|

市場調查報告書

商品編碼

1628752

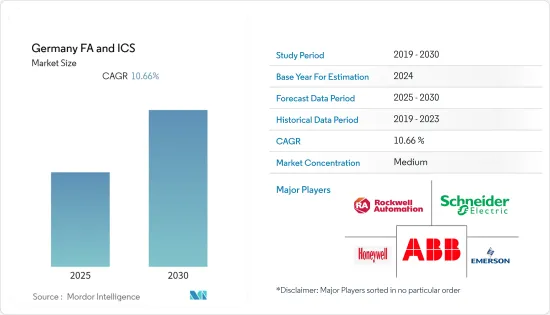

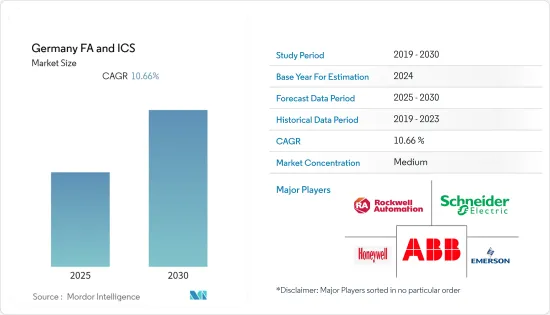

德國 FA 和 ICS:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Germany FA and ICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

德國FA和ICS(工廠自動化和工業控制系統)市場預計在預測期內複合年成長率為10.66%

主要亮點

- 根據經濟合作暨發展組織,德國將其GDP的2.88%投資於製造業創新,顯著高於經合組織2.4%的平均水準。近年來,德國汽車工業顯著提升了其在汽車生產領域的世界領先地位。此外,製造業的永續性預計將成為相關市場的關鍵促進因素。

- 協作機器人 (Cobot) 在汽車製造商和供應商中越來越受歡迎。這些技術通常更小、更靈巧,並且可以安全地與人類操作員一起使用。例如,寶馬依靠協作機器人來改善工廠工人的安全並提高所生產的商品和零件的品質。其他公司也是如此,包括日產和福特(尤其是他們的德國工廠)。

- 隨著德國加大對工廠自動化的投資,最終用戶也開始關注採用高解析度視覺感測器,這些感測器可以在一張影像中執行多次檢查,以產生豐富的流程和品質資料。為了滿足市場需求,該地區的供應商正在推出最新版本的感測器,並展示採用 3D 技術原理的創新產品。例如,2021 年 3 月,Sensopart 推出了 Visor V50,這是一款 500 萬像素感測器,內建鏡頭和照明,可靈活體組織切片測不同距離的物體。

- 此外,最近攻擊者利用控制器漏洞來破壞操作的情況增加。實施 ICS 是一項挑戰,因為需要使用各種通訊協定來確保 ICS 網路的安全。此外,操作技術供應商使用自己的 IEC-61131 標準實作來實現可程式邏輯控制器。

德國FA和ICS(工廠自動化和工業控制系統)市場趨勢

馬達領域大幅成長

- 由於工業化程度不斷提高以及各行業自動化程度的普遍提高,北美地區對馬達的需求不斷增加。因此需要更大、更節能的馬達來最大限度地減少額外的生產成本。

- 由於馬達在關鍵工業運作中的廣泛採用,加工廠中馬達的數量正在增加。此類資產的管理和監控對於防止核心流程錯誤(例如成分的正確混合)至關重要。

- 整合馬達控制、自動化和能源管理有助於降低成本,同時提高產量。此外,智慧馬達控制提供每個馬達的能耗資料,設備的資料可以透過Schneider Electric等公司提供的能源監控系統來擷取。

- 最近,即 2021 年 5 月,Schneider Electric與聯合電子與自動化公司合作,以適合小型面板製造商、OEM、系統整合商、工業承包商等的價格分佈生產高品質的馬達控制和保護設備。

- TeSys 產品線基於Schneider全功能 TeSys 產品線,提供簡單易用的解決方案,480V 時短路額定值高達 35kA。可從 Allied 的電子商務網站輕鬆存取。在國內,這種分銷商-供應商聯盟正在創造市場成長的潛力。這些因素可能會在預測期內促進該地區馬達的擴張。

汽車、交通運輸大幅成長

- 製造過程中擴大採用自動化、數位化和人工智慧的參與是推動該國汽車產業對工業機器人需求的主要因素。

- 例如,具有高承重能力和延伸臂功能的大型工業機器人可以點焊重型車身面板。小型機器人焊接輕型零件,例如安裝座和支架。機器人鎢極惰性氣體焊接機和金屬惰性氣體焊接機可以在每個循環期間將焊槍定位在完全相同的方向。此外,可重複的電弧和速度間隙使得在所有操作中保持高焊接標準成為可能。

