|

市場調查報告書

商品編碼

1636588

亞太地區塑膠包裝:市場佔有率分析、產業趨勢和成長預測(2025-2030)Asia Pacific Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

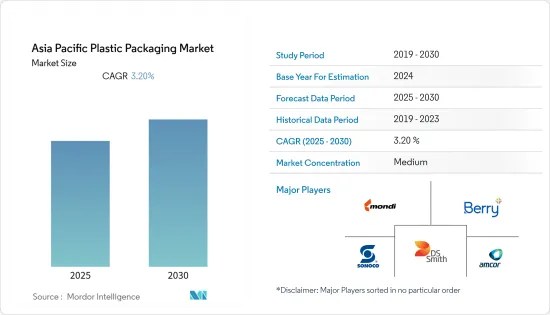

亞太塑膠包裝市場預計在預測期內複合年成長率為3.20%

主要亮點

- 塑膠包裝比其他產品更受消費者歡迎,因為塑膠重量輕、不易破碎且易於處理。大型製造商也更喜歡塑膠包裝,因為其製造成本較低。此外,聚對苯二甲酸乙二醇酯(PET)和高密度聚苯乙烯(HDPE)等聚合物的引入擴大了塑膠瓶的應用。市場對寶特瓶的需求不斷增加。

- 主要使用寶特瓶瓶罐的行業包括食品和飲料、化妝品/個人護理和醫療護理。由於瓶裝水和非酒精飲料的需求,飲料領域的寶特瓶市場預計將快速成長。

- 去年二月,可口可樂公司設定了業界領先的目標,即大幅增加可重複使用包裝的使用。到 2030 年,可口可樂公司將確保其品牌組合中至少 25% 的飲料採用可再填充和可回收的寶特瓶或傳統飲水機或可口可樂 Freestyle 分配器提供,我們的目標是用可再填充容器進行銷售。這些發展預計將增加寶特瓶製造的市場需求。

- 此外,電子商務行業的快速擴張預計將為市場擴張創造新的機會。為了降低運輸成本,電子商務公司更喜歡輕且靈活的包裝選擇。隨著越來越多的人在網路上購買日常生鮮食品、快速消費品、電子產品、服飾等,該細分市場預計將成長。

- 儘管人們對塑膠包裝對環境的影響表示嚴重擔憂,但對塑膠包裝的需求仍在持續飆升。然而,市場面臨政府法規和消費者需求的挑戰,迫使製造商尋找源自永續來源的生物分解性塑膠包裝解決方案。

- COVID-19 大流行表明,儘管公司限制了每位顧客的購買量,但對清潔瓶裝水、營養果汁和飲料的需求仍處於歷史最高水平。這些容器大多數是一次性的,但許多公司正在增加再生塑膠的使用,以滿足消費者的擔憂。

亞太地區塑膠包裝市場趨勢

產品的成本效益和延長的保存期限推動市場成長

- 塑膠包裝比其他材料製成的包裝更便宜、更方便。它在食品和飲料、醫療保健和化妝品等許多行業中具有多種用途。另外,根據Plastindia基金會的數據,印度對初級塑膠的總需求量為1500萬噸(不包括工程塑膠和熱固性塑膠),其中聚乙烯約佔600萬噸。當年,聚丙烯是需求量龐大的主要一般塑膠。

- 另外,根據軟包裝協會的數據,軟包裝主要用於食品,佔整個市場的60%以上。軟包裝產業正在健康發展,因為該行業已經能夠針對面臨的許多包裝挑戰推出創新解決方案。據IBEF稱,印度的食品和雜貨市場是全球第六大市場,其中零售業佔銷售額的70%。印度食品加工業是印度最大的產業之一,佔全國食品市場總量的32%,在產量、消費、出口和預期成長方面排名第五。

- 此外,EPS 重量輕、耐用、熱效率高且用途廣泛。它還具有出色的減震性能,非常適合存放和運輸易碎和昂貴的物品,例如電子產品、葡萄酒、化學品和藥品。 EPS 的絕緣和防潮特性可以延長生鮮產品(如軟水果、蔬菜和魚貝類)的保存期限。

