|

市場調查報告書

商品編碼

1683928

南美快遞、快遞、包裹 (CEP):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)South America Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

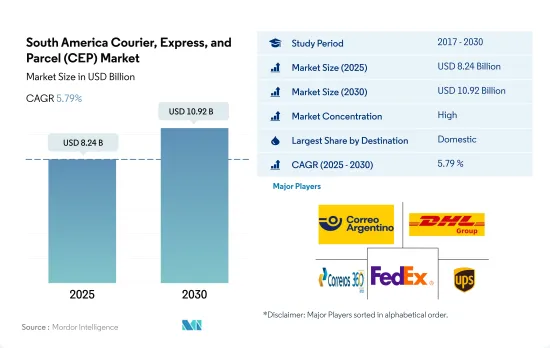

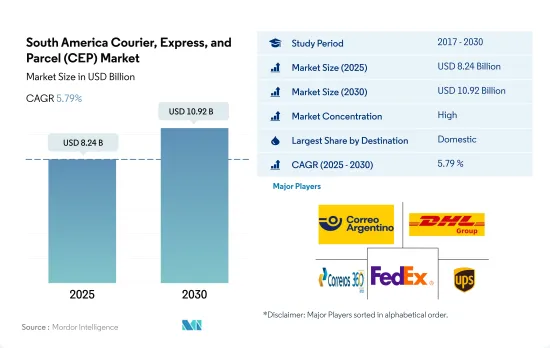

南美快遞包裹 (CEP) 市場規模預計在 2025 年為 82.4 億美元,預計到 2030 年將達到 109.2 億美元,預測期內(2025-2030 年)的複合年成長率為 5.79%。

市場領先的 B2C 電子商務領域

- 快遞包裹市場的主要需求促進因素之一是 B2C 電子商務。儘管B2C電子商務在拉丁美洲起步緩慢,但目前該地區多個國家的普及率已超過50%。預計 2021 年巴西的電子商務總銷售額最高,其次是墨西哥、哥倫比亞和阿根廷。總部位於阿根廷的線上市場MercadoLibre主導拉丁美洲的B2C電子商務市場,在阿根廷、墨西哥和智利等多個國家都名列前茅,並在2022年佔據了阿根廷電子商務市場的三分之二以上。 2022年,Mercado Libre的電子商務銷售額將超過120億美元。預計到 2027 年電子商務規模將達到 1,343 億美元,CEP 市場將經歷顯著成長。

- 電子商務的成長預計將極大地促進該地區的 CEP 市場。受該地區國內和跨境電子商務成長的推動,到 2023 年,電子商務用戶滲透率預計將達到 56.5%。預計2027年用戶數將達2.581億,2027年用戶滲透率將達61.4%。

小包裹配送中心的擴張、低成本空運服務等因素推動了當地市場的需求

- 該地區的 CEP 市場主要受到電子商務小包裹主導量的激增以及製造業和 BFSI 行業等其他終端用戶的需求的推動。巴西、智利、阿根廷等國家構成了該地區的CEP市場。在巴西,Magazine Luiza、Casabahia和Americanas佔據巴西前100家網路商店銷售額的36.5%,推動了2022年國內CEP需求。在阿根廷,Mercado Libre擁有約2,700萬線上消費者。到 2025 年,買方滲透率預計將達到 62% 左右,這將對預測期內的國內 CEP 需求產生重大影響。

- 宅配和小包裹遞送市場的主要需求促進因素之一是B2C電子商務。拉丁美洲B2C電子商務起步緩慢,目前在多個地區的滲透率已超過50%。 2021年,巴西的電子商務銷售額將位居第一,其次是墨西哥、哥倫比亞和阿根廷。總部位於阿根廷的線上市場MercadoLibre在阿根廷、墨西哥和智利等多個國家都名列前茅,在拉丁美洲的B2C電子商務領域佔據主導地位,佔2022年阿根廷電子商務領域的三分之二以上。

