|

市場調查報告書

商品編碼

1627186

德國塑膠包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

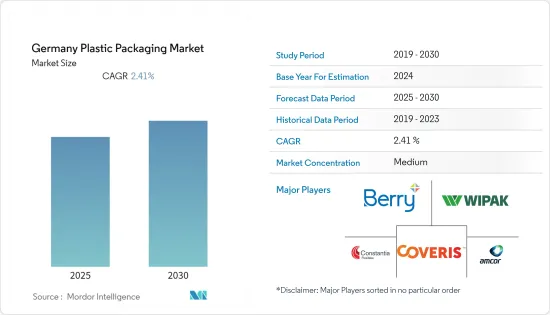

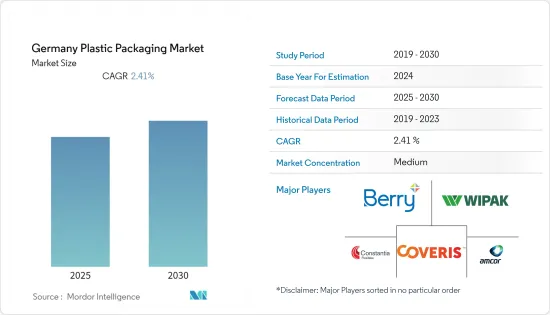

德國塑膠包裝市場預計在預測期內複合年成長率為2.41%

主要亮點

- 在德國,由於解決方案供應商和各種最終用戶的多項發展,塑膠包裝解決方案的採用正在增加。德國製造「典型的消費者對產品的認知為該地區的塑膠包裝公司提供了更好的表現場地。德國政府針對德國的塑膠包裝行業訂定了一些嚴格的法規。德國包裝方法包括包裝設計的回收、可回收政府的目標是到去年可再生63% 的塑膠包裝,高於 2018 年的 40%。

- 塑膠容器已成為各種最終用戶行業的必需品。新的填充技術和耐熱包裝材料的出現為市場帶來了新的可能性和選擇。儘管寶特瓶已成為多個領域的標準瓶,但飲料、化妝品、衛生用品和清潔劑主要以聚乙烯 (PE) 瓶銷售。

- 此外,多位德國研究人員在捷克共和國的一次會議上召開會議討論此類問題。水分滲透是影響產品品質的通用問題之一。一種更準確、可重複的方法來確定包裝在防潮方面的有效性將使整個行業受益。因此,USP 最近修訂了其包裝和水分滲透章節(USP 通則容器 - 性能測試),納入了測量高阻隔和低阻隔藥品包裝水分滲透的新方法。包裝,僅限於“封閉”和“密封”容器。

- 在過去的十年中,公眾對塑膠使用有害影響的認知迅速提高。政府所進行的一系列公共宣傳活動和措施提高了公眾的意識。因此,近年來塑膠包裝的消費受到了顯著的影響。

- 德國冷凍包裝產業的成長預計將對市場產生積極影響。例如,根據歐洲冷凍食品的數據,德國、法國和英國佔了歐洲冷凍食品市場50%以上的佔有率。由於 COVID-19 大流行,政府實施的封鎖有助於許多地區冷凍食品的銷售,對市場產生了積極影響。大流行後,由於送餐宅配服務的增加,市場出現成長。

德國塑膠包裝市場趨勢

環保包裝和再生塑膠的增加推動市場

- 近年來,德國塑膠包裝產業經歷了多次變革,監管也日益嚴格。德國包裝方法及其配額主要影響分發包裝的包裝製造商,這些包裝製造商現在需要向中央機構註冊。該法案第 21 條還要求包裝設計考慮回收、可回收性以及回收和可再生材料的使用。去年,政府的目標是將塑膠包裝的回收率從2018年的40%提高到63%。

- 根據歐盟指令,到 2025 年,歐盟一半的塑膠包裝必須回收。到2030年,這一比例將上升至55%。德國塑膠包裝產業更進一步,目標是到2025年使90%的家用塑膠包裝可回收或可重複使用。集中回收可以生產用於新包裝的高品質二次原料。

