|

市場調查報告書

商品編碼

1685780

農藥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Insecticide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

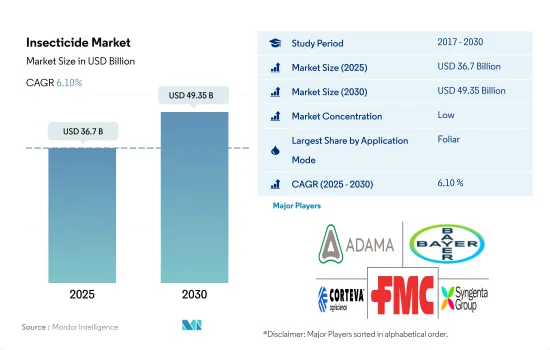

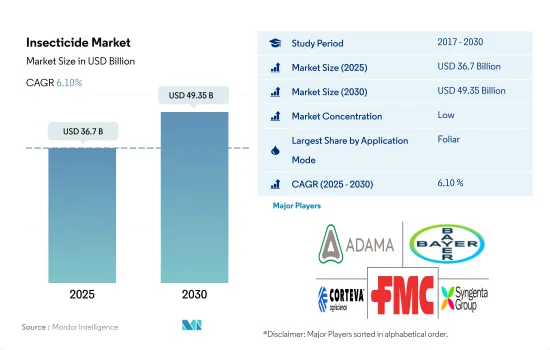

殺蟲劑市場規模預計在 2025 年為 367 億美元,預計到 2030 年將達到 493.5 億美元,預測期內(2025-2030 年)的複合年成長率為 6.10%。

害蟲壓力的增加以及保護作物免受害蟲侵害的需求推動了對農藥的需求

- 隨著使用方法的多樣化,農藥的使用量不斷增加,以保護作物免受蟲害。 2022 年,葉面噴布領域將佔據主要佔有率,佔整個殺蟲劑市場的 56.9%。這歸因於害蟲防治壓力的增加以及害蟲防治的有效性、快速性和針對性。

- 從以金額為準來看,全球殺蟲劑市場的種子處理方法預計在 2023 年至 2029 年期間的複合年成長率為 4.5%。這種方法之所以主要被使用,是因為它可以在作物生命週期的早期控制許多種子和幼苗害蟲,例如蚜蟲、薊馬、甘藍夜蛾和介殼蟲。

- 農藥市場中的土壤處理部分預計在 2023 年至 2029 年期間的複合年成長率為 4.1%。影響小麥、大豆、油棕櫚、可可和咖啡等重要經濟作物根部生長的主要害蟲是蛞蝓、金針蟲、船蟲和土壤蛀蟲。因此,預計土壤處理方面對農藥的需求將會增加,以保護作物免受這些害蟲的侵害。

- 農民對化學灌溉方法的認知越來越深入。將農藥施用與灌溉結合起來可以為農民節省時間和精力,這對於管理大型農業經營的農民來說是一個方便的選擇。受這些因素的推動,預計預測期內(2023-2029年),該應用模式殺蟲劑的市場價值將以 3.7% 的複合年成長率成長。

- 預計這些施用方法的全球殺蟲劑市場將經歷顯著成長,2023 年至 2029 年的複合年成長率為 4.2%。

由於氣候條件變化導致的種植面積擴大促進了市場成長。

- 世界人口不斷成長以及生產更多糧食的需求導致農業產量增加,這反過來又推動了對用於保護作物免受害蟲侵害的農藥的需求。在過去一段時期(2017-2022 年),殺蟲劑市場成長了 84.498 億美元3。

- 南美洲是農業生產的主要地區之一,2022 年佔了 24.9% 的市場。大豆、玉米、甘蔗和其他作物的大量產量對有效控制害蟲的殺蟲劑產生了巨大的需求。南方樹皮甲蟲(Spodoptera eridania)等昆蟲的侵擾日益增多,推動著市場的成長。

