|

市場調查報告書

商品編碼

1524098

OSAT -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)OSAT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

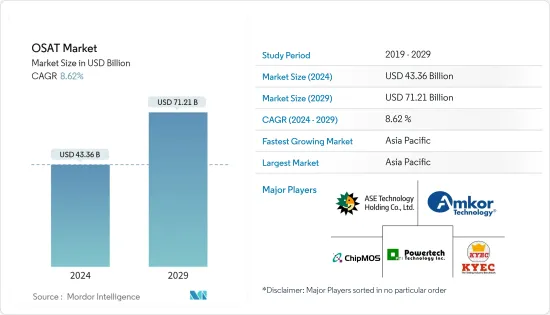

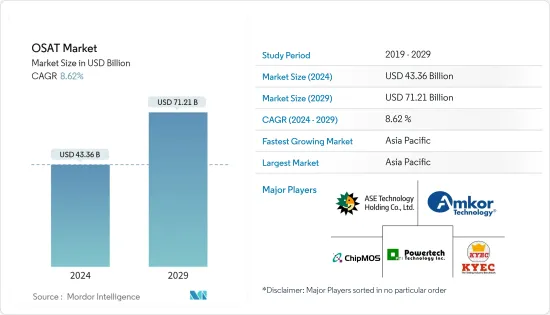

OSAT市場規模預計2024年為433.6億美元,預計2029年將達到712.1億美元,在市場估計和預測期間(2024-2029年)複合年成長率預計為8.62%。

半導體產業持續成長,重點關注小型化和效率。半導體正在成為所有現代技術的建造模組。該領域的進步和創新對所有下游技術產生直接影響。人工智慧(AI)和雲端運算等電子技術的快速發展,加上對高速、低功耗、高度積體電路(IC)的高需求,導致銷售強勁。

主要亮點

- 外包也是半導體產業的重要元素。除了設計之外,半導體產品開發的製造方面還依賴第三方供應商提供的服務。 Fabs(純晶圓代工廠)和 OSAT 是半導體外包的兩個突出例子。

- OSAT 半導體公司提供第三方IC封裝和測試服務,在晶圓代工廠製造的半導體裝置投放市場之前對其進行封裝和測試。這些公司提供創新、經濟高效的解決方案,在電子設備內的空間內提供更快的處理速度、更高的效能和功能。

- 英特爾、AMD 和 Nvidia 等半導體設計公司與 OSAT 公司簽訂合約來執行他們的設計。例如,英特爾既是晶片設計公司,也是一家晶圓代工廠(晶圓供應公司)。在將晶片運送給客戶之前,英特爾委託晶片封裝外包給各個 OSAT 來提供組裝和測試服務。

- 主要半導體製造商垂直整合到封裝業務是全球 OSAT 市場的主要威脅。美國貿易戰等多種因素正造成半導體產業供應鏈缺口。

- OSAT 供應商是為半導體積體電路提供組裝、封裝和測試服務的第三方。自新冠疫情以來,隨著晶片製造商專注於生產更小、更快和更有效率的半導體,半導體產業呈現成長態勢。

OSAT市場趨勢

通訊成為最大的應用領域

- 半導體市場的成長直接影響OSAT市場的開拓。這是因為包裝仍處於通訊價值鏈的早期階段。晶圓代工廠可以自己封裝或外包。例如,半導體和通訊設備製造商高通與 OSAT 簽訂合約來滿足其封裝需求。

- 通訊應用主要是通訊業的通訊晶片。功率放大器 (PA)、前端模組 (FEM) 以及其他射頻和連接設備等設備是 OSAT 和OEM的主要需求來源。根據半導體產業協會的數據,生產的所有半導體中約有 31% 用於網路設備和智慧型手機無線等通訊。

