|

市場調查報告書

商品編碼

1626339

日本工廠自動化與工業控制設備:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Japan Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

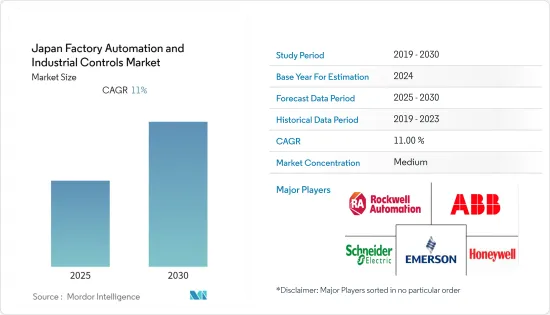

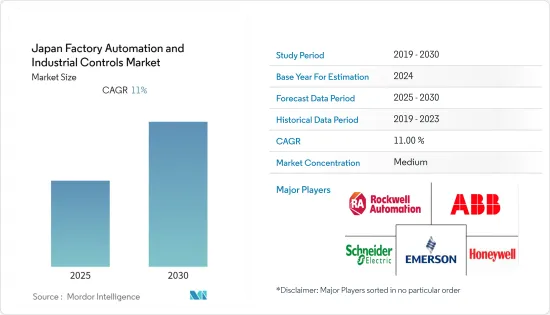

日本工廠自動化和工業控制設備市場預計在預測期內年複合成長率為 11%

主要亮點

- 自動化製造流程具有多種優勢,包括更輕鬆的監控、減少廢棄物和提高生產速度。該技術透過標準化來提高質量,為客戶提供準時、廉價且可靠的產品。

- 連接工業設備和機械並獲取即時資料在 PLC 系統、SCADA、HMI 和提供可視化的軟體的採用中發揮了關鍵作用。

- 工業 4.0 和物聯網 (IIOT) 是整個物流鏈開發、生產和管理的新技術方法的核心,被稱為智慧工廠自動化,其中機器和設備通過網際網路連接。

- 此外,由於工業4.0 和物聯網(IoT) 的普及,製造業發生了巨大轉變,正在推動企業變得敏捷和智慧,利用透過自動化補充和增強人力的技術來推動生產,並減少因流程而導致的工業事故。

- 根據 Zebra 最新的製造願景研究,基於物聯網和 RFID 的智慧資產追蹤解決方案預計到 2022 年將取代基於電子表格的傳統方法。根據工業IoT(IIoT) 公司 Microsoft 的一項研究,85% 的公司至少擁有一個 IIoT 用例計劃。這一數字預計還會增加,94% 的受訪者表示他們將在 2021 年之前實施 IIoT 策略。

- 此外,日本是向自動化工業經濟轉型的先驅。產業4.0版本正在以更快的速度被採用。日本已發展成為工廠自動化產品的製造地,供應其他亞太市場。眾多汽車製造商、電子產品製造商和食品工業的存在也使日本成為一個重要的市場。

- COVID-19的爆發給日本製造業帶來了許多挑戰。 COVID-19 大流行導致消費行為行為發生重大變化,預計將導致自動化和虛擬程度的提高。我們預計智慧工廠和辦公室將會增加,目前需要人工監督的關鍵功能可以遠端監控,或至少需要更少的人員。因此,預計市場在預測期內將會成長。為因應以COVID-19為代表的全球景氣衰退,日本工廠自動化市場在2020年上半年受到供給面和需求面的雙重影響。

- 智慧工廠舉措幫助製造業克服了 COVID-19 的挑戰,導致員工人數減少、某些產品銷量減少、社交距離以及最終用戶行業(主要是製造業和汽車業)的大多數公司 由於保持營運的能力。限制而關閉生產基地使我們能夠解決諸如降低營運成本的巨大壓力等問題。

日本工廠自動化及工業控制設備市場趨勢

分散式控制系統預計將經歷顯著的市場成長

- 分散式控制系統 (DCS) 是一種以流程為導向的平台,依賴互連的感測器、致動器、控制器和終端的網路,作為設施生產營運的集中主控制器。因此,DCS 專注於製程控制和監控,為設備操作員提供所有設備操作的單一視圖。 DCS 在封閉回路型控制平台上運行,能夠實施先進的製程自動化策略。因此,DCS適合控制單一設施或工廠的操作。此外,DCS 對於最大限度地提高設施日常營運流程的可見性至關重要。

