|

市場調查報告書

商品編碼

1629806

歐洲 AMH(自動物料輸送):市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Europe AMH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

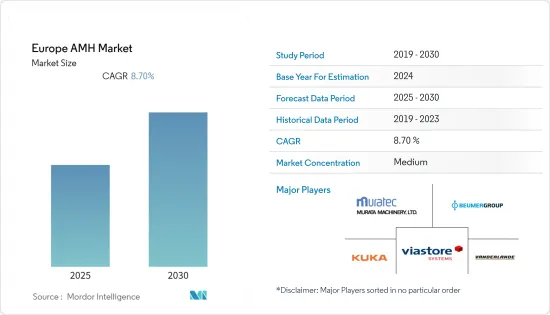

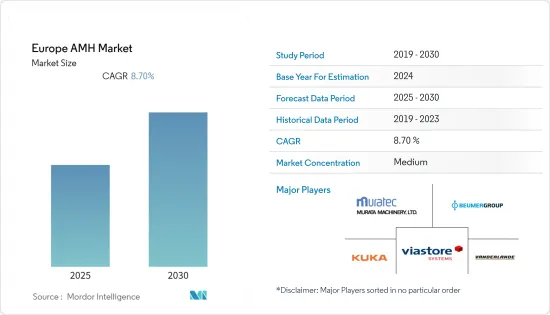

歐洲 AMH(自動物料輸送)市場預計在預測期內複合年成長率為 8.7%

主要亮點

- 政治、經濟和技術的發展對英國和整個歐洲的製造業成長產生相應的影響。英國脫歐公投震驚了所有產業,但製造業表現積極。

- 由於對工業 4.0 革命的投資增加,歐洲已成為工業自動化最重要的採用者。據CBI外交部稱,歐洲佔全球工業4.0投資的三分之一以上。西歐和北歐是其主要市場,尤其是該術語最初創造的德國,是領導者。

- 北歐傳統上是倉庫自動化最發達的市場。高人事費用和對工廠工作條件的特殊考慮促使採用複雜和高水準的自動化。在斯堪的斯堪地那維亞,System Logistics 為食品和飲料行業的重要客戶提供倉儲、揀選和物料輸送業務的高效管理支援。

- 此外,投資管理公司仲量聯行表示,在歐洲各地的倉庫中,人類和機器擴大協同工作,而高效和熟練人才的缺乏可能會進一步加速自動化進程。

- COVID-19 的封鎖進一步加速了電子雜貨管道的發展。 2020 年,歐洲主要市場成長了 50% 以上,進一步增加了對高效能電子雜貨履約解決方案的需求。為此,KNAPP、Ocado、Swisslog、Takeoff Technologies 和 WITRON 等技術和平台供應商不斷擴展其結合軟體和硬體的自動化解決方案組合。

歐洲AMH(自動物料輸送)市場趨勢

汽車預計將錄得顯著成長

- 歐盟(EU)是世界上最大的汽車生產國之一。該部門在研發方面的私人投資最多。為了增強汽車產業的競爭力並保持其技術領先地位,歐盟委員會支持全球技術協調並提案為研發提供資金。

- 此外,根據ACEA報告,歐盟(EU)每1000人擁有569輛持有。盧森堡的汽車密度是歐盟最高的(每千人擁有 694 輛汽車),而拉脫維亞的汽車密度是歐盟成員國中最低的。 OICA也表示,2020年歐洲乘用車總銷量將為1,416萬輛。

- 英國的汽車供應鏈是需求主導的(車輛內的個人化程度不斷提高),迫使OEM供應商選擇靈活的自動化。這導致了所研究市場中汽車細分市場的成長。

- 汽車製造過程中擴大採用自動化、數位化和人工智慧的出現是推動荷蘭汽車產業數位化需求的一些主要因素。

德國預計將擁有最大的市場佔有率

- 德國汽車工業是世界上最大的製造商之一。根據德國貿易投資署 (GTAI) 的數據,全球生產的高檔品牌汽車 70% 以上是由德國OEM生產的。

- 德國是全球領先的自動化物料輸送解決方案消費者之一。根據國際機器人聯合會(IFR)最近的估計,德國的機器人密度僅次於韓國和日本(每萬名工人 294 台機器人)。

- 除了汽車行業之外,郵政和小包裹行業也為 AMH 的成功做出了貢獻。總部位於德國的西門子郵政、小包裹和機場物流是郵政分類系統的全球市場領導者。 60 多個國家/地區的 23,000 多個系統使用西門子技術對郵件進行可靠分類。它也是機場物流創新產品和解決方案的主要企業,包括郵政和小包裹物流、自動化、行李和貨物處理。

- 製藥業也在引入自動化,預計將出現溫和成長。這家德國醫藥包裝巨頭的一項策略性舉措凸顯了瓶子與泡殼、玻璃與塑膠注射器的醫藥包裝趨勢,導致德國對包裝器材和設備的需求增加。

