|

市場調查報告書

商品編碼

1629809

拉丁美洲的 AMH(自動物料輸送):市場佔有率分析、產業趨勢、成長預測(2025-2030 年)LA AMH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

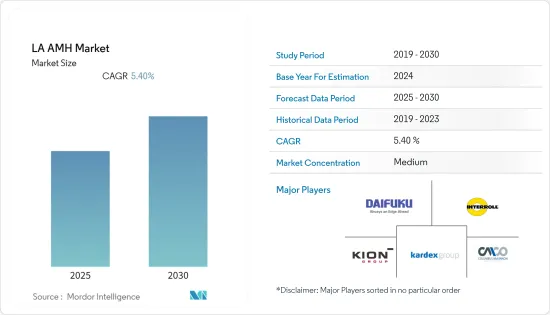

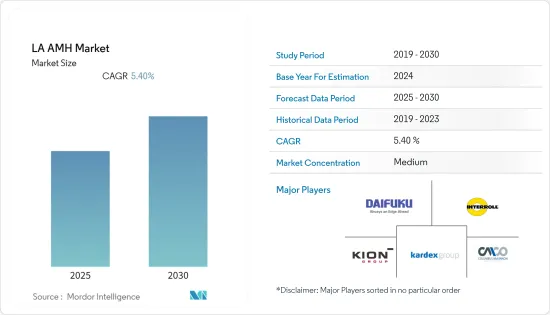

拉丁美洲 AMH(自動物料輸送)市場預計在預測期內複合年成長率為 5.4%

主要亮點

- 拉丁美洲經濟不斷擴張,資源豐富,人口結構良好。因此,這是一個充滿前景的自動化市場。該地區的上層和中產階級人口迅速成長,預計自動化的採用將增加。然而,許多經營模式可能會發生變化,這主要是由於人事費用的急劇增加。

- 在巴西,自動化帶來的收益回報 (ROI) 通常更快。 2-4年即可實現投資回報,與其他新興國家相比較低。部署自動化以降低營運成本並從根本上降低流程效率低下,在巴西的自動化實施中發揮重要作用。揀選和托盤搬運是關鍵領域,借助自動化技術可以實現許多好處。

- 該地區對電子商務的投資正在增加。例如,PayPal 向阿根廷電商巨頭 MercadoLibre 投資 7.5 億美元、Dragoneer 投資 1 億美元後,該地區在阿根廷、巴西和墨西哥開設了多個新的物流中心。

- 預計巴西也將佔該地區零售電子商務收益的最大佔有率,達到 173.5 億美元,這一佔有率在預測期內將保持一定程度的穩定。

- COVID-19 大流行促使多家公司採用物料輸送產品,以最大限度地減少人與人之間的互動。為此,2021年7月,酵母機械公司指定巴西聖若澤杜斯坎普斯(聖保羅)的CMP Trading作為其自動切割系統、物料輸送設備和設計軟體的經銷商。

拉丁美洲 AMH(自動物料輸送)市場趨勢

墨西哥成長最快

- 墨西哥擁有多種工業,包括汽車和航太工業。自動化投資將有助於增加墨西哥的高薪就業機會,因為墨西哥是人均工程畢業生比例最高的國家之一。

- 隨著墨西哥自動化的蓬勃發展,該地區採用機器人技術和先進自動化的公司有望實現創紀錄的成長。過去,有些公司完全避免在墨西哥投資,而有些公司則僅將墨西哥的資源作為廉價勞動力的來源。然而,墨西哥的自動化產業正變得越來越複雜,使其與其他主要國家相比更具競爭力。

- 此外,該國正在加強提高自動化程度。例如,墨西哥自動化促進協會(A3)宣傳自動化的好處,同時促進該國相關人員和自動化社區成員之間的聚會和交流。

- 此外,由於建立新機場和加強現有機場基礎設施的投資增加,預計該國 AMH(自動物料輸送)系統的採用將會增加。

成長率最高的食品和飲料

- 食品和飲料行業是該地區最大的經濟貢獻者之一。在拉丁美洲,巴西出口冷凍食品和肉品,阿根廷是包裝和加工食品領域的領先國家。

- 墨西哥擁有龐大的飲料工業。由於毗鄰美國和貿易協定,哥倫比亞的食品和飲料行業在過去十年中成長了 50% 以上,而秘魯和智利在處理水產品和冷凍食品方面處於領先地位。食品和飲料行業的高成長前景加上自動化服務供應商在該地區的滲透正在推動該行業對 AMH 系統的需求。

