|

市場調查報告書

商品編碼

1683459

美國宅配、快捷郵件和小包裹(CEP) 市場 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)United States Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

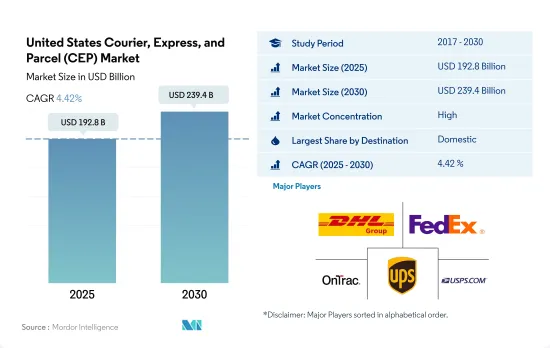

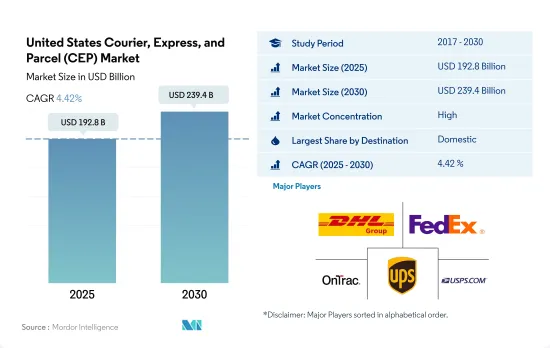

美國宅配、快捷郵件和小包裹(CEP) 市場規模估計在 2025 年將達到 1928 億美元,預計到 2030 年將達到 2394 億美元,在預測期內(2025-2030 年)的複合年成長率為 4.42%。

電子商務市場對宅配、快捷郵件和小包裹的國內需求不斷成長,推動了這一領域的需求

- 電子商務的成長和全球疫情推動了宅配市場的發展,因為消費者更喜歡在線上訂購而不是從實體店購買。隨著業務量的增加,許多公司正在國內進行收購。 2023 年 10 月,UPS Inc. 從 PayPal Holdings Inc. 收購了退貨管理軟體公司 Happy Returns。此次收購提升了 UPS 在快速成長的線上退貨領域的影響力。此外,該公司還在美國 12,000 多個投遞點提供無箱無標籤退貨服務。

- 美國電子商務市場正在不斷發展。美國零售電子商務銷售額預計將從 2022 年的約 9,048.9 億美元成長到 2025 年的約 1,4788.6 億美元。預計這將在預測期內推動國內和國際宅配、快捷郵件和小包裹市場規模的成長。在電子商務參與企業中,亞馬遜是美國最受歡迎的電子零售商,市場佔有率為37.8%。其他成功的公司包括 eBay(3.5% 的市場佔有率)、沃爾瑪(6.3% 的市場佔有率)、塔吉特(2.1% 的市場佔有率)和蘋果(3.9% 的市場佔有率)。

美國宅配小包裹快捷郵件

美國在該地區居領先地位,貢獻了 86% 的 GDP,主要得益於基礎設施和供應鏈投資

- 2024年9月,美國運輸部下屬的聯邦航空管理局向519個計劃撥款19億美元。這些計劃遍及 48 個州、關島、波多黎各和其他領土,都是機場改善計畫 (AIP) 的一部分。此外,2023 年還將額外撥款 2.69 億美元自由支配撥款,用於支持美國 56 個機場的 62 個計劃。這項競爭舉措將支持機場所有者和營運商加強美國機場系統。第五輪 AIP 資助是迄今為止最大的一輪,將資助從改善機場安全和永續性到降低噪音等一系列計劃。美國各地的機場無論規模大小均可獲得津貼。

- 在基礎設施建設和電子商務繁榮的推動下,運輸和倉儲行業的就業機會預計將激增。美國勞工統計局 (BLS) 預測 2022 年至 2032 年期間年增率為 0.8%,相當於新增約 57 萬個工作機會。值得注意的是,除了倉儲和儲存之外,宅配和信使服務預計將推動約 80% 的就業成長。

2022年美國仍將是原油淨進口國,從80個國家進口約628萬桶/天原油。

- 預計到 2024 年 10 月,即總統大選前,美國汽油價格將在三年多來首次跌至每加侖 3 美元以下。燃料價格下跌主要由於需求減弱和原油價格下跌,為面臨高成本(加劇通貨膨脹)的消費者提供了緩解。這也可以幫助副總統卡馬拉·哈里斯和其他民主黨人反駁共和黨對高油價的批評。 2024年9月,一般汽油平均價格為每加侖3.25美元,比上月下跌19美分,比去年下跌58美分。

- 根據美國能源資訊署 (EIA) 的數據,2024 年原油價格將與 2023 年持平,然後在 2025 年下跌。美國將在 2023 年安裝新的精製能力,從而運作並減少 2024 年和 2025 年石油產品價格的扭曲。此外,中東,特別是科威特,正在增加新的國際精製能力,這將有助於緩解全球汽油和柴油的價格壓力。此外,預計 2024 年裂解價差縮小將導致 2024 年和 2025 年美國平均零售燃料價格下降。預計 2024 年汽油價格為 3.36 美元/加侖,2025 年為 3.24 美元/加侖。

美國宅配、快捷郵件與小包裹(CEP) 產業概況

美國宅配、快捷郵件和小包裹(CEP) 市場相當集中,該市場有五家主要企業(按字母順序排列):DHL 集團、FedEx、OnTrac、美國聯合包裹服務公司 (UPS) 和 USPS。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的 GDP 分佈