歐洲AMH(自動物料輸送)產業概述

歐洲 AMH(自動物料輸送)市場競爭激烈,由多家大型企業組成。從市場佔有率來看,目前少數大公司佔據市場主導地位。這些擁有高市場佔有率的大公司正專注於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。此外,市場上的公司正在收購歐洲自動化物料輸送新興企業,以增強其產品能力。

- 2021 年 2 月 - Duravant LLC 是食品加工、包裝和物料輸送領域的全球工程設備和自動化解決方案供應商,是裝袋機、堆垛機機、拉伸食品機和托盤輸送系統的領先製造商,總部位於荷蘭。

- 2021 年 7 月 - ABB 今天宣布收購 ASTI 行動機器人集團 (ASTI)。 ASTI 是全球大型公司的自主移動機器人 (AMR) 製造商,擁有涵蓋其軟體套件支援的所有主要應用的廣泛產品組合。透過此次收購,ABB 擴大了在機器人和自動化領域的業務,並成為唯一為下一代彈性自動化提供完整產品組合的公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- COVID-19 對市場的影響

- 市場促進因素

- 自動化在倉庫應用中的廣泛採用

- 政府對自動化的支援政策

- 工業 4.0 投資推動自動化和物料輸送的需求

- 市場限制因素

- 缺乏技術純熟勞工

- 初始成本高

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依產品類型

- 硬體

- 軟體

- 服務

- 依設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單元貨載

- 組裝

- 特殊用途

- 自主移動機器人(AMR)

- 雷射導引車

- 自動儲存和搜尋系統(ASRS)

- 固定通道(堆垛機高機+穿梭系統)

- 輪播(水平輪播+垂直輪播)

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 常規型(高電位+低電位)

- 機器人

- 分類系統

- 移動機器人

- 按最終用戶

- 飛機場

- 車

- 飲食

- 零售/倉庫/配送中心/物流中心

- 一般製造業

- 藥品

- 小包裹

- 其他最終用戶

- 按國家/地區

- 英國

- 法國

- 義大利

- 德國

- 中歐/東歐

- 西班牙

- 其他歐洲國家

第6章 競爭狀況

- 公司簡介

- SSI SCHAEFER AG

- Daifuku Co. Limited

- Kardex Group

- Honeywell Intelligrated

- Beumer Group GMBH & Co. KG

- Vanderlande Industries BV

- Murata Machinery Limited

- TGW Logistics Group GmbH

- KUKA AG

- Witron Logistik

- Mecalux SA

- Viastore Systems GmbH

第7章 投資分析

第8章市場的未來

The Europe AMH Market is expected to register a CAGR of 8.7% during the forecast period.

Key Highlights

- Throughout the United Kingdom and Europe, political, economic, and technological developments are impacting the growth of the manufacturing industry proportionally. Although the BREXIT vote sent shockwaves across all industries, the manufacturing industry remained positive.

- Europe has been the most prominent adopter of industrial automation, owing to increasing investments in the Industry 4.0 revolution. According to the CBI Ministry of Foreign Affairs, Europe accounts for more than one-third of the global Industry 4.0 investments. Western and Northern Europe are its main markets, especially Germany, where the term was originally coined and a frontrunner.

- Northern Europe is traditionally the most developed market regarding the use of automation in warehouses. The high labor costs and special attention to the working conditions at the factory have prompted the adoption of sophisticated and advanced automation. In Scandinavia, System Logistics has supported important clients in the food and beverage sector in the efficient management of warehousing, picking, and material handling operations.

- Moreover, in warehouses across Europe, man and machine are increasingly working more closely together, and a lack of efficient and skilled manpower could accelerate automation further, according to JLL, an investment management company.

- The e-grocery channel accelerated further because of the COVID-19 lockdown. It grew by more than 50% growth in 2020 for key European markets, creating an even stronger need for efficient e-grocery fulfillment solutions. This has encouraged technology and platform providers such as KNAPP, Ocado, Swisslog, Takeoff Technologies, and WITRON to extend their ever-growing portfolio of automation solutions combining software and hardware.

Europe Automated Material Handling (AMH) Market Trends

Automotive is Expected to Register a Significant Growth

- The European Union (EU) is among the world's biggest producers of motor vehicles. The sector represents the largest private investor in R&D. To strengthen the automotive industry's competitiveness and preserve its technological leadership, the European Commission supports global technological harmonization and offers to fund R&D.

- Moreover, according to an ACEA report, The European Union counts 569 cars per 1,000 inhabitants. Luxembourg has the highest car density in the EU (694 per 1,000 people), and Latvia has the lowest among the EU members. The OICA also suggested that the total sales of passenger vehicles in Europe stood at 14.16 million in 2020.

