|

市場調查報告書

商品編碼

1698554

益智玩具市場機會、成長動力、產業趨勢分析及2025-2034年預測Educational Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

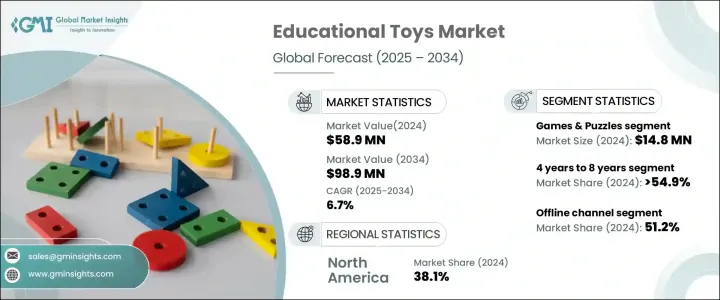

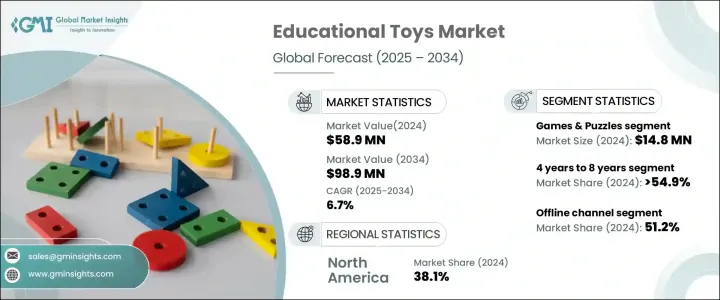

2024 年全球益智玩具市場價值為 5,890 萬美元,預計 2025 年至 2034 年期間的複合年成長率為 6.7%。推動這一市場發展的因素包括消費者對益智玩具發展益處的認知不斷提高,以及對 STEM 為重點產品的需求不斷成長。家長和教育工作者都認知到互動遊戲在培養認知、社交和運動技能方面的作用,因此對學習型玩具的偏好日益增加。

消費者越來越關注玩具所使用的材料,尤其是當幼兒傾向於透過觸覺和味覺來探索周圍環境時。接觸鄰苯二甲酸鹽、鉛和 BPA 等有害化學物質引發了人們的擔憂,促使人們轉向無毒替代品,如木製玩具、不含 BPA 的塑膠和蒙特梭利玩具。隨著全球安全法規日益嚴格,製造商紛紛推出符合嚴格環境和健康標準的產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5890萬美元 |

| 預測值 | 9890萬美元 |

| 複合年成長率 | 6.7% |

教育類和 STEM 類玩具的日益普及正在顯著影響市場趨勢。研究表明,大多數學齡前兒童喜歡玩那些鼓勵技能培養活動的玩具。興趣的激增反映了人們越來越傾向於旨在提高解決問題、創造力和批判性思考能力的產品。在產品類別中,遊戲和拼圖在 2024 年創造了 1,480 萬美元的收入,預計未來幾年的複合年成長率為 7.4%。消費者的偏好也在不斷變化,越來越傾向於永續和環保的益智玩具。日益成長的環境問題促使企業採用負責任的採購、可回收材料和更環保的製造流程。

按年齡細分,4 至 8 歲的兒童佔據最大的市場佔有率,到 2024 年將達到 54.9%。預計到 2034 年,這一細分市場將以 6.9% 的複合年成長率擴張。在這個發展階段,兒童的認知和運動功能會快速成長,因此益智玩具特別有益。家長和教育工作者正在投資支持讀寫能力、運算能力和分析思考基礎技能的玩具,以強化早期學習體驗。

市場也按分銷管道細分,到 2024 年,線下零售將佔銷售額的 51.2%。許多父母喜歡在店內購物,因為他們可以在購買前評估玩具的品質和安全性。零售商提供專家指導,幫助顧客選擇適合年齡的教育產品。然而,由於家庭購物的便利性、更廣泛的產品範圍以及方便的價格比較,網上銷售正在迅速成長。

從地理位置來看,北美是教育玩具市場的領導者,佔 38.1% 的佔有率,2024 年的收入為 2,240 萬美元。該地區的高可支配收入和對早期兒童教育的重視推動了學習型玩具的大量支出。強大的零售基礎設施確保了可近性,而政府對教育項目的持續投資進一步促進了市場擴張。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 玩具中的科技融合

- 無害材料的需求增加

- STEM玩具日益受到關注

- 產業陷阱與挑戰

- 仿冒品

- 無品牌產品日益盛行

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品類型,2021 - 2034 年(百萬美元)

- 主要趨勢

- 藝術與工藝

- 遊戲和謎題

- 運動技能

- 音樂玩具

- STEM玩具

- 角色扮演

- 其他

第6章:市場估計與預測:按年齡段,2021 - 2034 年(百萬美元)

- 主要趨勢

- 4歲至8歲

- 最多 4 年

- 8歲以上

第7章:市場估計與預測:按價格,2021 - 2034 年(百萬美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年(百萬美元)

- 主要趨勢

- 離線

- 線上

第9章:市場估計與預測:按地區,2021 - 2034 年(百萬美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Bandai Namco Holdings Inc.

