|

市場調查報告書

商品編碼

1687196

中國紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

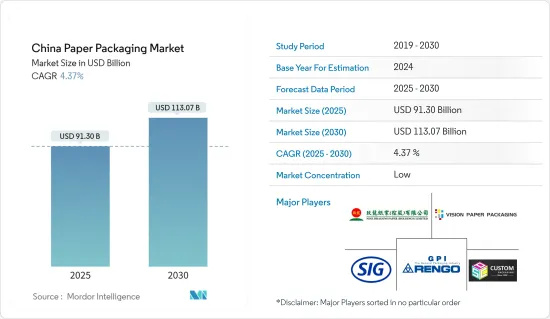

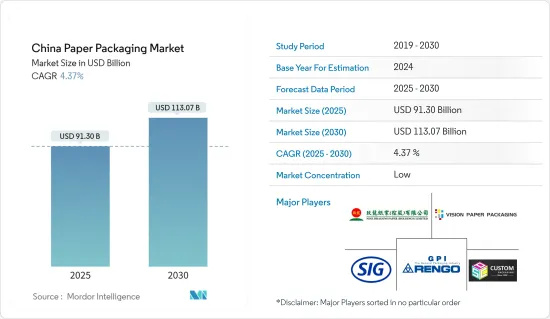

預計2025年中國紙包裝市場規模為913億美元,到2030年預計將達到1130.7億美元,預測期內(2025-2030年)的複合年成長率為4.37%。

中國紙漿造紙工業無論產量或需求量都是世界第一。預計電子商務、食品宅配服務等國內產業將持續成長,紙漿和紙產品的消費量也可望擴大。這將在全國範圍內創造重要的市場進入和投資機會。

關鍵亮點

- 包裝紙是中國紙製品生產和消費中佔比最大的產品。用於包裝的最常見紙張類型是紙箱和瓦楞紙箱。紙張產量的成長是由國內終端使用者產業對紙質包裝的持續需求所推動的。

- 近年來,中國電子商務產業發展迅速。電子商務技術推動的創新正在推動創業,使中小企業受益。隨著資訊科技的進步,電子商務在短時間內成為中國最突出的商業經濟趨勢之一。電子商務的優勢包括全天候可用性、快速存取、產品和服務類型多樣、可存取方便和全球影響力。對不同包裝形式的需求呈現正向趨勢。

- 中國的餐飲服務市場主要集中在都市區,其驅動力來自於年輕勞動人口,他們的時間安排緊湊,外出就餐的頻率也更高,而且由於跨國公司的存在,西方飲食模式的影響也越來越大。此外,勞動人口擴大能夠享用到提供優質食品和服務的餐廳也有望推動市場的發展。這些因素也導致了中國速食業的快速成長,隨著越來越多的連鎖餐廳在速食服務業擴張,整個市場也受益匪淺。

- 造紙業遇到的挑戰之一是污染。當紙張被其他材料(例如食物廢棄物或塑膠)污染時,不僅回收變得更加困難和昂貴,還會降低迴收產品的品質。這種污染可能發生在回收過程的任何環節,從收集到加工,從而為產業帶來額外的成本。

- COVID-19 疫情加劇了消費者對產品衛生、永續性和可用性的擔憂。這些不斷變化的需求強調了以消費者為中心的方法的重要性。因此,預計疫情過後對紙質包裝的需求將會上升。根據中國網際網路絡資訊中心(CNNIC)2023年8月發布的報告,中國是全球第二大電子商務市場。預計2023年6月,網消費者數將達8.841億,高於2017年的5.3332億。自2023年初以來,中國經濟逐漸復甦,電子商務產業也開始復甦。

中國紙包裝市場趨勢

按產品類型分類,瓦楞紙箱佔據最大市場佔有率

- 城鎮人口的成長、紙漿價格的下降、電子商務包裝行業的發展以及人們對環保包裝意識的增強預計將推動中國紙包裝市場的發展。該行業的主要趨勢和發展是增加箱板紙生產能力和技術突破。

- 因此,需要新的包裝材料、工藝和形式。預計阿里巴巴等電子商務巨頭的崛起將在預測期內刺激瓦楞包裝市場的發展。

- 瓦楞紙箱比塑膠或發泡聚苯乙烯製成的不可分解、不可回收的包裝對環境更安全。國內外對電子產品、汽車零件、居家醫療產品以及美容和個人保健產品的需求不斷成長,再加上中國政府最近實施的包裝指南,預計將推動瓦楞紙箱的需求,從而促進未來市場擴張。

