|

市場調查報告書

商品編碼

1683922

亞太國際快遞服務:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Asia Pacific International Express Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

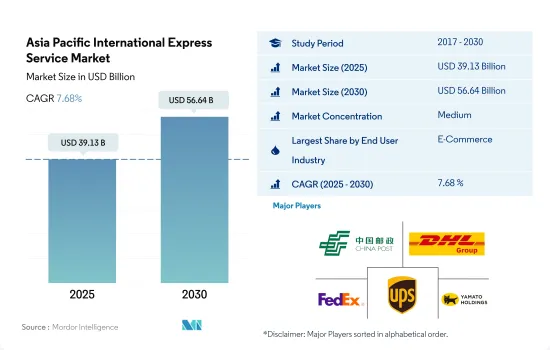

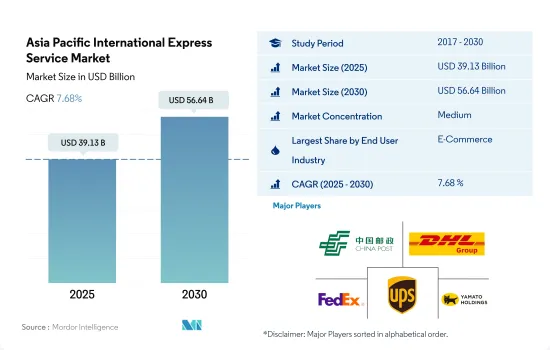

亞太國際快遞服務市場規模預計在 2025 年為 391.3 億美元,預計到 2030 年將達到 566.4 億美元,預測期內(2025-2030 年)的複合年成長率為 7.68%。

區域內貿易佔亞洲貿易的一半以上,推動市場成長

- 目前,區域內貿易佔亞洲貿易的一半以上。有些估計認為這個數字高達60%。與其他地區相比,亞洲內部的貿易量一直很高,推動市場的發展。自疫情爆發以來,其經濟影響一直限制著亞洲經濟成長,但印度、中國和東協仍是亞洲內部貿易的主要企業。

- 預計到 2028 年,印度的製造業出口額將達到 1 兆美元,這將在未來幾年推動製造業終端用戶產業的發展。此外,該地區的醫療設備市場預計將從 2022 年起以 4.4% 的複合年成長率成長,到 2030 年達到約 2,250 億美元。未來幾年,該地區的醫療保健產品國際快遞服務預計將成長,這受到多種因素的推動,包括對醫療用品的需求不斷增加、醫療保健支出不斷增加以及對更快、更有效率的配送服務的需求。

聯邦快遞推出全新快遞服務,拓展全球商業版圖,連結亞太地區170個市場

- 印度 SaaS 配送平台 iThink 物流最近推出了一個國際配送服務入口網站。新成立的 iThink Logistics International 旨在協助電子商務企業和 D2C 品牌擴大其在全球市場的銷售。預計到 2025 年,印度的國際跨境航運額將達到約 1,290 億美元。

- 這一擴張將受到製造業出口激增的推動,預計到 2028 年,印度的製造業出口將達到 1 兆美元。此外,製造業在印度 GDP 中的佔有率預計將大幅成長,從目前的 15.6% 成長到 2031 年的 21%。這一成長軌跡符合印度對製造業流程的戰略重點,製造業流程是印度經濟的關鍵驅動力。製造業出口的預期成長將意味著印度在全球市場上的地位將大幅提升。

亞太國際快遞服務市場趨勢

全球海運貿易推動亞太地區貨運需求將引發運輸業投資

- 2024 年 5 月 17 日,在日本東京車站舉行的展覽會上,人們重點關注高速客運列車在輕型貨運中的應用日益增加。這一轉變是由於商業駕駛人短缺和新的加班法導致公路運輸成本增加高達 20%。自 2023 年 8 月起,JR 東日本將使用 12 節車廂的 E 系列專用列車實施從新潟到東京的當日送貨服務。運送的物品包括生鮮食品、糖果零食、飲料、鮮花、精密零件、醫療用品等。 2023 年 9 月,JR 東日本在東北新幹線推出了貨運專用服務,目前在其高速和特快網路上提供「Hako BYUN」品牌貨運服務。