- 通訊應用通常部署在惡劣的環境條件下,需要可靠的封裝解決方案。特別是在大規模通訊應用中,系統級封裝 (SiP) 通常是各種通訊設備的首選。

- 過去幾年,智慧型手機市場的硬體和軟體都出現了顯著成長。儘管全球智慧型手機出貨量在 COVID-19 期間有所下降,但包括中國在內的許多市場的滲透率都很高。由於生物感測器、5G 智慧型手機和人工智慧功能等趨勢,新型智慧型手機的銷售預計將恢復勢頭。

- 根據 GSMA 的數據,到 2025 年,亞太地區的智慧型手機普及率預計將上升至 83%。同時,行動用戶滲透率預計到同年將達到 62%。 5G 智慧型手機的廣泛採用預計還將顯著提高連網型設備密度、無線資料通訊頻寬和延遲。

- 許多半導體製造商預計高矽含量的5G智慧型手機將在全球廣泛採用。 5G智慧型手機需要更高的能源效率、更快的通訊速度和更複雜的功能,這將增加每台裝置的半導體元件的使用量。因此,消費性電子產業對半導體封裝解決方案的需求預計將大幅增加。

- 根據GSMA報告,預計2025年,全球約三分之一的人口將連接5G網路。報告稱,屆時5G連線數將超過4億,約佔所有行動連線的14%。

- 預計到年終, 5G 滲透率將達到 17%,到 2030 年將增至 54%(相當於 53 億個連線)。這項技術進步預計將為全球經濟貢獻近1兆美元。因此,對半導體的需求預計將促進市場成長。

韓國市場預計將顯著成長

- 韓國是全球OSAT廠商最有前景的市場之一。該國是三星和 SK 海力士等消費性電子領域著名晶片製造商的所在地,使其成為半導體設備創新的有利中心。

- 韓國政府重點發展智慧製造,計畫在2025年擁有3萬家全自動化製造業。政府的目標是透過整合最新的自動化、資料交換和物聯網技術來實現這一目標,這些技術預計將成為該國 OSAT 服務的關鍵驅動力。

- 隨著三星電子系統半導體業務的成長,該國的半導體測試產業也顯著成長。 NEPES Ark、LB Semicon、Tesna 和 Hana Micron 等國內半導體測試公司正在透過大力投資必要的設施和設備來應對系統半導體供應的增加。

- SK海力士正投資120兆韓元(約900億日圓)在龍仁市元山地區建造下一代記憶體生產基地。 SK 海力士計劃於 2025 年開始建造其記憶體製造廠。 SK海力士也是HBM3的製造商。該公司計劃在其利川 DRAM 製造工廠安裝一條 TSV 封裝生產線。為了提高HBM的競爭力,三星和SK海力士正在考慮擴大其封裝生產線。

- 三星正致力於取代台積電提供的2.5D內插器整合服務。我們正在努力降低TSV(矽穿孔電極)封裝方法的製造成本。與SK海力士相比,三星在HBM(高頻寬記憶體)市場上屬於後來者。儘管如此,三星仍聲稱將增加對HBM產能的投資,並表示有意在2023年之前推出新的HBM產品,為HBM封裝產能擴張開闢了可能性。

- 5G領域的發展也帶動了晶片先進封裝的成長。根據科學資訊通訊部的數據,截至 2023 年 2 月,日本 5G用戶數為 2,913 萬,比 2021 年 2 月的 1,366 萬增加了 113%。

OSAT產業概況

半導體組裝與測試服務 (OSAT) 市場較為分散,主要企業包括日月光科技控股(ASE Technology Holding)、安靠科技(Amkor Technology Inc.)、力成科技(Powertech Technology Inc.)、茂茂科技(ChipMOS Technologies Inc.) 和景源電子(King Yuan Electronics)。市場參與者正在採取創新、合作和收購等策略來增強其產品供應並獲得永續的競爭優勢。