南美洲快遞包裹 (CEP) 市場趨勢

南美國家正大力投資基礎建設,以改善交通運輸部門。

- 2024年6月,阿根廷聯邦政府將914個基礎建設計劃移交給省級當局,為各省帶來了嚴峻的財政挑戰。儘管各州希望重新開放公共服務,但它們的主要收入來源——聯邦政府的撥款卻大幅削減。 2024 年 6 月,聯邦對各州的稅收轉移 (CFI) 與去年同期相比下降了 20%,2024 年六個月中有五個月出現兩位數的下降。 6 月其他聯邦政府轉移支付(RON)也下降了 24.1%。

- 2023年,巴西政府已撥款25.9億美元用於基礎建設物流,包括高速公路、鐵路、港口和機場。其中,約 24.2 億美元用於公路建設,鐵路建設獲得的撥款較少,為 3,025 萬美元。展望未來,政府計劃在 2024 年 6 月之前啟動一項重大國家舉措,旨在透過公共和私營部門的聯合融資來增加對貨運鐵路計劃的投資。基於這個雄心勃勃的願景,政府計劃向這些鐵路計劃注資 40 億美元。

俄烏戰爭對全球油價的影響,導致該地區油價大幅上漲。

- 2024年3月,受季節性波動和經濟放緩徵兆影響,巴西柴油需求下降。巴西石油公司決定降低柴油價格,並強制將生質柴油混合率從 12% 提高到 14%,進一步導致了傳統化石柴油需求的下降。國內市場也受到全球油價波動和政府穩定油價努力的影響。儘管巴西庫存有 320 萬桶俄羅斯輕質原油過剩,但巴西仍維持了俄羅斯原油的出口,而不是完全停止出口。

- 智利計劃在 2030 年開始大規模生產永續航空燃料 (SAF),並計劃到 2050 年用從石油、生物和城市廢棄物中提取的生質燃料滿足其一半的航空燃料需求。預計到 2040 年,空中交通量將加倍,智利將 SAF 視為其脫碳策略的關鍵要素。此外,SAF 可以與傳統噴射機燃料混合,無需對引擎進行任何改造即可減少高達 80% 的排放氣體。預計SAF將為智利貢獻一半以上的碳排放目標,並在該國實現淨零目標中發揮關鍵作用。

南美快遞包裹 (CEP) 產業概況

南美洲快遞包裹(CEP)市場相當集中,市場主要企業(按字母順序排列):阿根廷郵政、DHL集團、巴西郵政電報公司、聯邦快遞和美國聯合包裹服務公司(UPS)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的 GDP 分佈

- 經濟活動帶來的 GDP 成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業生產毛額

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 阿根廷

- 巴西

- 智利

- 價值鏈與通路分析

第5章 市場區隔

- 目的地

- 國內的

- 國際的

- 送貨速度

- 表達

- 非快遞

- 模型

- 企業對企業 (B2B)

- 企業對消費者 (B2C)

- 消費者對消費者(C2C)

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 運輸方式

- 航空郵件

- 路

- 其他

- 最終用戶

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

- 國家名稱

- 阿根廷

- 巴西

- 智利

- 南美洲其他地區

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Aramex

- Chilexpress

- Correo Argentino

- Correos de Chile

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Empresa Brasileira de Correios e Telegrafos

- FedEx

- La Poste Group

- United Parcel Service of America, Inc.(UPS)

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源和進一步閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001618

The South America Courier, Express, and Parcel (CEP) Market size is estimated at 8.24 billion USD in 2025, and is expected to reach 10.92 billion USD by 2030, growing at a CAGR of 5.79% during the forecast period (2025-2030).

B2C e-commerce segment leading the market

- One of the major demand generators for the courier, express, and parcel market is B2C e-commerce. Although B2C e-commerce in Latin America had a slow start, it has a penetration rate of over 50% in multiple countries in the region. Brazil was estimated to rank the highest in total e-commerce sales in 2021, followed by Mexico, Colombia, and Argentina. MercadoLibre, an online marketplace headquartered in Argentina, dominates the B2C e-commerce market In Latin America by being the top seller in several countries, including Argentina, Mexico, and Chile and account for more than two-thirds of Argentina's e-commerce market in 2022. In the 2022, Mercado Libre reached retail e-commerce sales worth over USD 12 billion. With e-commerce projected to touch USD 134.3 billion by 2027, CEP market is expected to grow significantly.

