|

市場調查報告書

商品編碼

1629800

北美自動化物料輸送:市場佔有率分析、產業趨勢與成長預測(2025-2030)North America Automated Material Handling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

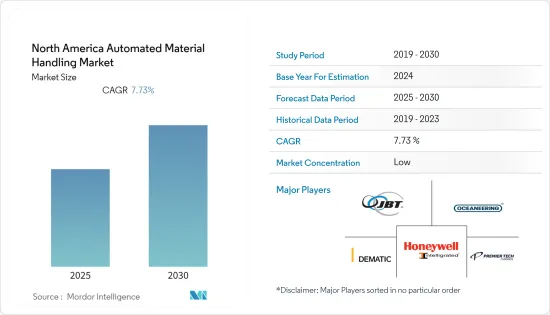

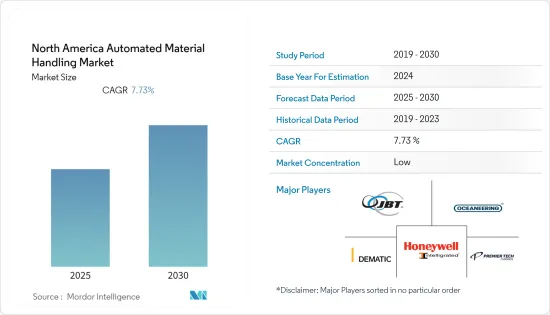

北美自動化物料輸送市場預計在預測期內複合年成長率為 7.73%

主要亮點

- 隨著越來越多的公司轉向自動化來提高倉庫效率、降低成本並保持市場競爭力,他們也在此過程中使員工的職場更加安全。自動化物料輸送的主要動機之一是改善工作和安全條件。根據美國勞工統計局的數據,2021 年,在需要休假的非致命職業傷害中,有 27% 是由滑倒、絆倒和跌倒造成的。超過 235,000 人因接觸設備或物體而不得不缺勤。透過自動化物料輸送任務,製造商可以將工人從危險或重複性任務中解放出來。這可以將人才重新部署到職場的其他部分,使員工能夠提高工作效率、安全性和成就感。

- 零售、汽車、食品和飲料以及製藥等行業是該國自動化物料輸送解決方案的最大需求來源。食品和飲料是最大的產業,占美國年度包裝出貨量的35%以上。

- 此外,由於倉庫空置率較低和租金價格上漲,公司擴大尋找較小的空間來租用存放。我們預計公司很快就會部署更多自動化解決方案,以在如此狹小的空間中最佳化生產力。

- 此外,美國電商物流成本占美國物流總成本的6.9%以上。雖然供應鏈中的最後一英里仍然很重要,但製造商認知到,沒有第一英里,就沒有最後一英里。應用正確的物料輸送技術可以節省可衡量的成本,同時帶來即時的投資回報。

- COVID-19 大流行影響了許多公司,包括小型和大型製造商。全球範圍內,自動物料輸送系統市場的產品需求在一定程度上受到限制。產品開發生命週期受到勞動力少和營運限制的顯著影響。停工限制放鬆後,需求在一定程度上穩定。公司已經創造了多種技術和方法來應對 COVID-19 帶來的挑戰。此外,2020 年 7 月,Honeywell發布的一項研究表明,超過 50% 的美國企業願意投資自動化以應對不斷變化的市場狀況。 2020 年Honeywell整合自動化投資研究強調電子商務 (66%)、食品飲料 (59%) 和物流 (55%) 產業是增加自動化投資的先鋒。

北美自動化物料輸送市場趨勢

零售/倉儲/物流將佔很大佔有率

- 美國擁有強大的電子商務生態系統。根據美國人口普查局數據,2022年1月至3月,美國零售電商銷售額達到約2,500億美元,較上季成長2.4%。快速發展的零售市場正在推動物流中心尋找並使用創新、靈活和自動化的方法來處理電子商務訂單。

- 電子商務是自動化配送倉庫需求的主要驅動力,因為消費者要求比以往更快的交貨時間。消費者需求的變化和配送方式的創新預計也將推動美國零售市場的發展。隨著電子商務市場的強勁成長,美國零售終端用戶對 AMH 設備的需求也預計會增加。

