|

市場調查報告書

商品編碼

1627206

義大利的工廠自動化和ICS:市場佔有率分析、產業趨勢和成長預測(2025-2030)Italy Factory Automation and ICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

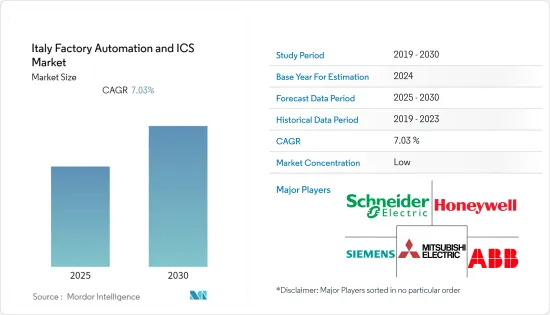

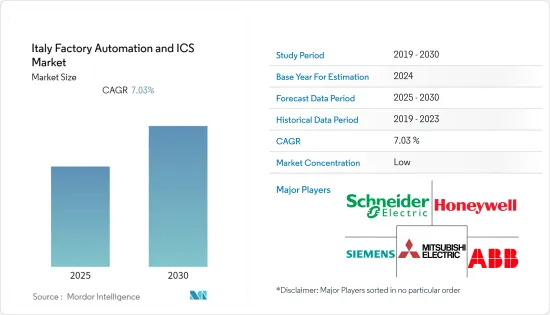

義大利工廠自動化和ICS市場預計在預測期間內複合年成長率為7.03%

主要亮點

- 義大利擁有中小企業(SME),其中大部分屬於叢集。這些公司能夠抵禦來自新興國家的競爭,因為它們專注於高品質的產品和低廉的人事費用。北方工業化程度很高,主要透過私人公司網路實現。由於大量中小企業的存在,該國正在積極推出舉措,鼓勵這些企業採用自動化解決方案,預計將帶動該國工廠自動化解決方案的需求。

- 西北地區(米蘭-都靈-熱那亞)是航太、海軍、機械和汽車等大型工業的所在地。義大利中部和東北部地區(以前是農村地區)是許多高工藝和低技術力的所在地,專門從事紡織、服飾、鞋類、家具、皮革製品、珠寶飾品、家具等。

- 此外,該國還確定了新舉措,主要專注於促進工業 4.0 的採用。例如,2020年工業4.0稅收優惠。在義大利,從2020年1月1日起,針對資本財投資的新稅額扣抵取代了先前的超折舊和超折舊。經濟發展部最近提案的改革趨勢引入了許多創新,以支持企業的技術和數位轉型過程。

- 此外,最近控制器漏洞有所增加,攻擊者利用這些漏洞來破壞業務。為了確保ICS網路的安全,需要使用各種通訊協定,這對ICS的實施帶來了挑戰。此外,操作技術供應商使用自己的 IEC-61131 標準實作來實現可程式邏輯控制器。

義大利工廠自動化與ICS市場趨勢

自動化程度顯著提高

- 鮮為人知的事實是,義大利處於製造業的前沿。不過,義大利政府計劃在2020年引入工業4.0(I4.0),戰略指導方針將在一年內實施。該舉措的重點是轉變傳統製造方法,重點是技能和先進技術,並支持義大利經濟的數位化。它還強調了與其他國家合作的未來,這將推動國內工廠自動化。

- 例如,工業自動化和機器人公司柯馬推出了其最具創新性的產品,包括MATE外骨骼、傳統工業機器人和協作機器人、Agile1500自動駕駛汽車以及e.DO教育機器人。 。柯馬此舉旨在支持企業取得生產流程和工具,以日益敏銳的方式實現智慧工廠。

- 在過去的幾年裡,許多汽車製造商已經實現了工廠自動化,我們看到許多公司正在轉向一站式自動化解決方案提供商,這些解決方案可以滿足他們所有的自動化需求,以提高收益和效率,並引領智慧工廠。

- 此外,將工業控制系統納入汽車製造工廠使公司能夠透過工廠連接產生的資料即時追蹤生產力和品質。這可能會讓生產線監督和工廠高層鬆一口氣。資料分析可以為預測從生產零件的品質到下一次機器故障等結果提供切入點。

- 此外,由於義大利市場為紡織業引入自動化提供了巨大的潛在機會,許多國際參與企業都在尋求擴大在該國的業務。中國領先的縫紉技術供應商傑克縫紉機有限公司收購了義大利牛仔褲自動化公司ViBeMac SPA。