*在最近的一份公告中,力成科技 (PTI) Inc. 宣布與華邦電子公司建立合作夥伴關係。此次合作旨在共同推動2.5D(晶圓上基板)/3D先進封裝業務。透過利用WEC的矽中介層、DRAM和快閃記憶體,PTI實現異質整合並引導客戶滿足市場對高頻寬和高效能運算服務的需求。

*2023 年 10 月 - 日月光科技控股宣布推出整合設計生態系統 (IDE),這是一個協作設計工具集。該工具集旨在系統地增強整個 VIPack 平台的先進封裝架構。這種創新方法可實現從單晶粒SoC 到多晶片分解 IP 模組(包括小晶片和記憶體)的無縫過渡。這可以透過使用 2.5D 或先進的扇出結構進行整合來實現。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 半導體產業展望

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 大流行的市場影響評估

第5章市場動態

- 市場促進因素

- 半導體在汽車中的應用增加

- 5G 等趨勢推動半導體封裝的先進發展

- 市場限制因素

- 垂直整合是 OSAT 廠商主要關注的問題之一。

第6章 市場細分

- 按服務類型

- 包裝

- 測試

- 按包裝類型

- 球柵陣列 (BGA) 封裝

- 晶片級封裝 (CSP)

- 堆疊晶片封裝

- 多晶片封裝

- 四扁平和雙列直插封裝

- 按申請

- 通訊設備

- 消費性電子產品

- 車

- 運算與網路

- 工業的

- 其他應用

- 按地區

- 美國

- 中國

- 台灣

- 韓國

- 馬來西亞

- 新加坡

- 日本

第7章 競爭格局

- 公司簡介

- ASE Technology Holding Co. Ltd

- Amkor Technology Inc.

- Powertech Technology Inc.

- ChipMOS Technologies Inc.

- King Yuan Electronics Co. Ltd

- Formosa Advanced Technologies Co. Ltd

- Jiangsu Changjiang Electronics Technology Co. Ltd

- UTAC Holdings Ltd

- Lingsen Precision Industries Ltd

- Tongfu Microelectronics Co.

- Chipbond Technology Corporation

- Hana Micron Inc.

- Integrated Micro-electronics Inc.

- Tianshui Huatian Technology Co. Ltd

- Vendor Share Analysis

第8章投資分析

第9章 市場機會及未來趨勢

The OSAT Market size is estimated at USD 43.36 billion in 2024, and is expected to reach USD 71.21 billion by 2029, growing at a CAGR of 8.62% during the forecast period (2024-2029).

The semiconductor industry has been growing, focusing on miniaturization and efficiency. Semiconductors are emerging as building blocks of all modern technology. The advancements and innovations in this field directly impact all downstream technologies. The rapid development of electronics technology, including artificial intelligence (AI) and cloud computing, is complemented by a high demand for integrated circuits (ICs) with high speed, low power consumption, and high integration, leading to its significant sales.

Key Highlights

- Outsourcing is also a significant factor in the semiconductor industry. More than just design, the manufacturing aspect of semiconductor product development is dependent on the services provided by third-party vendors. Fabs (Pure-Play Foundries) and OSATs are two prominent examples of semiconductor outsourcing.

- OSAT semiconductor firms provide third-party IC packaging and testing services package and test semiconductor devices made by foundries before shipping them to the market. Such companies in the market provide innovative and cost-effective solutions that deliver faster processing speeds, higher performance, and functionality while taking up less space in an electronic device.

- Semiconductor design companies, such as Intel, AMD, and Nvidia, contract OSAT companies to execute the companies' designs. For instance, Intel is a chip designer and a foundry (wafer provider) because they own and operate their fabs or foundries. Before shipping the chips to customers, Intel outsources its chip packaging to different OSATs for assembly and test services.

- Vertical integration of key semiconductor manufacturers into packaging operations is a significant threat to the global OSAT market. Various factors, such as the US-China trade war, have caused a supply chain gap in the semiconductor industry.