- 這迫使市場供應商進行創新並創建循環解決方案。去年3月,Alpla集團宣布將把德國寶特瓶的回收量增加到每年7.5萬噸。在此之前,雙方已達成協議,從 FROMM 集團收購回收公司 Texplast,並收購合資企業 PET Recycling Team Wolfen 的所有股份。隨著歐洲品牌為日益嚴格的循環經濟法規做準備,PET 回收需求旺盛。歐盟一次性塑膠指令要求到 2029 年,塑膠飲料瓶的回收率達到 90%,從 2025 年起, 寶特瓶的回收塑膠含量至少達到25%,並要求從2030 年起,所有飲料瓶的回收率達到90%。

- 去年二月,可口可樂德國公司更換了一次性寶特瓶的瓶蓋,以改善回收。歐盟各地的消費者很快就會看到新的瓶蓋,即使在打開後也能牢固地固定在瓶子上。德國可口可樂是首批採用歐盟 2024 年可回收期限的公司之一。整個歐洲正在採取轉變,以減少廢物並提高回收率。可口可樂也利用新瓶蓋的過渡來減少德國各地瓶子的材料使用。改良後的瓶蓋每瓶可節省 1.37 克塑膠。這反過來將支持可口可樂在德國的永續發展舉措。

- 此外,塑膠製品產生的收益逐年增加。根據德國聯邦統計局預測,到2025年,德國塑膠製品製造業的收益預計將達到約1,043.8億美元。

飲料預計將佔據主要市場佔有率

- 果汁、酒精飲料和代餐奶昔等飲料擴大採用軟質塑膠包裝解決方案。各種飲料包裝對立式袋和帶嘴袋的需求正在增加。

- 然而,飲料品質受到 pH 值、儲存溫度、壓力和污染物存在的影響。其水準的變化可以改變消費量。為了消除氧化的可能性,越來越多的公司開始轉向具有阻隔性(熱、濕氣、細菌)等特性的軟包裝產品。

- 快速採用輕質包裝材料的趨勢,以及降低生產、運輸和處理成本的趨勢,正在推動飲料用軟質塑膠包裝的發展。此外,以視覺包裝趨勢為重點的電子商務的興起正在推動需求。

- 此外,2021年5月,德國聯邦議院大多數議員核准了《德國包裝方法》修正案。內容是延長去年1月開始實施的PET果汁瓶強制押金規定。這些措施促進了循環經濟。

- 此外,該地區對碳酸飲料和礦泉水的需求多年來一直在穩步成長。例如,根據德國統計局的數據,2020年和2021年德國飲料業(包括啤酒、烈酒、葡萄酒、氣泡酒、非酒精軟性飲料和礦泉水)價值約為212.9億歐元(232億歐元),分別為212 億收益(231 億美元)。 寶特瓶比其他包裝具有優勢,因為它們有 200 毫升以上的大尺寸可供選擇,並且用途廣泛。

德國塑膠包裝產業概況

由於德國地區對塑膠包裝的需求顯著增加,市場適度細分,Amcor、Coveris Holding、Berry Global、Sealed Air Corporation 和 Constantia Flex等主要企業進入市場。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2022 年 5 月:Coveris 在德國紐倫堡舉行的歐洲領先包裝盛會 FachPack 2022 上宣布了乳製品包裝領域的新產品開發,同時在英國成功推出了一系列產品。 Coveris 將在本次活動中提供各種包裝材料,從阻隔膜到預製包裝、可剝離蓋膜到可再剝離蓋膜和熱成型膜,提供永續性、減重、視覺吸引力和保存期限。截止日期保護之類的需求。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 更多採用輕量化包裝方法

- 增加環保包裝和再生塑膠

- 市場問題

- 原料(塑膠樹脂)價格上漲

- 政府法規和環境問題

第6章 COVID-19 對市場的影響

第7章 市場區隔

- 按包裝類型

- 硬質塑膠包裝

- 軟質塑膠包裝

- 按行業分類

- 食物

- 飲料

- 醫療保健

- 個人護理和家居產品

- 其他

- 依產品類型

- 瓶罐

- 能

- 小袋

- 托盤/容器

- 薄膜包裝

- 其他

第8章 競爭格局

- 公司簡介

- Amcor Plc

- Coveris Holding

- Berry Global

- Constantia Flexibles

- Wipak UK Ltd.