機器人技術將推動市場適度成長

- 工業機器人細分市場包括關節型機器人、直角座標機器人、 SCARA機器人、協作機器人(cobots)、並聯機器人、工件拾取機器人等。工業機器人因其更高的精度、靈活性、減少的產品損壞、速度和最終的營運效率而擴大被大多數最終用戶和應用所採用。

- 智慧生產和自動化市場的快速成長正在推動工業機器人在全球的使用。根據橫河電機2020年進行的一項調查,64%的流程工業企業受訪者表示,他們預計2030年將完全自動化。

- 此外,89% 的受訪者表示,他們的公司目前計劃提高組織內部的自主權水平。關於目前的狀況,64%的受訪者表示他們目前正在實施半自動或自主運作或正在進行檢查,67%的受訪者預計工廠運作中的大多數決策流程將在2023年之前實施。將實現顯著的自動化。

- 工業機器人領域見證了老牌供應商和新興企業的許多創新努力。其重點是改善工業機器人的機器人感官並幫助它們與周圍的世界互動。

- 2021 年 2 月,ABB 在其協作機器人 (cobot) 產品組合中推出了 GoFa 和 SWIFTI 協作機器人系列,列出了更高的承重能力和速度,以補充ABB 的YuMi 和單臂YuMi I am 協作機器人系列。 GoFa 和 SWIFTI 的設計使客戶無需依賴內部程式專家。這解放了自動化程度較低的行業。

義大利工廠自動化與ICS產業概況

義大利工廠自動化和 ICS 市場適度整合,有一些大型企業的存在。公司不斷投資於策略聯盟和產品開發,以佔領更多的市場佔有率。我們將介紹一些最近的市場趨勢。

- 2021 年 5 月-施耐德電機與樂家集團合作加速脫碳。樂家集團是產品設計、生產和商業化領域的世界領導者,這些產品定義了脫碳的新藍圖,在整個集團範圍內建立了單一的全球策略。

- 2021 年 5 月 - 羅克韋爾與 Cisco Cyber Vision 合作擴展威脅偵測服務。 CyberVision 描述了工業控制系統的可視化,以建立安全的基礎設施。 Cyber Vision 解決方案加入了羅克韋爾的 LifecycleIQ 服務組合。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業魅力-波特的5點

力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對產業的影響

- 技術簡介

第5章市場動態

- 市場促進因素

- 由於工作人口減少,自動化技術興起

- 市場問題

- 缺乏熟練勞動力阻礙企業全面實施工廠自動化

第6章 市場細分

- 依產品

- 工業控制系統

- 集散控制系統(DCS)

- PLC(可程式邏輯控制器)

- 監控/資料採集(SCADA)

- 產品生命週期管理 (PLM)

- 人機介面 (HMI)

- 製造執行系統(MES)

- 現場設備

- 感測器和發射器

- 馬達

- 安全系統

- 工業機器人

- 工業控制系統

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 電力/公共產業

- 汽車/交通

- 纖維

- 其他

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Company

- ABB Limited

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Yasakawa Electric Corporation

- Fanuc Corporation

- Nidec Corporation

- Fuji Electric Co. Ltd

- Seiko Epson Corporation

第8章投資分析

第9章 未來展望

簡介目錄

Product Code: 51004

The Italy Factory Automation and ICS Market is expected to register a CAGR of 7.03% during the forecast period.

Key Highlights

- Italy has small and medium-sized businesses (SMEs), most of which are grouped in clusters. These enterprises specialize in high-quality products and lower labor costs, which enable them to withstand competition from upcoming economies. The northern part of the country is mainly industrialized with a network of private companies. Due to the presence of many SMEs, the country has been actively starting initiatives to encourage the adoption of automation solutions among these companies, which are anticipated to drive the demand for factory automation solutions in the country.

- The Northwest region (Milan-Turin-Genoa) is home to large industries as aerospace, naval, machinery, and automotive. The Central and Northeast parts of Italy (which were previously rural areas) have become a region with many small businesses of high craftsmanship, coupled with low technology, specialized in textiles, clothing, footwear, furniture, leather products, jewelry, and furniture, among others.

- Furthermore, the country has been witnessing new initiatives that are mainly focused on encouraging the adoption of Industry 4.0. For instance, New Industry 4.0 tax incentives in 2020. Starting from January 1, 2020, in Italy, the new tax credit for capital goods investments replaced the previous super-amortization and hyper-amortization. The recent amendment proposed by the Ministry of Economic Development introduces many innovations to support companies in their technological and digital transformation process.

- Moreover, recent controller vulnerabilities that attackers have exploited to disrupt operations are on the rise. This challenges the implementation of ICS, as to secure ICS networks, there is usage of different communication protocols. Also, operational technology vendors use their own proprietary implementation of the IEC-61131 standard for programmable logic controllers.

