|

市場調查報告書

商品編碼

1630275

拉丁美洲玻璃瓶和容器:市場佔有率分析、行業趨勢和成長預測(2025-2030)LA Glass Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

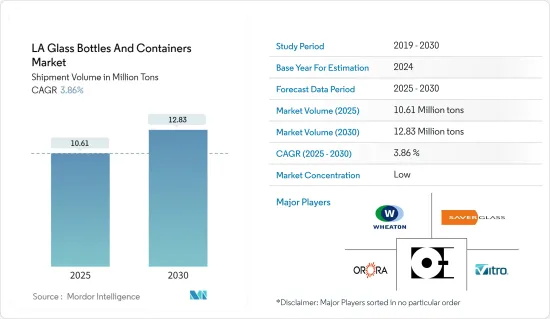

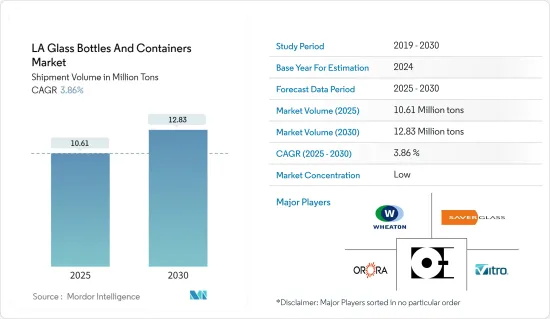

以出貨量為準,拉丁美洲玻璃瓶及容器市場規模預計將從2025年的1,061萬噸擴大到2030年的1,283萬噸,預測期間(2025-2030年)複合年成長率為3.86%。

在該地區不斷壯大的中階的推動下,拉丁美洲的容器玻璃市場正在經歷強勁成長。這一趨勢預計將吸引最終用戶產業增加投資,進一步推動預測期內的市場擴張。

主要亮點

- 在快速發展的拉丁美洲,對環保和永續包裝解決方案不斷成長的需求是成長的關鍵驅動力。可回收、可重複使用且環保的玻璃包裝越來越受到消費者和製造商的青睞。

- 飲料行業不斷成長的需求正在推動市場向前發展。根據阿根廷毒品政策總局的資料,全國人均酒精消費量排名第一。巴西的酒精消費率很高,反映了這個趨勢。此外,牛奶和果汁等非酒精飲料的日益普及也進一步擴大了該地區的玻璃瓶和容器市場。

- 輕質玻璃和高效回收方法等創新正在推動市場發展。先進的生產技術,特別是薄壁、輕質玻璃容器的引入,簡化了製造過程。尤其是窄頸壓吹製程對於減輕拉丁美洲生產的玻璃瓶的重量起著極其重要的作用。

- 該地區正在興起各種終端用戶產業,包括製藥業。巴西快速擴張的製藥業是一個關鍵驅動力。過去十年,巴西鞏固了其作為其他南美新興市場重要供應商的地位。隨著醫藥產業產能不斷上升,對玻璃包裝也產生了需求。

- 然而,市場面臨競爭性替代產品的挑戰。隨著消費者偏好轉向更方便的處理解決方案,對軟包裝選項的需求不斷增加。此外,塑膠包裝解決方案的先進包裝為玻璃包裝行業帶來了重大挑戰。

拉丁美洲玻璃瓶和容器市場的趨勢

乳製品佔很大佔有率

- 拉丁美洲乳製品市場是世界上成長最快的市場之一。儘管更廣泛的繁榮正在推動需求從玻璃轉向硬質塑膠和金屬,但對可重複使用玻璃等增值包裝的需求仍然很高。可再填充的玻璃瓶使該地區的消費者更能負擔得起牛奶和其他飲料。