- Sonoco Products Company

- Sealed Air Corporation

- National Flexible

- Tetra Laval

- Silgan Holdings

第9章投資分析

第10章市場的未來

簡介目錄

Product Code: 50507

The Germany Plastic Packaging Market is expected to register a CAGR of 2.41% during the forecast period.

Key Highlights

- Germany is increasingly adopting plastic packaging solutions, owing to the several developments in the country by the solution providers and different end users. The typical consumer perception of 'Made in Germany' goods provided a better performance space for the plastic packaging companies in the region. The government of Germany introduced several stringent regulations for the plastics packaging industry in Germany. The German Packaging Law requires packaging design for recycling, recyclability, and using recyclable and renewable materials. The government aims to recycle 63% of plastic packaging by the last year, up from 40% in 2018. Such measures are expected to profoundly impact the studied market in the envisaged timeline.

- Plastic containers are becoming essential in various end-user industries. New filling technologies and the emergence of heat-resistant packaging material opened up new possibilities and options in the market. While PET bottles are standard in multiple segments, beverages, cosmetics, sanitary products, and detergents are predominantly sold in polyethylene (PE) bottles.

- Furthermore, various German researchers held a meeting at the Czech Republic conference for such an issue discussion. Moisture permeation is one of the common challenges that can impact product quality. A more accurate and reproducible method to determine how effective the packaging is at keeping moisture out would benefit the industry. Accordingly, USP recently revised the packaging and moisture permeation chapters (USP General Chapter Containers-Performance Testing) to include a new method for determining moisture permeation for high and low-barrier pharmaceutical packaging. USP is also considering changing the USP classification system for the packaging, which is limited so far to 'well-closed,' 'tight,' and 'hermetic' containers.

- Since the past decade, awareness among the population regarding the harmful effects of plastic usage is growing drastically. Many public campaigns and initiatives by governments have resulted in increased awareness among the public. Thus, the consumption of plastic packaging witnessed a significant impact in the past few years.

- The growth of the frozen packaged industry across Germany is expected to impact the market positively. For instance, according to Frozen Food Europe, Germany, France, and the United Kingdom account for more than 50% of the frozen food market in Europe. The government-mandated lockdown due to the COVID-19 pandemic aided frozen food sales in many regions and thus impacted the market positively. After the pandemic, the market grew with increased food delivery services.

Germany Plastic Packaging Market Trends

Increased Eco-Friendly Packaging and Recycled Plastic Driving the Market

- Recent years have brought several changes and more stringent regulations for the plastics packaging industry in Germany. The German Packaging Law and its quotas mainly affect packaging manufacturers that carry packs into circulation, and they now must register with a centralized authority. Paragraph 21 of the law also requires packaging design for recycling, recyclability, and using recyclates and renewable materials. The government aimed to recycle 63% of plastic packaging last year, up from 40% in 2018.

- Under an EU directive, half of all plastic packaging in the EU should be recycled by 2025. It shall rise to 55% by 2030. The German plastic packaging industry is going a step further and set itself the target of making 90% of household plastic packaging recyclable or reusable by 2025. Focused recycling can produce high-quality secondary raw materials for new packaging.

- It compelled market vendors to produce circular solutions along with innovations. In March last year, AlplaGroup announced that it would increase its annual recycling volume in Germany to 75,000 tons of PET bottles. It is after agreeing to acquire recycling company Texplastfrom the FROMM Group and all of its shares in the joint venture PET Recycling Team Wolfen. PET recyclate is in hot demand as European brands prepare for increasingly stringent circular economy regulations. The EU's Single-Use Plastics Directive imposes a 90% collection rate for plastic beverage bottles by 2029 and a minimum of 25% recycled plastic in PET bottles from 2025, rising to 30% from 2030 in all beverage bottles.

