|

市場調查報告書

商品編碼

1627094

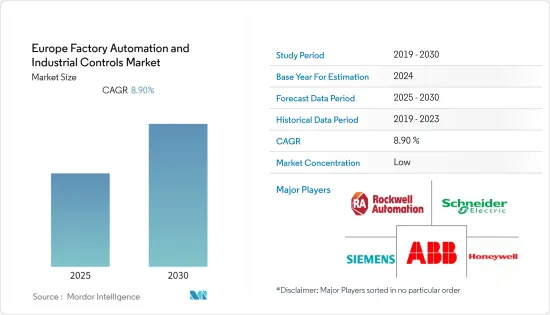

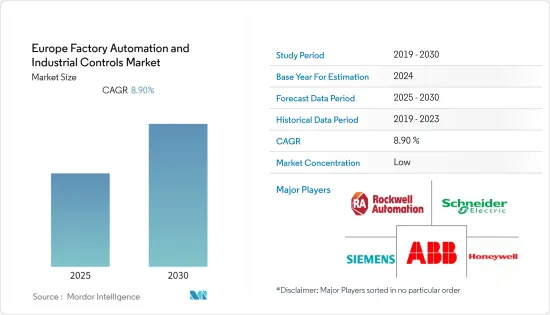

歐洲工廠自動化與工業控制:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Factory Automation and Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

歐洲工廠自動化和工業控制市場預計在預測期內複合年成長率為 8.9%

主要亮點

- 快速加劇的競爭和不斷變化的最終用戶需求迫使該地區的製造業採用更新的技術創新和數位轉型解決方案,以提高業務流程的效率。例如,馬達和感測器等現場設備為汽車行業提供了快速響應市場需求、減少製造停機時間、提高供應鏈效率和擴大生產力的機會。

- 此外,該地區各行業對工業自動化的採用有所增加,各大公司將工業自動化產品推向市場。例如,能源管理和自動化數位轉型的參與企業施耐德電機發布了 ClimaSys 智慧通風系統。它是一種智慧解決方案,用於在新建或重建應用中過濾和管理跨多個控制和配電盤的氣流。

- 根據經合組織的數據,德國將其GDP的2.88%用於製造業創新,顯著高於經合組織2.4%的平均值。近年來,德國汽車工業顯著擴大了在汽車生產中的全球地位。此外,製造業的永續性預計將成為所研究市場的主要促進因素。

- 此外,能源產業正在採取各種措施來增加輸電能力,例如智慧電網。因此,在預測期內工業控制系統的使用可能會增加。

- 俄羅斯政府已表示有興趣替代食品生產的進口。食品進口禁令可能會導致該國食品工業的發展和擴張,需要對現代加工和包裝技術進行進一步投資。此外,政府規劃了《醫藥2020戰略》,重點發展醫藥產業。目標是減少俄羅斯經濟對進口藥品的依賴,預計將鼓勵市場投資。

歐洲工廠自動化和工業控制市場趨勢

汽車產業推動市場成長

- 汽車工業是重要的產業之一,在全球自動化製造設備中佔有很大佔有率。各種汽車製造商的生產設施都實現了自動化,以保持效率。以電動車取代傳統汽車的趨勢日益明顯,預計將進一步擴大汽車產業的需求。

- 汽車業最關心的是計劃工期。因此,快速回報計劃與低成本自動化和成本創新相結合,正在幫助製造商透過提高生產力來更好地競爭。製造過程中擴大採用自動化、數位化和人工智慧的參與是推動汽車產業對工業機器人需求的關鍵因素。

- 瑞銀預計,到2025年,歐洲電動車銷量預計將達到633萬輛,其次是中國,銷量為484萬輛。隨著歐洲引領電動車需求,預計該地區將出現越來越多的智慧汽車工廠。

- 機器人和自動化在歐洲汽車行業的不斷成長預計將進一步刺激該地區的智慧工廠。此外,德國擁有歐洲最集中的汽車OEM製造商工廠。該國OEM工廠的進一步增加預計將增加對工業控制系統的需求。

德國佔有很大的市場佔有率

- 德國不僅是歐洲領先的自動化設備消費國,也是歐洲領先的自動化設備製造商。西門子、施耐德電氣和庫卡等幾家主要的自動化和控制設備公司的總部都在德國,這意味著他們在研發活動上投入大量資金。

- 該國對自動化解決方案的需求正在迅速成長。例如,2019 年 8 月,KUKA訂單。這些智慧自動駕駛車輛可以向機器人和機器餵料,並完美地控制生產過程。此外,印度與德國在工業4.0方面的合作預計將促進市場成長。