- 控制架構包括監督級控制,監督多個負責控制局部製程細節的整合子系統。這些子系統連接到感測器和致動器,並利用設定點控制來控制工廠內的物料流。

- DCS 系統的主要優勢之一是工作站、分散式控制器和其他計算元件之間的數位通訊遵循P2P存取的原則。這些先決條件正在推動 DCS 的採用。這些系統降低了操作複雜性、計劃風險,並提供了諸如在要求苛刻的應用中實現敏捷製造的靈活性等功能。 DCS 整合各種工廠製程控制(例如PLC、渦輪機械控制、安全系統、第三方控制)以及其他工廠製程控制(例如熱交換器、給水加熱器和水質)的能力進一步推動了DCS 在工業領域的採用。

- 隨著日本能源需求的增加,人們對在未來 15 至 20 年內建造新發電廠的興趣日益濃厚。因此,核能工業面臨提供高建設量的挑戰。應對這項挑戰的關鍵策略是採用先進的核能發電廠設計,實現模組化建造、高標準標準化、非能動安全功能、減少零件數量並縮短競標到施工時間。反過來,這為所研究市場的成長提供了有利可圖的機會。

- 核能發電廠、化工廠、石化廠和冶金廠擴大使用分散式控制系統,以最大程度地減少故障排除、縮短工程時間並提高效率。預計這一趨勢將顯著推動所研究市場的成長。

- 分散式控制系統為管理維持工廠安全高效運作所需的功能提供了有效的解決方案,但它們並沒有滿足工業領域數位技術的出現所帶來的期望。日本利用工業物聯網技術的智慧儀器和感測器等發展正在改變控制和資料存取的可能性,但將它們整合到分散式控制系統中的難度可能意味著其最大潛力在很大程度上仍未實現。因此,非常需要創新且敏捷的 DCS,同時不影響其可靠、安全地控制和協調大量本地生產資產的主要作用。

工業機器人預計將佔據主要市場佔有率

- 日本是機器人和工廠自動化系統生產的主要企業。日本擁有發達的機器人產業和自動化技術,是世界上在生產過程中採用機器人和自動化技術領先的國家之一。日本統計局預計,2024年日本機器人產業銷售額預計將達163.5億美元,高於2018年的101.8億美元。

- 日本目前在機器人技術領域的領先地位建立在製造業技術領先地位的悠久歷史之上。日本自動化公司目前正受益於其產品需求的強勁成長。

- 隨著整個經濟領域需求的增加,產品製造商正在轉向機器人來自動化一些重複性流程。由於智慧工廠系統的日益普及,過去十年工業機器人市場的需求量很大。這些機器人發揮著重要作用。

- 最新的工業革命工業 4.0 推動了協作機器人和人工智慧機器人等新技術的發展,使企業能夠利用機器人來簡化許多流程、提高效率並消除錯誤。職場安全的改善和生產能力的提高正在推動產業進一步投資機器人系統。

- 此外,工業機器人在不犧牲品質的情況下變得更小、更便宜,這使其成為對最終用戶行業的主要企業有吸引力的市場。然而,增加投資金額也可能阻礙市場成長。日本對工業機器人的需求激增是由於與COVID-19相關的停工和傳統產業升級造成的勞動力短缺所引發的。

日本工廠自動化及工控設備產業概況

日本工廠自動化和工業控制設備市場是一個適度整合的市場,多家公司各自擁有少量的市場力量。工業 4.0 和區域數位化努力為工業機器人市場提供了利潤豐厚的機會。

- 2022年3月-三菱電機公司宣布,在愛知縣尾張旭市收購了42,000平方公尺的土地,並將於2025年4月開始建立新的生產基地,用於製造FA(工廠自動化)控制系統產品。新工廠將採用包括5G通訊在內的多項先進技術,讓機器、自動導引運輸車(AGV)和工人在製造業務過程中同時連接。同時,整個工廠即時高速收集資料,為基於人工智慧的分析提供生產週期各個方面的資料集,從而實現靈活、安全的生產環境。

- 2022 年 2 月Yamaha公佈了支持其工廠自動化銷售網路的舉措。Yamaha Motor Co, Ltd.機器人工廠自動化部門在線上召開了2022年機構會議。它為經銷商推出了一個新的線上門戶,透過提供對零件和配置資訊的輕鬆存取來加速解決方案整合和客戶支援。此外,Yamaha工業機器人的主網站將提供有關機器人配置、編程和操作的額外幫助,並將添加追蹤等功能。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 啟動嚴格的節能標準並促進本地生產?

- 市場挑戰

- 貿易緊張局勢與貨幣政策收緊

- 技術簡介

第6章 市場細分

- 按類型

- 工業控制系統

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控/資料採集 (SCADA)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 人機介面 (HMI)

- 其他工業控制系統

- 透過現場設備

- 機器視覺

- 工業機器人

- 感測器和發射器

- 馬達和驅動器

- 安全系統

- 其他現場設備

- 工業控制系統

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 電力/公共產業

- 飲食

- 汽車/交通

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Yasakawa Electric Corporation

- Fanuc Corporation

- Nidec Corporation

- Fuji Electric Co. Ltd.

