|

市場調查報告書

商品編碼

1624584

亞太地區位置分析:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)APAC Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

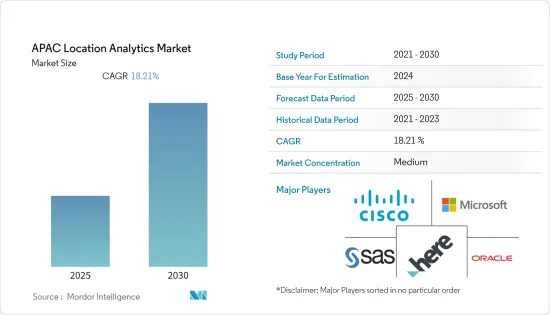

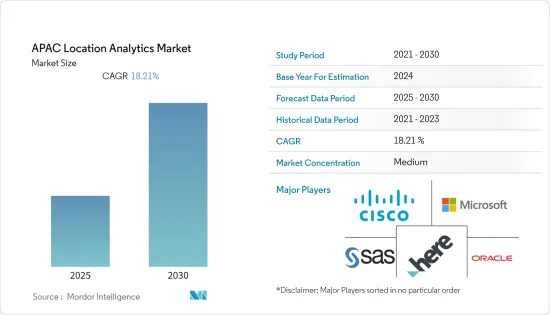

亞太地區位置分析市場預計在預測期內年複合成長率為 18.21%

主要亮點

- 零售商之間的激烈競爭試圖比競爭對手賺取更多的錢。智慧型手機席捲了世界。亞太市場正在蓬勃發展,對於任何智慧型手機公司來說都是一個巨大的市場。預算型和高階智慧型手機領域都有很大的需求。這兩種成長的結合正在支持該地區基於位置的分析市場。

- 市場區隔正在成為市場研究領域的關鍵部分之一。由於許多零售商店每天都在營業,每次消費者或顧客進入商店並在購買後停留直至離開時都會創建大量用戶資料。

- 目前正在使用各種分析解決方案對這些資料進行分析。基於位置的分析將基於位置的資料置於上下文中,以得出有意義的見解並為戰略業務決策提供資訊。位置分析供應商利用具有 Wi-Fi 網路的智慧型手機,以最低的成本運行位置分析解決方案。

- Wi-Fi 基於位置的分析 (LBS) 系統已在所有面向客戶的行業中引入。該系統允許顧客透過現場Wi-Fi進行連接,使零售中心和其他機構能夠更好地了解他們的消費者,並相應地提供適合他們需求的產品。

- 當今市場上流行各種分析解決方案,例如網路分析。基於位置的分析將成為設計和衡量客戶體驗的時代需求。位置分析解決方案將很快在市場上變得司空見慣。

這場大流行對世界各地的各種企業產生了重大影響,印度和中國等國家受到病毒爆發的負面影響。因此,全球智慧型手機以及基於位置的分析解決方案的使用量顯著增加。印度政府支持當局對接觸過新冠病毒陽性患者的人進行有效的接觸者追蹤,並從其使用中受益匪淺。

亞太區位分析市場趨勢

車載連接推動汽車產業的成長

- 內建導航的新車正在成為標準配置,車載導航供應商預計將會成長。此外,車輛的外部和內部連接正在推動連網式導航服務和即時位置內容的成長。

- 對於汽車製造商來說,嵌入式和連網型的位置服務,如路線規劃(TBT)導航、交通資訊和興趣點(POI)搜尋(包括停車場和加油站)將成為車載服務的主要部分未來五年,它將繼續成為資訊娛樂系統(IVI)的組成部分。尤其是導航系統在入門級汽車中變得越來越普遍。據預測,導航安裝率將從2020年佔新車銷售的38%增至2026年的近70%,為供應商提供顯著的成長機會。

- 儘管未來五年受到疫情的負面影響,但導航車輛的年銷量預計將成長近一倍,從 2020年終的超過 3450 萬輛增至 2025 年的超過 6800 萬輛。這總合不包括安全引導自動駕駛車輛所需的高清地圖。儘管如此,聯網汽車仍然包括在內。聯網汽車可以為使用者提供基於地圖的即時服務,作為連網型車載資訊娛樂 (IVI) 體驗的一部分。

- 隨著汽車行業致力於提高道路安全性並減少或消除交通事故,更多新車將配備 ADAS(高級駕駛輔助系統)。

分析師預測,到 2025 年,全球距離警告的普及率將達到輕型車輛的 76%,其中依賴 Masu 地圖的比例不斷增加(可能是四分之一到三分之一)。其他 ADAS 功能包括預測動力傳動系統距離警告、智慧速度援助和車道偏離警報。

