|

市場調查報告書

商品編碼

1683987

歐洲農藥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

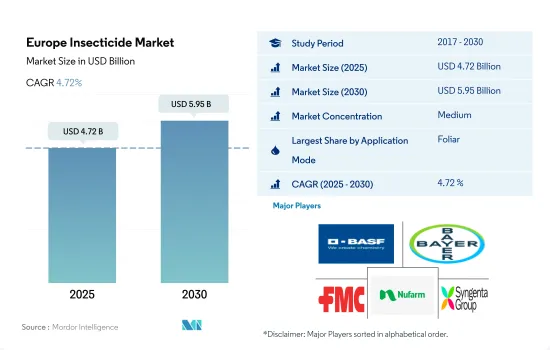

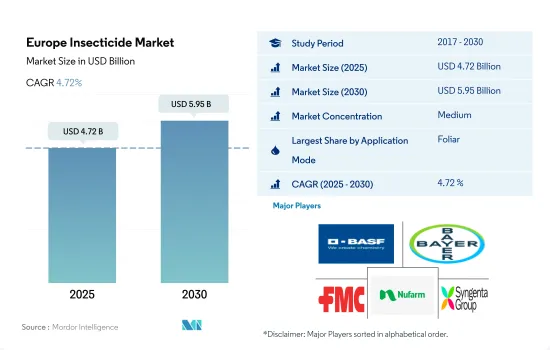

預計 2025 年歐洲殺蟲劑市場規模為 47.2 億美元,到 2030 年將達到 59.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.72%。

葉面噴布是歐洲最重要的殺蟲劑施用方法

- 歐洲葉面噴布市場規模龐大,佔最大市場佔有率58.2%,預計2024年金額26.3億美元。歐洲國家採用精準噴灑等現代農業技術以及對永續農業技術的認知不斷提高,促進了這種噴灑模式的成長。

- 2024 年種子處理佔 16.5%。殺蟲劑種子處理可有效對抗金針蟲、菜粉蝨、胡蘿蔔蠅、洋蔥蠅和科羅拉多馬鈴薯甲蟲等土傳疾病。金針蟲是介殼蟲的幼蟲,會對多種作物造成廣泛破壞,包括馬鈴薯、穀類、根莖類作物和觀賞植物。它們以植物的地下部分(如種子、根和塊莖)為食,導致植物生長不良、產量降低,有時甚至死亡。

- 人們越來越重視使用土壤處理模式的殺蟲劑施用來保護土壤健康並對抗危害農作物的土壤昆蟲(例如白蟻、金針蟲、鼴鼠、耳摳甲蟲、黑金龜子、皮蠹和火蟻)。因此,預計 2025 年至 2030 年間透過土壤處理施用的農藥消費量將增加 3,049.7 噸。

- 氫氰酸、萘、尼古丁和溴甲烷是該地區用於燻蒸的常見化學物質。燻蒸被認為是儲存穀類時消滅害蟲和降低感染風險的有效方法。

- 這些不同的應用方法可以幫助農民採取有針對性的方法來保護作物免受真菌感染並提高整體生產力。

德國在市場上佔據主導地位,是由於有效的害蟲防治需求導致對殺蟲劑的需求不斷增加。

- 歐洲農藥市場正在大幅擴張。殺蟲劑需求增加的原因是需要有效控制玉米螟、葉蟬、蚜蟲、莖蠅和大葉蟬等害蟲,這些害蟲對作物構成重大威脅並造成產量損失。截至 2024 年,歐洲佔全球殺蟲劑市場總市場佔有率的 12.9%。

- 2024 年,德國將佔據北美殺菌劑市場 46.7% 的佔有率,確立其主導地位。德國農業區面積廣闊,種類繁多,許多不同的地區都種植作物。這種多樣性使得作物容易受到各種害蟲的侵害,從而增加了對殺蟲劑的需求。殺蟲劑中最常用的有效成分是氨基甲酸酯和擬除蟲菊酯。

- 俄羅斯將以12.6%的較大市場佔有率,在2024年成為第二大農藥消費國。該國的農業實踐著重於集約農業,以大規模種植產量作物為特徵。然而,這種密集的種植方式為蚜蟲、蛆、粉蝨、地老虎、塊蟲、角蟬和薊馬等害蟲的快速蔓延創造了有利條件。這些害蟲對穀物和穀類構成重大威脅,造成作物損害並降低產量。因此,農藥對於保護作物和確保持續生產力至關重要。

- 預測期內(2025-2030 年),市場預計將以 4.7% 的複合年成長率成長,這主要是由於人們對糧食安全的擔憂日益加劇、對農產品的需求不斷增加以及農藥在保護農作物方面的重要性日益增加。

歐洲殺蟲劑市場趨勢

德國人均農藥消費量居歐洲之冠

- 害蟲以植物的葉子、莖、根和果實等組織為食。害蟲使用口器咬、鑽和吸食植物汁液,造成直接的物理損害。這種取食損害會導致植物組織的破壞,降低植物的光合作用、吸收養分和運輸水分的能力,最終降低作物產量。