- The suppliers of as OSAT are third parties that provide the assembly, packaging and testing services for a semiconductor integrated circuit. Post COVID, semiconductor industry has been witnessing the growth due to chipmakers are focused on producing smaller, faster and more efficient semiconductors and where which increased the growth of OSAT as its has playes an essential part in the by filling the gap between IC design and availability.

OSAT Market Trends

Communication to be the Largest Application Segment

- The semiconductor market's growth directly influences the OSAT market's development because the packaging is still at an early stage in the telecommunications value chain. The foundries can either handle the packaging themselves or contract it out. For instance, Qualcomm, a manufacturer of semiconductors and telecom equipment, contracts OSATs to handle its packaging needs.

- The communication applications primarily consist of communication chips in the telecommunication industry. Equipment such as power amplifiers (PAs), front-end modules (FEMs), and other RF and connectivity devices are major sources of demand for OSATs and OEMs. According to the Semiconductor Industry Association, about 31% of all semiconductors manufactured are used for communications, including networking equipment and smartphone radios.

- Communication applications require highly reliable packaging solutions as they are often deployed in harsh environmental conditions. In many cases, a system in package (SiP) is preferred for a large variety of communication equipment, especially in large-scale telecommunication applications.

- The smartphone market has grown significantly in hardware and software over the past few years. Despite declining global smartphone unit shipments during COVID-19, there was high penetration in many markets, including China. Sales of new smartphones are expected to regain momentum, driven by trends like biosensors, 5G smartphones, and AI features.

- The smartphone adoption rate in Asia-Pacific is expected to rise to 83% by 2025, according to GSMA. Concurrently, the mobile subscriber penetration rate is expected to reach 62% by the same year. The proliferation of 5G smartphones is also expected to significantly improve connected device density, wireless data communication bandwidth, and latency.

- Many semiconductor producers anticipate that 5G smartphones with higher silicon contents will be widely adopted worldwide. The use of semiconductor components per device will rise due to the need for 5G smartphones to have higher power efficiency, faster speeds, and more complex functionalities. In turn, the consumer electronics industry is anticipated to experience a significant increase in demand for semiconductor packaging solutions.

- According to the GSMA Report, around one-third of the global population is estimated to have access to 5G networks by 2025. The report also states that there will be more than 400 million 5G connections at that time, accounting for approximately 14% of all mobile connections.

- The adoption of 5G was projected to reach 17% by the end of 2023 and increase to 54% (equivalent to 5.3 billion connections) by 2030. This technological advancement is anticipated to contribute nearly USD 1 trillion to the global economy. As a result, the demand for semiconductors will enhance the market's growth.

South Korea Expected to Register Significant Growth in the Market

- South Korea is one of the promising markets for global OSAT vendors. The country is also home to some prominent chip makers for the consumer electronics segment, such as Samsung and SK Hynix, making it a lucrative hub for innovation in semiconductor devices.

- The South Korean government focuses on smart manufacturing and plans to have 30,000 fully automated manufacturing companies by 2025. The government aims to achieve this by incorporating the latest automation, data exchange, and IoT technologies, which are expected to be significant drivers for OSAT services in the country.

- The country's semiconductor testing sector has grown significantly with the growth of Samsung Electronics' system semiconductor business. The semiconductor testing companies in the country, such as NEPES Ark, LB Semicon, Tesna, and Hana Micron, have been dealing with increased supplies of system semiconductors by making significant investments in necessary facilities and equipment.

- SK Hynix is constructing a base for manufacturing next-generation memory in the Wonsam town region of Yongin by investing KRW 120 trillion ( USD 90 billion). The chipmaker anticipates breaking construction on the memory manufacturing facility in 2025. SK Hynix is also the manufacturer of HBM3. The company plans to install TSV packaging production lines at its Icheon DRAM manufacturing facility. To improve its HBM competitiveness, Samsung and SK Hynix are considering adding more packaging production lines.