- E-commerce growth is expected to significantly boost the CEP market in the region. The e-commerce user penetration is projected to touch 56.5% in 2023 owing to rising domestic and cross-border e-commerce in the region. It is further expected to have a 258.10 million users by 2027, accounting for 61.4% user penetration by 2027.

Expansion of parcel distribution centres, low-cost air cargo service, among drivers of regional market demand

- The CEP market in the region is driven mainly by a surge in e-commerce-led parcel shipments along with demand from other end users such as manufacturing, BFSI sector among others. Brazil, Chile, Argentina, along with other countries, comprise the CEP market in the region. In Brazil, Magazine Luiza, Casabahia, and Americanas accounted for 36.5% of Brazil's top 100 online stores' revenue, which drove domestic CEP demand in 2022. In Argentina, Mercado Libre has almost 27 million online consumers. By 2025, buyer penetration is expected to touch approximately 62%, significantly impacting domestic CEP demand during the forecast period.

- One of the major demand generators for the courier express and parcel market is B2C e-commerce. Although B2C e-commerce in Latin America had a slow start, it has a penetration rate of over 50% in multiple regional countries. Brazil ranked the highest in e-commerce sales in 2021, followed by Mexico, Colombia, and Argentina. MercadoLibre, an online marketplace headquartered in Argentina, dominated the B2C e-commerce segment in Latin America by being the top seller in several countries, including Argentina, Mexico, and Chile, and accounted for more than two-thirds of Argentina's e-commerce segment in 2022.

South America Courier, Express, and Parcel (CEP) Market Trends

South American countries are investing heavily in infrastructure development to improve the transportation sector

- In June 2024, Argentina's federal government transferred 914 infrastructure projects to provincial authorities, creating a tough financial challenge for the provinces. Despite wanting to resume public works, provinces have faced deep cuts to federal transfers, their main source of income. Federal tax transfers (CFI) to provinces dropped 20% YoY in June 2024 and have decreased by double digits in five out of the six months of 2024. Other federal transfers (RON) also fell 24.1% in June.

- In 2023, the Brazilian government allocated USD 2.59 billion to infrastructure logistics, encompassing highways, railways, ports, and airports. A significant portion, approximately USD 2.42 billion, was funneled into highways, while railways received a modest allocation of USD 30.25 million. Looking ahead, by June 2024, the government is set to launch a major national initiative aimed at amplifying investments in freight rail projects, leveraging a blend of public and private sector funding. With an ambitious vision, the government plans to inject a substantial USD 4 billion into these rail projects.

Crude oil prices in the region rose significantly owing to the impact of the Russia-Ukraine War on global crude oil

- In March 2024, seasonal fluctuations and signs of an economic slowdown led to a decline in Diesel demand in Brazil. Petrobras' decision to reduce Diesel prices, coupled with the mandated increase in biodiesel blending from 12% to 14%, further fueled this drop in demand for conventional fossil Diesel. The domestic market was also swayed by global fluctuations in crude oil prices and government efforts to stabilize them. Even with an excess of 3.2 million barrels of Russian Diesel on hand, Brazil maintained its shipments without a complete halt.

- By 2030, Chile plans to launch large-scale production of sustainable aviation fuel (SAF) and aims for these biofuel sources derived from oils, fats, and both biological and municipal waste to satisfy half of its aviation fuel needs by 2050. With projections of air traffic doubling by 2040, Chile views SAF as a pivotal element in its decarbonization strategy. Moreover, SAF can be blended with traditional jet fuel to reduce emissions by up to 80% without engine modifications. It is expected to contribute over half of Chile's targeted carbon emissions reductions, playing a key role in the country's net-zero goals.

South America Courier, Express, and Parcel (CEP) Industry Overview

The South America Courier, Express, and Parcel (CEP) Market is fairly consolidated, with the major five players in this market being Correo Argentino, DHL Group, Empresa Brasileira de Correios e Telegrafos, FedEx and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Argentina

- 4.12.2 Brazil

- 4.12.3 Chile

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Argentina

- 5.7.2 Brazil

- 5.7.3 Chile

- 5.7.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aramex

- 6.4.2 Chilexpress

- 6.4.3 Correo Argentino

- 6.4.4 Correos de Chile

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Empresa Brasileira de Correios e Telegrafos

- 6.4.8 FedEx

- 6.4.9 La Poste Group

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219