透過位置洞察提供競爭考察繼續推動企業需求

整個企業的許多層面都感受到了數位化的好處,包括銷售和行銷、營運、策略、IT 管理以及研發。收集和分析資料以獲得見解,以改善決策、課責、效率和業務績效。

智慧定位將地圖和地理空間服務與企業和組織資料結合。智慧定位是商業智慧的子集,可在地圖上視覺化業務產生的資料(性能資料、定價、成本資料等)(或應用位置服務),戰術性和策略目的。

智慧定位的使用案例包括地理行銷、定位廣告、站點位置規劃(例如零售店、餐廳、加油站和行動無線電接取網路等基礎設施)以及遠端設備效能監控。資產追蹤、車隊管理、隨選行動服務和其他業務功能也可以透過位置服務增強。

BCG 去年 2 月對 520 家公司進行的全球企業位置情報調查發現,位置資料對於跨行業的業務績效非常重要,其中 95% 的企業涉及房地產、物流和配送、零售、電子商務等、地圖和地理空間資料對於今天實現預期的業務成果至關重要,91% 的人表示,它們在三到五年內將變得更加重要。

亞太地區位置分析產業概覽

在亞太地區位置分析市場營運的公司集中度適中,注重夥伴關係和創新。市場上的主要供應商包括思科系統公司、微軟公司、HERE、SAS Institute Inc.、甲骨文公司、SAP SE、ESRI(環境系統研究所)、Tibco Software Inc.、Pitney Bowes 和 Gaige。

2022 年 7 月,Citycity 將與 HERE 合作,在其解決方案和產品中使用定位服務和應用程式介面 (API)。這將簡化城市交通營運,提供可行的分析來推動交通脫碳,減少交通堵塞、車輛管理、智慧城市停車和物流,並促進印度的智慧和永續生活。

2022 年 7 月,Google 地圖宣布與 Genesis International 和 Tech Mahindra 合作,在印度推出街景服務。這些夥伴關係關係的目的是創建有用的地圖,使導航和探索更容易、更準確,並與當地社區共用重要且有用的基於位置的資訊並為當地社區提供支援。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法與方法論

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 零售市場成長

- 更多採用分析商業智慧和地理資訊系統技術

- 物聯網的使用不斷增加

- 市場限制因素

- 安全和隱私問題

- 由於業務資訊不完整、資訊過時、位置資料庫限制等原因,系統容易發生錯誤。

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 業內競爭對手之間的對抗關係

第5章技術概述

- 技術簡介

- 持續發展

第6章 市場細分

- 按地點

- 室內的

- 戶外

- 按部署模型

- 本地

- 一經請求

- 按行業分類

- 零售

- 銀行

- 製造業

- 運輸

- 衛生保健

- 政府機構

- 能源/電力

- 其他行業

- 按國家/地區

- 中國

- 印度

- 日本

- 澳洲

- 其他國家

第7章 競爭格局

- 公司簡介

- Cisco Systems

- Microsoft Corporation

- HERE

- SAS Institute, Inc.

- Oracle Corporation

- SAP SE

- ESRI(Environmental Systems Research Institute)

- Tibco Software Inc.

- Pitney Bowes

- Galigeo

第8章投資分析

第9章亞太地區位置分析市場的未來性

The APAC Location Analytics Market is expected to register a CAGR of 18.21% during the forecast period.

Key Highlights

- There is cutthroat competition between the retailers to earn more than their rivals. Smartphones have taken the world by storm. The boom in Asia-Pacific markets has been enormous and is a huge market for every smartphone company. There is a huge demand in both the low-cost and high-end smartphone segments. The combination of growth in both has helped the location analytics market in this region.

- Location analytics is emerging as one of the major segments in the field of market research. As more retail stores open every day, a lot of user data is created every time a consumer or customer walks into a store and stays there until he or she leaves after making a purchase.

- These data points are now being analyzed with different analytical solutions. Location-based analytics aids in contextualizing location-centric data in order to derive meaningful insights and inform strategic business decisions.This data could enhance the customer experience and give us a competitive edge over other market players. By leveraging smartphones with wi-fi networks, location analytics vendors have enabled location analytics solutions to run at a minimal cost.

- The rise in all customer-facing industries has resulted in the introduction of the wi-fi location analytics (LBS) system, which allows customers to connect through on-site wi-fi, opening a direct channel of communication that enables retail centers and similar others to better understand their consumers and accordingly deliver products that meet their needs.This method helps maximize retail output and services by understanding the consumer's needs.

- Different analytics solutions, like web analytics, are popular in the market currently. Location-based analytics will become the need of the hour for designing and measuring the experiences of customers. Shortly, location analytics solutions will become commonplace in the marketplace.

The pandemic significantly impacted various businesses worldwide, with countries such as India and China being adversely affected by the outbreak of the virus. As a result, smartphone usage increased significantly globally, and location analysis solutions increased. The Government of India has greatly benefited from using it, as it has assisted authorities in conducting effective contact tracing for people who met COVID-positive patients.

