|

市場調查報告書

商品編碼

1685711

北美生物刺激素:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)North America Biostimulants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

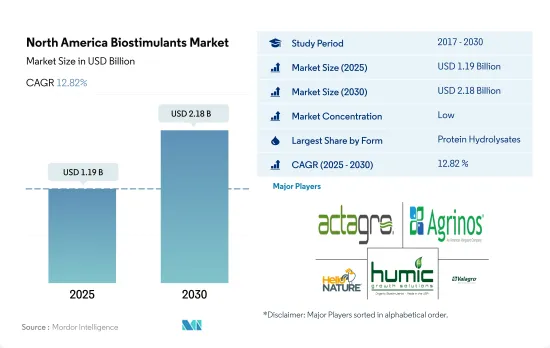

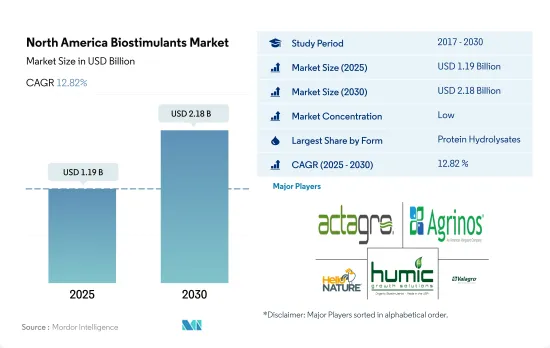

北美生物刺激素市場規模預計在 2025 年為 11.9 億美元,預計到 2030 年將達到 21.8 億美元,預測期內(2025-2030 年)的複合年成長率為 12.82%。

- 由於幾個關鍵因素,北美生物刺激素市場預計在未來幾年內成長。預計 2022 年市場規模為 8.402 億美元,消費量為 88,200 噸,其中蛋白質水解物是該地區消費最多的生物刺激素,市場佔有率為 40.9%。眾所周知,這些產品透過確保植物必需胺基酸和營養素的合成,即使在生物脅迫條件下也能提高作物的性能。

- 蛋白質水解物市場呈上升趨勢,預計 2017 年至 2022 年的複合年成長率為 12.8%。這是由於對提高作物產量和品質的需求日益成長,而這可以透過生物刺激素來實現。

- 腐植酸是另一種生物刺激素,在提高作物產量方面已顯示出良好的效果。眾所周知,在溫室和生長室中使用腐殖酸可以顯著提高作物產量,而在辣椒田中,以 20.0 毫升/公升的速率進行葉面噴布可以產生最高的葉綠素含量。 L-脯胺酸、L-甘胺酸、L-麩胺酸和L-甲硫胺酸等胺基酸是農業常用的生物刺激素。這些產品可以改善植物的各種過程,如發芽、坐果、授粉和抵抗環境壓力。

- 生物刺激素為提高作物產量和品質同時減少化學肥料和殺蟲劑的使用提供了一個有希望的解決方案。隨著對有機和永續農業方法的需求不斷成長,生物刺激素可能會在農業中發揮越來越重要的作用。

- 在農業高度發展的美國,農業生產多採用自然、有機的耕作方式。該地區生物刺激素的消費量很高,越來越多的農民選擇使用生物刺激素,因為它們能夠提高作物產量。

- 2022年美國市場規模為4.168億美元。美國佔北美生物刺激素消費量的最大佔有率,為49.6%,進一步推動了有機種植面積的增加。

- 加拿大是第二大市場,2022 年的市佔率為 35.2%。加拿大政府對安全農業實踐的支持以及該國對有機食品日益成長的需求正在推動市場成長。

- 根據加拿大有機聯合會報告的資料,2020年加拿大有機食品銷售額達81億美元。加拿大是世界第六大有機產品市場,據報道,該國有機產品的供應量無法滿足需求。這些因素是該國生物刺激素發展的潛在驅動力。

- 墨西哥是北美新興農業國家之一。 2022年,它將佔該地區農業生物刺激素市場總量的約13.3%。由於有機農業在該國已十分成熟,生物刺激素具有巨大的潛力。預計2023年至2029年間,墨西哥的有機種植面積將成長16.4%,這將推動對生物刺激素的需求。

- 由於該地區擴大採用永續農業實踐和對有機食品的需求不斷成長,北美生物刺激素市場預計將進一步成長。

北美生物刺激素市場趨勢

美國等主要國家對有機農產品的需求正在成長,政府的支持也有助於增加有機農產品的種植面積

- 根據FibL統計的資料,2021年北美有機種植面積達到創紀錄的150萬公頃。該地區的有機種植面積從2017年到2022年增加了13.5%。在北美國家中,美國佔據主導地位,有62.3萬公頃的農地進行有機種植,其中加州、緬因州和紐約州是實施有機種植的主要州。