- 中國是世界最大貿易國之一,出口和進口比重都很大。該國的製成品出口貿易(也被稱為世界工廠)在經歷一段嚴重停滯後正在復甦。由於出口貿易的持續成長,預計市場對用於三級包裝的散裝和重型瓦楞紙箱的需求將強勁。

- 瓦楞紙箱廣泛用作第三級包裝,為保護、處理、儲存和運輸多個銷售單位提供了一種手段,並且更常用於需要使用堅固的包裝層來保護其出口供應產品的出口企業,因為它可以使所有物品在運輸過程中保持有序的單元貨載。

個人護理是一個快速成長的終端用戶產業

- 該國的個人護理市場是成長最快的市場之一,受益於日益成長的消費者群體,推動了所研究市場的成長。消費者在個人保健產品上的支出不斷增加,且越來越傾向於購買包裝更精緻、更昂貴的產品。護膚和裝飾化妝品正在成長,而臉部保養和醫學護膚的需求強勁。此外,對抗衰老產品和防止環境污染的產品的需求也在推動市場的發展。

- 根據中國國家統計局的數據,2023年6月中國化妝品零售額將達450.8億元人民幣(約62.6億美元),2023年11月將達到548.5億元(約76.2億美元)。中國個人護理品類的成長意味著化妝品銷售額的潛在成長。因此,對紙包裝等包裝材料的需求可能會增加,以滿足不斷擴大的市場需求。

- 改善皮膚健康和外觀已成為許多消費者的首要任務,導致對護膚產品的需求激增。護膚供應商正在全國各地開設新設施來擴大業務。例如,如新企業於2023年11月在中國上海開設了一家製造工廠。這家擁有如新、華茂和ageLOC等品牌的美國多層次傳銷公司表示,這家投資5,500萬美元的工廠將擴大其在中國和其他亞洲市場的生產能力和供應鏈。護膚產品需求的不斷成長推動了該國紙質包裝市場的發展。

- 根據 SEO Agency China 2023 年 7 月的數據,中國的電子商務市場是世界上最大的電子商務市場之一,每年都會發生大量的線上銷售。這為國際品牌進入中國蓬勃發展的電子商務市場提供了巨大的機會。利用人們對天然和有機美容產品日益成長的興趣,品牌強調其對永續實踐的奉獻、使用天然成分和創造環保包裝有望推動市場成長。

中國紙包裝市場概況

中國紙包裝市場高度細分,領先公司包括玖龍紙業(控股)有限公司、東莞宏信紙業、聯高、SIG康美包集團和上海訂製包裝等。市場參與企業正在採取聯盟和收購等策略來擴大其產品供應並獲得永續的競爭優勢。

2023 年 10 月,SIG 宣佈在中國推出一款新型便攜紙盒裝飲料瓶 SIG Dome Mini。根據 SIG 介紹,紙盒瓶的開發旨在將塑膠瓶的便利性與標準紙盒包裝的永續性優勢結合。根據SIG介紹,該紙盒瓶裝飲料將率先在中國市場推出,未來計畫拓展至其他國家。

2023年6月,Rengo宣布其合併子公司Tri-Wall Limited透過全資子公司在中國四川省遂寧市設立子公司。新成立的子公司特耐王博正包裝科技股份有限公司主要生產和銷售重型包裝紙板和通用紙箱,目前工廠已開始運作。透過特耐王集團,Rengo 將在全球拓展與重型瓦楞包裝相關的包裝材料業務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響

