|

市場調查報告書

商品編碼

1684587

嬰幼兒玩具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Infants and Toddlers Toy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

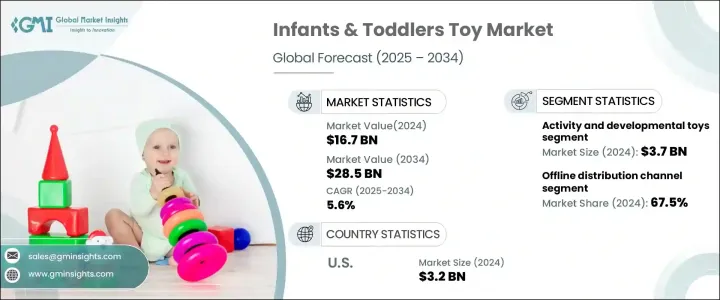

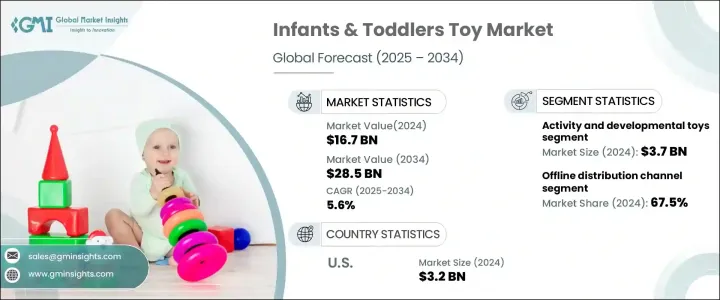

2024 年全球嬰幼兒玩具市場規模達到 167 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.6%。旨在增強運動技能、促進早期學習和提高解決問題能力的玩具已成為致力於支持孩子成長和認知發展的父母的首要任務。人們越來越意識到早期兒童發展的重要性以及玩具在其中的作用,這正在重塑購買行為。此外,隨著全球中產階級的崛起和新興市場的購買力不斷增強,越來越多的家長開始投資購買對孩子的學習過程有積極貢獻的優質玩具。

嬰幼兒玩具市場涵蓋多個類別,包括益智玩具、軟玩具、活動和發展玩具、騎乘玩具、建築套裝玩具、洗澡玩具等。其中,活動和發展玩具預計將在 2024 年佔據主導地位,市佔率達到 37 億美元。由於人們對刺激認知和身體發育的玩具的偏好日益增加,預計 2025 年至 2034 年期間這一細分市場每年將成長 6%。家長們尤其喜歡那些鼓勵解決問題和創造力的玩具,因為它們對於早期兒童教育至關重要。因此,這些玩具不僅被視為玩物,也是有價值的教育工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 167億美元 |

| 預測值 | 285億美元 |

| 複合年成長率 | 5.6% |

嬰幼兒玩具的銷售管道主要有線上和線下兩個。 2024年,線下銷售引領市場,佔67.5%的市佔率。預計 2025 年至 2034 年期間,這一領域的成長率將達到 5.4%。對於父母來說,這一點尤其重要,因為他們在選擇玩具時會優先考慮安全性、品質和適合年齡。這些因素極大地影響著購買決策,使得店內購物對於尋求確保孩子成長得到最好的玩具支持的父母來說成為一種寶貴的體驗。

2024年,美國以38.2%的佔有率佔據嬰幼兒玩具市場的主導地位。強大的消費文化和日益成長的兒童數量助長了這種主導地位。線上線下銷售管道均已完善,可滿足各種消費者的偏好。同樣,在亞太地區,中國在 2024 年佔據嬰幼兒玩具市場的 31.2% 的顯著佔有率。中國在全球玩具製造業的突出地位也增強了在該市場的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 人們對早期兒童發展的認知不斷提高

- 環保安全玩具受歡迎

- 個性化和可客製化的玩具

- 產業陷阱與挑戰

- 仿冒和仿冒品

- 育兒趨勢和不斷變化的消費者偏好

- 成長動力

- 技術與創新格局

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 益智玩具

- 絨毛玩具

- 活動和發展玩具

- 騎乘玩具

- 建築套件

- 洗澡玩具

- 其他(出牙玩具、拖拉玩具)

第 6 章:市場估計與預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 塑膠

- 木製的

- 布料/布料

- 矽膠/橡膠

- 環保材料(如竹子、再生材料)

第7章:市場估計與預測:依年齡層,2021 – 2034 年

- 主要趨勢

- 0–6個月

- 6-12個月

- 1-2歲

- 2–4 歲

第 8 章:市場估計與預測:按價格,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 9 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務平台

- 品牌網站

- 離線

- 超市/大賣場

- 玩具專賣店

- 百貨公司

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- Mattel, Inc.

