|

市場調查報告書

商品編碼

1628767

英國玻璃包裝:市場佔有率分析、產業趨勢與成長預測(2025-2030)United Kingdom Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

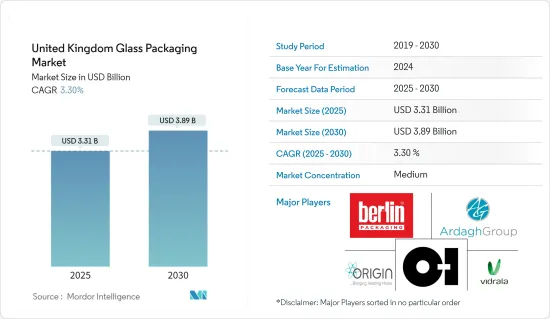

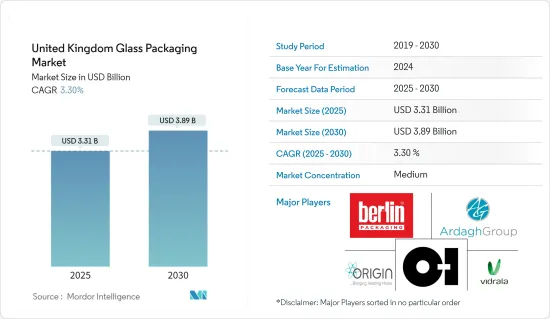

英國玻璃包裝市場規模預計到2025年將達到33.1億美元,預計2030年將達到38.9億美元,預測期內(2025-2030年)複合年成長率為3.3%。

主要亮點

- 消費者對更安全、更健康的包裝的需求不斷成長,推動了玻璃包裝在各個類別的擴張。壓花、成型和藝術飾面等創新技術增加了玻璃包裝對最終用戶的吸引力。此外,對環保產品的需求不斷成長,特別是在食品和飲料領域,正在推動市場成長。隨著消費者擴大轉向啤酒和葡萄酒,玻璃包裝製造商正在增加產量以配合。與塑膠等替代品相比,優質食品和飲料品牌更喜歡使用玻璃作為容器,因為玻璃具有化學惰性、無孔和不滲透的特性。

- 近年來,食品包裝產業的透明度趨勢日益明顯。玻璃容器可容納各種食品,從即溶咖啡和加工嬰兒食品到乳製品和糖漬。消費者希望在購買前看到產品,而不僅僅是成分。為了利用這一趨勢,許多公司正在轉向透明玻璃容器,特別是在乳製品領域。永續和環保包裝的發展正在加強玻璃包裝市場。根據 Trivium Packaging 的研究,約 74% 的消費者願意為永續包裝支付溢價。

- 法國玻璃瓶和容器市場呼籲建立穩定的脫碳政策框架,讓製造商投資減少溫室氣體排放。 2023年8月,法國政府撥款1.716億英鎊(2.115億美元)用於銷毀剩餘葡萄酒並支持生產商,此舉與歐盟形成鮮明對比。該舉措旨在穩定價格並確保釀酒師有收入來源。預計英國也會出現類似的趨勢,即所謂的“牛鞭效應”,這可能有利於研究市場。

- 2024 年 6 月,Egg 推出了一款新的烈酒瓶 Geddy's,作為其食品和飲料包裝系列的一部分。以 Yenice 烈酒瓶的成功為基礎,「Gediz」擁有引人注目的設計,具有寬敞的印刷和標籤面板,使其成為各種烈酒產品的理想選擇。

- 能源價格的預期波動迫使企業簽訂長期合約,以避免原料和能源成本波動。這對於食品和飲料行業的公司尤其重要,因為突然的價格變化可能會促使消費者轉向競爭對手的品牌。例如,英國葡萄酒產業正面臨酒杯短缺,導致裝瓶商價格飆升。除了這些挑戰之外,許多英國裝瓶商還在為英國脫歐而儲備庫存,而品牌所有者從塑膠瓶轉向玻璃瓶的顯著轉變進一步給市場帶來壓力。