Italy Factory Automation and Industrial Control Market Trends

Automation is Observing a Significant Increase

- Italy is not commonly known to be at the forefront of the manufacturing sector. However, the government of Italy introduced Industria 4.0 (I4.0) in 2020 and aimed to include strategic guidelines to be implemented in a year. The initiative is focused on transforming traditional manufacturing methods with a focus on skills and advanced technology and supporting the digitization of the Italian economy. It also emphasizes a future based on collaboration with other countries-this driving factory automation in the country.

- In another instance, Comau, industrial automation, and robotics company, support the Milan Competence Center by providing its most innovative products, like the MATE exoskeleton, traditional industrial robots and collaborative robots, the autonomous driving vehicle Agile1500, and thee.DO educational robot. By doing so, Comau aims to support companies in acquiring production processes and tools, enabling the smart factory in an increasingly incisive manner.

- In the past few years, many automakers have automated their plants, and many companies have been identified as tending toward one-stop automation solution providers who can cater to all of their automation needs to gain better returns and efficiency, driving the smart factory market.

- Moreover, the inculcation of industrial control systems in auto manufacturing plants gives companies the ability to keep real-time track of productivity & quality through the data generated through plant connectivity. It may offer mitigating actions to the line supervisors and plant executives. Data analytics can offer a gateway to predicting various outcomes, from the quality of the part being produced to the next machine breakdown.

- Furthermore, with the Italian market posing high potential opportunities for the adoption of automation in the textile industries, various international players see to expand in the country. Jack Sewing Machine Co., a leading Chinese sewing technology provider, acquired Italian jeans automation company ViBeMac SPA in yet another accomplishment.

Robotics is Propelling the Market With Gradual Growth

- The industrial robotics segment consists of articulated robots, cartesian robots, SCARA robots, collaborative industry robots (cobots), parallel robots, piece picking robots, etc. The adoption of industrial robots has been increasing in most end-users and applications as these robots enhance accuracy, flexibility, reduced product damage, speed, and ultimately the efficiency of operations.

- The rapidly growing market for smart production and automation is propelling the use of industrial robotics across the globe. According to a survey by Yokogawa Electric Corporation in 2020, 64% of respondents from companies in process industries pointed out that they are anticipating fully autonomous operations by 2030.

- Also, 89% of the respondents said their companies currently have plans to increase the level of autonomy in their operations. Regarding the current status, 64% of respondents said they are conducting or are piloting semi-autonomous or autonomous operations, while 67% expect significant automation of most decision-making processes in plant operations by 2023.

- There are a lot of innovation practices done in industrial robotics by start-ups as well as established vendors. The focus is on improving the robotic senses of industrial robots, which helps their interaction with the world around them.

- In February 2021, ABB announced its collaborative robot (cobot) portfolio with the GoFa and SWIFTI cobot families, offering higher payloads and speeds to complement YuMi and Single Arm YuMi in ABB's cobot line-up. GoFa and SWIFTI are designed so that the customers do not need rely on in-house programming specialists. This unlocks industries that have low levels of automation.

Italy Factory Automation and Industrial Control Industry Overview

The Italy factory automation and industrial control market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2021 - Schneider Electric partnered with Roca Group to accelerate decarbonization. Roca Group, a world leader in the design, production, and commercialization of products to define a new roadmap toward decarbonization, has been establishing a single, global strategy across the group.

- May 2021- Rockwell partnered with Cisco Cyber Vision to expand its threat detection services. Cyber Vision provides visibility into industrial control systems to build secure infrastructures. Cyber Vision solution will be to Rockwell's LifecycleIQ Services portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five

Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of Impact of Covid-19 on the Industry

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Gaining Prominence for Automation Technologies Due to Declining Workforce

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 PLC (Programmable Logic Controller)

- 6.1.1.3 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.4 Product Lifecycle Management (PLM)

- 6.1.1.5 Human Machine Interface (HMI)

- 6.1.1.6 Manufacturing Execution System (MES)

- 6.1.2 Field Devices

- 6.1.2.1 Sensors and Transmitters

- 6.1.2.2 Electric Motors

- 6.1.2.3 Safety Systems

- 6.1.2.4 Industrial Robotics

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical and Petrochemical

- 6.2.3 Power and Utilities

- 6.2.4 Automotive and Transportation

- 6.2.5 Textile

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Company

- 7.1.5 ABB Limited

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Yasakawa Electric Corporation

- 7.1.11 Fanuc Corporation

- 7.1.12 Nidec Corporation

- 7.1.13 Fuji Electric Co. Ltd

- 7.1.14 Seiko Epson Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219