- 金額,亞太地區是殺蟲劑市場佔有最大佔有率的地區,預計將成為成長最快的市場,預測期內(2023-2029 年)的複合年成長率為 3.9%。由於氣候變化,破壞農作物的害蟲變得越來越普遍。因此,殺蟲劑的需求預計會增加,因為它們是防治害蟲和確保作物產量的有效手段。

- 預計預測期內(2023-2029 年)北美的複合年成長率將達到 4.7%。保護作物的需要,加上入侵害蟲的引入或擴散,可能會增加對用於管理和控制這些新威脅的殺蟲劑的需求。

- 然而,歐洲和非洲擁有強勁的農業部門,在全球農藥市場中發揮關鍵作用。預計在此期間這兩個地區的複合年成長率分別為 4.6% 和 3.7%。

- 預計 2023-2029 年全球殺蟲劑市場複合年成長率為 4.2%。由於氣候變化,農業部門的快速擴張正在推動市場成長。

全球殺蟲劑市場趨勢

全球暖化導致害蟲增多,農藥使用量增加

- 全球平均每公頃農地化學農藥消費量為918.7公克。由於農業集約化、害蟲增加以及為確保全球糧食安全而對高產量和作物生產力的需求等因素,這一情況多年來一直在增加。根據聯合國糧食及農業組織的資料,全球每年有40%的農作物產量因病蟲害而損失,平均造成700億美元左右的經濟損失。

- 歐洲使用的殺蟲劑比世界上任何其他地區都多,其中德國使用的殺蟲劑最多,達到每公頃 3,028.0 克。這可能是由於高度集約的農業實踐注重最大限度地提高作物產量。集約農業通常使用大量投入,包括殺蟲劑,來控制害蟲並確保最佳作物產量。緊隨歐洲之後的是亞太地區,平均殺蟲劑施用率為每公頃 975.1 克。

- 在北美國家中,美國每公頃殺蟲劑消費量最高,2022 年為 791.7 克。這是因為作物種植面積大,不斷變化的氣候條件增加了遭受蟲害的機會。

- 全球暖化導致的氣候條件變化為某些害蟲的滋生創造了有利條件,從而引發嚴重的疫情。例如,2020年蝗蟲嚴重影響了23個國家,其中中東9個國家、東北和非洲11個國家、南亞3個國家,造成的損失估計達85億美元。這種情況迫使農民在農業生產中使用大量農藥。

Imidacloprid是最經濟的殺蟲劑,且殺蟲劑頻譜廣。

- Lambda-Cyhalothrin屬於擬除蟲菊酯類殺蟲劑,是一種以菊花中天然除蟲菊酯為原型的合成化學物質。Lambda-Cyhalothrin用於防治棉花、玉米、大豆、蔬菜和水果作物中的蚜蟲、薊馬、葉蟬、粉蝨和各種毛蟲等害蟲。活性成分可作為神經毒素,針對昆蟲的神經系統。它會抑制神經細胞的正常功能,導致害蟲癱瘓並最終死亡。 2022 年的價格為每噸 22,700 美元。

- Cypermethrin是一種非合成擬除蟲菊酯,用於控制跳甲、果子狸、蟑螂、白蟻、瓢蟲、蠍子和黃蜂。 2022年的價格為21,000美元。巴西是全球三大Cypermethrin進口國之一,根據歐盟-南方共同市場協議,歐盟是巴西的主要出口國。

- Emamectin benzoate是一種屬於阿維菌素類化學殺蟲劑。它透過攻擊神經系統來殺死害蟲。它與神經細胞上的特定受體結合,使害蟲麻痺並最終殺死它們。歐洲國家使用Emamectin benzoate來防治農業中的各種害蟲。價格為每噸17,300美元。

- Imidacloprid是一種新菸鹼類殺蟲劑,可有效控制多種害蟲,包括蚜蟲、葉蟬、粉蝨、薊馬和某些甲蟲。 2022 年該活性成分的價格為每噸 17,170 美元。Malathion是農藥中最便宜的化學物質。 2022 年的價格為每噸 12,500 美元。