英國玻璃包裝市場趨勢

飲料細分市場成長最快

- 玻璃瓶長期以來一直是飲料行業的首選包裝,趨勢保持穩定。玻璃瓶具有許多優點,包括保持產品品質和保護內容物免受外部因素的影響。

- 由於其化學無菌性和滲透性,玻璃瓶和容器主要用於酒精和非酒精飲料。玻璃是一種出色的阻隔材料,具有高包裝透明度。其特性可防止二氧化碳損失和氧氣進入,從而確保較長的保存期限。加工和塗層的最新進展提高了玻璃瓶的翻邊性,最新的輕量化技術增強了強度和易用性。

- 根據OEC(經濟複雜性觀察站)資料,2023年4月,英國玻璃瓶出口額為1580萬英鎊(1948萬美元),進口額為4070萬英鎊(5018萬美元),進口額為2490萬英鎊( 3070萬虧損)。 2022年4月至2023年4月,英國玻璃瓶出口額減少了931,000英鎊(1,147,965美元),從1,670萬英鎊(2,059萬美元)降至1,580萬英鎊(1,948萬美元),降幅為5.57%。同時,進口額成長了33.9%,達到1,000萬英鎊(12,330,456,220美元),從3,040萬英鎊(3,748萬美元)躍升至4,007萬英鎊(4,940萬美元)。

- 英國玻璃瓶進口的增加主要是由酒精和非酒精飲料領域的需求推動的,預計這一趨勢將持續下去。

- 優質化趨勢正在影響包括軟性飲料在內的各種飲料領域對玻璃包裝的選擇。軟性飲料因其廣泛的吸引力和適合各種場合的多種口味而佔據了很大的市場佔有率。特別是,根據UNESDA資料,低熱量和無糖飲料佔歐洲一些市場銷售的30%。

化妝品板塊預計將佔據較大佔有率

- 玻璃包裝是奢華香水、護膚和個人保健產品的首選。化妝品和香水中使用的玻璃主要由天然和永續材料製成,例如沙子、石灰石和堿灰。最重要的是,玻璃包裝具有 100% 的回收率,可以無限期回收,而不會損失品質或純度。令人驚訝的是,80% 的回收玻璃被回收製成新的玻璃產品。

- 在個人護理行業,玻璃是奢華的代名詞。其堅固的感覺超越了替代包裝材料,其高成本營造了一種奢侈品的感覺,增加了產品的感知價值。化妝品包裝包括各種容器,例如用於護膚、護髮、指甲護理和化妝產品的瓶子、罐子、管瓶和安瓿。這些化妝品容器通常由玻璃製成,尤其是在奢侈品領域。玻璃罐和瓶子因其多功能性而廣受歡迎,使其能夠容納各種分配器選項,包括噴射和滴入插件、發泡蓋、噴嘴和泵頭。

- 隨著消費者越來越注重自己的外觀以及防曬和防污染需求的增加,化妝品和香水市場正在經歷顯著成長。該領域的公司在創新方面投入巨資,特別是在成熟的類別中,目的是保持成長並每年推出新的增值產品。這一趨勢正在增加消費者對預防措施和治療的興趣。因此,對清爽、排毒、保濕產品的需求激增。這些趨勢正在推動個人護理和化妝品領域對玻璃瓶和容器的需求。

- 化妝品、盥洗用品和香水協會 (CTPA) 的資料凸顯了 2023 年洗護用品和美容品領域的強勁表現,優於前一年的指標。該產業價值95.6億英鎊(約121.4億美元),與前一年同期比較去年同期成長9.7%。隨著通貨膨脹率穩定以及美容和洗護用品使用頻率的增加,該行業對未來幾年的進一步顯著成長持樂觀態度,這一趨勢將加強英國玻璃包裝市場。

英國玻璃包裝產業概況

英國玻璃包裝市場競爭溫和,Ardagh Packaging、Berlin Packaging 和 Owens-Illinois Inc. 等公司利用策略合作措施來提高市場佔有率和盈利。 然而,由於玻璃的特性及其對飲料、化妝品和其他行業的好處,玻璃瓶和容器的採用正在增加。 供應商正致力於以環保產品玻璃取代塑膠。