- 許多墨西哥製造商正在轉向混合自動化而不是完全自動化。由於墨西哥缺乏技術純熟勞工,許多自動化提供者支持這種做法。透過採用混合自動化,現有工人只需最少的培訓即可開發新技能。

- 因此,市場上對協作機器人和半自動化解決方案的需求不斷成長。這種趨勢在海鮮加工公司中尤其明顯,這些公司以加工章魚、沙丁魚、蝦和龍蝦等複雜農產品而聞名。

拉丁美洲 AMH(自動化物料輸送)產業概況

拉丁美洲 AMH(自動物料輸送)市場分散且競爭適中。產品推出、高額研發投入、夥伴關係與收購是國內企業維持激烈競爭所採取的主要成長策略。

- 2021 年 5 月 - ZKW 集團是創新高階照明系統和電子產品的專家,與瑞仕格合作,在其位於墨西哥錫勞的工廠安裝 Tornado 微型負載起重機、快速移動輸送機系統和過道貨架。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對市場的影響

- 市場促進因素

- 電子商務產業的崛起

- 工業 4.0 投資推動自動化和物料輸送的需求

- 市場限制因素

- 確保人力資源的問題

- 初始成本高

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依產品類型

- 硬體

- 軟體

- 服務

- 依設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單元貨載

- 組裝

- 特殊用途

- 自主移動機器人(AMR)

- 雷射導引車

- 自動儲存和搜尋系統(ASRS)

- 固定通道(堆垛機高機+穿梭系統)

- 輪播(水平輪播+垂直輪播)

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 常規型(高電位+低電位)

- 機器人

- 分類系統

- 移動機器人

- 按最終用戶

- 飛機場

- 車

- 飲食

- 零售/倉庫/配送中心/物流中心

- 一般製造業

- 藥品

- 小包裹

- 其他最終用戶

- 按國家/地區

- 巴西

- 阿根廷

- 墨西哥

- 哥倫比亞

- 秘魯

- 智利

- 其他拉丁美洲

第6章 競爭狀況

- 公司簡介

- Daifuku Co. Ltd

- Interroll Group

- Kardex Group

- KION Group

- Columbus McKinnon Group

- BEUMER Group GmbH & Co. KG

- **List is not Exhaustive

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 57262

The LA AMH Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- Latin America is economically expanding, is resourceful, and demographically buoyant. Thus, it is a promising market for automation. The burgeoning population of the upper and middle classes in the region is expected to increase automation adoption. However, primarily due to a rapid increase in labor costs, many business models are likely to change.

- The delivery of a return on investment (ROI) from automation is generally fast in Brazil. ROI of 2-4 years is achievable, which is less as compared to other emerging countries. Decreasing operating costs and radically reducing inefficiencies in the processes by implementing automation are playing major roles in the adoption of automation in the country. Picking and pallet handling are the major areas in which many gains can be achieved with the help of automation technologies.

- The region has witnessed an increasing investment in e-commerce. For instance, the region witnessed the establishment of several new distribution centers in Argentina, Brazil, and Mexico post the investment of USD 750 million and USD 100 million by PayPal and Dragoneer in Argentina-based e-commerce giant, MercadoLibre.

- Besides, Brazil is expected to account for the most considerable retail e-commerce revenue in the region, with a value of USD 17.35 billion, at a slightly constant rate over the forecast period.

- The Covid-19 pandemic has ushered several companies to incorporate Material Handling products to minimize human interaction on the floor. Thus, to tap into this demand, in July 2021, Eastman Machine Company appointed CMP Trading of Sao Jose dos Campos (Sao Paulo), Brazil, to represent its line of automated cutting systems, material handling equipment, and design software.

Latin America AMH Market Trends

Mexico to witness the Highest Growth

- Mexico is home to various industries, including substantial automotive and aerospace manufacturing sectors. Automation investments can help increase the number of well-paying jobs in Mexico since the country has one of the highest ratios of engineering graduates per capita.