- 德國的主要種植區,即北德平原、下萊茵地區、黑森林和波羅的海沿岸,以其農業生產力而聞名。這些地區主要種植小麥、大麥、油菜籽、馬鈴薯和甜菜等作物。然而,這些作物面臨蚜蟲、菜青蟲、科羅拉多馬鈴薯甲蟲和金針蟲等害蟲的嚴峻挑戰,這些害蟲可能導致嚴重的作物損失。為了對抗這些害蟲並確保最佳產量,殺蟲劑對於害蟲控制和管理至關重要。由於這些因素,2022 年德國的殺蟲劑消費量居歐洲首位,為 3.0 公斤/公頃。

- 義大利是第二大農藥消費國,2022 年的農藥消費量為 2.7 公斤/公頃。波河谷、普利亞、西西里島和艾米利亞-羅馬涅是義大利重要的種植區,氣候條件多樣,從大陸性氣候到地中海氣候。這種氣候條件導致葡萄蛾、科羅拉多馬鈴薯甲蟲、玉米螟、蚜蟲和紅棕象鼻蟲的侵擾,導致嚴重的作物損失。為了防治這些害蟲的侵擾並減少作物損失,農民通常會使用殺蟲劑。

- 歐洲多溫暖氣候,為多種害蟲提供了理想的棲息地,使它們能夠快速繁殖。預計這些因素將在預測期內推動殺蟲劑市場的發展。

農藥使用量的增加推動了對這些活性成分的需求。

- 高效能氯氟Lambda-Cyhalothrin被歸類為擬除蟲菊酯類殺蟲劑,是一種受菊花中天然除蟲菊酯啟發的合成化合物。其目的是防治棉花、玉米、大豆、蔬菜和水果等作物中的蚜蟲、薊馬、葉蟬、粉蝨和各種毛蟲等害蟲。活性成分可作為神經毒素,針對昆蟲的神經系統。它會破壞正常的神經細胞功能,導致害蟲癱瘓並最終死亡。 2022 年,該成本為每噸 22,700 美元。

- 2022 年Cypermethrin的成本估計為每噸 21,200 美元。這種活性成分能有效控制多種昆蟲物種,包括蚜蟲、介殼蟲、斑甲蟲、粉紅甲蟲、早斑蟲和毛蟲,因此在農業中被大量使用。其已被證實的有效性使其成為希望保護作物免受蟲害並實現高產量的歐洲農民的最愛。

- Emamectin benzoate是一種殺蟲劑,對多種以農作物果實和葉子為目標的有害鱗翅目害蟲非常有效。這種天然存在的活性成分屬於阿維菌素類化學成分,可透過活化神經節的氯離子通道,導致幼蟲癱瘓。Emamectin benzoate具有快速活性和作用方式,使其在幼蟲發育的各個階段以最少的施用量發揮高效作用。專為噴灑核果、葡萄和多種蔬菜等作物而開發。它也適合果園和溫室的綜合害蟲管理 (IPM) 工作。 2022 年的成本為每噸 17,400 美元。

歐洲農藥產業概況

歐洲殺蟲劑市場呈現中度整合態勢,前五大公司佔46.60%的市佔率。市場的主要企業是:BASF公司、拜耳公司、FMC 公司、Nufarm 有限公司和先正達集團(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 有效成分價格分析

- 法律規範

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 價值鏈與通路分析

第5章 市場區隔

- 如何使用

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 原產地

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲國家

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

- Wynca Group(Wynca Chemicals)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001689

The Europe Insecticide Market size is estimated at 4.72 billion USD in 2025, and is expected to reach 5.95 billion USD by 2030, growing at a CAGR of 4.72% during the forecast period (2025-2030).

Foliar application is the most significant method of insecticide application in Europe

- The market for foliar application of insecticides in Europe is significant and accounted for the largest market share of 58.2% in 2024, with a value of USD 2.63 billion. The adoption of modern agricultural practices like precision application and the increasing awareness of sustainable farming techniques in European countries have contributed to the growth of this application mode.

- Seed treatment accounted for a share of 16.5% in 2024. Seed treatment of insecticides is effective against soil-borne diseases like wireworms, cabbage root flies, carrot flies, onion flies, and Colorado potato beetles. Wireworms are the larvae of click beetles and can cause significant damage to various crops, including potatoes, cereals, root vegetables, and ornamental plants. They feed on the underground parts of plants, such as seeds, roots, and tubers, leading to stunted growth, reduced yields, and sometimes plant death.

- There is a growing emphasis on the utilization of the soil treatment mode of insecticide application to protect soil health and combat soil-borne insects that damage agricultural crops like white grub, termites, wireworms, mole cricket, earwigs, black scarab beetles, cutworms, and fire ants. Due to this, the consumption of insecticides through soil treatment methods is projected to increase by 3,049.7 metric tons between 2025 and 2030.

- Hydrogen cyanide, naphthalene, nicotine, and methyl bromide are the common chemicals used for fumigation purposes in the region. Fumigation is considered an effective method for controlling pests and reducing the risk of infestations in storing grains and cereals.