2024 年 7 月 自從英國玻璃包裝公司 Croxsons 為專門生產填充用護膚品的品牌 Necessary Good 推出新的初級包裝解決方案以來,已經過去一年了。這種創新的玻璃包裝由 Croxson 致力於生活方式、美容、健康和保健的專業部門製造。該製造商生產了兩種類型的用於生活必需品的圓柱形玻璃瓶:100ml 和200ml。

2023年5月,英國Ardagh玻璃包裝公司(AGP)宣佈建造一座永續的“高效熔爐”,旨在減少玻璃生產過程中的溫室氣體排放。該熔爐將安裝在 AGP 的唐卡斯特工廠,採用先進的工業技術。該熔爐配備了先進的氣體過濾系統,利用創新的過濾技術來解決並顯著降低其他排放因素,達到遠低於目前行業基準的水平。這個雄心勃勃的計劃部分由政府工業能源轉型基金(IETF)資助。 IETF 是舉措。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 以循環經濟為重點的產業生態系分析

- 法律規範

- 進出口分析

- 成本分析,包括關鍵促進因素(零件和能源消耗)

- 英國日益重視玻璃回收以及目前可回收率分析

- 英國玻璃製造業整體分析

第5章市場動態

- 市場促進因素

- 飲料業對玻璃包裝的需求增加

- 優質包裝市場整合進一步推動成長

- 市場問題

- 替代包裝形式對市場成長構成挑戰

第6章 市場細分

- 依產品類型

- 瓶子

- 管瓶

- 安瓿

- 罐

- 其他產品類型(預填充式注射器、faials、香水瓶等)

- 按行業分類

- 飲料

- 酒精飲料

- 啤酒和蘋果酒

- 葡萄酒和烈酒

- 其他酒精飲料

- 非酒精性

- 碳酸飲料

- 牛奶

- 水和其他非酒精飲料(例如果汁)

- 食物

- 個人護理和化妝品

- 醫療和製藥

- 其他最終用途產業

- 飲料

第7章 競爭狀況

- 公司簡介

- Berlin Packaging LLC

- Ardagh Packaging Group

- Owens-Illinois Inc.

- Origin Pharma Packaging

- Vidrala SA

- Beatson Clark

- Ciner Glass Ltd

- Stoelzle Flaconnage Ltd

- Beatson Clark

- Glassworks International Limited

- 熱圖分析

第8章投資分析

第9章市場的未來

The United Kingdom Glass Packaging Market size is estimated at USD 3.31 billion in 2025, and is expected to reach USD 3.89 billion by 2030, at a CAGR of 3.3% during the forecast period (2025-2030).

Key Highlights

- Growing consumer demand for safer and healthier packaging is driving the expansion of glass packaging across various categories. Innovative technologies, such as embossing, shaping, and artistic finishes, are enhancing the appeal of glass packaging to end users. In addition, the surging demand for eco-friendly products, particularly from the food and beverage sector, is propelling market growth. As consumers increasingly gravitate toward beer and wine, glass packaging manufacturers are adapting their production accordingly. Premium food and beverage brands favor container glass over alternatives like plastic, citing glass's chemical inertness, non-porous nature, and impermeability.

- In recent years, the food packaging industry has witnessed a growing trend toward transparency. Glass containers house a diverse array of foods, from instant coffee and processed baby foods to dairy products and sugar preserves. Beyond just ingredients, consumers want to see the product physically before buying. To leverage this trend, many companies, especially in the dairy sector, are transitioning to transparent glass containers. The push for sustainable and eco-friendly packaging bolsters the glass packaging market. Research by Trivium Packaging highlights that about 74% of consumers are willing to pay a premium for sustainable packaging.

- The glass bottles and containers market in the country seeks a stable policy framework for decarbonization, enabling manufacturers to invest in reducing greenhouse gas emissions. In August 2023, the French government, in a move contrasting with the European Union, allocated GBP 171.6 million (USD 211.5 million) to destroy surplus wine and bolster producers. This initiative aims to stabilize prices, ensuring winemakers regain revenue sources. A similar trend termed the "bullwhip effect," is anticipated in the United Kingdom, potentially benefiting the studied market.