- 根據國際機器人聯合會 (IFR) 最近的估計,德國的機器人密度位居世界第三(每 10,000 名工人擁有 338 台機器人),僅次於新加坡和韓國。 IFR預測,隨著各產業尤其是汽車產業對機器人的需求不斷增加,2018年至2020年德國的年供應量可能會繼續以每年至少5%的速度成長。該國工業機器人供應量的增加預計將推動市場研究。

- 國家正在建構完整的5G生態系統,這將進一步加快工業數位化的步伐。這加強了德國在國際競爭中的地位。最近,德國電信業者德國電信為其基於 5G 的智慧工廠生態系統增添了新的合作夥伴。新的合作夥伴是 EK Automation、Konica Minolta和 Endress+Hauser。

歐洲工廠自動化和工業控制產業概況

由於眾多參與企業,歐洲工廠自動化和工業控制市場競爭非常激烈。參與企業從事產品開發、夥伴關係、併購和收購等策略活動。

- 2020 年 8 月 - 能源管理和自動化數位轉型的領導者Schneider Electric透過收購 ProLeiT AG 擴大了其產品組合,加強了其對整體和軟體支援的自動化的承諾。 ProLeiT AG 提供具有整合製造執行系統 (MES) 功能的製程控制系統 (PCS),針對消費品市場進行了最佳化,包括食品和飲料、化學品和生命科學領域。

- 2020 年 3 月 - 自主機器人揀選解決方案供應商 RightHand Robotics (RHR) 在德國法蘭克福設立了銷售和業務開發辦事處,繼續其全球擴張。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 人們對能源效率和降低成本的興趣日益濃厚

- 市場限制因素

- 貿易摩擦與實施挑戰

第6章 行業標準和法規

第7章 市場區隔

- 依產品

- 工業控制系統

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控/資料採集(SCADA)

- 產品生命週期管理 (PLM)

- 人機介面 (HMI)

- 製造執行系統(MES)

- 企業資源規劃(ERP)

- 其他工業控制系統

- 現場設備

- 機器視覺系統

- 機器人(工業)

- 感測器和發射器

- 馬達與驅動器

- 其他現場設備

- 工業控制系統

- 按最終用戶產業

- 車

- 化學/石化

- 公共產業

- 製藥

- 飲食

- 石油和天然氣

- 其他

- 國家名稱

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區

第8章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Robert Bosch GmbH

- Yokogawa Electric Corporation

第9章投資分析

第10章 投資分析市場的未來展望

簡介目錄

Product Code: 48814

The Europe Factory Automation and Industrial Controls Market is expected to register a CAGR of 8.9% during the forecast period.

Key Highlights

- With a rapid increase in competition and evolving end-user requirements, manufacturing units in the region are being forced to adopt newer technological innovations and digital transformation solutions to make their business process as efficient as possible. For instance, field devices, like motors and sensors, among others, offer opportunities to the auto industry to react faster to market requirements, reduce manufacturing downtimes, and enhance the efficiency of supply chains, and expand productivity.

- The region is also adopting industrial automation in various industries, with major firms launching industrial automation products in the market. For instance, Schneider Electric, a player in the digital transformation of energy management and automation, announced the ClimaSys smart ventilation system, which is an intelligent solution for filtering and managing the airflow for multiple control panels or electrical distribution cabinets in new or renovated applications.

- According to OECD, Germany spends 2.88% of its GDP into manufacturing innovation, well ahead of the OECD average of 2.4%. The German automotive industry has extended its worldwide position in automotive production, significantly, over the past few years. Moreover, sustainability in the manufacturing sector is expected to be a major driver for the market studied.

- Furthermore, various measures are being taken to boost power transmission capacity, such as smart grid, in the energy landscape The measures by the four national grid operators, to boost power transmission capacity, add up to a cost of EUR 50 billion. This is likely to escalate the usage of industrial control systems during the forecast period.

- The Russian government is showing interest in import substitution of food production. The ban on imports of food could lead to the development and expansion of the country's food industry, further demanding investment in modern technology for processing and packaging. Also, the government is focused on creating its pharmaceutical industry by planning 'Pharma 2020 Strategy'. Its goal is to reduce the reliance on the Russian economy on imported pharmaceuticals, which is expected to drive investments in the market.

Europe Factory Automation & Industrial Controls Market Trends

Automotive Industry to Drive the Market Growth

- The automotive industry is among the prominent sectors that hold a significant share of the world's automated manufacturing facilities. The production facilities of various automakers are automated to maintain efficiency. The growing trend of replacing conventional vehicles with EVs is expected to augment the automotive industry's demand further.

- The primary concern of the automotive industry is the length of a project. Hence, quick return-on-investment projects, combined with low-cost automation and cost innovation, are helping the manufacturers improve competitiveness through productivity improvement. The growing adoption of automation in manufacturing processes and digitization and AI involvement are primary factors driving industrial robots' demand in the automotive sector.

