|

市場調查報告書

商品編碼

1624582

中國塑膠包裝:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

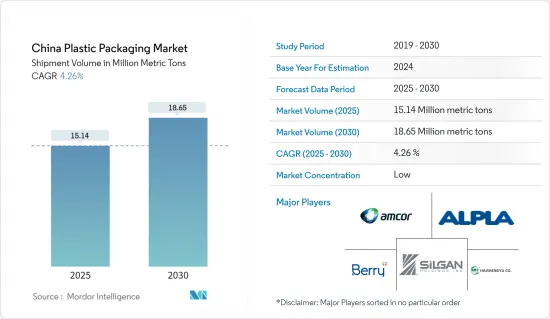

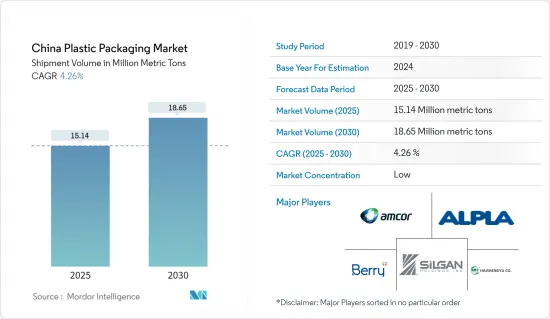

以出貨量為準,中國塑膠包裝市場規模預計將從2025年的1514萬噸擴大到2030年的1865萬噸,預測期間(2025-2030年)年複合成長率為4.26%。

在中國,消費者意識的提高和製造業的快速成長正在推動塑膠包裝市場的擴張。蓬勃發展的食品工業和蓬勃發展的包裝產業進一步推動了這種成長。

主要亮點

- 作為塑膠的主要生產國和消費國,中國在世界舞台上佔有壓倒性的地位。中國對塑膠生產和出口的重視很大程度上是由於對PET(聚對苯二甲酸乙二醇酯)、HDPE(高密度聚苯乙烯)和其他聚合物瓶子和容器的依賴增加的原因。這些材料在食品和飲料、藥品和個人護理等領域極為重要。

- 以中國為首的亞洲對瓶裝水的需求不斷成長,正在推動塑膠市場的發展。聯合國機構聯合國水、環境與健康研究所的資料凸顯了這個趨勢,顯示亞太國家佔瓶裝水消費量量的大部分。中國是僅次於美國的全球第二大瓶裝水市場,對PET塑膠的需求正在進一步增加。

- 為了因應環保產品需求的激增,中國製造商正在大力轉向永續包裝。例如,2024年5月,在中國開展業務的奧地利公司Alpla Werke Alwin Lehner GmbH &Co KG推出了可回收的PET酒瓶。這款創新的瓶子不僅比傳統玻璃瓶減少了38%的碳消費量,也提高了公司的環保資格。

- 然而,市場正面臨日益轉向替代包裝解決方案的挑戰。塑膠污染是全球廢棄物和海洋垃圾的重要來源,中國對塑膠污染的打擊凸顯了環境問題。中國作為全球最大的塑膠生產國和消費國,面臨市場成長的風險,特別是當消費者轉向紙包裝等替代品時。

中國塑膠包裝市場趨勢

食品業可望主導市場

- 根據國家統計局(NBS)報告,2023年中國國內生產總值(GDP)達17.52兆美元(126.6兆元),與前一年同期比較成長5.2%。美國農業部(USDA)強調,中國是全球最大的糧食進口國,2023年糧食進口總額將超過1,400億美元。

- 中國消費者偏好的變化,尤其是包裝食品的成長趨勢,正在推動塑膠包裝需求的成長。美國農業部指出,中國食品市場的關鍵趨勢是電子商務領域的快速成長。根據預測,2024年中國食品電商市場規模將達到1,480億美元,進一步拉動硬質塑膠包裝解決方案的需求。

