|

市場調查報告書

商品編碼

1683969

英國汽車 LED 照明:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)UK Automotive LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

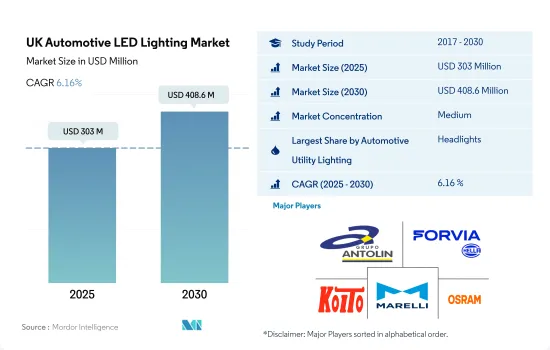

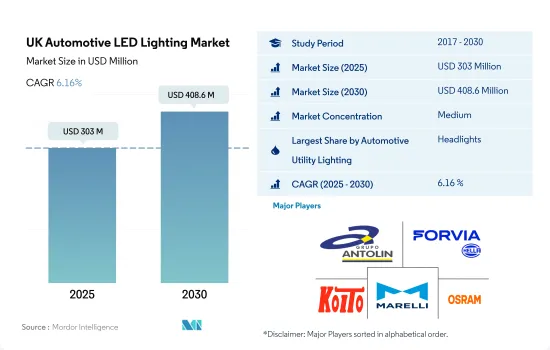

英國汽車 LED 照明市場規模預計在 2025 年為 3.03 億美元,預計到 2030 年將達到 4.086 億美元,預測期內(2025-2030 年)的複合年成長率為 6.16%。

國內物流服務需求上升推動商用車成長

- 根據市場調查,2023年前照燈的金額佔有率最高,其次是其他燈和日間行車燈。預計預測期內轉向訊號燈和煞車燈的市場佔有率將保持不變。日間行車燈可使英國白天的事故和死亡人數減少 6%。然而,使用 DRL 預計會使二氧化碳排放和燃料消費量增加 0.5%,如果使用 LED 燈代替燈絲光源,預計這一增幅會更小。

- 從出貨量佔有率來看,2023年轉向訊號燈將佔多數,其次是頭燈和其他燈光。預計這些燈的市場佔有率將保持穩定,波動不大。在英國,過去十年來物流設施的數量不斷增加,中部地區等倉庫和物流公司集中的地區近年來不斷擴大。隨著各行各業的企業適應新冠疫情和英國脫歐,對額外倉庫空間的需求也隨之增加。隨著物流規模的擴大,商用車的需求也不斷增加,進而推動LED在汽車產業的應用。

- 英國政府正在推動使用LED照明,自我調整照明正變得越來越普遍。自適應 LED 大燈現已成為英國銷售的許多新車的標準配備。政府為製造商和消費者提供推廣電動車的獎勵可能會推動汽車產業對 LED 的採用。

英國汽車 LED 照明市場趨勢

主要汽車製造商的技術進步和政府立法推動 LED 市場成長

- 預計2022年英國汽車總產量為98萬輛,2023年將達102萬輛。新冠疫情對英國汽車產業產生了負面影響。 2020年英國汽車產量下降29.3%,達到920,928輛,為1984年以來的最低水準。對美國、日本和澳洲的所有貨物出貨量分別下降了-33.7%、-21.6%和-21.8%。英國國內和國際旅行限制以及製造工廠的關閉抑制了汽車行業對 LED 照明的需求。

- 國內主要汽車製造商包括阿斯頓馬丁、賓利、卡特漢姆汽車、戴姆勒、捷豹、拉共達、路虎、利斯特汽車、蓮花汽車、麥克拉倫、Mini、MOKE、摩根和勞斯萊斯。汽車製造商不斷致力於利用最新技術來改進他們的汽車。例如,勞斯萊斯於 2022 年 10 月推出了該品牌首款全電動汽車 Spectre。格柵由 22 個 LED 柔和照明,照亮了每輛貨車的噴砂底部。 LED照明市場正受到此類創新的推動。

- 英國的新立法鼓勵使用 LED 照明。自2023年9月起,英國銷售的所有新車都必須配備智慧車速輔助(ISA)系統。在國內,汽車照明領域另一個越來越受歡迎的創新是數位照明。數位照明使用單獨可調節的 LED 燈矩陣來創造動態照明效果。預計預測期內英國的趨勢將推動汽車產業對 LED 照明的需求。