- In June 2024, Aegg unveiled its new spirit bottle, 'Gediz,' as part of its food and drink packaging lineup. Building on the success of the 'Yenice' spirit bottle, the Gediz boasts an eye-catching design with a spacious panel for printing or labeling, making it ideal for various spirit-based products.

- Anticipated fluctuations in energy prices are pushing businesses to secure long-term contracts to shield against volatile raw material and energy costs. This is especially crucial for those in the food and beverage sector, where sudden price shifts can drive consumers to rival brands. The UK wine industry, for example, is grappling with a glass shortage, leading to steep price increases for bottlers. Beyond these challenges, many UK bottlers have been stockpiling in anticipation of Brexit, and a notable shift from plastic to glass bottles by brand owners has further strained the market.

United Kingdom Glass Packaging Market Trends

Beverage Segment is Set to Witness The Highest Growth

- Glass bottles have long been a favored packaging choice in the beverage industry, a trend that remains steadfast today. They provide numerous advantages, such as preserving product quality and shielding contents from external factors.

- Due to their chemical sterility and non-permeability, glass bottles and containers are predominantly utilized for alcoholic and non-alcoholic beverages. Glass stands out as an excellent barrier material, boasting high transparency for packaging. Its properties ensure a prolonged shelf life by resisting CO2 loss and O2 intrusion. Recent advancements in processing and coatings have enhanced the frangibility of glass bottles, while modern lightweight techniques bolster their strength and user-friendliness.

- Data from the Observatory of Economic Complexity (OEC) reveals that in April 2023, the UK exported glass bottles worth GBP 15.8 million (USD 19.48 million) and imported them at GBP 40.7 million (USD 50.18 million), leading to a trade deficit of GBP 24.9 million (USD 30.70 million). Between April 2022 and April 2023, UK glass bottle exports dipped by GBP 931,000 (USD 1,147,965), marking a 5.57% decline from GBP 16.7 million (USD 20.59 million) to GBP 15.8 million (USD 19.48 million). In contrast, imports surged by GBP 10 million (USD 12,330,456.2), a notable 33.9% increase, rising from GBP 30.4 million (USD 37.48 million) to GBP 40.07 million (USD 49.40 million).

- The rising imports of glass bottles in the United Kingdom are primarily fueled by demand from alcoholic and non-alcoholic beverage sectors, a trend anticipated to persist in the coming years.

- Trends in premiumization have influenced the choice of glass packaging across various beverage segments, including soft drinks. Given their widespread appeal and diverse flavors tailored for every occasion, soft drinks command a substantial share of the market. Notably, data from UNESDA highlights that in several European markets, low-calorie and sugar-free beverages represent up to 30% of sales.

Cosmetic Sector is Expected to Witness Significant Share

- Glass packaging is the preferred choice for exclusive fragrances, skincare, and personal care products. The glass utilized in cosmetics and fragrances is primarily derived from natural and sustainable materials, including sand, limestone, and soda ash. Notably, glass packaging boasts a 100% recyclability rate, allowing it to be recycled infinitely without any degradation in quality or purity. Impressively, 80% of recycled glass is repurposed into new glass products.

- In the personal care industry, glass is synonymous with luxury. Its heft surpasses that of alternative packaging materials, and its higher cost fosters a perception of premium quality, thereby elevating the product's perceived value. Cosmetic packaging encompasses a range of containers, including bottles, jars, vials, and ampoules, catering to skincare, haircare, nail care, and makeup products. These cosmetic containers, especially in luxury segments, prominently feature glass. Glass jars and bottles are favored for their versatility, accommodating various dispensing options like jet and drop inserts, frothing caps, spray nozzles, and pump heads.

- As consumers become more conscious of their appearance and the need for sun and pollution protection, the cosmetics and perfume market is witnessing significant growth. Companies in this sector are heavily investing in innovations, aiming to sustain growth and introduce new, value-added products annually, particularly in mature categories. This trend piques consumer interest not only in preventive measures but also in treatments. Consequently, products like refreshing, detoxifying, and moisturizing solutions are poised for a surge in demand. Such dynamics are propelling the demand for glass bottles and containers in the personal care and cosmetics arena.