- 經濟活動帶來的 GDP 成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業生產毛額

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 美國

- 價值鏈與通路分析

第 5 章。市場區隔(包括市場規模(百萬美元)、2030 年預測和成長前景分析)

- 匯出目的地

- 國內的

- 國際的

- 送貨速度

- 快捷郵件

- 非快捷郵件

- 模型

- 企業對企業 (B2B)

- B2C

- 消費者對消費者(C2C)

- 運輸重量

- 重貨

- 輕型貨物

- 中等重量貨物

- 運輸方式

- 航空郵件

- 路

- 其他

- 最終用戶

- 電子商務

- 金融服務(BFSI)

- 醫療

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Amazon

- Aramex

- DHL Group

- Dropoff Inc.

- FedEx

- 國際分銷服務(包括 GLS)

- OnTrac

- Spee-Dee Delivery Service, Inc.

- United Parcel Service of America, Inc.(UPS)

- USA Couriers

- USPS

- WeDo Logistics Limited(含 Lone Star Overnight Inc.)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源和進一步閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 71758

The United States Courier, Express, and Parcel (CEP) Market size is estimated at 192.8 billion USD in 2025, and is expected to reach 239.4 billion USD by 2030, growing at a CAGR of 4.42% during the forecast period (2025-2030).

Rising domestic demand for courier, express, and parcel in ecommerce market leading the sector demand

- E-commerce growth and the global pandemic fueled the parcel shipping market, as consumers were more inclined toward ordering online compared to purchasing from physical stores. With rising volumes, many companies are undertaking acquisitions in the country. In October 2023, UPS Inc. acquired Happy Returns, a returns management software company, from PayPal Holdings Inc. The deal enhances UPS' presence in the rapidly growing online returns sector. Additionally, the company will provide box and label-free return options at over 12,000 drop-off locations across the US.

- The US e-commerce market has been constantly evolving. Retail e-commerce sales in the United States are projected to grow from around USD 904.89 billion in 2022 to around USD 1,478.86 billion in 2025. This is expected to give a boost to both domestic and international courier, express, and parcel market volumes during the forecast period. Among the e-commerce players, Amazon is the most popular e-retailer in the United States, with a market share of 37.8%. Other successful shopping websites include eBay (3.5% market share), Walmart (6.3% market share), Target (2.1% market share), and Apple (3.9% market share).

United States Courier, Express, and Parcel (CEP) Market Trends

United States leads regional GDP with 86% contribution, driven by infrastructure and supply chain investments

- In September 2024, the FAA, under the US Department of Transportation, allocated USD 1.9 billion in grants for 519 projects. These projects span 48 states, Guam, Puerto Rico, and other territories, all part of the Airport Improvement Program (AIP). Additionally, USD 269 million in Supplemental Discretionary Grants for 2023 will back 62 projects at 56 U.S. airports. This competitive initiative aids airport owners and operators in enhancing the U.S. airport system. Marking its largest round yet, this fifth AIP grant cycle funds diverse projects, from airport safety and sustainability upgrades to noise reduction. The grants cater to airports nationwide, regardless of size.

- With infrastructure development and the e-commerce boom, the transportation and storage sector is set for a job surge. The Bureau of Labor Statistics (BLS) projects a 0.8% annual growth rate from 2022 to 2032, translating to nearly 570,000 new jobs. Notably, the couriers and messengers industry, alongside warehousing and storage, is expected to drive about 80% of this job growth.

The United States remained a net crude oil importer in 2022, importing about 6.28 million bpd of crude oil from 80 countries

- Gasoline prices in the US are expected to drop below USD 3 a gallon for the first time in over three years by October 2024, just before the presidential election. Lower fuel prices are mainly due to weaker demand and falling oil prices, providing relief to consumers who have faced high costs that fueled inflation. This could also help Vice President Kamala Harris and other Democrats counter Republican criticism over high gas prices. In September 2024, the average price for regular gas was USD 3.25 a gallon, down 19 cents from last month and 58 cents from last year.

- According to US Energy Information Administration (EIA), crude oil prices will stay steady in 2024 compared to 2023, then decrease in 2025. The US' introduction of new refining capacities in 2023 will boost its operable capacity, alleviating price strain on oil products in 2024 and 2025. Furthermore, the Middle East, particularly Kuwait, will add new international refining capacities, which will help ease global price pressure on gasoline and diesel. Also, it is expected, narrowing crack spreads in 2024 are likely to lead to lower average US retail fuel prices in both 2024 and 2025. Gasoline prices are projected to USD 3.36/gal in 2024 and USD 3.24/gal in 2025.

United States Courier, Express, and Parcel (CEP) Industry Overview

The United States Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being DHL Group, FedEx, OnTrac, United Parcel Service of America, Inc. (UPS) and USPS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 United States

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Amazon

- 6.4.2 Aramex

- 6.4.3 DHL Group

- 6.4.4 Dropoff Inc.

- 6.4.5 FedEx

- 6.4.6 International Distributions Services (including GLS)

- 6.4.7 OnTrac

- 6.4.8 Spee-Dee Delivery Service, Inc.

- 6.4.9 United Parcel Service of America, Inc. (UPS)

- 6.4.10 USA Couriers

- 6.4.11 USPS

- 6.4.12 WeDo Logistics Limited (including Lone Star Overnight Inc.)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219