農藥業概況

農藥市場較為分散,前五大企業的市佔率為33.15%。該市場的主要企業是:ADAMA Agricultural Solutions Ltd.、Bayer AG、Corteva Agriscience、FMC Corporation和Syngenta Group(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 每公頃農藥消費量

- 有效成分價格分析

- 法律規範

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 智利

- 中國

- 法國

- 德國

- 印度

- 印尼

- 義大利

- 日本

- 墨西哥

- 緬甸

- 荷蘭

- 巴基斯坦

- 菲律賓

- 俄羅斯

- 南非

- 西班牙

- 泰國

- 烏克蘭

- 英國

- 美國

- 越南

- 價值鏈與通路分析

第5章 市場區隔

- 如何使用

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 糧食

- 豆類和油籽

- 草坪和觀賞植物

- 地區

- 非洲

- 按國家

- 南非

- 非洲其他地區

- 亞太地區

- 按國家

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 緬甸

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 其他亞太地區

- 歐洲

- 按國家

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲國家

- 北美洲

- 按國家

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 按國家

- 阿根廷

- 巴西

- 智利

- 其他南美國家

- 非洲

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 47401

The Insecticide Market size is estimated at 36.7 billion USD in 2025, and is expected to reach 49.35 billion USD by 2030, growing at a CAGR of 6.10% during the forecast period (2025-2030).

The rising pest pressure and the need to protect crops from damaging insects are driving the demand for insecticides

- Insecticide use is increasing through different application modes to protect crops from insect pests. In 2022, the foliar segment held the major share, accounting for 56.9% of the overall insecticide market. This could be attributed to increasing pest pressure and its effectiveness in controlling insects, rapid action, and targeted control.

- In terms of value, the seed treatment method in the global insecticide market is expected to record a CAGR of 4.5% between 2023 and 2029. This method is being majorly adopted because it protects against many pests that attack seeds or seedlings, such as aphids, thrips, wireworms, and beetles, at the very beginning of a crop's life cycle.

- Soil treatment in the insecticide market is expected to record a 4.1% CAGR between 2023 and 2029. The main pests affecting the root growth of economically significant crops such as wheat, soybean, oil palm, cocoa, and coffee are slugs, wireworms, fungi gnats, and soil mealybugs. Therefore, to protect crops from these pests, the demand for insecticides in terms of soil treatment is expected to increase.

- Farmers are becoming more and more aware of the chemigation method. By combining insecticide application with irrigation, farmers can save time and labor, making it a convenient choice for farmers managing large-scale agricultural operations. Due to these factors, the insecticide market value in this application mode is projected to record a 3.7% CAGR during the forecast period (2023-2029).

- The global insecticide market in these application methods is expected to witness significant growth and is projected to record a 4.2% CAGR from 2023 to 2029.

The expansion of cropland areas with changes in climate conditions is contributing to the growth of the market

- The increase in global population and the need for higher food production have led to the expansion of agricultural production, which, in turn, boosted the demand for insecticides to protect the crops from damaging pests. During the historical period (2017-2022), the insecticide market grew by USD 8,449.8 million.3

- South America was one of the major regions in agriculture production, with a 24.9% market value in 2022. The vast production of soybeans, corn, sugarcane, and other crops creates a significant demand for insecticides to manage pests effectively. The rise of infestation of insects such as southern armyworm (Spodoptera eridania) has driven the growth of the market.

- Asia-Pacific holds the largest insecticide market value share, and the market is anticipated to grow fastest in the region, registering a CAGR of 3.9% during the forecast period (2023-2029). Insect pests that could damage crops are spreading due to the changing climate. Consequently, the demand for insecticides is expected to rise as they are efficient tools for addressing these pests and ensuring crop productivity.

- North America is projected to register a CAGR of 4.7% during the forecast period (2023-2029). The need to protect the crops, coupled with the introduction or spread of invasive pests, could lead to increased demand for insecticides to manage and control these new threats.

- However, Europe and Africa have a substantial agricultural sector and play a vital role in the global insecticide market. These regions are projected to register CAGRs of 4.6% and 3.7%, respectively, during the period.