- The demand-driven nature of the automotive supply chain in the United Kingdom (involving increasing levels of personalization within a vehicle) is forcing suppliers of OEMs to opt for automation with greater levels of flexibility. This is leading to the growth of the automotive segment in the market studied.

- The increasing adoption of automation in the automotive manufacturing process and the advent of digitization and AI are some of the primary factors driving the demand for digitalization in the automotive sector of the Netherlands.

Germany is Expected to Have the Largest Market Share

- The German automotive industry has one of the largest manufacturing sectors in the world. According to the Germany Trade and Investment (GTAI) agency, of all premium brand vehicles produced globally, over 70% are German-OEM manufactured.

- Germany is one of the major consumers of automated material handling solutions in the world. According to the recent estimates of the International Federation of Robotics (IFR), Germany has a high robot density (294 units per 10,000 workers), after countries, like South Korea and Japan.

- In addition to the automotive industry, the post and parcel industry is also contributing toward the success of AMH in the country. Siemens Postal, Parcel, and Airport Logistics, headquartered in Germany, ranks as a global market leader for mail sorting systems. More than 23,000 systems, using Siemens technology, are reliably sorting mail in more than 60 countries. The company is also a leading provider of innovative products and solutions for mail and parcel logistics, automation, and airport logistics, including baggage and cargo handling.

- The pharmaceutical sector is also adopting automation and is expected to record moderate growth. Strategic moves by the German pharmaceutical packaging giants are shedding light on drug packaging trends related to bottles vs. blisters and glass vs. plastic syringes, leading to a growth in the demand for packaging machinery and equipment in Germany.

Europe Automated Material Handling (AMH) Industry Overview

The European automated material handling market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market shares and profitability. The companies operating in the market are also acquiring start-ups working on European automated material handling technologies to strengthen their product capabilities.

- February 2021 - Duravant LLC, global engineered equipment and automation solutions provider to the food processing, packaging, and material handling sectors, acquired Votech GS B.V., a leading manufacturer of bag filling machines, palletizer machines, stretch hood machines, and pallet transport systems based in The Netherlands.

- July 2021 - ABB today announced to acquire ASTI Mobile Robotics Group (ASTI), a leading global autonomous mobile robot (AMR) manufacturer with a broad portfolio across all major applications enabled by the company's software suite. The acquisition will expand ABB's robotics and automation offering, making it the only company to offer a complete portfolio for the next generation of flexible automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of Covid-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Wide Adoption of Automation in Warehouse Applications

- 4.3.2 Supporting Government Policies for Automation

- 4.3.3 Industry 4.0 investments driving the demand for automation and material handling

- 4.4 Market Restraints

- 4.4.1 Shortage of Skilled Workforce

- 4.4.2 High Initial Costs

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Equipment Type

- 5.2.1 Mobile Robots

- 5.2.1.1 Automated Guided Vehicle (AGV)

- 5.2.1.1.1 Automated Forklift

- 5.2.1.1.2 Automated Tow/Tractor/Tug

- 5.2.1.1.3 Unit Load

- 5.2.1.1.4 Assembly Line

- 5.2.1.1.5 Special Purpose

- 5.2.1.2 Autonomous Mobile Robots (AMR)

- 5.2.1.3 Laser Guided Vehicle

- 5.2.2 Automated Storage and Retrieval System (ASRS)

- 5.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3 Vertical Lift Module

- 5.2.3 Automated Conveyor

- 5.2.3.1 Belt

- 5.2.3.2 Roller

- 5.2.3.3 Pallet

- 5.2.3.4 Overhead

- 5.2.4 Palletizer

- 5.2.4.1 Conventional (High Level + Low Level)

- 5.2.4.2 Robotic

- 5.2.5 Sortation System

- 5.2.1 Mobile Robots

- 5.3 By End-user Vertical

- 5.3.1 Airport

- 5.3.2 Automotive

- 5.3.3 Food and Beverage

- 5.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 5.3.5 General Manufacturing

- 5.3.6 Pharmaceuticals

- 5.3.7 Post and Parcel

- 5.3.8 Other End Users

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 France

- 5.4.3 Italy

- 5.4.4 Germany

- 5.4.5 Central/Eastern Europe

- 5.4.6 Spain

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SSI SCHAEFER AG

- 6.1.2 Daifuku Co. Limited

- 6.1.3 Kardex Group

- 6.1.4 Honeywell Intelligrated

- 6.1.5 Beumer Group GMBH & Co. KG

- 6.1.6 Vanderlande Industries BV

- 6.1.7 Murata Machinery Limited

- 6.1.8 TGW Logistics Group GmbH

- 6.1.9 KUKA AG

- 6.1.10 Witron Logistik

- 6.1.11 Mecalux SA

- 6.1.12 Viastore Systems GmbH