- According to UBS, the projected electric vehicle sales in Europe are expected to reach 6.33 million units by 2025, followed by China, with 4.84 million units. As Europe is leading the electric vehicles' demand, the region is anticipated to see an increase in smart automotive factories' implementation.

- The growing presence of robots and automation in the European automotive industries is further expected to fuel the region's smart factory. Additionally, Germany also possesses the largest concentration of automotive OEM plants in Europe. A further increase in OEM sites in the country is expected to increase industrial control systems' demand.

Germany Holds Significant Market Share

- Germany is not only a major consumer of automation equipment, but it is also a major manufacturer of automation equipment in Europe. Several major players of automation and control equipment, such as Siemens, Schneider Electric, KUKA, etc., are based out of Germany, thus driving a high investment flow toward R & D activities.

- The country has been witnessing rapid growth in the demand for automation solutions. For instance, in August 2019, KUKA received an order for 22 KMP 1500s from an automotive customer. These intelligent, autonomous vehicles can supply materials to robots and machines, perfectly timing the production process. Additionally, a collaboration between India and Germany in Industry 4.0 is expected to augment the market growth.

- According to the recent estimates from the International Federation of Robotics (IFR), Germany has the third most robot density in the world (338 units per 10,000 workers), after Singapore and South Korea. IFR estimates that the annual supply in Germany may continue to grow by at least 5% on average per year, between 2018 and 2020, due to the increasing demand for robots in various industries, with a focus on the automotive industry. This increasing supply of industrial robots in the country is expected to drive the market studied.

- There is the development of a complete 5G ecosystem in the country, which will further accelerate the pace of digitization in the industry. This will strengthen Germany's position in global competition. Recently, Deutsche Telekom, a German telecommunications company, added new partners for its 5G-based smart factory ecosystem. The new partners are EK Automation, Konica Minolta, and Endress+Hauser.

Europe Factory Automation & Industrial Controls Industry Overview

The European factory automation and industrial controls market is competitive due to several players in the market. Players are involved in product development and strategic activities such as partnerships, mergers, and acquisitions.

- August 2020 - Schneider Electric, the digital transformation leader of energy management and automation, is expanding its portfolio and reinforcing its commitment to holistic and software-supported automation through the acquisition of ProLeiT AG. ProLeiT AG provides Process Control Systems (PCS) with an integrated Manufacturing Execution System (MES) functions optimized for the Consumer Packed Goods marketplace, including the Food and Beverage, Chemicals, and Life Sciences segments

- March 2020 - RightHand Robotics (RHR), a provider of autonomous robotic picking solutions, continues for its global expansion by establishing a sales and business development office in Frankfurt, Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 An Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Energy Efficiency and Cost Reduction

- 5.2 Market Restraints

- 5.2.1 Trade Tensions and Implementation Challenges

6 INDUSTRY STANDARDS AND REGULATIONS

7 MARKET SEGMENTATION

- 7.1 By Product

- 7.1.1 Industrial Control Systems

- 7.1.1.1 Distributed Control System (DCS)

- 7.1.1.2 Programmable Logic Controller (PLC )

- 7.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 7.1.1.4 Product Lifecycle Management (PLM)

- 7.1.1.5 Human Machine Interface (HMI)

- 7.1.1.6 Manufacturing Execution System (MES)

- 7.1.1.7 Enterprise Resource Planning (ERP)

- 7.1.1.8 Other Industrial Control Systems

- 7.1.2 Field Devices

- 7.1.2.1 Machine Vision Systems

- 7.1.2.2 Robotics (Industrial)

- 7.1.2.3 Sensors and Transmitters

- 7.1.2.4 Motors and Drives

- 7.1.2.5 Other Field Devices

- 7.1.1 Industrial Control Systems

- 7.2 By End-user Industry

- 7.2.1 Automotive

- 7.2.2 Chemical and Petrochemical

- 7.2.3 Utility

- 7.2.4 Pharmaceutical

- 7.2.5 Food and Beverage

- 7.2.6 Oil and Gas

- 7.2.7 Other End-user Industries

- 7.3 Country

- 7.3.1 United Kingdom

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Rest of Europe

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Schneider Electric SE

- 8.1.2 Rockwell Automation Inc.

- 8.1.3 Honeywell International Inc.

- 8.1.4 Emerson Electric Company

- 8.1.5 ABB Ltd

- 8.1.6 Mitsubishi Electric Corporation

- 8.1.7 Siemens AG

- 8.1.8 Omron Corporation

- 8.1.9 Robert Bosch GmbH

- 8.1.10 Yokogawa Electric Corporation

9 INVESTMENT ANALYSIS

10 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219