- The global insecticide market is projected to register a CAGR of 4.2% during 2023-2029. The rapidly expanding agriculture sector with a changing climate is driving the growth of the market.

Global Insecticide Market Trends

Increased pest proliferation due to global warming is increasing the usage of insecticides

- The average global consumption of chemical insecticides is 918.7 g per hectare of agricultural land. It has been increasing over the years owing to factors like the intensification of agriculture, increasing pest populations, and the need for higher yield and crop productivity to ensure global food security. According to the data provided by the Food and Agriculture Organization, 40% of global crop production is lost to pests annually, resulting in an average economic loss of around USD 70.0 billion.

- Europe witnessed higher insecticide applications compared to other regions of the world, with Germany having a higher per-hectare consumption of 3,028.0 g, which may be attributed to its highly intensive agricultural practices, with a significant focus on maximizing crop yields. Intensive agriculture often involves the use of higher inputs, including insecticides, to manage pests and ensure optimal crop production. Europe is followed by Asia-Pacific, with an average insecticide application of 975.1 g per hectare.

- Among the North American countries, the United States witnessed the largest consumption of insecticides per hectare, with 791.7 g in 2022, attributed to the large area under the cultivation of crops and increased exposure to insect pest infestations due to constantly changing climatic conditions.

- Changing climatic conditions due to global warming have created favorable conditions for certain pests, resulting in severe outbreaks. For instance, a locust outbreak in 2020 severely affected 23 countries, i.e., nine in East Africa, 11 in North Africa and the Middle East, and three in South Asia, causing an estimated loss of USD 8.5 billion. These circumstances necessitate farmers to use higher amounts of insecticides in agriculture.

Imidacloprid is the most affordable insecticide with a broad spectrum of activity

- Lambda-cyhalothrin belongs to the class of pyrethroid insecticides, which are synthetic chemicals modeled after natural pyrethrins found in chrysanthemum flowers. Lambda-cyhalothrin is used to control pests such as aphids, thrips, leafhoppers, whiteflies, and various caterpillar species in crops like cotton, corn, soybean, vegetables, and fruits. This active ingredient acts as a neurotoxin, targeting the nervous system of insects. It disrupts the normal functioning of nerve cells, leading to paralysis and, ultimately, the death of the pests. In 2022, it was priced at USD 22.7 thousand per metric ton.

- Cypermethrin is a non-synthetic pyrethroid used to control flea beetles, boxelder bugs, cockroaches, termites, ladybugs, scorpions, and yellow jackets. It was priced at USD 21.0 thousand in 2022. Brazil ranks among the top three importers of cypermethrin globally, with the European Union being a major exporter to Brazil under the EU-Mercosur deal.

- Emamectin benzoate is an insecticide belonging to the chemical class of avermectins. It kills the pests by targeting the nervous system. It binds to specific receptors in nerve cells, leading to paralysis and the eventual death of the pests. Emamectin benzoate is majorly used in European countries to control various insect pests in agriculture. It was priced at USD 17.3 thousand per metric ton.

- Imidacloprid is a neonicotinoid insecticide used to effectively manage various pests, including aphids, leafhoppers, whiteflies, thrips, and certain beetle species. This active ingredient was priced at USD 17.17 thousand per metric ton in 2022. Malathion is the most affordable chemical among the insecticides. It was valued at USD 12.5 thousand per metric ton in 2022.

Insecticide Industry Overview

The Insecticide Market is fragmented, with the top five companies occupying 33.15%. The major players in this market are ADAMA Agricultural Solutions Ltd., Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 Chile

- 4.3.6 China

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Italy

- 4.3.12 Japan

- 4.3.13 Mexico

- 4.3.14 Myanmar

- 4.3.15 Netherlands

- 4.3.16 Pakistan

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Ukraine

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Myanmar

- 5.3.2.1.7 Pakistan

- 5.3.2.1.8 Philippines

- 5.3.2.1.9 Thailand

- 5.3.2.1.10 Vietnam

- 5.3.2.1.11 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Ukraine

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.4.1.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Chile

- 5.3.5.1.4 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219