- Clementoni SpA

- Fisher-Price, Inc.

- Gigo Toys

- Hape International AG

- Hasbro, Inc.

- K'NEX Brands

- LeapFrog Enterprises, Inc.

- LEGO Group

- Mattel, Inc.

- Melissa & Doug, LLC

- Ravensburger AG

- Spin Master Corp.

- VTech Holdings Limited

- WowWee Group Limited

The Global Educational Toys Market was valued at USD 58.9 million in 2024 and is projected to expand at a CAGR of 6.7% from 2025 to 2034. This market is driven by increasing consumer awareness of the developmental benefits of educational toys and the rising demand for STEM-focused products. Parents and educators recognize the role of interactive play in fostering cognitive, social, and motor skills, leading to a growing preference for learning-oriented toys.

Consumers are becoming more conscious of the materials used in toys, especially as young children tend to explore their surroundings through touch and taste. Exposure to harmful chemicals such as phthalates, lead, and BPA has raised concerns, prompting a shift towards non-toxic alternatives like wooden toys, BPA-free plastic, and Montessori-based options. With safety regulations tightening globally, manufacturers are responding by introducing products that meet strict environmental and health standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.9 Million |

| Forecast Value | $98.9 Million |

| CAGR | 6.7% |

The rising popularity of educational and STEM-focused toys is significantly influencing market trends. Studies indicate that a majority of preschool-age children engage with toys that encourage skill-building activities. This surge in interest reflects a broader shift towards products designed to enhance problem-solving, creativity, and critical thinking abilities. Among product categories, games and puzzles generated USD 14.8 million in revenue in 2024 and are forecasted to expand at a CAGR of 7.4% in the coming years. Consumer preferences are also evolving, with an increasing inclination toward sustainable and eco-friendly educational toys. Growing environmental concerns are pushing companies to adopt responsible sourcing, recyclable materials, and greener manufacturing processes.

Age-based segmentation highlights that children aged 4 to 8 years represent the largest share of the market, accounting for 54.9% in 2024. This segment is projected to expand at a 6.9% CAGR through 2034. At this developmental stage, children experience rapid growth in cognitive and motor functions, making educational toys particularly beneficial. Parents and educators are investing in toys that support foundational skills in literacy, numeracy, and analytical thinking, reinforcing early learning experiences.

The market is also segmented by distribution channels, with offline retail accounting for 51.2% of sales in 2024. Many parents prefer in-store shopping, where they can assess the quality and safety of toys before making a purchase. Retailers provide expert guidance to help customers choose age-appropriate educational products. However, online sales are rapidly increasing, driven by the convenience of home shopping, access to a wider product range, and easy price comparisons.

Geographically, North America leads the educational toys market, holding a 38.1% share and generating USD 22.4 million in revenue in 2024. The region's high disposable income and emphasis on early childhood education drive significant spending on learning-based toys. A strong retail infrastructure ensures accessibility, while ongoing government investments in educational programs further boost market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Integration of technology in toys

- 3.10.1.2 Increase in demand for non-harmful materials

- 3.10.1.3 Growing focus on STEM Toys

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Counterfeit products

- 3.10.2.2 Rising prevalence of unbranded products

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Arts & craft

- 5.3 Games & Puzzles

- 5.4 Motor Skills

- 5.5 Musical Toys

- 5.6 STEM Toys

- 5.7 Role play

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Age Group, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Key trends

- 6.2 4 years to 8 years

- 6.3 Up to 4 years

- 6.4 Above 8 years

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bandai Namco Holdings Inc.

- 10.2 Clementoni S.p.A.

- 10.3 Fisher-Price, Inc.

- 10.4 Gigo Toys

- 10.5 Hape International AG

- 10.6 Hasbro, Inc.

- 10.7 K’NEX Brands

- 10.8 LeapFrog Enterprises, Inc.

- 10.9 LEGO Group

- 10.10 Mattel, Inc.

- 10.11 Melissa & Doug, LLC

- 10.12 Ravensburger AG

- 10.13 Spin Master Corp.

- 10.14 VTech Holdings Limited

- 10.15 WowWee Group Limited