- With the boom of automation in Mexico, any company that employs robotics or advanced automation in the region is poised to register growth. In the past, some companies completely avoided investing in Mexico or only used the resources for cheap labor. However, the automation industry in Mexico is becoming more advanced, which is providing it with a competitive edge over other major countries.

- Furthermore, the country has been witnessing an increase in initiations to promote automation. For instance, the Association for the Advancement of Automation (A3) Mexico promotes the benefits of automation while facilitating gatherings and interchanges between the stakeholders and members of the automation community in the country.

- Moreover, the country is anticipated to witness growth in the adoption of automated material handling systems due to the increasing investments in establishing new airports and enhancing the existing airports' infrastructure.

Food and Beverage to witness the Highest growth rate

- The food and beverage industry is one of the most significant economic contributors to the region. In Latin America, Brazil exports frozen food and meat products, while Argentina is the leading country in the packaged and processed food segment.

- Mexico has a large beverage industry. Due to its proximity to the United States and trade agreements, the Colombian food and beverage industry experienced a growth of over 50% in the last decade, while Peru and Chile were at the forefront in dealing with seafood and frozen food. A high prospect for growth in the food and beverage industry, coupled with the penetration of the automation service providers in the region, is driving the need for AMH systems in the sector.

- Most of the Mexican manufacturers are inclined toward hybrid automation rather than complete automation. Many automation providers support this practice, as the country has a considerable scarcity of skilled workforce. Employing hybrid automation would allow existing workers to cultivate new skills with minimal training.

- As a result, there is a high demand for collaborative robots and semi-automation solutions in the market. This trend is highly visible in the seafood processing companies that are highly renowned for processing complex produce, including Octopus, Sardine, Shrimp, and Lobster.

Latin America AMH Industry Overview

The Latin America automated material handling market is fragmented and moderately competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- May 2021 - The ZKW Group, the specialist for innovative, premium lighting systems and electronics, has partnered with Swisslog to install Tornado miniload cranes, QuickMove conveyor systems, and aisle racking in its facility located in Silao, Mexico.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of the Impact of COVID-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Rising E-commerce Industry

- 4.3.2 Industry 4.0 investments driving the demand for automation and material handling

- 4.4 Market Restraints

- 4.4.1 The Staffing Challenge

- 4.4.2 High Initial Costs

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Equipment Type

- 5.2.1 Mobile Robots

- 5.2.1.1 Automated Guided Vehicle (AGV)

- 5.2.1.1.1 Automated Forklift

- 5.2.1.1.2 Automated Tow/Tractor/Tug

- 5.2.1.1.3 Unit Load

- 5.2.1.1.4 Assembly Line

- 5.2.1.1.5 Special Purpose

- 5.2.1.2 Autonomous Mobile Robots (AMR)

- 5.2.1.3 Laser Guided Vehicle

- 5.2.2 Automated Storage and Retrieval System (ASRS)

- 5.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3 Vertical Lift Module

- 5.2.3 Automated Conveyor

- 5.2.3.1 Belt

- 5.2.3.2 Roller

- 5.2.3.3 Pallet

- 5.2.3.4 Overhead

- 5.2.4 Palletizer

- 5.2.4.1 Conventional (High Level + Low Level)

- 5.2.4.2 Robotic

- 5.2.5 Sortation System

- 5.2.1 Mobile Robots

- 5.3 By End-user Vertical

- 5.3.1 Airport

- 5.3.2 Automotive

- 5.3.3 Food and Beverage

- 5.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 5.3.5 General Manufacturing

- 5.3.6 Pharmaceuticals

- 5.3.7 Post and Parcel

- 5.3.8 Other End Users

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Mexico

- 5.4.4 Colombia

- 5.4.5 Peru

- 5.4.6 Chile

- 5.4.7 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Daifuku Co. Ltd

- 6.1.2 Interroll Group

- 6.1.3 Kardex Group

- 6.1.4 KION Group

- 6.1.5 Columbus McKinnon Group

- 6.1.6 BEUMER Group GmbH & Co. KG

- 6.1.7 ** List is not Exhaustive

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219