- 中國紙包裝活動及展覽會

- 中國紙漿造紙業:外國投資者的機會

第5章市場動態

- 市場促進因素

- 中國電子商務銷售額成長

- 食品服務業需求增加

- 提高消費者對紙包裝的認知

- 包括閉合迴路系統在內的回收措施將促進紙質包裝材料的市場採用

- 市場挑戰/限制

- 回收、原料供應鏈管理、紙包裝產業面臨的挑戰

- 森林砍伐對紙質包裝材料的影響

- 原料成本上漲和外包

第6章市場區隔

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 個人護理

- 家居用品

- 電器

- 其他

第7章競爭格局

- 公司簡介

- Nine Dragons Paper(Holdings)Limited

- Dongguan Vision Paper Products Co. Ltd

- Rengo Co. Ltd

- SIG Combibloc Group

- Shanghai Custom Packaging Co., Ltd

- Xiamen Hexing Packaging and Printing Co. Ltd

- JML Packaging

- Suneco Box Co. Ltd

- Asia Pulp & Paper Pvt. Ltd

- Shanghai DE Printed Box

- Mondi Group

- Belpax

第8章投資分析

第9章:市場的未來

The China Paper Packaging Market size is estimated at USD 91.30 billion in 2025, and is expected to reach USD 113.07 billion by 2030, at a CAGR of 4.37% during the forecast period (2025-2030).

The Chinese pulp and paper industry is the largest in terms of production and demand in the world. Domestic industries like e-commerce, food delivery services, etc., would continue to grow, and so will the consumption of pulp and paper products. This presents significant market entry and investment opportunities across the country.

Key Highlights

- Packaging paper makes up the largest share of paper products produced and consumed in China. The most common types of paper used for packaging are folding cartons and corrugated boxes. The growth of paper production is driven by the constant demand for paper packaging from the end-user industries across the country.

- The Chinese e-commerce industry has experienced rapid growth in the past few years. Innovations by e-commerce technologies drive entrepreneurship to benefit small and medium enterprises (SMEs). With the emergence of IT, e-commerce has become one of the most prominent business and economic trends in China in just a short period. The advantages of e-commerce include 24/7 availability, fast access, a greater variety of products and services, ease of access, and global reach. The requirement for different modes of packaging shows positive trends.

- The Chinese foodservice market is primarily driven by the rising frequency of dining out amid the time-pressed schedules of the young and working population and the increasing influence of Western dietary patterns with the presence of global companies, mainly in urban areas. The working population's accessibility to restaurants that offer quality food and services is also expected to drive the market. These factors have also led to the rapid growth of the fast-food sector in China, expanding more food chains in the quick-service sector, thus benefitting the overall market studied.

- One of the challenges encountered in the paper manufacturing industry is contamination. If paper is contaminated with other materials, such as food waste and plastic, it can make it difficult and costly to recycle and decrease the quality of the recycled product. This contamination can happen at any point in the recycling process, from collection to processing, resulting in additional costs for the industry.

- The COVID-19 pandemic has heightened consumer concerns regarding product hygiene, sustainability, and accessibility. These shifting needs underscore the importance of a consumer-centric approach. Consequently, the demand for paper packaging is poised to rise in the post-pandemic landscape. In August 2023 report from the China Internet Network Information Center (CNNIC) revealed that China ranks as the global second-largest e-commerce market. The number of online shoppers reached 884.1 million by June 2023, up from 533.32 million in 2017. Since early 2023, China's economy has gradually rebounded, with the E-commerce sector witnessing a resurgence.

China Paper Packaging Market Trends

Corrugated Boxes Holds Largest Market Share in the Product Type Segment

- The growing urban population, dropping pulp prices, developing e-commerce package industry, and improving population awareness about environment-friendly packaging are expected to propel the Chinese paper packaging market. The industry's key trends and developments are increased containerboard capacity and technological breakthroughs.

- As a result, new packaging materials, processes, and forms are required. Over the projection period, the rise of e-commerce behemoths like Alibaba is expected to fuel the corrugated packaging market.

- Cardboard boxes are safer for the environment than plastic or Styrofoam non-degradable and non-recyclable packaging. An increase in the domestic and international demand for electronic goods, automotive components, home care, and beauty and personal care products, coupled with China's recent government-implemented packaging guidelines, is expected to boost demand for corrugated boxes, resulting in market expansion in the upcoming years.

- With a significant rate of imports and exports, China is one of the largest trading countries in the world. Also known as the world's factory, the country's export trade for manufactured goods is again rebounding after a sudden stagnation for a brief period. With the continued growth in the export trade, the market would witness robust demand for bulk and sturdy corrugated boxes for tertiary packaging.

- Since corrugated boxes, widely used for tertiary packaging, provide a means of protecting, handling, storing, and transporting several sales units to organize everything into unit loads during transit, it is more commonly used by export firms that need to protect their products for export materials with strong layers of packaging.