- Seiko Epson Corporation

- Shibaura Machine CO

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 47842

The Japan Factory Automation and Industrial Controls Market is expected to register a CAGR of 11% during the forecast period.

Key Highlights

- Automation of manufacturing processes has presented several benefits like effortless monitoring, waste reduction, and production speed. This technology offers customers improved quality with standardization and reliable products within time and at a cheaper cost.

- Connecting the industrial equipment & machinery and acquiring real-time data have played a critical role in the adoption of PLC systems, SCADA, HMI, and software that offer visualization; thus, enabling decreasing the faults in the product, scheduling maintenance, reducing downtime, and switching from being in the reactive state to predictive and prescriptive stages for decision-making.

- The Industrial 4.0 and the Industrial Internet of Things (IIOT) are at the center of new technological approaches for the development, production, and management of the entire logistics chain, otherwise known as smart factory automation, and are dominating trends in the industrial sector, with machinery and devices being connected via the internet.

- Moreover, massive shifts in manufacturing due to industry 4.0 and the acceptance of IoT require enterprises to adopt agile, smarter, and innovative ways to advance production with technologies that complement and augment human labor with automation and reduce industrial accidents caused by process failure.

- According to Zebra's latest Manufacturing Vision Study, smart asset tracking solutions based on IoT and RFID are envisioned to overtake traditional, spreadsheet-based methods by 2022. A study by Industrial IoT (IIoT) company, Microsoft Corporation, established that 85% of companies have at least one IIoT use case project. This number is foreseen to increase, as 94% of respondents said they would implement IIoT strategies by 2021.

- Further, Japan has been a pioneer in transforming into an automated industrial economy. The Industrial version 4.0 is being adopted at a faster pace. The country has materialized as a manufacturing hub for factory automation products and supplies them to other Asian-Pacific regional markets. Also, the presence of multiple automobile manufacturers, the electronic products manufacturing industry, food processing industry makes Japan an important market.

- The COVID-19 pandemic posed many challenges for the manufacturing industry in Japan. The profound change in consumer behavior because of the COVID-19 pandemic is expected to lead to more automation and virtualization. Smart factories and offices are expected to increase, allowing critical functions that currently need to be overseen in person to be monitored remotely or, at a minimum, by fewer people. Hence, the market is predicted to grow during the forecast period. Following the global economic recession led by COVID-19, the factory automation market in Japan noticed a mixed impact from the supply side and a positive effect from the demand side in 1st half of 2020.

- Smart factory initiatives have helped manufacturers to overcome COVID-19 challenges and address issues such as workforce reductions, drops in sales for some specific products, social distancing, and extreme pressure to cut operational costs since most enterprises operating in the end-user industries (majorly manufacturing, automotive) had shuttered down their production sites due to lockdown restrictions.

Japan Factory Automation & Industrial Controls Market Trends

Distributed Control Systems are Expected to Witness a Significant Market Growth

- Distributed Control Systems (DCS) are process-oriented platforms that rely on a network of interconnected sensors, actuators, and controllers, terminals to act as a centralized master controller for a facility's production operations. Resultantly, a DCS focuses on controlling and monitoring processes and allowing facility operators to see all facility operations in one place. DCS enables the implementation of advanced process automation strategies as it operates on a closed-loop control platform. Thus, DCS is suitable for controlling operations at a single facility or factory. Further, a DCS is crucial for maximizing the visibility of a facility's everyday operational processes.

- The control architecture includes a supervisory level of control, overseeing multiply-integrated sub-systems, responsible for controlling the details of a localized process. They are connected to sensors and actuators and utilize setpoint control to control material flow through the plant.

- One of the important benefits of the DCS systems is that the digital communication between workstations, distributed controllers, and other computing elements follows the peer-to-peer access principle. These prerequisites have driven the adoption of DCS, as these systems provide lower operational complexity, project risk, and functionalities like flexibility for agile manufacturing in highly-demanding applications. The ability of DCS to integrate PLCs, turbomachinery controls, safety systems, third-party controls, and various other plant process controls for heat exchangers, feedwater heaters, and water quality, among others, further drives the adoption of DCS in the energy sector.

- With Japan's growing demand for energy, the interest in constructing new power plants over the next 15 to 20 years has increased. This has challenged the nuclear industry to provide a high construction volume. A key strategy to meet this challenge is developing an advanced nuclear power plant design that allows for modular construction, a high level of standardization, passive safety features, a reduced number of components, and a short bid-to-build time. Resultantly, it offers lucrative opportunities for the growth of the studied market.

- There is also an increase in the usage of Distributed Control systems in nuclear power plants, chemical, petrochemical, metallurgical plants, etc., due to minimal troubleshooting requirements, engineering time, enhanced efficiency, etc. This trend is anticipated to drive the growth of the studied market significantly.

- While Distributed Control Systems have delivered an efficient solution for managing the functions required to keep plants operating safely and efficiently, they are struggling to meet the expectations stemming from the emergence of digital technologies in the industrial space. While developments in Japan like smart instrumentation and sensors utilizing IIoT technologies are transforming possibilities for control and access to data, the hardships of integrating them into Distributed Control Systems have meant that, in some cases, their highest potential has remained predominantly unrealized. Therefore, there is a massive demand for innovative and agile DCS without compromising their primary role of reliably and safely controlling and coordinating large numbers of regional production assets.

Industrial Robots are Anticipated to Hold a Major Market Share

- Japan is a major player in the production of robots and factory automation systems. With its well-developed robotic sector and automation technologies, Japan is one of the leading countries to employ robotics and automation in production processes globally. According to the Statistics Bureau of Japan, the industry revenue of robots in the country is likely to reach USD 16.35 billion in 2024 from USD 10.18 billion in 2018.

- Japan's current leadership in robotics was built on a long history of technological leadership in manufacturing. Currently, Japanese automation companies are benefiting from strong growth in demand for their products.

- With increased demand across economies, product manufacturers are adopting robots to automate some of the repetitive processes. The industrial robot market has witnessed a huge demand over the past decade, owing to the rising adoption of smart factory systems. These robots play a crucial part.

- Industry 4.0, the most recent industrial revolution, has fueled the evolution of new technologies, like collaborative robots, AI-enabled robots, etc., and has facilitated enterprises to utilize robots to streamline many processes, improve efficiency, and eliminate errors. Augmented workplace safety and improved production capabilities have further driven industries to invest in robotic systems.

- Additionally, industrial robots are becoming smaller and cheaper without compromising quality; the market is becoming attractive for key players in several end-user industries. However, higher investments may hamper the growth of the market. The upsurge in demand for industrial robots in Japan was triggered by a shortage of workers who remained off duty because of COVID-19-related lockdowns and an upgrade of traditional industries.

Japan Factory Automation & Industrial Controls Industry Overview

The Japan Factory Automation and Industrial Control Market is a moderately consolidated market with several firms in the market, each having a small level of market dominance. Industry 4.0 and digitalization initiatives across regions provide lucrative opportunities in the industrial robots market.

- March 2022 - Mitsubishi Electric Corporation announced that it had acquired 42,000 square meters of land in OwariasahiCity, Aichi Prefecture, Japan, to establish a new production site to manufacture factory automation (FA) control system products from April 2025. The new factory would employ numerous advanced technologies like 5G communication, permitting simultaneous connection of machines, automatic guided vehicles (AGVs), and human workers as they perform their manufacturing duties. In parallel, real-time and high-speed data acquisition throughout the factory will deliver data sets on all facets of the production cycle for Artificial Intelligence based analysis to realize a flexible and safe production environment.

- February 2022 - Yamaha Revealed Initiatives to Support Factory-automation Sales Network. Yamaha Motor Robotics Factory Automation section has held its 2022 annual distributor meeting online. Among new initiatives revealed during the meeting, a new online portal for agents was introduced that accelerates solution integration and customer support by easing access to parts and setup information. In addition, the main Yamaha industrial robots website is claimed to provide extra help to configure, program, and operate the robots and add capabilities like tracking.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Covid-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing?

- 5.2 Market Challenges

- 5.2.1 Trade Tensions and Monetary Policy Tightening

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Programable Logic Controller (PLC)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Manufacturing Execution System (MES)

- 6.1.1.6 Human Machine Interface (HMI)

- 6.1.1.7 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision

- 6.1.2.2 Industrial Robotics

- 6.1.2.3 Sensors and Transmitters

- 6.1.2.4 Motors and Drives

- 6.1.2.5 Safety Systems

- 6.1.2.6 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Food and Beverage

- 6.2.5 Automotive and Transportation

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Ltd

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Yasakawa Electric Corporation

- 7.1.11 Fanuc Corporation

- 7.1.12 Nidec Corporation

- 7.1.13 Fuji Electric Co. Ltd.

- 7.1.14 Seiko Epson Corporation

- 7.1.15 Shibaura Machine CO

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219