|

市場調查報告書

商品編碼

1683907

中歐和東歐快遞、快遞和包裹 (CEP):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Central and Eastern Europe Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

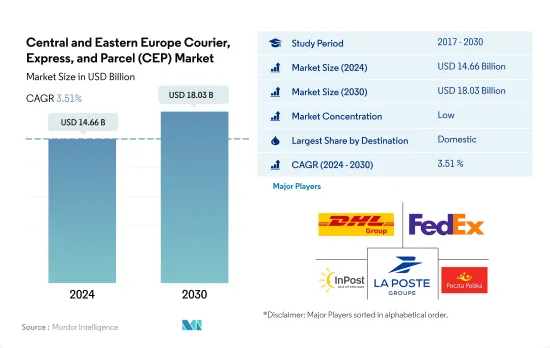

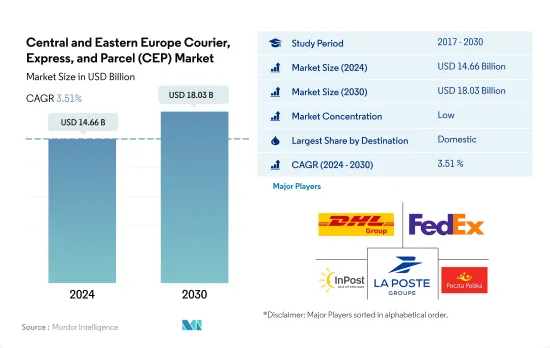

中歐和東歐快遞包裹 (CEP) 市場規模預計在 2024 年將達到 146.6 億美元,預計到 2030 年將達到 180.3 億美元,在預測期內(2024-2030 年)的複合年成長率為 3.51%。

由於服務範圍擴大、價格降低以及電子商務使用量成長,該地區的 CEP 產業正在蓬勃發展

- 2022年,匈牙利CEP業者已開始發展該領域。例如,匈牙利營運商Magyar Posta將於2022年安裝新的Leonardo分類系統,以增強其物流能力。 Leonardo 是小包裹和小包裹自動化解決方案的領先提供者。該系統將於 2023 年交付,用於處理國內和國際小包裹,每年最多可處理 1 億件小包裹。 FoxPost 總部同樣位於匈牙利,為匈牙利 20,000 家企業提供服務,在全國擁有 2,500 個小包裹儲物櫃。

- 歐洲領先的線上時尚和生活方式平台 Zalando 於 2021 年與捷克物流和技術公司 Zasilkovna 合作。此舉是為了回應捷克客戶不斷變化的偏好,四分之一的捷克人選擇取貨點,對小包裹儲物櫃的偏好在三年內從 0% 增加到 6%。該合作將允許 Zalando 客戶使用 1,500 個 Zasilkovna 儲物櫃和 4,700 個提貨點,並選擇貨到付款作為付款方式。目的是迎合捷克顧客的偏好,為捷克顧客提供便利。此外,由於戰爭導致在波蘭的烏克蘭人數量增加,烏克蘭最大的郵政業者新郵政(Nova Poshta)已將2022年向波蘭寄送個人物品的關稅降低2.5倍。

- 電子商務是該地區 CEP 需求的主要驅動力。例如,斯洛伐克 85.07% 的線上消費者最有可能在 2022 年進行線上購物。羅馬尼亞和保加利亞的網路使用者佔有率在 2022 年分別達到 51.46% 和 48.78%。由於到 2027 年斯洛伐克的電子商務用戶普及率將達到 318 萬,該地區對 CEP 的需求預計也將增加。

中東歐地區的電子商務市場規模預計將在2022年達到346.3億美元,進而產生對CEP運輸的需求。

- 中東歐地區的電子商務市場預計將在 2022 年達到 346.3 億美元,其中時尚和電子產業的收益佔有率分別佔 31.68% 和 28.10%。 2022 年,波蘭(278 億美元)將佔據該地區電子商務佔有率最高,其次是捷克共和國(130 億美元)。 2022 年,斯洛伐克居民(85%)是所有中東歐國家中最有可能進行網路購物的國家。 2022 年,斯洛伐克人在線上購物的比例比歐盟平均高出 10%。捷克共和國、匈牙利和愛沙尼亞在歐盟 27 國中電子商務使用率評級高於平均值。