- 此外,根據澳洲包裝規範組織(APCO)的數據,澳洲每年消耗的EPS包裝總量估計超過44,000噸,其中20,000噸用於包裝電氣和電子產品,20,000噸用於其他包裝量為24,000噸。

硬質塑膠包裝佔據主要市場佔有率

- 硬質塑膠包裝容器具有獨特的優點,如高衝擊強度、剛性和阻隔性,近年來擴大了硬質塑膠包裝。此外,由於持續的需求,正在推出新的和改進的更堅韌的 PE 樹脂。例如,Braskem 去年在硬包裝領域推出了一種新型聚乙烯 (PE) 樹脂。 Braskem 向市場推出了新產品選項 HD1954M,它是 Rigio 系列產品組合的一部分。高密度聚苯乙烯兼具高剛度、100% 可回收等級、卓越的衝擊強度和環境應力開裂 (ESCR) 性能,可最佳化包裝並提高生產率。

- 聚對苯二甲酸乙二醇酯(PET)和高密度聚苯乙烯(HDPE)聚合物的採用擴大了塑膠瓶的用途。高密度聚苯乙烯寶特瓶是鮮榨果汁和牛奶市場上流行的包裝之一。

- 在硬質包裝行業,PET 用於軟性飲料、水、果汁、運動飲料、啤酒、漱口水、貓糧、沙拉醬、食品罐和微波爐食品托盤的塑膠瓶。此外, 寶特瓶是日本使用最廣泛的寶特瓶材料之一。在日本, 寶特瓶也用於包裝碳酸飲料。在日本,平均每人每年購買 183 個寶特瓶。 HDPE 和 PP 等其他包裝材料的採用率也在不斷提高,公司希望透過提供多樣化的產品來吸引更多消費者。

- 此外,多家公司正在進行策略性收購,以進軍塑膠包裝產業不斷成長的市場。例如,去年,TricorBraus 同意收購 Cormack Packaging,預計該公司將在紐西蘭和澳洲設立工廠,為食品和飲料、製藥、個人護理、工業和家庭清潔行業提供硬包裝。

- 去年,聚乙烯(PE)在印度的應用主要用於包裝。軟包裝領域佔同年 PE 需求的 52%,而硬包裝佔整個市場的 18%。

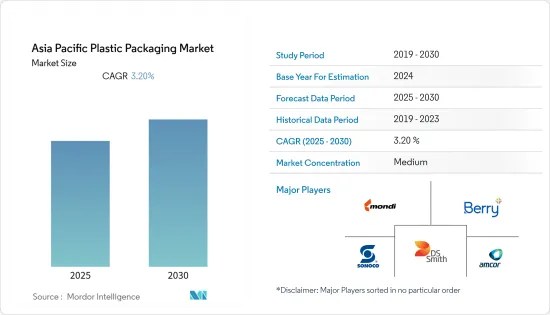

亞太地區塑膠包裝產業概況

亞太塑膠包裝市場競爭激烈,有幾個主要參與者進入該市場。一些參與企業享有更好的市場信譽,並擴大了其地理知名度和影響力。擁有較大市場佔有率的領先公司正致力於擴大基本客群。

- 2022年3月:日本石化製造商東曹計畫開發化學回收技術,從混合塑膠生成原料單體,並計畫在2025年3月年底前建立該技術。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 產品成本效益和延長的保存期限

- 封裝小型化

- 市場限制因素

- 嚴格的環境法規

第6章 市場細分

- 按類型

- 硬質塑膠包裝

- 軟質塑膠包裝

- 按材質

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯 (CPP)

- 乙烯 - 乙烯醇(EVOH)

- 聚乙烯(PE)

- 聚對苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和發泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 其他

- 依產品

- 瓶罐

- 托盤/容器

- 小袋

- 包包

- 薄膜包裝

- 其他

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 化妝品/個人護理

- 其他

- 按國家/地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Mondi Group

- Berry Plastics Corporation

- Sonoco Products Company

- Amcor Limited

- DS Smith PLC

- Bemis Company, Inc.