- 中國在其「十四五」規劃(2021-2025年)中公佈了擴大交通網路的目標。到2025年,高鐵里程由2020年的3.8萬公里增加到5萬公里,250公里線路覆蓋95%的50萬人口以上城市。到2025年,全國鐵路營業里程將達到16.5萬公里,民用機場270個以上,都市區地鐵營業里程將達到1萬公里,高速公路營業里程將達到19萬公里,高等級內河航道營業里程將達到1.85萬公里。主要目標是到2025年實現一體化發展,重點是轉變交通運輸體系並提高其對GDP的貢獻。

由於大多數亞洲國家都是石油淨進口國,全球不確定性導致油價上漲。

- 2023年,受俄烏戰爭導致全球油價上漲影響,中國原油進口量增加11%,至5.6399億噸。 2024年初,由於中國利用早期價格下跌的機會,進口量與前一年同期比較增5.1%,達到8,831萬噸。布蘭特原油期貨在2023年9月達到97.69美元,12月跌至72.29美元,2024年3月升至84.05美元。 OPEC+決定將減產協議延長至2024年3月,可能會推高油價,並引發對全球需求的擔憂,減緩2024年下半年中國的進口。

- 澳洲聯邦政府將於 2025 年 1 月 1 日起實施針對乘用車和輕型商用車的新燃油效率標準。在此之前,在起草新法律之前,經過了為期一個月的諮詢期。該標準是 2023 年預算的一部分,與 2023 年 4 月發布的電動車策略相關聯,將為汽車製造商設定平均二氧化碳目標。這些目標將逐步降低,要求生產更省油、低排放氣體和零排放的汽車。

亞太國際快遞服務產業概況

亞太國際快遞服務市場整合程度適中,主要有五主要企業(按字母順序排列):中國郵政、DHL集團、聯邦快遞、美國聯合包裹服務公司(UPS)和大和控股。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的 GDP 分佈

- 按經濟活動分類的GDP成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 價值鍊和通路分析

第5章 市場區隔

- 運輸重量

- 重型貨物運輸

- 出貨量輕

- 中等重量運輸

- 根

- 區域之間

- 區域內

- 最終用戶產業

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

- 國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

第6章競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Blue Dart Express Limited

- China Post

- CJ Logistics Corporation

- DHL Group

- DTDC Express Limited

- FedEx

- JWD Group

- SF Express(KEX-SF)

- SG Holdings Co., Ltd.

- Shanghai YTO Express(Logistics)Co., Ltd.

- United Parcel Service of America, Inc.(UPS)

- Yamato Holdings Co., Ltd.

- ZTO Express

第 7 章 CEO 的關鍵策略問題CEO 的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001612

The Asia Pacific International Express Service Market size is estimated at 39.13 billion USD in 2025, and is expected to reach 56.64 billion USD by 2030, growing at a CAGR of 7.68% during the forecast period (2025-2030).

Intra-regional trade accounts for more than half of Asian trade and driving the growth of the market

- The intra-regional trade now accounts for more than half of Asian trade. Some estimates put the figure as high as 60%. The value of intra-Asia trade has been consistently high compared to other regional blocs, which is driving the market. While the economic impact of the pandemic has curtailed the growth of Asian economies since the pandemic began, India, China, and ASEAN remained key players in intra-Asia trade.

- India is expected to reach USD 1 trillion in manufacturing exports by 2028, which is expected to boost the manufacturing end-user segment in the coming years. Moreover, the medical device market in the region is expected to register a CAGR of 4.4% from 2022 to reach approximately USD 225 billion in 2030. The international express delivery services for healthcare products are expected to grow in the coming years in the region due to several factors, including increasing demand for medical supplies, rising healthcare spending, and the need for faster and more efficient delivery services.

FedEx expands global reach with new express services connecting Asia-Pacific to 170 markets

- The collaboration between courier companies and e-commerce players in the region is increasingly prevalent, particularly in providing international express delivery services. iThink Logistics, a SaaS-based shipping platform in India, has recently introduced its international shipping services portal. The new venture, iThink Logistics International, aims to assist thriving e-commerce businesses and D2C brands in expanding their sales to global markets. The value of international cross-border shipping from India is projected to reach approximately USD 129 billion by 2025.

- The expansion can be credited to the upsurge in manufacturing exports, with India forecasted to attain USD 1 trillion in such exports by 2028. Additionally, projections indicate a surge in the manufacturing sector's contribution to India's GDP, slated to elevate from its current 15.6% to an estimated 21% by 2031. This growth trajectory aligns with India's strategic focus on its manufacturing process, which serves as a key driver in the nation's economic landscape. The anticipated increase in manufacturing exports denotes a significant leap in India's global market presence.