- Hasbro, Inc.

- Spin Master Corp.

- LEGO Group

- Hamleys

- VTech

- Fisher-Price

- Melissa & Doug

- Little Tikes

- Chicco

- Playmobil

- Tomy

- Clementoni

- Hape

- Janod

The Global Infants And Toddlers Toys Market reached USD 16.7 billion in 2024 and is projected to grow at a CAGR of 5.6% between 2025 and 2034. As more parents and guardians recognize the vital role toys play in the development of young children, the demand for educational and developmental toys continues to rise. Toys designed to enhance motor skills, foster early learning, and promote problem-solving abilities have become a top priority for parents dedicated to supporting their child's growth and cognitive development. The increasing awareness around the importance of early childhood development and the role of engaging toys in it is reshaping buying behaviors. Furthermore, with a rising global middle class and expanding purchasing power in emerging markets, more parents are investing in quality toys that contribute positively to their child's learning process.

The market for infants & toddlers toys spans various categories, including educational, soft, activity and developmental, ride-on, construction sets, bath toys, and others. Among these, activity and developmental toys are expected to dominate in 2024, representing a market share of USD 3.7 billion. This segment is projected to grow by 6% annually from 2025 to 2034, driven by an increasing preference for toys that stimulate both cognitive and physical development. Parents are particularly drawn to toys that encourage problem-solving and creativity, which are essential to early childhood education. As such, these toys are not only seen as playthings but also as valuable tools for educational engagement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.7 Billion |

| Forecast Value | $28.5 Billion |

| CAGR | 5.6% |

Toys for infants & toddlers are primarily distributed through two channels: online and offline. In 2024, offline sales led the market, accounting for 67.5% of the market share. This segment is expected to experience a growth rate of 5.4% from 2025 to 2034. Physical stores, such as toy retailers, department stores, and supermarkets, offer a key advantage by allowing customers to physically inspect and handle toys before making a purchase. This is especially important for parents, who prioritize safety, quality, and age appropriateness when choosing toys. These factors significantly influence purchasing decisions, making in-store shopping a valuable experience for parents seeking to ensure their child's development is supported by the best possible toys.

In 2024, the U.S. dominated the infants and toddlers toy market with a 38.2% share. The strong consumer culture and the growing number of young children in the country fuel this dominance. Both offline and online sales channels are well-established and cater to a variety of consumer preferences. Similarly, in the Asia-Pacific region, China holds a notable share of 31.2% of the infants & toddlers toy market in 2024. The country benefits from a rapidly expanding child population and a robust domestic production capacity, which supports the growing demand across both urban and rural areas. China's prominent role in the global toy manufacturing sector also enhances its position in this market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing awareness of early childhood development

- 3.2.1.2 Popularity of eco-friendly and safe toys

- 3.2.1.3 Personalized and customizable toys

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Imitation and counterfeit products

- 3.2.2.2 Parenting trends and changing consumer preferences

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Educational toys

- 5.3 Soft toys

- 5.4 Activity and developmental toys

- 5.5 Ride-on toys

- 5.6 Building sets

- 5.7 Bath toys

- 5.8 Others (teething toys, pull-along toys)

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Wooden

- 6.4 Fabric/cloth

- 6.5 Silicone/rubber

- 6.6 Eco-friendly materials (e.g., bamboo, recycled materials)

Chapter 7 Market Estimates & Forecast, By Age Group, 2021 – 2034, (USD Billion)

- 7.1 Key trends

- 7.2 0–6 Months

- 7.3 6–12 Months

- 7.4 1–2 Years

- 7.5 2–4 Years

Chapter 8 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce platforms

- 9.2.2 Brand websites

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarkets

- 9.3.2 Specialty toy stores

- 9.3.3 Department stores

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Mattel, Inc.

- 11.2 Hasbro, Inc.

- 11.3 Spin Master Corp.

- 11.4 LEGO Group

- 11.5 Hamleys

- 11.6 VTech

- 11.7 Fisher-Price

- 11.8 Melissa & Doug

- 11.9 Little Tikes

- 11.10 Chicco

- 11.11 Playmobil

- 11.12 Tomy

- 11.13 Clementoni

- 11.14 Hape

- 11.15 Janod