- 此外,2023年中國餐飲業強勢復甦,尤其是已調理食品業。移動食品消費的增加刺激了剛性和軟質塑膠包裝解決方案的使用。中國蓬勃發展的外帶食品產業進一步放大了這一趨勢,導致對塑膠包裝的需求增加。

- 中國的食品進口包括多種消費品,包括乳製品、加工食品和肉類(特別是牛肉)。美國農業部資料顯示,2023年中國這些消費品的進口總額達1,064億美元。主要出口國為中國、紐西蘭、泰國、巴西、美國,各佔10-12%的佔有率,對拉動中國塑膠包裝需求發揮至關重要的作用。

瓶子和罐子佔據了最高的市場佔有率。

- 聚對苯二甲酸乙二醇酯 (PET)、聚丙烯 (PP) 和聚乙烯 (PE) 是生產用於包裝解決方案的塑膠瓶和罐子的主要材料。這些材料重量輕、不易破碎且易於物料輸送。在中國,食品飲料產業對瓶瓶罐罐的需求正在快速成長,硬質塑膠包裝的需求也正在快速成長。具體來說,擴大使用寶特瓶來包裝寶特瓶水、果汁、軟性飲料、藥品、家用清潔劑和個人保養用品,推動了塑膠包裝市場的擴張。

- 中國快速成長的製藥業擴大使用寶特瓶和容器進行包裝,進一步推動了該行業的成長。媒體平台Policy Circle的資料顯示,2023-24年中國將佔印度藥品進口的43.45%,增加了對塑膠包裝解決方案的需求。

- 隨著消費者對可回收和可重複使用包裝的偏好日益成長,Amcor Group 等中國製造商正在優先推出永續的硬質包裝解決方案,包括飲料瓶。 2024 年 4 月,在中國也有業務的瑞士 Amcor 集團將推出一款專門由 100% 消費後回收 (PCR) 材料製成的 1 公升寶特瓶,專為碳酸軟性飲料設計。

- 作為塑膠製品的主要製造中心,中國已經實現了重要的生產里程碑。根據ChemmAnalyst報告顯示,2023年12月,中國塑膠製品產量約698萬噸,與前一年同期比較增加2.8%。特別是,中國向美國和澳洲、馬來西亞和日本等亞洲國家出口塑膠製品,尤其是瓶子。

中國塑膠包裝產業概況

中國塑膠包裝市場較為分散。 Amcor Group、Berry Global Inc.、ALPLA Werke Alwin Lehner GmbH &Co KG、Silgan Holdings Inc.、山東海盛宇塑業等主要企業在積極強化產品系列,以期在馬蘇市場佔據更大佔有率。這些公司正在採用有機和無機相結合的策略,例如併購、夥伴關係、擴張、新產品發布和聯盟,以維護其在中國市場的主導地位。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 食品飲料產業對塑膠包裝的需求快速成長

- 更多採用環保包裝選項

- 市場挑戰

- 人們對塑膠包裝的環境問題日益關注

第6章 行業法規、政策與標準

第7章 市場區隔

- 按包裝類型

- 軟質塑膠包裝

- 依產品類型

- 小袋

- 包包

- 薄膜和包裝

- 其他產品類型

- 按最終用戶產業

- 食品

- 飲料

- 衛生保健

- 化妝品/個人護理

- 居家護理

- 其他最終用戶產業(工業、電子商務等)

- 硬質塑膠包裝

- 依產品類型

- 瓶子和罐子

- 托盤和容器

- 蓋子與封口裝置

- 其他產品類型

- 按最終用戶產業

- 食品

- 飲料

- 衛生保健

- 化妝品/個人護理

- 居家護理

- 其他最終用戶產業(工業、汽車等)

- 軟質塑膠包裝

第8章 競爭格局

- 公司簡介

- Shangdong Haishengyu Plastic Industry Co. Ltd

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Amcor Group

- Berry Global Inc.