- 波蘭是該地區另一個提供國內和國際快遞服務的國家。國家郵政服務 Poczta Polska 透過其快捷郵件郵政服務 (EMS) 提供這些服務。 Poczta Polska 透過 EMS 向 170 多個國家提供國際門到門快遞服務。國內和國際貨件的最大重量為 20 公斤。由於捷克共和國和斯洛伐克兩國距離較近,國家郵政服務對寄往捷克共和國和斯洛伐克的 EMS 貨件提供特別折扣。

- 由於需求不斷增加,羅馬尼亞是該地區提供國內和國際快遞服務的國家之一。羅馬尼亞國家郵政服務羅馬尼亞郵政透過 EMS 提供此項服務。國內快遞的重量限制為普通小包裹15 公斤,隱形物品 20 公斤。國際特快專遞提供從羅馬尼亞到大約 105 個國家的國際快遞服務。從羅馬尼亞可以透過國際宅配至大約 105 個國家,最大運送重量為 31.5 公斤。

中歐和東歐快遞包裹 (CEP) 市場趨勢

阿爾巴尼亞在全球挑戰中面臨成長放緩,而保加利亞、捷克共和國和波蘭則加強了高影響力的基礎設施投資

- 世界銀行預測,2023年阿爾巴尼亞經濟僅成長2.2%。受烏克蘭戰爭和能源危機加劇影響,2024年阿爾巴尼亞經濟成長可能進一步減弱,可能引發歐元區景氣衰退並推高運輸成本。不過,保加利亞已為這三個計劃投資了 11 億美元和 4.31 億美元的國家資金,此外還為保加利亞復甦和復原計畫 (RRP) 撥款 15 億美元。其中包括在魯塞郊區建造一個跨區域樞紐,預計於 2026 年完工。

- 2023年,捷克計畫新開通118公里公路,其中包括100多公里的高速公路,並建設計畫18公里的一級公路。該戰略可望緩解交通堵塞、縮短旅行時間並提高道路安全。此外,高速公路和道路建設計劃可以帶來巨大的經濟效益,創造新的就業機會並促進一個國家的經濟成長。改善的交通基礎設施還可以提高可及性和連接性,使企業更容易在全國範圍內運輸貨物和服務。

- 波蘭政府計劃投資175億美元用於鐵路基礎設施,投資366億美元用於公路基礎設施。道路和高速公路總局(GDDKiA)、波蘭鐵路 PKP SA、波蘭鐵路網(PKP-PLK)、經濟發展和技術部以及基礎設施部等主要機構負責涵蓋全國或特定地區的計劃。

保加利亞公共產業監管機構核准天然氣價格降價30.7%(不含稅)

- 匈牙利實施價格管制措施,維持能源價格低廉,使其天然氣和電費成為歐洲最便宜的之一。匈牙利的天然氣購買折扣單價約為 0.25 歐元(0.26 美元),每年最多可購買 1,729 立方公尺。同時,歐元區通膨率最高的愛沙尼亞正努力應對能源成本上漲,政府計劃透過凍結電力和燃料消費稅至2024年4月並考慮降低燃料稅等其他措施來減輕對家庭的影響。

- 2021年天然氣價格較2020年上漲49.41%。受俄烏戰爭影響,天然氣價格上漲約七倍,煤炭價格上漲約四倍,導致能源局勢不穩定,尤其導致愛沙尼亞、立陶宛、拉脫維亞三國居民消費價格上漲。 2023年6月,愛沙尼亞汽油價格在中東歐國家最高,每公升1.84美元,其次是阿爾巴尼亞,每公升1.79美元。

- 針對2023年,保加利亞公共產業監管局於2月核准將受監管的天然氣價格降低30.7%,新價格為每兆瓦時124.34保加利亞列弗(67.8美元)(不含運輸費、消費稅和增值稅)。降價是由於歐洲天氣變暖和天然氣蘊藏量充足導致國際天然氣市場價格下跌。預計此次降價將使許多消費者受益,監管機構決定在冬季供暖季的剩餘時間內保持中央暖氣供應價格不變。

中東歐快遞包裹 (CEP) 產業概覽

中東歐快遞包裹(CEP)市場較為分散,前五大公司佔31.80%的市佔率。市場的主要企業是:DHL集團、聯邦快遞、InPost、法國郵政集團和波蘭郵政公司(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的 GDP 分佈

- 經濟活動帶來的 GDP 成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業生產毛額

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 中歐和東歐 (CEE)