- Data from the Cosmetics, Toiletry, and Perfumery Association (CTPA) highlights a robust performance in the toiletries and beauty sectors for 2023, surpassing the previous year's metrics. The industry's total valuation experienced a Y-o-Y surge of 9.7%, reaching a notable GBP 9.56 billion (equivalent to USD 12.14 billion). With inflation rates stabilizing and an uptick in the frequency of beauty and toiletry usage, the industry is optimistic about even more pronounced growth in the forthcoming years, a trend likely to bolster the glass packaging market in the United Kingdom.

United Kingdom Glass Packaging Industry Overview

The United Kingdom glass packaging market is moderately competitive, with many regional and global players such as Ardagh Packaging, Berlin Packaging, Owens-Illinois Inc., and many more. The companies are leveraging strategic collaborative initiatives to increase market share and profitability. However, the properties of glass and its benefits to beverages, cosmetics, and other industries are leading to the increased adoption of glass bottles and containers. Vendors are focusing on replacing plastic with environmentally friendly product glass.

July 2024: United Kingdom-based glass packaging firm Croxsons completed one year of the unveiling of its new primary packaging solution for Necessary Good, a brand specializing in refillable skincare essentials. This innovative glass packaging was manufactured by Croxson's dedicated division focusing on lifestyle, beauty, health, and wellness. The manufacturer produced two cylindrical glass bottle sizes for Necessary Goods, which are 100 ml and 200 ml.

May 2023: In the United Kingdom, Ardagh Glass Packaging (AGP) announced the construction of a sustainable 'Efficient Furnace' aimed at curbing greenhouse gas emissions during glass production. This furnace, set to be installed at AGP's Doncaster facility, leverages advanced industrial technology. The furnace is equipped with an advanced gas filtration system, utilizing innovative filter technology to address and significantly diminish other emission elements, achieving levels well below current industrial benchmarks. This ambitious project receives partial funding from the Government's Industrial Energy Transformation Fund (IETF), an initiative designed to assist energy-intensive businesses in their shift towards a low-carbon future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis with an Emphasis on Circular Economy

- 4.4 Regulatory Framework

- 4.5 Import and Export Analysis

- 4.6 Cost Analysis with Key Drivers (Components and Energy Consumption)

- 4.7 Analysis of the Increasing Emphasis on Glass Recycling and the Current Recyclability Rate in the United Kingdom

- 4.8 Analysis of the Overall Glass Manufacturing Industry in the United Kingdom

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Glass Packaging in Beverage Industry

- 5.1.2 Increased Integration in the Premium Packaging Market Further Drives the Growth

- 5.2 Market Challenges

- 5.2.1 Alternative Forms of Packaging is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Jars

- 6.1.5 Other Product Type (Pre-Filled Syringes, Phials, Flacons, among Others)

- 6.2 By End-use Vertical

- 6.2.1 Beverages

- 6.2.1.1 Alcoholic**

- 6.2.1.1.1 Beer and Cider

- 6.2.1.1.2 Wine and Spirit

- 6.2.1.1.3 Other Alcoholic Beverages

- 6.2.1.2 Non-alcoholic**

- 6.2.1.2.1 Carbonated Soft Drinks

- 6.2.1.2.2 Milk

- 6.2.1.2.3 Water and Other Non-alcoholic Beverages (Juices, Among others)

- 6.2.2 Food

- 6.2.3 Personal Care and Cosmetics

- 6.2.4 Healthcare and Pharmaceutical

- 6.2.5 Other End-use Verticals

- 6.2.1 Beverages

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berlin Packaging LLC

- 7.1.2 Ardagh Packaging Group

- 7.1.3 Owens-Illinois Inc.

- 7.1.4 Origin Pharma Packaging

- 7.1.5 Vidrala SA

- 7.1.6 Beatson Clark

- 7.1.7 Ciner Glass Ltd

- 7.1.8 Stoelzle Flaconnage Ltd

- 7.1.9 Beatson Clark

- 7.1.10 Glassworks International Limited

- 7.2 Heat Map Analysis