- 玻璃瓶主要用於包裝牛奶。與其他類型的包裝相比,它可以更長時間地保留牛奶等乳製品的風味。這是因為玻璃使得內容物不太可能與空氣和其他可能的化學物質混合。

- 《國家地理》、《時代》、《商業內幕》和美國食品藥物管理局等知名組織的研究強調了寶特瓶的缺點,並特別強調了玻璃瓶的優點。

- 根據美國農業部的報告,巴西和墨西哥是拉丁美洲最大的兩個牛奶生產國。 2023年,巴西原乳產量約2,520萬噸,而墨西哥為1,350萬噸。這比 2022 年的 2,470 萬噸和 1,325 萬噸有所增加。

- 市場也面臨原乳生產的挑戰。正如農業和園藝發展委員會在 2024 年 11 月報告的那樣,由於年初以來疲軟的經濟狀況和惡劣天氣的影響,牛奶生產開局艱難。同時,許多地區報告九月牛奶產量下降。特別是阿根廷9月牛奶產量僅下降1.9%。阿根廷的牛奶產量遠遠落後去年的數字。這一挫折是由於惡劣的天氣條件和猖獗的通貨膨脹導致牛奶價格下降。

化妝品產業推動市場成長

- 在拉丁美洲,化妝品包裝領域的高階奢侈品(包括護膚、護髮品和香水)越來越青睞玻璃包裝。隨著玻璃增強產品的優雅度並提升其奢華地位,這一趨勢正在不斷發展。

- 巴西等國家可支配收入的增加正在推動全球對奢侈化妝品的需求。巴西的化妝品產業正在不斷擴張,並成為世界上成長最快、最具活力的產業之一。

- 巴西人越來越重視整裝儀容和個人化。過去十年,化妝品銷售額從8%飆升至10%,使巴西成為拉丁美洲最大的化妝品消費國。年輕人,尤其是整裝儀容對整裝儀容的高度關注,支持了對化妝品玻璃包裝的需求不斷成長。

- 巴西是拉丁美洲的美容和個人護理之都,也是世界領先的化妝品市場之一。根據巴西個人衛生、香水和化妝品協會 (ABIHPEC) 的資料,2023 年 4 月是該行業的歷史性里程碑,今年前四個月的出口將成長 17.2%,4 月份將成長 25.5%。

- 此外,根據國家統計和區域研究所的數據,2020年墨西哥化妝品、香水和洗護用品用品的年產值為1,247.5億墨西哥比索(70.3億美元);因此,隨著化妝品和其他相關產品銷售的增加,整個產業對容器玻璃的需求將會增加。

- 推動市場成長的關鍵因素之一是擴大收購國際品牌化妝品公司。例如,2023年7月,贏創收購了阿根廷永續化妝品實踐創新者Novachem。收購 Novachem 將使贏創能夠為個人護理市場的客戶提供更具創新性和永續的解決方案。

拉丁美洲玻璃瓶及容器產業概況

玻璃是產品包裝的首選,因為它能夠最大限度地減少污染風險並保護內容物免受損壞。作為一種剛性包裝解決方案,玻璃可以保護各種密度、尺寸和形狀的內容物。市面上提供各種形式的玻璃容器,尤其是瓶子。隨著消費者擴大將玻璃視為優先考慮健康、偏好和環境安全的可靠包裝選擇,拉丁美洲的玻璃市場成長正在加速。

拉丁美洲容器玻璃市場較為分散。區域參與者和國際供應商透過價格和關鍵競爭策略吸引客戶來爭奪市場佔有率,從而導致適度的市場競爭。主要參與者有 Vitro、SAB de CV、Owens-illinois Inc.。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- PESTEL 分析 - 拉丁美洲容器玻璃產業

