據 CIBRC 的指導方針,Malathion僅允許用於高粱、豌豆、大豆、蓖麻、向日葵、秋葵、茄子、花椰菜、蘿蔔、蕪菁、番茄、蘋果、芒果和葡萄。

- 根據印度政府統計,每年約有15-25%的作物因害蟲而損失。印度農民最關心的問題就是保護作物免受害蟲侵害。例如,根據印度蔬菜研究所的數據,全國各地的番茄種植者每年因水果害蟲而損失 65% 的產量。蟲害會導致花朵掉落、植物健康狀況不佳,並降低果實質量,對作物產量負面影響。所有這些因素都會影響農藥的需求,進而影響農藥的價格。

印度農藥業概況

印度農藥市場較為分散,前五大公司的市佔率為37.36%。該市場的主要企業是:ADAMA Agricultural Solutions Ltd、FMC Corporation、PI Industries、住友化學和UPL Limited(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 有效成分價格分析

- 法律規範

- 印度

- 價值鏈與通路分析

第5章 市場區隔

- 如何使用

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Gharda Chemicals Ltd

- PI Industries

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001694

The India Insecticide Market size is estimated at 1.84 billion USD in 2025, and is expected to reach 2.19 billion USD by 2030, growing at a CAGR of 3.54% during the forecast period (2025-2030).

The foliar application mode is a common and effective way of applying insecticides for preventive and curative methods

- In India, insecticides are applied through various modes to control insects in agricultural practices. Farmers can achieve cost savings by choosing a suitable application method covering specific areas and minimizing wastage. This increased efficiency leads to optimized insecticide usage and reduced input costs for farmers.

- The dominant mode of insecticide application in agricultural practices is foliar application, which accounted for 57.5% of the insecticide application segment in 2022. This method is predominantly used in grains and cereals cultivation, which holds the largest market share at 44.6%. The popularity of foliar treatment insecticides can be attributed to their rapid effectiveness in controlling insect infestations, making them crucial for efficient pest management.

- Seed treatment is the second most prevalent application method, accounting for a market share of 16.9% in the segment. This is primarily because farmers have acknowledged the significance of safeguarding seeds and seedlings from insect pests to ensure optimal crop establishment, maximize yield, and reduce insecticide usage in future growth stages.

- From 2019 to 2021, the application mode market demonstrated a projected increase with a CAGR of 2.2%. Farmers' preference for a specific application mode depends on the target insect, crop type, insect stage, and equipment availability. The growing global population and the resulting higher demand for food have led to a necessity to enhance agricultural productivity. As a result, the application mode segment is expected to witness a CAGR of 3.8% during the forecast period.

India Insecticide Market Trends

The rising need to protect the crops from harmful insects and improve production may fuel the consumption of insecticides during the forecast period

- India has a diverse range of agro-climatic conditions, which can contribute to the prevalence of various insects. Insects such as stink bugs, loopers, armyworms, aphids, and whiteflies can cause major crop losses if not successfully handled. To protect crops from such insects, farmers are resorting to increased insecticide use. The consumption of insecticides in India per hectare experienced an increase of 0.5% from 2021 to 2022. Insecticide usage per capita in India increased to boost the average agricultural output per hectare.

- The consumption of insecticides in India per hectare in 2022 accounted for 151.9 g/ha. This is attributed to the cultivation of a wide range of crops, including staple food grains, like rice and wheat, and cash crops, like cotton, sugarcane, and vegetables. It is critical to protect these crops against insects to maintain yields.

- India has a total of 173 invasive species, including 47 invasive agricultural ecosystem species, 23 of which are insects. These invasive insects contribute to the need for increased pesticide use. Furthermore, the development of insect resistance to certain insecticides is a rising problem. Insects can evolve and develop resistance to the effects of particular pesticides over time, making them less effective. To achieve the necessary degree of pest control, larger application rates or more frequent usage of insecticides are required, increasing the consumption of insecticide.

- India aims to boost agricultural output to meet rising food demand. Insecticides serve an important role in increasing agricultural yields by protecting plants from pests that might disrupt output. The necessity to fulfill the population's food requirements drives the reliance on pesticides.

The growing demand for insecticides owing to the increasing pest attack and crop losses.

- Cypermethrin is a synthetic pyrethroid used to control flea beetles, boxelder bugs, cockroaches, termites, ladybugs, scorpions, and yellow jackets. It was priced at USD 21.0 thousand in 2022. In India, cypermethrin is registered by CIBRC for use in eight specified crops, such as cabbage, wheat, cotton, rice, sugarcane, brinjal, sunflower, and okra.

- Imidacloprid is a neonicotinoid, which is a class of neuroactive insecticides. It can be used as a spray for the control of sucking and other insects, such as thrips, aphids, jassids, brown plant hoppers, and white-backed plant hoppers, in different crops, like cotton, paddy, sugarcane, mango, groundnut, grapes, chilies, and tomato, in India. In 2022, imidacloprid was priced at USD 17.1 thousand in India.

- Malathion is an organophosphate insecticide, which was valued at USD 12.5 thousand in 2022. It is used to control aphids, thrips, mites, scales, borers, worms, leaf miners, fleas, grasshoppers, bugs, and maggots. As per guidelines of CIBRC, malathion is permitted to be used only in sorghum, pea, soybean, castor, sunflower, bhindi, brinjal, cauliflower, radish, turnip, tomato, apple, mango, and grape crops.

- According to the Government of India statistics, about 15 to 25% of crops are lost due to pests every year. Indian farmers' major concern is safeguarding their crops from pests. For instance, according to the Indian Institute of Vegetable Research, tomato farmers across the country lose up to 65% of their yields to fruit borers every year. The infestation of the pest leads to flower dropping and poor plant health, resulting in poor quality fruiting, thus adversely impacting crop yields. All these factors will influence the demand for insecticides, which will further affect their prices.

India Insecticide Industry Overview

The India Insecticide Market is fragmented, with the top five companies occupying 37.36%. The major players in this market are ADAMA Agricultural Solutions Ltd, FMC Corporation, PI Industries, Sumitomo Chemical Co. Ltd and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Gharda Chemicals Ltd

- 6.4.7 PI Industries

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219