政府推動電動車轉型的舉措可能會推動 LED 市場成長

- 由於消費者需求的成長和電動車規格的提高,英國的電動車數量正在迅速增加。到2023年5月底,英國道路上將有超過78萬輛全電動汽車和超過50萬輛插電式混合動力汽車。 2016 年純電動車數量將為 30,669 輛,到 2023 年 5 月將達到 784,968 輛。 2022 年註冊的純電動車將超過 265,000 輛,比 2021 年增加 40%。

- 英國政府大力支持人們選擇電動車,以增加該國註冊的電動車數量。英國政府也宣布了2030年全面電氣化政策,向交通運輸領域投資數十億美元。買家可以享受插電式津貼,該補助金為新款電動車提供高達 2,500 歐元(2,692.81 美元)的折扣。蘇格蘭也為購買新舊電動車提供無息貸款。電動車車主可免徵機動車消費稅,並享有降低的實體福利稅率。

- 2022 年 12 月,福特馬達(FN) 宣布將額外投資 1.49 億英鎊(1.8 億美元),將其位於英國北部的引擎工廠的電動車動力裝置產量提高 70%。海伍德工廠電力驅動裝置產能可從每年25萬台增加至42萬台,預計2024年投入生產。為因應電動車日益成長的需求,汽車製造商在汽車LED的開發和生產方面展開了激烈的競爭。 LED 汽車燈比鹵素燈泡消耗的能量更少,有助於節省能源並延長電動車的行駛里程。這些優勢可能會進一步刺激英國對汽車 LED 的需求。

英國汽車 LED 照明產業概況

英國汽車LED照明市場適度整合,前五大企業佔比為40.62%。該市場的主要企業有:GRUPO ANTOLIN IRAUSA, SA、HELLA GmbH & Co. KGaA (FORVIA)、KOITO MANUFACTURING、Marelli Holdings 和 OSRAM GmbH。 (按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 汽車持有量

- LED進口總量

- 家庭數量

- 道路網路

- 滲透率

- 法律規範

- 英國

- 價值鏈與通路分析

第5章 市場區隔

- 汽車實用照明

- 日間行車燈 (DRL)

- 轉向指示燈

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介(包括全球概況、市場層級概況、主要業務部門、財務狀況、員工人數、關鍵資訊、市場排名、市場佔有率、產品和服務、最新發展分析)

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- Hyundai Mobis

- KOITO MANUFACTURING CO., LTD.

- Lumileds Holding BV(NARVA)

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Phoenix Lamps Ltd(Suprajit Engineering Ltd)

- Signify(Philips)

- Stanley Electric Co., Ltd.

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The UK Automotive LED Lighting Market size is estimated at 303 million USD in 2025, and is expected to reach 408.6 million USD by 2030, growing at a CAGR of 6.16% during the forecast period (2025-2030).

Growth in the commercial vehicle is driven by the rising demand for logistics services in the country

- According to market research, headlights had the highest value share in 2023, followed by other lights and daytime running lights. The market share for directional signal lights and stoplights is expected to remain the same during the forecast period. Daytime running lights have led to a decrease in daytime accidents and fatalities in the United Kingdom by up to 6%. However, the use of DRLs is expected to cause a 0.5% increase in CO2 emissions and fuel consumption, which is expected to be less when using LED lights instead of filament light sources.

- In terms of volume share, directional signal lights accounted for the majority in 2023, followed by headlights and other lights. The market share for these lights is expected to remain stable with little to no fluctuation. The United Kingdom has seen an increase in logistical facilities over the last decade, with the Midlands and other areas with a high concentration of warehousing and logistics companies expanding in recent years. The need for more warehouse space has been driven by companies across various industries adapting to the COVID-19 outbreak and Brexit. As logistics have grown, so has the demand for commercial vehicles, which, in turn, has increased the use of LEDs in the automotive industry.

- The UK government is promoting the use of LED lighting, and adaptive lighting is becoming more popular. Adaptable LED headlights are now a standard feature on many new automobiles sold in the UK. Incentives offered by the government to manufacturers and consumers to promote electric vehicles would help increase the penetration of LEDs in the auto industry.