- NatureWorks LLC

- Reynolds Group Holdings Ltd(Packaging Finance Limited)

- ALPLA-Werke Alwin Lehner GmbH & Co. KG

- Consolidated Container Company

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 52545

The Asia Pacific Plastic Packaging Market is expected to register a CAGR of 3.20% during the forecast period.

Key Highlights

- Plastic packaging became popular among consumers over other products, as plastic is lightweight and unbreakable, making it easier to handle. Even significant manufacturers prefer plastic packaging, owing to the lower production cost. Moreover, introducing polymers, such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE), is expanding plastic bottle applications. The market is witnessing an increasing demand for PET bottles.

- The industries where plastic bottles and jars are mainly used in the market include food and beverage, cosmetics and personal care, and healthcare. The beverage sector market for plastic bottles is anticipated to witness rapid growth, owing to the demand for bottled water and non-alcoholic beverages.

- In February last year, the Coca-Cola Company set an industry-leading objective to increase its reusable packaging usage significantly. By 2030, the firm hopes to have at least 25% of all beverages sold in refillable/returnable plastic bottles or refillable containers through a traditional fountain or Coca-Cola Freestyle dispensers across its portfolio of brands. Such developments are expected to increase the market demand for plastic bottle manufacturing.

- Additionally, the e-commerce industry's rapid expansion is anticipated to create new opportunities for market expansion. To cut transportation costs, e-commerce enterprises favor lightweight and flexible packaging options. The sector is expected to increase as more people shop online for everyday fresh foods, FMCG products, electrical devices, and clothing.

- Plastic packaging demand continues to surge even though serious concerns about its environmental impact are raised. However, the market will face challenges from government regulations and consumer demand, pushing manufacturers to look for biodegradable plastic packaging solutions derived from sustainable sources.

- The COVID-19 pandemic indicated that demand for clean bottled water, nutritious juices, and beverages is at an all-time high, despite businesses limiting the amount of each customer's purchase. Although most of these containers were single-use, many firms are attempting to increase the use of recycled plastic content to satisfy consumer concerns.

Asia Pacific Plastic Packaging Market Trends

Cost-effectiveness & increased shelf-life of the product to drive the growth of the market

- Plastic packaging is cheaper and more convenient than packaging made from other materials. It is commonly used for multiple purposes in many industries, including food and beverages, healthcare, cosmetics, etc. Also, according to Plastindia Foundation, In India, there was a total demand for primary plastics in the range of 15 million tons (excluding engineering plastics and thermosets), with polyethylene varieties accounting for around six million metric tons of that total. During that year, polypropylene was the primary commodity plastic with an enormous demand.

- Also, according to the Flexible Packaging Association, flexible packaging is mainly used for food, contributing to more than 60% of the total market. The flexible packaging industry is witnessing healthy growth, as the industry was able to implement innovative solutions for the many packaging challenges it faced. According to IBEF, the Indian food and grocery market is the sixth-largest global, with retail contributing 70% of the sales. The Indian food processing industry accounted for 32% of the country's total food market, one of the largest industries in India, ranked fifth in terms of production, consumption, export, and expected growth.

- Additionally, EPS is lightweight, durable, thermally efficient, and versatile. It also includes exceptional shock-absorbing characteristics, making it ideal for storing and transporting fragile and expensive items, such as electronic equipment, wine, chemicals, and pharmaceutical products. The thermal insulation and moisture-resistant properties of EPS enable a shelf-life extension of perishable products, such as soft fruits, vegetables, and seafood.

- Moreover, according to the Australian Packaging Covenant Organization (APCO), the total amount of EPS packaging consumed in Australia every year is estimated to be more than 44,000 metric tons, broken down into applications of 20,000 metric tons for packaging of electrical and electronic products and 24,000 metric tons for another packaging.