- Samsung has been working on replacing the 2.5D interposer integration service offered by TSMC. It seeks to lower the cost of manufacturing the through-silicon via (TSV) packaging method. Compared to SK Hynix, Samsung is a latecomer to the HBM (high bandwidth memory) market. Still, the business claims it is increasing investments in its HBM capacity and declared intentions to introduce new HBM products by 2023, opening possibilities for expanding HBMs' packaging capacity.

- The developments in the 5G space have also led to the growth of advanced packaging of chips. According to the Ministry of Science and ICT, as of February 2023, the country had 29.13 million 5G Subscribers, an increase of 113% compared to 13.66 million 5G subscribers in February 2021.

OSAT Industry Overview

The outsourced semiconductor assembly and test services (OSAT) market is fragmented, with the presence of major players like ASE Technology Holding Co. Ltd, Amkor Technology Inc., Powertech Technology Inc., ChipMOS Technologies Inc., and King Yuan Electronics Co. Ltd. Players in the market are adopting strategies such as innovations, partnerships, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

* December 2023 - In a recent announcement, Powertech Technology (PTI) Inc. revealed its partnership with Winbond Electronics Corporation by signing a letter of intent. This collaboration aims to jointly advance the business of 2.5D (Chip on Wafer on Substrate)/3D advanced packaging. PTI will guide its customers to leverage WEC's silicon Interposer, DRAM, and Flash to enable heterogeneous integration and cater to the market's demand for high-bandwidth and high-performance computing services.

* October 2023 - ASE Technology Holding Co. Ltd launched its Integrated Design Ecosystem (IDE), a collaborative design toolset. This toolset is designed to enhance advanced package architecture across the VIPack platform systematically. This innovative approach enables a seamless transition from single-die SoC to multi-die disaggregated IP blocks, including chiplets and memory. It can be achieved by integrating them using 2.5D or advanced fanout structures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Semiconductor Industry Outlook

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Applications of Semiconductors in Automotive

- 5.1.2 Advancement in Semiconductor Packaging Due to Trends like 5G

- 5.2 Market Restraints

- 5.2.1 Vertical Integration is One of the Significant Concerns of OSAT Players

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Packaging

- 6.1.2 Testing

- 6.2 By Type of Packaging

- 6.2.1 Ball Grid Array (BGA) Packaging

- 6.2.2 Chip Scale Packaging (CSP)

- 6.2.3 Stacked Die Packaging

- 6.2.4 Multi Chip Packaging

- 6.2.5 Quad Flat and Dual-inline Packaging

- 6.3 By Application

- 6.3.1 Communication

- 6.3.2 Consumer Electronics

- 6.3.3 Automotive

- 6.3.4 Computing and Networking

- 6.3.5 Industrial

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 China

- 6.4.3 Taiwan

- 6.4.4 South Korea

- 6.4.5 Malaysia

- 6.4.6 Singapore

- 6.4.7 Japan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 ASE Technology Holding Co. Ltd

- 7.1.2 Amkor Technology Inc.

- 7.1.3 Powertech Technology Inc.

- 7.1.4 ChipMOS Technologies Inc.

- 7.1.5 King Yuan Electronics Co. Ltd

- 7.1.6 Formosa Advanced Technologies Co. Ltd

- 7.1.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 7.1.8 UTAC Holdings Ltd

- 7.1.9 Lingsen Precision Industries Ltd

- 7.1.10 Tongfu Microelectronics Co.

- 7.1.11 Chipbond Technology Corporation

- 7.1.12 Hana Micron Inc.

- 7.1.13 Integrated Micro-electronics Inc.

- 7.1.14 Tianshui Huatian Technology Co. Ltd

- 7.2 Vendor Share Analysis

![OSAT(半導體組裝和測試外包)市場:趨勢、機會和競爭分析 [2024-2030]](/sample/img/cover/42/1496912.png)