- 緊隨美國之後的是墨西哥,2021年有機農業面積達531,100公頃。墨西哥是全球前20大有機食品生產國之一。根據世界咖啡大師的資料,墨西哥是世界上最大的有機咖啡出口國。該國擁有全球最大的有機咖啡生產面積和最多的有機咖啡生產商。

- 該國主要的有機食品生產州是恰帕斯州、瓦哈卡州、米卻肯州、奇瓦瓦州和格雷羅州,佔全國有機種植面積的80.0%。在墨西哥,國家有機農業協會等組織正在推廣有機農業,希望能激勵更多農民從事有機農業。除了資金支持外,墨西哥政府也支持有機農業的研發活動。

- 加拿大作物作物面積從2017年的40萬公頃增加到2021年的45萬公頃,其中2021年將達到最大面積42萬公頃。加拿大政府宣布,將於2021年向有機發展基金提供297,330美元,用於支持有機農民。這些努力有望增加該地區有機種植的面積。

國內外市場對有機農產品的需求不斷成長,人均有機食品支出不斷增加

- 2021年北美人均有機食品支出為109.7美元,美國是北美國家中人均支出最高的國家,2021年平均支出為186.7美元。根據有機緩步動物協會統計,2021年美國有機產品銷售額超過630億美元,與前一年同期比較成長2.0%,其中有機食品銷售額達575億美元。有機水果和蔬菜佔有機產品總銷售額的15.0%,2021年價值210億美元。

- 根據加拿大有機聯盟報告的資料,2020 年加拿大有機食品銷售額達到 81 億美元。加拿大是世界第六大有機產品市場,據報道,該國有機產品的供應量無法滿足需求。 2021年有機食品人均支出為142.6美元。政府加強對零售商的支持力度預計將提高該國有機產品的供應量、可近性和可負擔性。有機塔爾德協會預測,2021 年至 2026 年間,加拿大有機產品市場將達到 6.3% 的複合年成長率。

- 2021年,墨西哥有機產品市場規模估計為6,300萬美元,全球排名第35位,預計2021年至2026年期間的複合年成長率為7.2%。然而,該國2021年的人均有機產品支出為0.49美元,低於該地區的其他國家。隨著越來越多的公司進入墨西哥市場,該國對有機產品的需求預計將會增加。

北美生物刺激素產業概況。

北美生物刺激素市場較為分散,前五大公司市佔率合計為3.23%。市場的主要企業有:Actagro LLC、Agrinos、Hello Nature USA Inc.、Humic Growth Solutions Inc. 和 Valagro USA(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 有機種植區

- 有機產品人均支出

- 法律規範

- 加拿大

- 墨西哥

- 美國

- 價值鍊和通路分析

第5章市場區隔

- 形式

- 胺基酸

- 富裡酸

- 腐植酸

- 蛋白質水解物

- 海藻萃取物

- 其他生物刺激素

- 作物類型

- 經濟作物

- 園藝作物

- 田間作物

- 原產地

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- Actagro LLC

- Agriculture Solutions Inc.

- Agrinos

- Agrocare Canada Inc.

- Hello Nature USA Inc.

- Humic Growth Solutions Inc.

- Koppert Biological Systems Inc.

- Plant Response Biotech Inc.

- Sigma Agriscience LLC

- Valagro USA

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 46580

The North America Biostimulants Market size is estimated at 1.19 billion USD in 2025, and is expected to reach 2.18 billion USD by 2030, growing at a CAGR of 12.82% during the forecast period (2025-2030).

- The North American biostimulants market is anticipated to grow over the coming years, driven by several key factors. With a value of USD 840.2 million and volume consumption of 88.2 thousand metric tons in 2022, protein hydrolysates are the most consumed biostimulant type in the region, accounting for a market share of 40.9%. These products are known to improve crop performance, even under abiotic stress conditions, by ensuring the synthesis of essential plant amino acids and nutrients.

- During 2017-2022, the market for protein hydrolysates saw an upward trend and is expected to register a CAGR of 12.8%. This is due to a growing need for increased crop productivity and quality of produce, which can be achieved through biostimulants.

- Humic acid is another biostimulant that has shown promising results in improving crop yield. The application of humic acid in greenhouses and growth chambers has been known to significantly improve crop yield, while foliar application at the rate of 20.0 ml/lit in pepper fields has recorded the highest chlorophyll content. Amino acids, such as L-proline, L-Glycine, L-Glutamic acid, and L-Methionine, are commonly used biostimulants in agriculture. These products can improve various plant processes, including germination, fruit set, pollination, and resistance, to environmental stresses.

- Biostimulants offer a promising solution for improving crop productivity and quality while reducing the use of chemical fertilizers and pesticides. As the demand for organic and sustainable farming practices continues to rise, biostimulants are likely to play an increasingly important role in agriculture.

- The United States, with its highly evolved agricultural sector, has been adapting natural and organic ways of farming. The region is witnessing high consumption of biostimulants, with more farmers preferring to use them due to their ability to enhance crop performance.