Asia Pacific International Express Service Market Trends

Asia Pacific freight demands driven by global seaborne trade, which is triggering transport sector investments

- On May 17, 2024, a fair at Tokyo Station in Japan highlighted the growing use of high-speed passenger trains for light freight. This shift, driven by a shortage of commercial drivers and new overtime laws, has increased road delivery costs by up to 20%. Since August 2023, JR East has been running a same-day delivery service from Niigata to Tokyo using a dedicated 12-car Series E trainset. Items transported include fresh food, confectionery, drinks, flowers, precision components, and medical supplies. In September 2023, JR East launched a freight-only service on the Tohoku Shinkansen and now offers Hakobyun-branded freight services across its high-speed and Limited Express networks.

- In the 14th Five-Year Plan (2021-2025), China revealed goals for expanding its transportation network. By 2025, high-speed railways will extend to 50,000 kms, up from 38,000 kms in 2020, with 95% of cities with populations above 500,000 covered by 250-km lines. The country aims to increase its railway length to 165,000 kms, civil airports to over 270, subway lines in cities to 10,000 kms, expressways to 190,000 kms, and high-level inland waterways to 18,500 kms by 2025. The primary objective is to achieve integrated development by 2025, emphasizing advancements in the transformation of the transportation system and its contribution to GDP.

Owing to global uncertainties, crude oil prices are soaring in the Asian economies as most of them are net oil importers

- In 2023, China's crude oil imports rose by 11% to 563.99 MMT, driven by higher global oil prices due to the Russia-Ukraine War. In early 2024, imports increased by 5.1% YoY, reaching 88.31 MMT, as China capitalized on lower prices earlier. Brent futures peaked at USD 97.69 in September 2023, dropped to USD 72.29 in December, and rose to USD 84.05 by March 2024. OPEC+'s decision in March 2024 to extend output cuts has further boosted prices, raising concerns about global demand and potentially slowing China's imports in H2 2024.

- Australia's federal government will introduce a new fuel efficiency standard for passenger and light commercial vehicles starting January 1, 2025. This follows a one-month consultation period before drafting the new laws. Announced as part of the 2023 budget and linked to the EV strategy released in April 2023, the standard sets average CO2 targets for vehicle manufacturers. These targets will gradually decrease, requiring the production of more fuel-efficient and low or zero-emissions vehicles.

Asia Pacific International Express Service Industry Overview

The Asia Pacific International Express Service Market is moderately consolidated, with the major five players in this market being China Post, DHL Group, FedEx, United Parcel Service of America, Inc. (UPS) and Yamato Holdings Co., Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Australia

- 4.12.2 China

- 4.12.3 India

- 4.12.4 Indonesia

- 4.12.5 Japan

- 4.12.6 Malaysia

- 4.12.7 Pakistan

- 4.12.8 Philippines

- 4.12.9 Thailand

- 4.12.10 Vietnam

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Shipment Weight

- 5.1.1 Heavy Weight Shipments

- 5.1.2 Light Weight Shipments

- 5.1.3 Medium Weight Shipments

- 5.2 Route

- 5.2.1 Inter-Region

- 5.2.2 Intra-Region

- 5.3 End User Industry

- 5.3.1 E-Commerce

- 5.3.2 Financial Services (BFSI)

- 5.3.3 Healthcare

- 5.3.4 Manufacturing

- 5.3.5 Primary Industry

- 5.3.6 Wholesale and Retail Trade (Offline)

- 5.3.7 Others

- 5.4 Country

- 5.4.1 Australia

- 5.4.2 China

- 5.4.3 India

- 5.4.4 Indonesia

- 5.4.5 Japan

- 5.4.6 Malaysia

- 5.4.7 Pakistan

- 5.4.8 Philippines

- 5.4.9 Thailand

- 5.4.10 Vietnam

- 5.4.11 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Blue Dart Express Limited

- 6.4.2 China Post

- 6.4.3 CJ Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 DTDC Express Limited

- 6.4.6 FedEx

- 6.4.7 JWD Group

- 6.4.8 SF Express (KEX-SF)

- 6.4.9 SG Holdings Co., Ltd.

- 6.4.10 Shanghai YTO Express (Logistics) Co., Ltd.

- 6.4.11 United Parcel Service of America, Inc. (UPS)

- 6.4.12 Yamato Holdings Co., Ltd.

- 6.4.13 ZTO Express

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219