- BMW位於德國雷根斯堡的智慧工廠宣布,科技將有助於在 2020 年將品質問題減少 5%。我們還能夠將部署新應用程式所需的時間減少 80%。德國汽車和航太製造商正在尋求工程服務供應商幫助他們實施 5G、人工智慧和物聯網等新技術,以改善他們的產品和流程。

- 德國一直處於向零排放汽車和電動車製造工廠轉型的前沿。作為走在轉型前沿的幾家製造商之一,漢高建立了獨特的雲端基礎的系統,連接 30 多個設施和 10 個物流地點。另一家產業領導者 Alice Gleaner Company (AGCO) 使用類似的技術將數位解決方案和智慧生產線設計相結合,在一條組裝上生產九種不同的曳引機系列。

- 德國是世界上最大的汽車製造商之一,包括奧迪、寶馬、保時捷、福斯、賓士等。它也是電動和自動駕駛汽車的主要製造商。歐洲汽車工業協會(ACEA)的數據顯示,2020年第二季度,電動和充電汽車的市場佔有率佔歐洲汽車總銷量的7.2%,而2019年同期為2.4%。

德國FA和ICS(工廠自動化和工業控制系統)概述

德國 FA 和 ICS 市場適度整合,有一些大型企業的存在。公司不斷投資於策略聯盟和產品開發,以增加市場佔有率。以下是近期的一些市場趨勢:

- 2021 年 5 月 - 艾默生宣布推出 PACEdge 工業邊緣平台。 PACEdge 平台將開放原始碼技術結合到一個多功能、整合且安全的平台中以利用機器資料,從而簡化了應用程式創建。

- 2021 年 4 月 - Google Cloud 和西門子合作簡化生產業務並提高現場效率。西門子計畫將Google雲端的頂級資料雲和人工智慧/機器學習(AI/ML)功能整合到其工廠自動化解決方案中,以協助製造商進行製造流程。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力 - 波特的 5 點

力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 自動化技術的興起

- 更加關注成本最佳化和業務流程改進

- 市場挑戰

- 安裝成本高

- 技術簡介

第6章 市場細分

- 按類型

- 工業控制系統

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 監控/資料採集 (SCADA)

- 產品生命週期管理 (PLM)

- 製造執行系統(MES)

- 人機介面 (HMI)

- 其他工業控制系統

- 透過現場設備

- 機器視覺

- 工業機器人

- 馬達

- 安全系統

- 感測器和發射器

- 其他現場設備

- 工業控制系統

- 按最終用戶產業

- 石油和天然氣

- 化工/石化

- 電力/公共產業

- 飲食

- 汽車/交通

- 製藥

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Dassault Systems

- Autodesk Inc.

- Robert Bosch GmbH

- Texas Instruments, Inc.

第8章投資分析

第9章 未來展望

簡介目錄

Product Code: 53151

The Germany FA and ICS Market is expected to register a CAGR of 10.66% during the forecast period.

Key Highlights

- According to the Organisation for Economic Co-operation and Development(OECD), Germany invests 2.88 % of its GDP in manufacturing innovation, well above the OECD average of 2.4 %. Over the last few years, the German automotive industry has dramatically increased its global position in car production. Furthermore, the manufacturing sector's sustainability is projected to be a significant driver for the market under consideration.

- Cobots, or collaborative robots, are becoming more popular among automakers and suppliers. These technologies are typically smaller, have greater dexterity, and can be used safely alongside human operators. For instance, BMW relies on cobots to improve the safety of workers within its plat and for the quality of goods and components produced. Other companies following the same include Nissan, Ford - specifically in their Germany, plant.

- With increased investments for factory automation in the country, the end-users are also focusing on adopting high-resolution Vision sensors for multiple inspections with a single image to generate rich data for the process and quality. To address the market requirements, vendors in the region are introducing an updated version of the sensor, introducing innovative products that are built on 3D technological principles. For instance, in March 2021, Sensopart introduced a 5-megapixel sensor Visor V50 with an integrated lens and lighting for flexible detection of objects at fluctuating distances.

- Moreover, recent controller vulnerabilities that attackers have exploited to disrupt operations are on the rise. This challenges the implementation of ICS as in order to secure ICS networks, there is usage of different communication protocols. Also, operational technology vendors uses their own proprietary implementation of the IEC-61131 standard for programmable logic controllers.