- 當零售店的後台或配送中心易於操作和組織時,自動化物料輸送設備可以幫助確保整體客戶滿意度,並提高庫存和庫存效率。例如,REB 等公司在美國供應、交付和安裝物料輸送和儲存系統,並專注於滿足客戶滿意度。

- 零售業是輸送機和分類要求非常重要的主要產業之一。它幫助線上零售商對產品進行分類並提高交付效率。此外,零售公司還部署這種自動化物料輸送設備進行最後一英里的交付。

- 自動化物料輸送設備使零售後台和配送中心易於操作且井井有條,確保整體客戶滿意度並提高採購和庫存效率。例如,REB 等公司為美國的零售企業供應、交付和安裝物料輸送和儲存系統,並專注於滿足客戶滿意度。

美國佔有很大佔有率

- 美國是世界上最發達的經濟體。該國的製造業是AMH市場的龐大需求來源,依賴主導的美國經濟,美國經濟佔該地區經濟產出的82%。

- 該國擁有強大的貿易和非常活躍的電子商務部門,增加了對倉庫空間的需求。此外,北美機場業是世界上最大的機場業之一。它每年為大約 10.115 億國內和國際乘客提供服務。它也是世界上最大的機場之一的所在地,預計將加強自動化的採用力度,以避免經營模式受到干擾。

- 美國擁有全球最大的汽車市場之一,是全球各類汽車製造商和汽車零件製造商的所在地。加上汽車需求的增加,美國作為最大的出口國和製造國(第二大)以及投資的增加,預計所研究的市場將見證美國汽車工業的強勁需求。

- 此外,由於製藥業的變化和研發生產力的下降,美國製藥業的成長正在放緩。該地區價值鏈各個階段的數位化和自動化程度不斷提高,幫助製藥業更快地將藥品從實驗室送到患者手中。預計新的政策改革將影響預測期內的市場成長。以患者為中心的藥物和生物相似藥等趨勢預計將對所研究市場的成長產生積極影響。

- 此外,該地區不斷上漲的勞動力工資也催生了對新技術的需求,以幫助減少對物料輸送工人的依賴。加拿大統計局數據顯示,繼前兩季小漲後,2021年第二季加拿大企業每單位產出的人事費用上漲2.7%。這是去年以來最高的季度成長率。

北美自動化物料輸送產業概況

自動化物料輸送市場由各種硬體、軟體和服務供應商適度整合。然而,大福、卡迪斯集團、凱傲集團和 JBT 公司等主要供應商作為自動物料輸送產品/解決方案/服務供應商,已獲得從中小型企業到大型企業的廣泛認可。由於市場優勢,這些公司正在更新與物料輸送公司的夥伴關係。

- 2022 年 7 月 - JBT Corporation 收購 Alco-food-machines GmbH & Co.KG (Alco)。透過採用先進的自動化物料輸送設備,您可以確保產品和員工的安全,而不會影響流程品質、時間或利潤。 Alco 是 JBT 的理想選擇,該品牌接觸了廣泛的食品和飲料平台,並為一家擁有關鍵技術和食品領域專業知識的公司描述了一個有吸引力的繼任機會。

- 2021 年 11 月 - Westfalia 的自動儲存/搜尋系統 (AS/RS) 和 Savanna.NET 倉庫執行系統 (WES) 實現食品生產的完全自動化。 Kens Foods 選擇 Westfalia Technologies 來實現亞特蘭大地區新倉庫的自動化。 Westfalia 的技術描述了一個可靠的溫控倉庫環境,為所有物料輸送提供客製化解決方案,從收貨到運輸幾乎實現零接觸。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對自動化物料輸送市場的影響

第5章市場動態

- 市場促進因素

- 技術進步不斷推動市場成長

- 工業 4.0 投資推動自動化和物料輸送的需求

- 電子商務快速成長

- 市場問題

- 初始成本高

- 缺乏技術純熟勞工

第6章 市場細分

- 依產品類型

- 硬體

- 軟體

- 服務

- 依設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單元貨載

- 組裝

- 特殊用途

- 自主移動機器人(AMR)

- 雷射導引車

- 自動儲存和搜尋系統(ASRS)

- 固定通道(堆垛機高機+穿梭系統)

- 輪播(水平輪播+垂直輪播)

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 常規型(高電位+低電位)

- 機器人

- 分類系統

- 移動機器人

- 按最終用戶產業

- 飛機場

- 車

- 飲食

- 零售/倉庫/配送中心/物流中心

- 一般製造業

- 藥品

- 小包裹

- 其他

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- JBT Corporation

- Oceaneering International Inc.