- 包裝玻璃容器產業標準及法規

- 包裝玻璃的原料分析及材質注意事項

- 容器和包裝的永續性趨勢

- 拉丁美洲容器玻璃熔爐產能與位置

第5章市場動態

- 市場促進因素

- 飲料業需求不斷成長

- 最近的創新,例如減輕重量和有效回收

- 市場限制因素

- 替代產品的激烈競爭

- 拉丁美洲市場分析 拉丁美洲容器玻璃市場

- 貿易情景-拉丁美洲容器玻璃產業進出口範式的歷史與現況分析

第6章 市場細分

- 按最終用戶產業

- 飲料

- 酒精飲料

- 葡萄酒/烈酒

- 啤酒/蘋果酒

- 非酒精飲料

- 碳酸飲料

- 水

- 乳類飲料

- 其他非酒精飲料

- 食物

- 化妝品

- 藥品

- 其他最終用戶

- 飲料

- 按國家/地區

- 巴西

- 墨西哥

- 阿根廷

第7章 競爭格局

- 公司簡介

- Vitro, SAB de CV

- Wheaton Brasil Group

- Orora Limited

- Saverglass SAS

- Owens-illinois Inc.

- Ardagh Group SA

- Verallia SA

- Gerresheimer AG

第8章補充資料:拉丁美洲玻璃容器主要供貨窯爐製造商分析

第9章 市場未來展望

The LA Glass Bottles And Containers Market size in terms of shipment volume is expected to grow from 10.61 million tons in 2025 to 12.83 million tons by 2030, at a CAGR of 3.86% during the forecast period (2025-2030).

Latin America's Container Glass market is experiencing robust growth, driven by the region's expanding middle class. This trend is poised to attract increased investments from end-user industries, further bolstering the market's expansion during the forecast period.

Key Highlights

- In Latin America, a region with several rapidly developing nations, the rising demand for eco-friendly and sustainable packaging solutions is a key growth driver. Glass packaging, being recyclable, reusable, and environmentally friendly, has gained favour among consumers and manufacturers.

- The beverage industry's rising demand is propelling the market forward. Data from Argentina's Secretary of Integral Policy on Drugs highlights that the country leads in per capita alcohol consumption. Brazil mirrors this trend with its high alcohol consumption rates. Additionally, the increasing popularity of non-alcoholic beverages like milk and juices further broadens the region's market for glass bottles and containers.

- Innovations like lightweight glass and efficient recycling methods are energizing the market. Advanced production techniques, especially the introduction of thin-walled and lightweight glass containers, have streamlined manufacturing processes. Notably, the Narrow Neck Press and Blow process has played a pivotal role in reducing the weight of glass bottles produced in Latin America.

- Various end-user industries, including pharmaceuticals, are rising in the region. Brazil's rapidly expanding pharmaceutical sector stands out as a significant growth driver. Over the last ten years, Brazil has solidified its position as a critical supplier to other emerging South American markets. With the pharmaceutical industry's production capacity on the rise, the demand for glass packaging also exists.

- However, the market faces challenges from competing substitute products. As consumer preferences shift towards more convenient handling solutions, there's a growing demand for flexible packaging options. Moreover, advancements in plastic packaging solutions present a notable challenge to the glass packaging sector.

Latin America Glass Bottles & Containers Market Trends

Dairy-based Products to Hold a Significant Share

- Latin America's dairy market is one of the fastest-growing markets in the world. While broader prosperity has helped shift demand from glass to rigid plastic and metal, demand for value-added packaging like reusable glass is still high. Refillable glass bottles have long made beverages, like milk, more affordable for consumers in this region.

- Glass bottles are mainly used for packaging milk. They preserve the flavour of dairy products, such as milk, much longer than other types of packaging. This is because glass is less likely to allow contents to mix with air or other possible chemicals.

- Research from credible entities, including National Geographic, Time, Business Insider, and the US Food and Drug Administration, underscores the disadvantages of plastic bottles and especially highlights the benefits of glass bottles.

- As the US Department of Agriculture reported, Brazil and Mexico are the top two milk-producing nations in Latin America. 2023 Brazil's milk production reached approximately 25.2 million metric tons, while Mexico's output was 13.5 million metric tons. This marks an uptick from their respective 2022 figures of 24.7 million metric tons and 13.25 million metric tons.