- The market in the United States was valued at USD 416.8 million in 2022. The United States accounted for a maximum share of 49.6% of North America in biostimulant consumption, further aided by the increasing organic acreages.

- Canada is the second-largest market, with a share of 35.2% in 2022. The Canadian government's support for safe agriculture practices and the growing demand for organic food in the country are driving the market's growth.

- Organic food sales in the country reached a value of USD 8.10 billion in 2020, as per the data reported by the Organic Federation of Canada. It is reported that Canada is the 6th largest market in the world for organic products, with the supply of organic products failing to keep up with the demand in the country. These factors act as potential drivers for biostimulants in the country.

- Mexico is one of the emerging agricultural countries in North America. It accounted for around 13.3% of the overall agricultural biostimulants market in the region in 2022. There is an immense potential for biostimulants in the country due to its well-established organic farming. The organic area in Mexico is estimated to grow by 16.4% between 2023 and 2029, which is expected to boost the demand for biostimulants.

- The biostimulant market in North America is poised for further growth, driven by the increasing adoption of sustainable agriculture practices and the growing demand for organic food in the region.

North America Biostimulants Market Trends

Organic produce demand grows in major countries like the United States, increasing cultivation area with government support

- The area under organic cultivation of crops in North America was recorded at 1.5 million hectares in 2021, according to the data provided by FibL statistics. The organic area in the region increased by 13.5% between 2017 and 2022. Among the North American countries, the United States is dominant, with 623.0 thousand hectares of agricultural land under organic farming, with California, Maine, and New York being the major states practicing agriculture.

- The United States is followed by Mexico, with 531.1 thousand hectares of area under organic farming in 2021. Mexico is among the top 20 organic food producers in the world. Mexico is the largest exporter of organic coffee in the world, according to the Global Coffee Masters data. The country has the largest area under organic coffee production and even in terms of the number of organic coffee producers.

- The major organic food-producing states in the country include Chiapas, Oaxaca, Michoacan, Chihuahua, and Guerrero, which account for 80.0% of the total organic area in the country. Organizations, such as National Association for Organic Agriculture, promote organic agriculture in the country, which is expected to motivate more farmers to take up organic agriculture. The Mexican government, in addition to financial assistance, is supporting research and development activities to help organic agriculture.

- Canada's area under organic crop cultivation increased from 0.4 million hectares in 2017 to 0.45 million hectares in 2021. Row crops occupied the maximum area with 0.42 million hectares in 2021. The Canadian government announced a sum of USD 297,330 in 2021 as Organic Development Fund to support organic farmers. These initiatives are expected to increase the organic area in the region.

Growing demand for organic produce in domestic and international markets, rise in per capita spending on organic food

- The average per capita spending on organic food products in North America was recorded as USD 109.7 in 2021. The per capita spending in the United States is the highest among the North American countries, with average spending of USD 186.7 in 2021. According to the Organic Tarde Association, the sales of organic products in the United States crossed USD 63.00 billion in 2021, with a 2.0% increase over the previous year, with organic food sales standing at USD 57.5 billion in 2021. Organic fruits and vegetables accounted for 15.0% of the total organic product sales, with a value of USD 21.0 billion in 2021.

- Organic food sales in Canada reached a value of USD 8.10 billion in 2020, as per the data reported by the Organic Federation of Canada. It is reported that Canada is the 6th largest market in the world for organic products, with the supply of organic products failing to keep up with the demand in the country. The average spending on organic food per person was USD 142.6 in 2021. Increasing government support to retailers is expected to increase the availability, accessibility, and affordability of organic products in the country. Organic Tarde Association estimated that the Canadian organic products market is expected to register a CAGR of 6.3% between 2021 and 2026.

- In 2021, Mexico registered a market size of USD 63.0 million for organic products with a global rank of 35, and it is estimated to register a CAGR of 7.2% between 2021 and 2026. However, the per capita spending on organic products in the country is less compared to other countries in the region, with a value of USD 0.49 in 2021. More players entering the market in Mexico are expected to increase the demand for organic products in the country.

North America Biostimulants Industry Overview

The North America Biostimulants Market is fragmented, with the top five companies occupying 3.23%. The major players in this market are Actagro LLC, Agrinos, Hello Nature USA Inc., Humic Growth Solutions Inc. and Valagro USA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Amino Acids

- 5.1.2 Fulvic Acid

- 5.1.3 Humic Acid

- 5.1.4 Protein Hydrolysates

- 5.1.5 Seaweed Extracts

- 5.1.6 Other Biostimulants

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Actagro LLC

- 6.4.2 Agriculture Solutions Inc.

- 6.4.3 Agrinos

- 6.4.4 Agrocare Canada Inc.

- 6.4.5 Hello Nature USA Inc.

- 6.4.6 Humic Growth Solutions Inc.

- 6.4.7 Koppert Biological Systems Inc.

- 6.4.8 Plant Response Biotech Inc.

- 6.4.9 Sigma Agriscience LLC

- 6.4.10 Valagro USA

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219