- Dematic Corp.

- Honeywell Intelligrated

- Premier Tech Chronos

- DMW&H

- Westfalia Technologies Inc.

- OPUS Automation Inc.

- Creative Automation Inc.

- Remtec Automation

- Shuttleworth LLC

- Siggins

- Cornerstone Automation Systems LLC

第8章投資分析

第9章 市場的未來

The North America Automated Material Handling Market is expected to register a CAGR of 7.73% during the forecast period.

Key Highlights

- As more businesses turn to automation to boost efficiency in the warehouse, lower costs, and stay competitive in the market, they also make the workplace safer for employees in the process. One of the main motivations for automated material handling is improving working and safety conditions. According to the United States Bureau of Labor Statistics, in 2021, slips, stumbles, and falls were the cause of 27% of nonfatal occupational injuries that required days off from work. More than 235,000 people had to take time off work as a result of equipment or object contact. Automating material handling tasks allows manufacturers to remove workers from dangerous or repetitive work. This allows them to redeploy talent to other areas of the workplace where workers can be more productive, safe, and fulfilled.

- Sectors, including retail, automotive, food and beverage, and pharmaceutical, are the largest sources of demand for automated material handling solutions in the country. Food and beverage is the largest industry and represents more than 35% of US packaging shipments annually.

- Additionally, owing to low vacancy and a surge in the rental prices of warehouses, enterprises are progressively looking for smaller places to rent out for warehouse purposes. In order to optimize the productivity of these narrow spaces, they are expected to deploy more automated solutions soon.

- Moreover, the e-commerce logistics costs in the United States account for over 6.9% of the total US logistics costs. The importance of the last mile in the supply chain will never be lost; however, manufacturers realize that there is no last mile without the first. Applying the proper material handling technology produces measurable cost savings while bringing an immediate ROI.

- The COVID-19 pandemic had an impact on a variety of businesses, including small and big manufacturers. It limited the demand for products in the automated material handling system market on a global scale to some extent. The product development life cycle was significantly impacted by a small workforce and operational constraints. After the lockdown restrictions were later eased, demand stabilized to some extent. Companies created various technologies and methods to address issues caused by COVID-19. Further, in July 2020, a study released by Honeywell suggested that over 50% of U.S. companies have shown openness to investing in automation to survive changing market conditions. The 2020 Honeywell Integrated Automation Investment Study highlighted that the e-commerce (66%); grocery, food, and beverage (59%); and logistics (55%) industries are the forerunners in investing more in automation.

North America Automated Material Handling Market Trends

Retail/Warehousing/Logistics to Hold Significant Share

- The United States boasts a robust E-commerce ecosystem. According to the US Census Bureau, from January to March 2022, US retail e-commerce sales accounted for almost USD 250 billion, marking a 2.4% increase compared to the previous quarter. The rapidly evolving retail market is encouraging distribution centers to find and use innovative, flexible, and automated approaches to e-commerce order fulfillment.

- E-commerce is a significant driving factor for the demand from automated distribution warehouses, as consumers seek ever-shorter delivery times. Also, changing consumer needs and innovation in delivery methods are expected to drive the US retailing market. With the e-commerce market expected to witness robust growth, the demand for AMH equipment from the US retail end-user segment is also expected to increase.

- With a retail backroom or distribution center that is easy to steer and is well-organized, automated material handling equipment help ensure overall customer satisfaction and makes stocking and inventory more efficient. For instance, companies like REB furnish, deliver, and install material handling and storage systems nationwide in the United States, focusing on meeting customer satisfaction.

- Retail is one of the major industries in which the requirement for conveyors and sortation is important. It helps online retailers to sort goods and enhance delivery efficiency. Furthermore, retail companies are also adopting this automated material handling equipment to perform last-mile delivery.

- With a retail backroom or distribution center that is easy to steer and is well-organized, automated material handling equipment help ensure overall customer satisfaction and makes stocking and inventory more efficient. For instance, companies like REB furnish, deliver, and install material handling and storage systems for the retail sector nationwide in the United States, focusing on meeting customer satisfaction.