- Silgan Holdings Inc.

- Taizhou Huangyan Baitong Plastic Co. Ltd

- Shenyang Powerful Packing, Co., Ltd.

- Jieshou Tianhong New Material Co. Ltd

- Qingdao Haoyu Packing Co. Ltd

- Ningbo Kinpack Commodity Co. Ltd

第 9 章回收與永續性觀點

第10章市場的未來

The China Plastic Packaging Market size in terms of shipment volume is expected to grow from 15.14 million metric tons in 2025 to 18.65 million metric tons by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

In China, heightened consumerism and a burgeoning manufacturing sector are driving the expansion of the plastic packaging market. This growth is further fueled by a surging food industry and a thriving packaging sector.

Key Highlights

- China is a dominant player on the global stage, both as a leading producer and consumer of plastic. The nation's intensified focus on plastic production and export is largely due to its heightened reliance on PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), and other polymer-based bottles and containers. These materials are pivotal for sectors like food and beverage, pharmaceuticals, and personal care.

- Asia's rising appetite for bottled water, with China leading the charge, is propelling the plastic market. Data from the United Nations University Institute for Water, Environment and Health, a UN agency, underscores this trend, revealing that Asia-Pacific nations dominate bottled water consumption. China, as the world's second-largest bottled water market, only behind the United States, further amplifies the demand for PET plastics.

- Responding to the surging demand for eco-friendly products, Chinese manufacturers are making a notable pivot towards sustainable packaging. For instance, in May 2024, Alpla Werke Alwin Lehner GmbH & Co KG, an Austrian firm operating in China, unveiled a recyclable PET wine bottle. This innovative bottle not only slashes carbon consumption by 38% compared to traditional glass but also enhances the company's environmental credentials.

- However, the market faces challenges from a growing shift towards alternative packaging solutions. China's battle with plastic pollution, a significant contributor to global waste and marine debris, highlights the environmental stakes. As the world's top producer and consumer of plastic, China's market growth is at risk, especially with a noticeable consumer shift towards alternatives like paper packaging.

China Plastic Packaging Market Trends

Food Industry is Expected to Dominate the Market

- In 2023, China's gross domestic product (GDP) reached USD 17.52 trillion (126.06 trillion yuan), marking a year-on-year increase of 5.2%, as reported by the National Bureau of Statistics (NBS). The United States Department of Agriculture (USDA) highlighted that China, the world's largest food-importing nation, saw its total food import value exceed USD 140 billion in 2023.

- Shifting consumer preferences in China, especially the rising trend of packaged foods, are driving an increased demand for plastic packaging. The USDA notes that a significant trend in China's food market is the burgeoning e-commerce sector. Forecasts suggest that China's food e-commerce market will hit USD 148 billion in 2024, further fueling the demand for rigid plastic packaging solutions.

- Moreover, China's food service industry made a strong comeback in 2023, particularly in the prepared food segment. The uptick in on-the-go food consumption has spurred using rigid and flexible plastic packaging solutions. This trend is further amplified by the booming takeaway food industry in China, leading to a heightened demand for plastic packaging.

- China's food imports encompass a range of consumer-oriented products, including dairy, processed foods, and meat, with a notable emphasis on beef. USDA data reveals that in 2023, China's imports of these consumer-oriented products totaled USD 106.4 billion. Key exporters to China, New Zealand, Thailand, Brazil, and the United States each holding a 10-12% share, play a pivotal role in driving the nation's demand for plastic packaging.

Bottles and Jars Segment to Register Highest Market Share

- Polyethylene terephthalate (PET), polypropylene (PP), and polyethylene (PE) are the primary materials used in the production of plastic bottles and jars for packaging solutions. These materials are lightweight and unbreakable, enhancing their ease of handling. In China, the food and beverage industry's surging demand for bottles and jars is rapidly boosting the need for rigid plastic packaging. Specifically, the rising use of PET bottles for packaging bottled water, juices, soft drinks, medicines, household cleaners, and personal care items is a key driver of the plastic packaging market's expansion.