- 價值鏈與通路分析

第5章 市場區隔

- 目的地

- 國內的

- 國際的

- 送貨速度

- 表達

- 非快遞

- 模型

- 企業對企業 (B2B)

- 企業對消費者 (B2C)

- 消費者對消費者(C2C)

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 運輸方式

- 航空郵件

- 路

- 其他

- 最終用戶

- 電子商務

- 金融服務(BFSI)

- 衛生保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

- 國家名稱

- 阿爾巴尼亞

- 保加利亞

- 克羅埃西亞

- 捷克共和國

- 愛沙尼亞

- 匈牙利

- 拉脫維亞

- 立陶宛

- 波蘭

- 羅馬尼亞

- 日本與斯洛伐克關係

- 斯洛維尼亞

- 其他中東歐

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- CARGUS SRL

- DHL Group

- Fan Courier

- FedEx

- InPost

- International Distributions Services(including GLS)

- La Poste Group

- Poczta Polska SA

- Posta Romana SA

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源和進一步閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50001575

The Central and Eastern Europe Courier, Express, and Parcel (CEP) Market size is estimated at 14.66 billion USD in 2024, and is expected to reach 18.03 billion USD by 2030, growing at a CAGR of 3.51% during the forecast period (2024-2030).

Developing CEP segment in the region owing to services expansion, reducing tariffs, and growing e-commerce usage

- In 2022, CEP players in Hungary have taken the initiative to develop the segment. For instance, Hungarian operator Magyar Posta increased its distribution capacity with Leonardo's new sorting system in 2022. Leonardo is a major provider of automated solutions for small packets and parcels. The system, which would be supplied during 2023, is designed to process domestic and international parcels, wherein it could potentially process up to 100 million parcels a year. Also, Hungary-based FoxPost serves 20,000 businesses in Hungary, with 2,500 parcel lockers in Hungary.

- Zalando, Europe's leading online fashion and lifestyle platform, partnered with local logistics and technology Czech company Zasilkovna in 2021. The move responds to the shift in preferences of Czech customers wherein 1 in 4 Czechs chose pick-up points, and the preference for pick-up via parcel lockers rose from 0% to 6% in 3 years. Through the partnership, Zalando customers can use 1,500 Zasilkovna lockers and 4,700 pick-up points, with cash on delivery as one of the payment options. The aim is to cater to local customer preferences and provide convenience to Czech customers. Also, Nova Poshta, a major Ukrainian postal carrier, made a 2.5-fold reduction in tariffs for sending personal items to Poland in 2022, and this was done owing to the rise in the number of Ukrainians in Poland due to the war.

- E-commerce is a major driver for CEP demand in the region. For instance, 85.07% of online consumers in Slovakia were most likely to make purchases online in 2022. Share of internet users in Romania and Bulgaria stood at 51.46% and 48.78%, respectively, in 2022. With e-commerce user penetration to touch 3.18 million by 2027 in Slovakia, the demand for CEP is also projected to rise in the region.

E-commerce market in the CEE region hit USD 34.63 billion in 2022 generating the demand for CEP deliveries

- The e-commerce market in the CEE region reached a value of USD 34.63 billion in 2022, with the fashion and electronics segments leading the revenue shares with 31.68% and 28.10%, respectively. In 2022, Poland (USD 27.80 billion) had the highest e-commerce share in the region, followed by Czechia (USD 13 billion). In 2022, residents of Slovakia (85%) were the most likely to shop online in CEE countries. The percentage of people in Slovakia shopping online was 10% higher compared to the EU average in 2022. Czechia, Hungary, and Estonia were rated above average for using e-commerce among the 27 EU countries.

- Poland is another country in the region providing domestic and international express delivery services. Poczta Polska, the national postal service, provides these services via express mail service (EMS). Poczta Polska facilitates door-to-door international express deliveries via EMS to over 170 countries. The maximum weight of shipments of domestic and international goods is 20 kg. The national postal service has special lowered rates for EMS shipments being delivered to the Czech Republic and Slovakia due to their proximity.

- Due to increased demand, Romania is one of the countries in the region providing domestic and international express delivery services. The Romanian Post, the national postal service, provides this service via its EMS. The domestic delivery weight limit is 15 kg for ordinary parcels and 20 kg for invisible contents. The express delivery service can cater to international deliveries to about 105 countries from Romania. The maximum weight of parcels for these shipments at the time of posting and delivery should be 31.5 kg.