Rigid Plastic Packaging to Hold the Significant Market Share

- Rigid plastic packaging containers provide unique benefits, such as high impact strength, stiffness, and barrier properties, which have expanded rigid plastic packaging in recent years. Also, new and improved tough PE resins are introduced due to sustained demand. For instance, Braskem launched a new polyethylene (PE) resin in the rigid packaging segment the previous year. Braskem provided the market with a new product option, HD1954M, which is a part of the Rigeofamily portfolio. High-density polyethylene offers a combination of high rigidity, 100% recyclable grade, good impact strength, and Environmental Stress Cracking (ESCR), rendering packaging optimization and productivity gains.

- The introduction of polyethylene terephthalate (PET) and high-density polyethylene (HDPE) polymers expanded plastic bottling applications. High-density polyethylene plastic bottles are among the popular packaging choices for the fresh juice and milk market.

- In the rigid packaging industry, PET is used for plastic bottles for soft drinks, water, juice, sports drinks, beer, mouthwash, catsup, salad dressing, food jars, and microwavable food trays. Also, PET is one of Japan's most widely used materials for manufacturing plastic bottles. PET bottles are also used for packaging carbonated drinks in the country. An average person in the country buys 183 PET bottles per year. Other packaging materials, such as HDPE and PP, are also witnessing rising adoption rates, with companies looking to attract more consumers by offering different products.

- Also, several companies are making strategic acquisitions to tap into the growing market of the plastic packaging industry. For instance, in the previous year, TricorBrausentered an agreement to acquire Cormack Packaging, expected to establish the former's footprint in New Zealand and Australia and serve the food and beverage, pharmaceutical, personal care, industrial, and household cleaning industries with rigid packaging.

- Packaging is India's primary polyethylene (PE) application in the last financial year. The flexible packaging segment accounted for 52 % of PE demand in the same year, while rigid packaging made up 18 % of the total market.

Asia Pacific Plastic Packaging Industry Overview

The Asia Pacific Plastic Packaging Market is highly competitive and includes several significant players. A few players enjoy better market goodwill and extended geographical recognition and presence. The major players, who have a relatively prominent market share, focus on expanding their customer base across the end-user industries.

- March 2022: Tosoh, a Japanese petrochemical producer, aims to develop its chemical recycling technology to generate raw monomers from mixed plastics, targeting to establish the technology by the end of March 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost-Effectiveness & Increased Shelf-Life Of The Product

- 5.1.2 Downsizing Of Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Environmental Regulations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rigid Plastic Packaging

- 6.1.2 Flexible Plastic Packaging

- 6.2 By Material

- 6.2.1 Bi-orientated Polypropylene (BOPP)

- 6.2.2 Cast polypropylene (CPP)

- 6.2.3 Ethylene Vinyl Alcohol (EVOH)

- 6.2.4 Polyethylene (PE)

- 6.2.5 Polyethylene Terephthalate (PET)

- 6.2.6 Polypropylene (PP)

- 6.2.7 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 6.2.8 Polyvinyl Chloride (PVC)

- 6.2.9 Other Materials

- 6.3 By Product

- 6.3.1 Bottles and Jars

- 6.3.2 Trays and containers

- 6.3.3 Pouches

- 6.3.4 Bags

- 6.3.5 Films & Wraps

- 6.3.6 Other Products

- 6.4 By End-user Industry

- 6.4.1 Food

- 6.4.2 Beverage

- 6.4.3 Healthcare

- 6.4.4 Cosmetics and Personal Care

- 6.4.5 Other End-user Industries

- 6.5 By Country

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Japan

- 6.5.4 Australia

- 6.5.5 South Korea

- 6.5.6 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi Group

- 7.1.2 Berry Plastics Corporation

- 7.1.3 Sonoco Products Company

- 7.1.4 Amcor Limited

- 7.1.5 DS Smith PLC

- 7.1.6 Bemis Company, Inc.

- 7.1.7 NatureWorks LLC

- 7.1.8 Reynolds Group Holdings Ltd (Packaging Finance Limited)

- 7.1.9 ALPLA-Werke Alwin Lehner GmbH & Co. KG

- 7.1.10 Consolidated Container Company

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219