United States to Hold Major Share

- The United States is the most advanced economy in the world. The country's manufacturing sector, which is a huge source of demand for the AMH market, hinges on the dominant US economy, accounting for 82% of the region's economic output.

- The country has a high trading profile and a highly active e-commerce sector, which increases the demand for warehouse space. Moreover, the North American airport industry is one of the largest airport industries in the world. It provides services to about 1,011.5 million domestic and international passengers every year. It is also home to some of the world's biggest airports and is expected to bolster the adoption of automation to ensure no disruptions in the business model.

- The United States is home to one of the largest automotive markets in the world, with the presence of various global vehicle and auto part manufacturers. With the increasing demand for automotive vehicles and the United States being one of the largest exporters and manufacturers (second-largest), coupled with increasing investment, the market studied is expected to witness significant demand from the US automotive industry.

- Additionally, the US pharmaceutical industry is experiencing slow growth with the changing pharmaceutical landscape and diminished productivity in R&D. Digitalization and automation in the region, at every point along the value chain, help the pharmaceutical industry get pharmaceuticals from the lab to the patient more swiftly. New policy reforms are expected to influence market growth over the forecast period. Trends, such as patient-centric healthcare and biosimilars, is expected to positively impact the growth of the market studied.

- Furthermore, the increasing labor rates in the region are also developing the need for new technologies which help in reducing the dependency on laborers for material handling. According to Statistics Canada, Labour costs per unit of output of Canadian businesses rose 2.7% in the second quarter of 2021, following slight increases in the previous two quarters. This was the highest quarterly growth rate in a year.

North America Automated Material Handling Industry Overview

The automated material handling market is moderately consolidated, with a range of hardware, software, and service providers. However, major vendors such as Daifuku Co. Ltd, Kardex Group, KION Group, JBT Corporation, and many more are highly preferred automated material handling product/solution/service providers across small and large enterprises. The firms are renewing their partnership with material handling companies due to the benefits of the market.

- July 2022 - JBT Corporation acquired Alco-food-machines GmbH & Co. KG (Alco), a provider of other food processing solutions and production lines. The deployment of advanced and automated material handling equipment helps the company ensure the safety of products and employees without compromising process quality, time, and profits. Alco represents the ideal fit for JBT, where the brands approach the broad food and beverage platform and offer a compelling succession opportunity for companies with leading technology and food domain expertise.

- November 2021 - Westfalia's automated storage/retrieval system (AS/RS) and Savanna.NET Warehouse Execution System (WES) will fully automate food manufacturing. Kens foods chose Westfalia Technologies to automate the new Atlanta-area warehouse. Westfalia's technology will provide a reliable, temperature-controlled warehousing environment with a customized solution addressing all material handling while delivering almost zero touches from receiving to shipping.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Automated Material Handling Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancments Aiding Market Growth

- 5.1.2 Industry 4.0 Investments Driving the Demand for Automation and Material Handling

- 5.1.3 Rapid Growth of E-Commerce

- 5.2 Market Challenges

- 5.2.1 High Initial Costs

- 5.2.2 Unavailability for Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle (AGV)

- 6.2.1.1.1 Automated Forklift

- 6.2.1.1.2 Automated Tow/Tractor/Tug

- 6.2.1.1.3 Unit Load

- 6.2.1.1.4 Assembly Line

- 6.2.1.1.5 Special Purpose

- 6.2.1.2 Autonomous Mobile Robots (AMR)

- 6.2.1.3 Laser Guided Vehicle

- 6.2.2 Automated Storage and Retrieval System (ASRS)

- 6.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional (High Level + Low Level)

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End-user Vertical

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End Users

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JBT Corporation

- 7.1.2 Oceaneering International Inc.

- 7.1.3 Dematic Corp.

- 7.1.4 Honeywell Intelligrated

- 7.1.5 Premier Tech Chronos

- 7.1.6 DMW&H

- 7.1.7 Westfalia Technologies Inc.

- 7.1.8 OPUS Automation Inc.

- 7.1.9 Creative Automation Inc.

- 7.1.10 Remtec Automation

- 7.1.11 Shuttleworth LLC

- 7.1.12 Siggins

- 7.1.13 Cornerstone Automation Systems LLC