UK Automotive LED Lighting Market Trends

Technological advancements by major automotive manufacturers and government laws to drive the growth of the LED market

- The total automobile vehicle production in the United Kingdom was 0.98 million units in 2022, and it is expected to reach 1.02 million units in 2023. The COVID-19 pandemic had a negative impact on the automotive industry in the United Kingdom. The production of cars in the United Kingdom dropped by 29.3% in 2020, reaching 920,928 units, the lowest number since 1984. All shipments to the United States, Japan, and Australia declined by -33.7%, -21.6%, and -21.8%, respectively. As a result of travel restrictions both inside and outside the country and the shutdown of UK manufacturing facilities, the demand for LED lighting in the automotive sector suffered.

- Major automakers in the nation include Aston Martin, Bentley, Caterham Cars, Daimler, Jaguar, Lagonda, Land Rover, Lister Cars, Lotus, McLaren, Mini, MOKE, Morgan, and Rolls-Royce. Automakers are constantly working to improve their automobiles with the newest technology. For instance, Rolls-Royce introduced the Spectre, the brand's first entirely electric vehicle, in October 2022. The grille is softly illuminated with 22 LEDs lighting up the sandblasted back side of each of the vans. The market for LED lights is driven by such innovation.

- New laws in the United Kingdom are encouraging the use of LED lighting. All new automobiles sold in the United Kingdom starting September 2023 must include an intelligent speed assistance (ISA) system. Another innovation in car lighting that is taking off in the country is digital lighting. Digital lighting uses a matrix of LED lights that can be individually adjusted to generate dynamic lighting effects. The trends in the United Kingdom are expected to drive the demand for LED lighting in the automotive industry during the forecast period.

The shift toward electric mobility through government initiatives may drive the growth of the LED market

- The number of electric vehicles in the United Kingdom is rapidly expanding due to rising consumer demand and increased availability of electric versions. By the end of May 2023, there were over 780,000 completely electric cars and 500,000 plug-in hybrids on UK roads. In 2016, there were 30,669 battery-electric cars in the country, reaching 784,968 by May 2023. More than 265,000 battery-electric vehicles were registered in 2022, a 40% increase over 2021.

- The British government strongly supports the people who choose EVs to increase the number of registered electric vehicles in the country. The UK government also announced a comprehensive electrification policy by 2030, and it is investing billions in the transport sector. Buyers can benefit from the Plug-In Grant, which offers a discount of up to EUR 2,500 (USD 2692.81) on new EVs. Scotland also offers interest-free loans on purchases of new and used EVs. EV owners are exempt from the Vehicle Excise Duty and can get a reduction in their Benefit-In-Kind tax rate.

- In December 2022, Ford Motor Co. (F.N) announced the investment of an extra GBP 149 million (USD 180 million) to boost the output of EV power units by 70% at its engine factory in northern England as the US carmaker accelerates its push to go electric. The production capacity of the Halewood plant's electric drive unit may increase from 250,000 units to 420,000 units per year, and it is planned to start in 2024. Automobile manufacturers are racing to develop and produce automotive LEDs due to the rising demand for EVs. LED car lights can help EVs save energy and extend their driving range, as they consume less power than halogen bulbs. Such benefits may further boost the demand for automotive LEDs in the United Kingdom.

UK Automotive LED Lighting Industry Overview

The UK Automotive LED Lighting Market is moderately consolidated, with the top five companies occupying 40.62%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., HELLA GmbH & Co. KGaA (FORVIA), KOITO MANUFACTURING CO., LTD., Marelli Holdings Co., Ltd. and OSRAM GmbH. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 # Of Households

- 4.9 Road Networks

- 4.10 Led Penetration

- 4.11 Regulatory Framework

- 4.11.1 United Kingdom

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Automotive Utility Lighting

- 5.1.1 Daytime Running Lights (DRL)

- 5.1.2 Directional Signal Lights

- 5.1.3 Headlights

- 5.1.4 Reverse Light

- 5.1.5 Stop Light

- 5.1.6 Tail Light

- 5.1.7 Others

- 5.2 Automotive Vehicle Lighting

- 5.2.1 2 Wheelers

- 5.2.2 Commercial Vehicles

- 5.2.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.2 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.3 Hyundai Mobis

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 Lumileds Holding B.V. (NARVA)

- 6.4.6 Marelli Holdings Co., Ltd.

- 6.4.7 OSRAM GmbH.

- 6.4.8 Phoenix Lamps Ltd (Suprajit Engineering Ltd)

- 6.4.9 Signify (Philips)

- 6.4.10 Stanley Electric Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms