|

市場調查報告書

商品編碼

1640375

中國工廠自動化與工業控制:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Factory Automation And Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

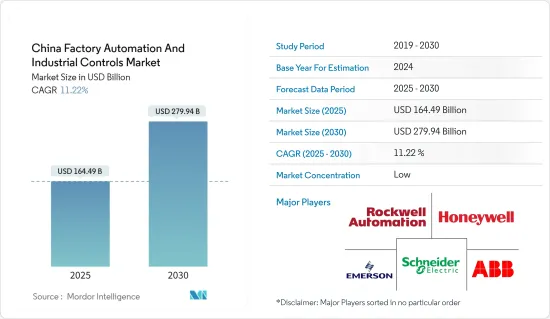

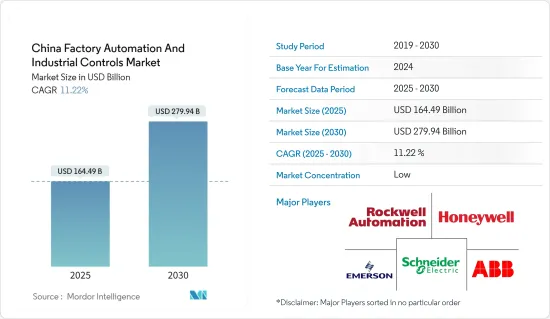

預計2025年中國工廠自動化和工業控制市場規模為1,644.9億美元,2030年將達2,799.4億美元,預測期間(2025-2030年)複合年成長率為11.22%。

主要亮點

- 各種製造設備的技術進步和創新正在推動自動化技術的採用。

- 中國的數位化和工業 4.0舉措極大地刺激了各行業自動化的發展,需要更多創新和自動化解決方案(例如機器人和控制系統)來改善生產流程。由於其製造能力和政府對工廠、基礎設施和機械的投資,中國經濟經歷了令人矚目的成長。

- 中國在工業機器人市場上處於領先地位,並推動了該地區的工廠自動化之路。該國也是亞太地區世界領先的製造業國家之一。國內工業機器人出貨量的增加以及各種工業控制系統軟體在全國範圍內的採用正在推動大規模工廠自動化。

- 隨著智慧製造的引入,中國自動化可望拓展智慧化。據工業信部介紹,過去幾年,我國已啟動了100多個智慧生產先導計畫。此外,2022年6月,深圳市發表了《智慧機器人產業叢集培育發展行動計畫》。 2023年6月,北京市政府公佈了《北京市機器人產業創新發展行動計畫(2023-2025年)》。

- 政府的獎勵和目標提高了中國市場進入工廠自動化的潛力。 《中國製造2025》計畫鼓勵國內參與企業減少對外國參與企業的依賴。中國人事費用的快速上升和製造業勞動力供應的下降也推動了工業機器人和工廠自動化的普及。

- 政府對採購計畫的大力支持也支持向工業 4.0 的過渡。例如,中國工業機器人製造商新鬆與中國科學院合作,中國科學院又與政府合作。

- 隨著中國生產成本上升以及人民幣兌美元走強,投資者將注意力轉向生產所在地。然而,製造商應關注高品質生產和環保製造法規。隨著技術的發展,完全自動化的設施需要數年時間來調整和發展。另一方面,由於主動自動化適應方面的不利或延遲努力,以地區為基礎上的成長受到限制。

中國工廠自動化與工業控制市場趨勢

分散式控制系統領域預計將佔據主要市場佔有率

- DCS 是一個以流程為導向的平台,依靠互連的感測器、控制器、終端和致動器作為設施生產營運的集中主控制器。因此,DCS著重於製程控制和監控,使設備操作員能夠從一個位置查看所有設備的運作情況。

- DCS 系統的主要優點之一是分散式控制器、工作站和其他運算元件之間的數位通訊遵循P2P存取的原則。在石化、核能工業、石油和天然氣工業等製程工業中,對控制器的需求不斷增加,這些控制器可以在指定的設定點附近提供指定的製程公差,以實現更高的精度和控制。

- 此外,許多需求正在推動 DCS 的採用。這些系統降低了操作複雜性、計劃風險,並提供了諸如在要求苛刻的應用中實現敏捷製造的靈活性等功能。 DCS 整合各種工廠製程控制(例如 PLC、渦輪機械控制、安全系統、第三方控制、熱交換器、給水加熱器和水質)的能力進一步推動了 DCS 在能源領域的採用。

- 中國發電的發展正在推動對分散式控制系統(DCS)的需求。根據中電聯發布的《2023年全國消費性電子電力產業統計資料》,2023年我國發電總裝置容量為2919.6吉瓦。

- 2022年1月,中國宣布採用雙控系統控制能源消耗。未來,能源消費量和基本單位將轉變為二氧化碳排放和電力的「雙控系統」。這些努力預計將在 2024 年至 2029 年間加速主要製造工廠採用 DCS 系統。

石油和天然氣產業預計將大幅成長

- 石油和天然氣平台地理位置分散,需要適當的通訊系統。 PLC、SCADA、DCS、安全自動化等解決方案的發展得益於中國龐大的工業發展。我們也預期對自動化產品(包括 DCS 系統)的大規模需求。

- 2023年3月,沙烏地阿美簽署最終協議,以246億元人民幣(36億美元)收購深圳上市公司熔盛石化10%的股權。根據該策略協議,阿美公司將向熔盛集團的子公司浙江石化每天供應48萬桶阿拉伯原油,作為與該公司正在進行的長期銷售協議的一部分。

- 此外,石油和天然氣產業也受到有關安全、工廠可靠性和效率的多項政府法規的約束。 ICS應用於遠端終端單元(RTU)以及泵站和壓縮站以確保安全。

- 業界擴大採用 ICS 解決方案,以在不影響生產效率的情況下保持安全和環境完整性。自動化有助於整合資訊和控制、電力和安全解決方案,以滿足負擔得起的能源和嚴格的政府法規的要求。

- 此外,由於石油和天然氣行業對自動化的高需求,Seeq 正在為其 CygNet 企業監控和資料採集 (SCADA) WellSite 資訊傳輸標記語言 (WITSML)資料存儲系統引入新的連接器,並擴大了我們的支援範圍。這使得在當今充滿挑戰的工業環境中能夠進行高階分析和資料驅動的決策。

- 近年來,石油和燃氣公司在網路安全技術上投入了大量資金,包括事件回應解決方案和軟體,可以從ICS環境中收集日誌,提高網路可見度和分段,以及行動和消除直接威脅。

- 各行業擴大採用 ICS 解決方案,以在不影響生產效率的情況下保持安全和環境完整性。自動化有助於整合資訊和控制、電力和安全解決方案,以滿足負擔得起的能源和嚴格的政府法規的要求。

中國工廠自動化與工業控制產業概況

中國的工廠自動化和工業控制市場高度細分,擁有多家知名企業。公司不斷投資於策略夥伴關係和產品開發,以獲得市場佔有率。我們將介紹一些最近的市場發展趨勢。

- 2024 年 3 月 - 羅克韋爾自動化宣布與 Nvidia 合作,加速下一代工業架構的發展。為了幫助自動化客戶實現工業流程數位化,羅克韋爾計劃透過建造未來工廠來推動產業發展。

- 2024 年 2 月 - ABB 宣布計劃在汽車、消費品、教育、醫療保健、零售和新能源等新興領域利用人工智慧和機器人技術的整合。這項策略性舉措旨在透過為中國各地的機器人應用引入新的自主水平,為客戶創造更多價值。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 由於工作人口減少,自動化技術興起

- 市場問題

- 行業法規政策

第6章 市場細分

- 按類型

- 工業控制系統

- 集散控制系統(DCS)

- PLC(可程式邏輯控制器)

- SCADA(監控/資料採集)

- 產品生命週期管理 (PLM)

- 人機介面 (HMI)

- 製造執行系統(MES)

- 企業資源規劃系統(ERP)

- 其他工業控制系統

- 現場設備

- 感測器和發射器

- 馬達和驅動器

- 工業機器人

- 機器視覺系統

- 其他現場設備

- 工業控制系統

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 電力/公共產業

- 汽車/交通

- 藥品

- 飲食

- 其他

第7章 競爭格局

- 公司簡介

- General Electric Company

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 52079

The China Factory Automation And Industrial Controls Market size is estimated at USD 164.49 billion in 2025, and is expected to reach USD 279.94 billion by 2030, at a CAGR of 11.22% during the forecast period (2025-2030).

Key Highlights

- The evolution of technological advancements and innovations across various manufacturing units has encouraged the adoption of automation technologies.

- Digitization and Industry 4.0 initiatives in China have significantly stimulated the growth of automation among industries by necessitating more innovative and automated solutions, such as robotics and control systems, to improve production processes. China's economy witnessed impressive growth due to its manufacturing capabilities and the government's investments in factories, infrastructure, and machinery.

- China has led the industrial robot market, driving its way to factory automation in the region. The country is also one of the leading manufacturing countries globally in Asia-Pacific. The increase in the shipment of industrial robots in the country and the adoption of various industrial control system software across the country facilitates factory automation at scale.

- Automation in China is expected to be augmented by the uptake of intelligent manufacturing. According to the Ministry of Industry and Information Technology, the country has initiated over 100 pilot projects for intellectual manufacturing in the past few years. Also, in June 2022, Shenzhen announced the Action Plan for Cultivating and Developing Intelligent Robot Industry Clusters. In June 2023, the Beijing Municipal government announced the Beijing Robot Industry Innovation and Development Action Plan (2023-2025).

- Government incentives and targets have advanced the potential of the Chinese market to dive into factory automation. Made in China 2025 plan encourages domestic players to decrease their dependency on foreign players. The rapidly soaring labor costs and declining manufacturing labor force supply in China are also helping in the penetration of industrial robots and factory automation.

- The government's strong support in the acquisition program has helped the country move towards Industry 4.0. For instance, Siasun, a China-based industrial robot maker, is affiliated with the Chinese Academy of Sciences, which is further linked to the government.

- With the rising cost of production in China and the strengthening of the Yuan against the Dollar, investors have been looking at alternate manufacturing destinations. However, manufacturers need to focus on quality production and environment-friendly manufacturing regulations. With the growing technology, a fully automated facility takes years to adjust and evolve. Meanwhile, unfavorable or delayed initiatives on active automation adaptation have limited growth on a regional basis.

China Factory Automation And Industrial Controls Market Trends

The Distributed Control System Segment is Expected to Hold a Significant Market Share

- DCS are process-oriented platforms that depend on interconnected sensors, controllers, terminals, and actuators to act as a centralized master controller for a facility's production operations. Thus, a DCS focuses on controlling and monitoring processes and allowing facility operators to see all facility operations from one place.

- One of the significant benefits of the DCS system is that the digital communication between distributed controllers, workstations, and other computing elements follows the peer-to-peer access principle. To achieve greater precision and control in process industries, like the petrochemical, nuclear, and oil and gas industries, there is an increasing demand for controllers that offer specified process tolerance around an identified set point.

- Moreover, many requirements have driven the adoption of DCS, as these systems provide lower operational complexity, project risk, and functionalities like flexibility for agile manufacturing in highly demanding applications. The ability of DCS to integrate PLCs, turbomachinery controls, safety systems, third-party controls, and various other plant process controls for heat exchangers, feedwater heaters, and water quality further drives the adoption of DCS in the energy sector.

- The growth in electric power generation in China is developing demand for distributed control systems (DCS). According to the national power industry statistics for the 2023 report published by CEC, the total installed electricity generation capacity in China in 2023 was 2919.6 gigawatts.

- In January 2022, China announced the use of dual control systems to control energy consumption. In the future, energy consumption and intensity will be transformed into a "dual control system" for carbon emissions and power. These initiatives will accelerate the adoption of the DCS system in the major manufacturing facilities between 2024 and 2029.

The Oil and Gas Sector is Expected to Register a Significant Growth

- The geographically dispersed oil and gas platforms require proper communication systems. Growth in solutions like PLC, SCADA, DCS, and safety automation is attributed to the enormous development of industries in China. It is also expected to create a massive demand for automation products that include DCS systems.

- In March 2023, Aramco signed definitive agreements to acquire a 10% shareholding in Shenzhen-listed Rongsheng Petrochemical Co. Ltd for CNY 24.6 billion (USD 3.6 billion); this would significantly expand its downstream presence in China. Under the strategic agreement, as part of an ongoing long-term sales arrangement with Rongsheng's subsidiary Zhejiang Petroleum and Chemical Co. Ltd, Aramco would supply this company with 480,000 barrels of Arabian crude oil daily.

- Moreover, the oil and gas industry is subject to several government regulations for safety, plant reliability, and efficiency. ICS finds applications in remote terminal units (RTU) and pumping and compression stations to ensure safety.

- The industry increasingly adopts ICS solutions to maintain safety and environmental integrity without compromising production efficiency. Automation helps integrate information and control, power, and safety solutions to meet the requirements of affordable energy and stringent government regulations.

- Moreover, owing to the high demand for automation in the oil and gas industry, Seeq expanded its support for the oil and gas industry by introducing new connectors to CygNet enterprise Supervisory Control and Data Acquisition (SCADA) Wellsite Information Transfer Markup Language (WITSML) data storage systems. This enables advanced analytics and faster data-based decision-making in the current challenging industry environment.

- Over the past few years, oil and gas companies have invested heavily in cybersecurity technologies, such as incident response solutions and software capable of collecting logs in ICS environments to enhance visibility and segmenting networks, prevent lateral movement, and eliminate imminent threats.

- The industry increasingly adopts ICS solutions to maintain safety and environmental integrity without compromising production efficiency. Automation helps integrate information and control, power, and safety solutions to meet the requirements of affordable energy and stringent government regulations.

China Factory Automation And Industrial Controls Industry Overview

The Chinese factory automation and industrial controls market is highly fragmented, with the presence of several prominent companies. Companies continuously invest in strategic partnerships and product developments to gain market share. Some of the recent developments in the market are:

- March 2024 - Rockwell Automation announced that it is collaborating with NVIDIA to accelerate the next-generation industrial architecture. To make it easier for automation customers to digitalize industrial processes, Rockwell plans to evolve the industry by building a future factory.

- February 2024 - ABB announced that it plans to leverage this integration of AI with robotics in sectors such as automotive, consumer goods, education, and emerging areas like healthcare, retail, and new energy. This strategic move aims to create additional value for customers by introducing new levels of autonomy in robotic applications across China.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Prominence of Automation Technologies Due to Declining Workforce

- 5.2 Market Challenges

- 5.2.1 Industry Policies and Regulations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 PLC (Programmable Logic Controller)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Human Machine Interface (HMI)

- 6.1.1.6 Manufacturing Execution System (MES)

- 6.1.1.7 Enterprise Resource Planning (ERP)

- 6.1.1.8 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Sensors and Transmitters

- 6.1.2.2 Electric Motors and Drives

- 6.1.2.3 Industrial Robotics

- 6.1.2.4 Machine Vision Systems

- 6.1.2.5 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Automotive and Transportation

- 6.2.5 Pharmaceuticals

- 6.2.6 Food and Beverage

- 6.2.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 General Electric Company

- 7.1.2 Schneider Electric SE

- 7.1.3 Rockwell Automation Inc.

- 7.1.4 Honeywell International Inc.

- 7.1.5 Emerson Electric Company

- 7.1.6 ABB Ltd

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 Siemens AG

- 7.1.9 Omron Corporation

- 7.1.10 Yokogawa Electric Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219