Personal Care to be the Fastest Growing End-user Industry

- The personal care market in the country has been one of the fastest-growing sectors, benefitting from an increasingly committed consumer base and boosting the growth of the market studied. Consumer spending on personal care products continues to increase, enabling the trend toward adopting processed, packaged, and expensive products. Skincare and decorative cosmetics are growing, with facial care and medical skincare witnessing a strong demand. Moreover, demand for anti-aging products and those intended to protect against environmental pollution drive the market.

- According to the National Bureau of Statistics of China, the retail trade revenue of cosmetics in China was CNY 45.08 billion (USD 6.26 billion approximately) in June 2023, reaching CNY 54.85 billion (USD 7.62 billion approximately) in November 2023. The growth of the personal care sector in China implies a potential increase in the sales of cosmetic products. As a result, the demand for packaging materials, such as paper packaging, is likely to experience an uptick to meet the requirements of the expanding market.

- The need for improved skin health and appearance has become a priority for many consumers, resulting in a surge in demand for skincare products. Skin care providers are expanding their business by opening new facilities nationwide. For instance, in November 2023, Nu Skin Enterprises opened a manufacturing facility in Shanghai, China. The US multilevel marketing company, whose brands include Nu Skin, Pharmanex, and ageLOC, stated that the USD 55 million facility would increase its production capacity and supply chain in China and other Asian markets. Increased demand for skin care products drives the paper packaging market in the country.

- According to SEO Agency China, in July 2023, the country's e-commerce market was one of the largest globally, with many online sales annually. This presents significant opportunities for international brands to tap into China's booming e-commerce market. Capitalizing on this growing interest in natural and organic beauty products, highlighting the brand's dedication to sustainable practices, using natural ingredients, and creating environmentally friendly packaging is expected to drive the market's growth.

China Paper Packaging Market Overview

The Chinese paper packaging market is highly fragmented, with the presence of major players like Nine Dragons Paper (Holdings) Limited, Dongguan Vision Paper Products Co. Ltd, Rengo Co. Ltd, SIG Combibloc Group, and Shanghai Custom Packaging Co. Ltd. Market players adopt strategies like partnerships and acquisitions to increase their product offerings and gain sustainable competitive advantage.

In October 2023, SIG announced the introduction of a new on-the-go carton bottle, SIG DomeMini, in China. According to SIG, the carton bottle has been developed to combine the ease of a plastic bottle with the sustainability advantages of a standard carton pack. SIG said that the carton bottle will be launched for the Chinese market first, with plans to roll it out to other countries in the future.

In June 2023, Rengo Co. Ltd announced that its consolidated subsidiary, Tri-Wall Limited, established a subsidiary in Suining City, Sichuan Province, China, through its wholly-owned subsidiary. The new subsidiary, Tri-Wall Bozheng Packaging Technology Co. Ltd, manufactures and sells heavy-duty and general corrugated boards and cases and has started the operation of its plant. Through the Tri-Wall Group, Rengo developed its global packaging materials business related to heavy-duty corrugated packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Paper Packaging Events and Exhibitions China

- 4.6 China's Pulp and Paper Industry Opportunities for Foreign Investors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in E-commerce Sales in China

- 5.1.2 Rising Demand from the Food-service Sector

- 5.1.3 Growing Consumer Awareness on Paper Packaging

- 5.1.4 Recycling Initiatives Involving Closed-loop Systems to Aid Market Adoption of Paper Packaging-based Materials

- 5.2 Market Challenges/Restraints

- 5.2.1 Recycling, Raw Material Supply Chain Management, and Challenges in the Paper Packaging Industry

- 5.2.2 Effects of Deforestation on Paper Packaging

- 5.2.3 Increasing Raw Material Costs and Outsourcing

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Household Care

- 6.2.6 Electrical Products

- 6.2.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nine Dragons Paper (Holdings) Limited

- 7.1.2 Dongguan Vision Paper Products Co. Ltd

- 7.1.3 Rengo Co. Ltd

- 7.1.4 SIG Combibloc Group

- 7.1.5 Shanghai Custom Packaging Co., Ltd

- 7.1.6 Xiamen Hexing Packaging and Printing Co. Ltd

- 7.1.7 JML Packaging

- 7.1.8 Suneco Box Co. Ltd

- 7.1.9 Asia Pulp & Paper Pvt. Ltd

- 7.1.10 Shanghai DE Printed Box

- 7.1.11 Mondi Group

- 7.1.12 Belpax