APAC Location Analytics Market Trends

In-vehicle connectivity is driving growth in the Automotive sector

- New vehicles with built-in navigation are becoming standard, which will allow in-vehicle navigation suppliers to grow. Also, the growth of connected navigation services and live location content is being driven by both external and internal connectivity in vehicles.

- For carmakers, embedded and connected location services, such as turn-by-turn (TBT) navigation, traffic information, and point-of-interest (POI) search (including parking and gas stations), will remain an essential component of in-vehicle infotainment systems (IVI) over the next five years. Specifically, navigation systems are becoming common in entry-tier vehicles. According to predictions, the attach rate for navigation will increase from 38% of new cars sold in 2020 to almost 70% by 2026, providing suppliers with a sizable opportunity for growth.

- Despite the negative impact of the pandemic over the next five years, it is estimated that annual sales of navigation-enabled cars will almost double from over 34.5 million at the end of 2020 to exceed 68 million by 2025. This total excludes HD maps required to guide autonomous cars safely. Still, it includes connected cars, which can deliver live map-based services to users as part of the connected in-vehicle infotainment (IVI) experience.

- As the auto industry works to make roads safer and cut down on or get rid of car accidents, more new cars will have advanced driver assistance systems (ADAS).

Analysts expect the global penetration of the distance warning feature to reach 76% of light-duty vehicles in 2025, with a growing share (likely between a quarter and a third) of these relying on an ADAS map. Other ADAS features include distance warning with predictive powertrain, intelligent speed assistance, and lane departure alerts.

Achieving competitive advantage through location insights continues to drive demand for Enterprises

The benefits of digitalization are felt at various levels across enterprises, e.g., sales and marketing, operations, strategy, IT management, and R&D. Data is collected and analyzed to gain insights that improve decision-making, accountability, efficiency, and business performance.

Location intelligence combines mapping and geospatial services with a company's or organization's data. Location intelligence is a subset of business intelligence whereby a business visualizes the data it generates, e.g., performance data, pricing, cost data, etc., on a map (or applies location services) for improved tactical and strategic decision-making.

Use cases for location intelligence include geo-marketing, location-targeted advertising, site location planning (e.g., retail stores, restaurants, fueling stations, and other infrastructure like mobile radio access networks), and remote equipment performance monitoring. Asset tracking, fleet management, on-demand mobility services, and other business functions can also be enhanced with location services.

A BCG global survey on location intelligence for enterprises conducted across 520 companies in February last year shows the high importance of location data to business performance across different sectors, where 95% said that mapping and geospatial data are essential in achieving desired business results today and 91% said that they would be even more essential in three to five years, including in real estate, logistics and delivery, retail, and e-commerce.

APAC Location Analytics Industry Overview

Companies operating in the Asia-Pacific Location Analytics Market focus on partnerships and innovations and are moderately concentrated. Some of the key vendors in the market include Cisco Systems, Microsoft Corporation, HERE, SAS Institute Inc., Oracle Corporation, SAP SE, ESRI (Environmental Systems Research Institute), Tibco Software Inc., Pitney Bowes, and Gaige.

In July 2022, Citility will work with HERE to use location services and application programming interfaces (APIs) in its solutions and products. This will provide actionable analytics that streamline city mobility operations and encourage the decarbonization of transportation and reduce traffic congestion, fleet management, smart city parking, and logistics to promote smart, sustainable living in India.

In July 2022, Google Maps announced partnerships with Genesys International and Tech Mahindra to launch Street View in India. The goal of these partnerships is to make helpful maps that make navigation and exploration easier and more accurate and to share important and useful location-based information with communities to help them.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH APPROACH AND METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Retail Market

- 4.2.2 Increasing adoption of analytical business intelligence and geographic information systems technology

- 4.2.3 Increasing Usage of Internet of Things

- 4.3 Market Restraints

- 4.3.1 Concerns about security and privacy

- 4.3.2 Systems are error prone In cases like incomplete business information, out-of-date information and limitation of place databases

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat from new entrants

- 4.5.4 Threat from substitute Product Types

- 4.5.5 Competitive rivalry within the industry

5 TECHNOLOGY OVERVIEW

- 5.1 Technology Snapshot

- 5.2 Ongoing developments

6 MARKET SEGMENTATION

- 6.1 By Location

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Deployment Model

- 6.2.1 On-premise

- 6.2.2 On-demand

- 6.3 By Verticals

- 6.3.1 Retail

- 6.3.2 Banking

- 6.3.3 Manufacturing

- 6.3.4 Transportation

- 6.3.5 Healthcare

- 6.3.6 Government

- 6.3.7 Energy and Power

- 6.3.8 Other Verticals

- 6.4 By Countries

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems

- 7.1.2 Microsoft Corporation

- 7.1.3 HERE

- 7.1.4 SAS Institute, Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 SAP SE

- 7.1.7 ESRI (Environmental Systems Research Institute)

- 7.1.8 Tibco Software Inc.

- 7.1.9 Pitney Bowes

- 7.1.10 Galigeo