- These different application methods help farmers employ targeted approaches to protect their crops from fungal infections and enhance overall productivity.

Germany's dominance in the market is fueled by the increasing demand for insecticides driven by the necessity for effective insect control.

- The European insecticide market is witnessing significant expansion. This increased demand for insecticides is driven by the need to effectively manage insect pests such as the corn borer, leaf beetle, aphids, stem sawfly, and leafhoppers, which pose significant threats to crops, causing yield losses. As of 2024, Europe accounted for 12.9% of the total market share value in the global insecticide market.

- In 2024, Germany held a significant share of 46.7% in the North American fungicide market, asserting its dominance. Germany has a vast and diverse agricultural landscape, cultivating crops across different areas. This diversity makes crops more vulnerable to a variety of insect pests, resulting in an increased need for insecticides. The most frequently utilized insecticide active ingredients are carbamates and pyrethroids.

- With a significant market share of 12.6%, Russia ranks as the second-largest consumer of insecticides in 2024. The country's agricultural practices focus on intensive farming, characterized by the extensive cultivation of high-yield crops. However, this intensive approach also creates favorable conditions for the rapid spread of insect pests, such as aphids, maggots, whiteflies, flea beetles, cutworms, hornworms, and thrips. These pests pose a substantial threat to grains and cereals, resulting in crop damage and diminished yields. Therefore, insecticides become essential to safeguard crops and ensure continued productivity.

- The market is expected to experience a CAGR of 4.7% during the forecast period (2025-2030), primarily driven by the raised concerns for food security, growing demand for agricultural products, and the rising significance of insecticides in protecting crops.

Europe Insecticide Market Trends

Germany recorded the highest insecticide per capita consumption rate in Europe

- Insect pests feed on plant tissues, such as leaves, stems, roots, or fruits. They use their mouth parts to chew, pierce, or suck plant fluids, leading to direct physical damage. This feeding can result in the removal of plant tissues, reducing the plant's abilities of photosynthesis, nutrient uptake, and water transport, eventually reducing crop yield.

- Germany's major cropping regions, namely the North German Plain, Lower Rhine Region, Black Forest Region, and Baltic Sea Coast are renowned for agricultural productivity. These regions majorly cultivate crops such as wheat, barley, rapeseed, potatoes, and sugar beets. However, these crops face notable challenges from pests such as aphids, cabbage white butterflies, Colorado beetles, and wireworms, which can result in substantial crop losses. To combat these pests and ensure optimal yields, insecticides are crucial for pest control and management. Owing to these factors, Germany recorded the highest insecticide consumption rate of 3.0 kg/ha in 2022 in Europe.

- Italy is the second-largest consumer of insecticide, with a consumption rate of 2.7 kg/ha in 2022. The Po Valley, Puglia, Sicily, and Emilia-Romagna regions are significant cropping regions in Italy, characterized by a range of climatic conditions from continental to Mediterranean. These climatic conditions enable infestation by grapevine moths, Colorado potato beetles, corn borers, aphids, and red palm weevils, leading to major crop losses. To combat these pest infestations and mitigate crop losses, farmers often rely on the use of insecticides.

- Europe has a predominantly temperate climate, which is an ideal habitat for various pests, allowing them to reproduce and multiply rapidly. Such factors are expected to drive the insecticides market during the forecast period.

The demand for these active ingredients is growing due to the rising usage of insecticides

- Lambda-cyhalothrin, classified as a pyrethroid insecticide, is a synthetic compound inspired by natural pyrethrins found in chrysanthemum flowers. Its purpose is to combat pests, including aphids, thrips, leafhoppers, whiteflies, and various caterpillar species in crops like cotton, corn, soybeans, vegetables, and fruits. This active ingredient acts as a neurotoxin, targeting insects' nervous systems. It disrupts normal nerve cell function, inducing paralysis and eventual pest demise. In 2022, its cost stood at USD 22.7 thousand per metric ton.

- In 2022, the cost of cypermethrin was estimated at USD 21.2 thousand per metric ton. This active ingredient has gained substantial usage in agriculture due to its efficiency in managing diverse insect species like aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its proven efficacy has rendered it a favored selection among European farmers aiming to safeguard their crops from pests and ensure a productive harvest.

- Emamectin benzoate functions as an insecticide, displaying potent effectiveness against various damaging Lepidoptera species that target agricultural crops' fruits and leaves. Derived naturally, its active component belongs to the avermectin chemical group, causing paralysis in larvae by activating chloride channels at the nerve level. Emamectin benzoate offers rapid activity and mode of action to achieve high efficiency at minimal application rates across all stages of larval development. It was developed for application on crops like stonefruits, grapes, and a wide range of vegetables. It is also a compatible option for integrated pest management (IPM) initiatives in orchards and greenhouses. In 2022, its cost stood at USD 17.4 thousand per metric ton.

Europe Insecticide Industry Overview

The Europe Insecticide Market is moderately consolidated, with the top five companies occupying 46.60%. The major players in this market are BASF SE, Bayer AG, FMC Corporation, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 UPL Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219