Germany Factory Automation & Industrial Controls Market Trends

Electric Motors Segment is Observing Significant Increase

- Rising industrialization and the growing proliferation of automation across various industries are propelling the demand for electric motors in the North American region. Therefore, large and energy-efficient motors are required to minimize the additional cost of production.

- The number of motors in process plants is increasing owing to the wide adoption in critical industrial operations. The management and monitoring of such assets are essential to preventing core process errors such as the proper mixing of ingredients.

- The integration of motor control, automation, and energy management help reduce costs while increasing production. Furthermore, intelligent motor control provides energy consumption data for each motor, and data from the devices can be captured by energy monitoring systems offered by companies such as Schneider Electric.

- Recently, in May 2021, Schneider Electric and Allied Electronics & Automation collaborated to create a limited-feature set of high-quality motor control and protection devices at a price point that is appropriate for smaller panel builders, OEMs, systems integrators, industrial contractors, and others.

- Based on Schneider's full-featured TeSys line, the TeSys product line provides an easy, simple solution with short-circuit ratings up to 35kA at 480V. It is conveniently accessible through Allied's e-commerce site. In the country, such distributor and vendor alliances generate market growth potential. During the projection period, such factors will contribute to the expansion of electric motors in the region.

Automotive and Transportation is Observing a Significant Increase

- The growing adoption of automation in manufacturing processes and digitization and AI involvement are primary factors driving industrial robots' demand in the automotive sector of the country.

- For instance, large industrial robots with a higher payload and extended arms capabilities handle spot welding on heavy body panels. Smaller robots weld lighter parts such as mounts and brackets. Robotic tungsten inert gas and metal inert gas welders can position the torch in exactly the same orientation for every cycle. Also, preserving high welding standards in every fabrication is now doable and feasible due to the repeatable arc and speed gap.

- BMW's smart factory in Regensburg, Germany, announced that technology-enabled the reduction of its quality issues by 5% in 2020. It was also able to cut the time needed to deploy new applications by 80%. Automotive and aerospace manufacturers in Germany are seeking support from engineering services providers as they adopt emerging technologies like 5G, artificial intelligence, and the Internet of Things to improve both products and processes.

- Germany was a at the forefront in the shift to zero-emission automobiles and EV manufacturing plants. Henkel established a unique cloud-based system that connected more than 30 facilities and 10 distribution hubs as one of several manufacturers at the forefront of the transformation. Another industry player, Allis-Gleaner Corp. (AGCO), used similar technology to combine digital solutions with intelligent line design, producing nine different tractor series on a single assembly line.

- Germany is one of the world's largest vehicle manufacturers, with Audi, BMW, Porsche, Volkswagen, and Mercedes-Benz. It is also a major manufacturer of electric and self-driving vehicles. According to figures from European Automobile Manufacturers Association (ACEA), in the second quarter of 2020, electrically-chargeable vehicle market share increased to 7.2% of total European car sales, compared to 2.4% share during the same period in 2019.

Germany Factory Automation & Industrial Controls Industry Overview

The German factory automation and industrial control market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2021 - Emerson introduced the PACEdge industrial edge platform, which allows customers to easily construct and scale-up performance-improving applications to assist manufacturers in speed digital transformation projects. The PACEdge platform makes application creation easier by combining open-source technologies into a versatile, integrated, and secure platform for using machine data.

- April 2021- Google Cloud and Siemens collaborated to streamline production operations and boost shop floor efficiency. Siemens plans to integrate Google Cloud's top data cloud and artificial intelligence/machine learning (AI/ML) capabilities with its factory automation solutions to assist manufacturers in the manufacturing process.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five

Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Covid-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gaining Prominence for Automation Technologies

- 5.1.2 Increasing Focus Towards Cost Optimization and Business Process Improvement

- 5.2 Market Challenges

- 5.2.1 High Installation Costs

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Programable Logic Controller (PLC)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Manufacturing Execution System (MES)

- 6.1.1.6 Human Machine Interface (HMI)

- 6.1.1.7 Other Industrial Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Machine Vision

- 6.1.2.2 Industrial Robotics

- 6.1.2.3 Electric Motors

- 6.1.2.4 Safety Systems

- 6.1.2.5 Sensors & Transmitters

- 6.1.2.6 Other Field Devices

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Food and Beverage

- 6.2.5 Automotive and Transportation

- 6.2.6 Pharmaceutical

- 6.2.7 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Ltd

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Dassault Systems

- 7.1.9 Autodesk Inc.

- 7.1.10 Robert Bosch GmbH

- 7.1.11 Texas Instruments, Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219