- China's burgeoning pharmaceutical sector is increasingly turning to PET bottles and containers for packaging, further fueling this segment's growth. Data from Policy Circle, a media platform, highlights that in 2023-24, China constituted 43.45% of India's pharmaceutical imports, underscoring the heightened demand for plastic packaging solutions.

- In response to the rising consumer preference for recyclable and reusable packaging, Chinese manufacturers such as Amcor Group prioritise launching sustainable rigid packaging solutions, including beverage bottles. In April 2024, Amcor Group, a Switzerland-based entity with a footprint in China, unveiled a one-liter PET bottle crafted entirely from 100% post-consumer recycled (PCR) content, specifically designed for carbonated soft drinks.

- As a leading hub for plastic product manufacturing, China has seen significant production milestones. ChemAnalyst reported that in December 2023, China's plastic product output reached around 6.98 million tons, marking a 2.8% increase from the previous year. Notably, China exports its plastic products, especially bottles, to the United States and several Asian nations, including Australia, Malaysia, and Japan.

China Plastic Packaging Industry Overview

The plastic packaging market in China exhibits a fragmented landscape. Key players, including Amcor Group, Berry Global Inc., ALPLA Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc., and Shangdong Haishengyu Plastic Industry Co. Ltd., are actively enhancing their product portfolios in a bid to capture a larger share of the market. These companies are employing a mix of organic and inorganic strategies, such as mergers and acquisitions, partnerships, expansions, new product launches, and collaborations, to assert their dominance in the Chinese market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surging Demand for Plastic Packaging in the Food and Beverage Sector

- 5.1.2 Increasing Adoption of Eco-Friendly Packaging Options

- 5.2 Market Challenges

- 5.2.1 Rising Environmental Concerns Over Plastic Packaging

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGEMENTATION

- 7.1 By Packaging Type

- 7.1.1 Flexible Plastic Packaging

- 7.1.1.1 By Product Type

- 7.1.1.1.1 Pouches

- 7.1.1.1.2 Bags

- 7.1.1.1.3 Films & Wraps

- 7.1.1.1.4 Other Product Types

- 7.1.1.2 By End-User Industry

- 7.1.1.2.1 Food

- 7.1.1.2.2 Beverage

- 7.1.1.2.3 Healthcare

- 7.1.1.2.4 Cosmetics and Personal Care

- 7.1.1.2.5 Household Care

- 7.1.1.2.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 7.1.2 Rigid Plastic Packaging

- 7.1.2.1 By Product Type

- 7.1.2.1.1 Bottles and Jars

- 7.1.2.1.2 Trays and Containers

- 7.1.2.1.3 Caps and Closures

- 7.1.2.1.4 Other Product Types

- 7.1.2.2 By End-User Industry

- 7.1.2.2.1 Food

- 7.1.2.2.2 Beverage

- 7.1.2.2.3 Healthcare

- 7.1.2.2.4 Cosmetics and Personal Care

- 7.1.2.2.5 Household Care

- 7.1.2.2.6 Other End-User Industries (Industrial, Automotive, Among Others)

- 7.1.1 Flexible Plastic Packaging

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Shangdong Haishengyu Plastic Industry Co. Ltd

- 8.1.2 ALPLA Werke Alwin Lehner GmbH & Co KG

- 8.1.3 Amcor Group

- 8.1.4 Berry Global Inc.

- 8.1.5 Silgan Holdings Inc.

- 8.1.6 Taizhou Huangyan Baitong Plastic Co. Ltd

- 8.1.7 Shenyang Powerful Packing, Co., Ltd.

- 8.1.8 Jieshou Tianhong New Material Co. Ltd

- 8.1.9 Qingdao Haoyu Packing Co. Ltd

- 8.1.10 Ningbo Kinpack Commodity Co. Ltd