Central and Eastern Europe Courier, Express, and Parcel (CEP) Market Trends

Albania faces slower growth amid global challenges, while Bulgaria, Czech Republic, and Poland ramp up high-impact infrastructure investments

- The World Bank predicts that Albania's economy will grow by only 2.2% in 2023. Albania's economic growth may be even weaker in 2024 due to the war in Ukraine and the energy crisis deepening and causing an economic downturn in the eurozone, which may increase transportation costs. However, Bulgaria invested in three projects with USD 1.5 billion allocated to Bulgaria's Recovery and Resilience Plan (RRP), along with USD 1.1 billion and USD 431 million from National Funding. This includes the construction of an intermodular regional hub outside of Rousse, which is expected to be finished by 2026.

- In 2023, the Czech Republic was expected to open up to 118 km of new highway stretches, including a plan to build over 100 km of highway and 18 km of Class I road. This strategy is expected to reduce traffic congestion, reduce travel time, and improve road safety. The highway and road construction projects may also have a significant economic impact, creating new jobs and boosting the country's economic growth. Improved transportation infrastructure may also enhance accessibility and connectivity, making it easier for businesses to move goods and services across the country.

- The Polish government plans to invest USD 17.5 billion in railway infrastructure and USD 36.6 billion in road infrastructure. The key organizations, such as the General Directorate of National Roads and Motorways (GDDKiA), Polish Railway PKP SA, Polish Railway Networks (PKP-PLK), and the Ministry of Economic Development and Technology and the Ministry of Infrastructure, are taking charge of projects spanning across the nation or specific regions.

Post approval from Bulgaria's utilities regulator, gas prices reduced by 30.7%, excluding taxes

- Hungary has implemented price regulation measures to keep energy prices low, resulting in one of the lowest gas and electricity prices in Europe. Gas prices in Hungary are available at a reduced unit price of approximately EUR 0.25 (USD 0.26) for up to 1,729 cubic meters per year. On the other hand, Estonia, which has the highest inflation rate in the Eurozone, struggles with rising energy costs, and the government plans to alleviate the impact on households by freezing excise duty on electricity and fuel until April 2024 and considering other measures, such as reducing taxes on fuels.

- In 2021, the price of natural gas increased by 49.41%, up from 2020. The price of natural gas increased by almost seven times, and coal prices quadrupled due to the Russian-Ukraine War, leading to an unstable energy situation and increased consumer price inflation, particularly in the Baltic countries of Estonia, Lithuania, and Latvia. In June 2023, Estonia recorded the highest gasoline prices among Central and Eastern European countries, at 1.84 USD per liter, followed by Albania at 1.79 USD/liter.

- In 2023, Bulgaria's utilities regulator gave its approval for a reduction of 30.7% in the regulated gas price for February, resulting in a new price of BGN 124.34 (USD 67.8) per MWh (excluding transportation costs, excise, and value-added tax). The price reduction is attributed to the lower prices in international gas markets, owing to warm weather and sufficient gas storage in Europe. This price reduction is expected to benefit significant consumers, and the regulator has decided to maintain central heating prices for the rest of the winter heating season.

Central and Eastern Europe Courier, Express, and Parcel (CEP) Industry Overview

The Central and Eastern Europe Courier, Express, and Parcel (CEP) Market is fragmented, with the top five companies occupying 31.80%. The major players in this market are DHL Group, FedEx, InPost, La Poste Group and Poczta Polska SA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Central and Eastern Europe (CEE)

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Albania

- 5.7.2 Bulgaria

- 5.7.3 Croatia

- 5.7.4 Czech Republic

- 5.7.5 Estonia

- 5.7.6 Hungary

- 5.7.7 Latvia

- 5.7.8 Lithuania

- 5.7.9 Poland

- 5.7.10 Romania

- 5.7.11 Slovak Republic

- 5.7.12 Slovenia

- 5.7.13 Rest of CEE

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 CARGUS SRL

- 6.4.2 DHL Group

- 6.4.3 Fan Courier

- 6.4.4 FedEx

- 6.4.5 InPost

- 6.4.6 International Distributions Services (including GLS)

- 6.4.7 La Poste Group

- 6.4.8 Poczta Polska SA

- 6.4.9 Posta Romana SA

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219