- In February last year, Coca-Cola Germany replaced the cap on its single-use PET bottles to improve recycling. Consumers across the EU would soon see new closures that stay securely connected to the bottle after it opens. Coca-Cola in Germany is one of the early adopters of the EU's 2024 recyclability deadline. Across Europe, a transition is underway to reduce trash and enhance recycling collection rates. Coca-Cola is also using the move to the new caps to lower the material amount used in the bottles overall in Germany. The improved closures could save up to 1.37 grams of plastic per bottle. It, in turn, helps Coca-Cola's sustainability initiatives in Germany.

- Further, the revenue generated by plastic products is increasing yearly. According to Statistisches Bundesamt, the projected revenue of the manufacture of plastic products in Germany would amount to approximately USD 104.38 billion by 2025.

Bevarages is Expected to Hold Major Market Share

- Beverages, including fruit juices, alcoholic drinks, and meal replacement shakes, are increasingly embracing flexible plastic packaging solutions. There is an increasing demand for stand-up and spouted pouches for various beverage packaging.

- However, the beverage quality is affected by pH, storage temperature, pressure, and the presence of contaminants. Changes in the levels can alter beverage consumption. Companies are increasingly employing flexible packaging products with properties such as high barrier resistance (heat, moisture, and bacteria) to eliminate possible oxidation.

- The rapidly adopted trend of lightweight packaging material, alongside the inclination towards reducing production, shipment, and handling costs, is driving the flexible plastic packaging of beverages. Furthermore, the demand is driven by the rise of e-commerce focusing on visually appealing packaging trends.

- Further, in May 2021, most parliamentarians in Germany's Bundestag approved changes to the German Packaging Law. It comprised an extension of the mandatory deposit to include PET juice bottles that came into force as of January last year. Such initiatives would promote a circular economy.

- Moreover, the region also witnessed a steady growth in the demand for carbonated soft drinks and mineral water over the years. For instance, according to Statistisches Bundesamt, in 2020 and 2021, the German beverage industry (comprising beer, distilled spirits, wine, sparkling wine, non-alcoholic soft drinks, and mineral water) generated revenues of approximately EUR 21.29 billion (USD 23.20 billion) and EUR 21.2 billion (USD 23.10 billion), respectively. PET bottles provide an advantage over other packaging as they are available in larger sizes from 200 ml, making them versatile.

Germany Plastic Packaging Industry Overview

As the demand for plastic packaging is increasing significantly in the German region, the market is moderately fragmented, with significant players like Amcor, Coveris Holding, Berry Global, Sealed Air Corporation, and Constantia Flexibles, among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2022: With many successful product launches in the UK, Coveris launched its new dairy packaging developments to FachPack 2022 in Nuremberg, Germany, one of Europe's leading packaging events. Coveris offers a variety of packaging materials in the event, from barrier films to pre-made packs, peelable to re-closable lidding films, thermoforming films, and many more, to support market needs for sustainability, weight reduction, visual appeal, and shelf-life protection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight-packaging Methods

- 5.1.2 Increased eco-friendly packaging and recycled plastic

- 5.2 Market Challenges

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations & Environmental Concerns

6 IMPACT OF COVID-19 ON THE MARKET

7 MARKET SEGEMENTATION

- 7.1 By Packaging Type

- 7.1.1 Rigid Plastic Packaging

- 7.1.2 Flexible Plastic Packaging

- 7.2 By End-User Vertical

- 7.2.1 Food

- 7.2.2 Beverage

- 7.2.3 Healthcare

- 7.2.4 Personal care and Household

- 7.2.5 Other End-User

- 7.3 By Product Type

- 7.3.1 Bottles and Jars

- 7.3.2 Cans

- 7.3.3 Pouches

- 7.3.4 Trays and containers

- 7.3.5 Films & Wraps

- 7.3.6 Other Product Types

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Plc

- 8.1.2 Coveris Holding

- 8.1.3 Berry Global

- 8.1.4 Constantia Flexibles

- 8.1.5 Wipak UK Ltd.

- 8.1.6 Sonoco Products Company

- 8.1.7 Sealed Air Corporation

- 8.1.8 National Flexible

- 8.1.9 Tetra Laval

- 8.1.10 Silgan Holdings

9 INVESTMENT ANLAYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219