- The market is also witnessing challenges in the production of milk. As the Agriculture and Horticulture Development Board reported in November 2024, milk production saw a tough start to the year marked by low economic confidence and adverse weather conditions. At the same time, many regions reported decreased volumes in September. Notably, milk production in Argentina saw a drop of only 1.9% in September. Argentina's milk production lagged significantly behind last year's figures. This setback was attributed to harsh weather conditions and the erosion of milk prices due to rampant inflation.

Cosmetics Sector to Drive the Market Growth

- In Latin America, the cosmetic packaging segment, encompassing skincare, hair care, and perfumes, increasingly favours glass packaging for high-end luxury products. This trend is gaining momentum as glass enhances the product's elegance and elevates its premium status.

- Rising disposable incomes in countries like Brazil fuel a global demand for premium cosmetic products. Brazil's cosmetics industry is expanding and has established itself as one of the fastest-growing and most dynamic in the world.

- Brazilians are increasingly prioritizing grooming and personalization. Over the past decade, cosmetic product sales have surged from 8% to 10%, positioning Brazil as Latin America's top cosmetics consumer. The youth's keen interest in grooming, especially men, underscores the rising demand for glass packaging in cosmetics.

- Brazil is Latin America's premier beauty and personal care hub and one of the prominent players in the world's leading cosmetics markets. Data from the Brazilian Association of Personal Hygiene, Perfumery and Cosmetics (ABIHPEC) highlights a historic milestone for the sector, with exports surging by 17.2% in the year's initial four months and a remarkable 25.5% jump in April 2023.

- Further, According to the National Institute of Statistics and Geography, the annual production value of cosmetics, perfumes, and toiletries in Mexico in 2020 was MXN 124.75 billion (USD 7.03 billion), which has increased to MXN 146.51 billion (USD 8.26 billion). Therefore, a rise in sales of cosmetics and other related products would advance the need for container glass across the industry.

- One of the significant factors driving the market's growth is the rise in the acquisition of cosmetic companies with international brands. For instance, in July 2023, Evonik acquired Novachem, an Argentinian innovator of sustainable cosmetic activities. Novachem will allow us to bring even more innovative and sustainable solutions to customers in the personal care market.

Latin America Glass Bottles & Containers Industry Overview

Glass is preferred for product packaging due to its ability to minimize contamination risks and protect contents from damage. As a rigid packaging solution, glass encompasses diverse densities, sizes, and shapes to safeguard its contents. The market offers various forms of container glass, prominently featuring bottles. In Latin America, the glass market is witnessing accelerated growth, driven by rising consumer acceptance of glass as a trusted packaging choice, prioritizing health, taste, and environmental safety.

The Latin American container glass market is fragmented. Regional players and international vendors compete for market share by attracting customers with prices and significant competitive strategies, leading to moderate market competition. Key players are Vitro, S.A.B. de CV, Owens-illinois Inc., Wheaton Brasil Group, Orora Limited, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 PESTEL ANALYSIS - Container Glass Industry in Latin America

- 4.3 Industry Standards and Regulations for Container Glass for Packaging

- 4.4 Raw Material Analysis & Material Considerations for Packaging

- 4.5 Sustainability Trends for Packaging

- 4.6 Container Glass Furnace Capacity and Location in Latin America

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Beverage Industry

- 5.1.2 Recent Innovations Such as Lightweight and Effective Recycling

- 5.2 Market Restraint

- 5.2.1 High Competition From Substitute Products

- 5.3 Analysis of the Current Positioning of Latin America in the Latin America Container Glass Market

- 5.4 Trade Scenario - Analysis of the Historical and Current Export-Import Paradigm for the Container Glass Industry in Latin America

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Beverage

- 6.1.1.1 Alcoholic Beverages

- 6.1.1.1.1 Wines and Spirits

- 6.1.1.1.2 Beer and Cider

- 6.1.1.2 Non-Alcoholic Beverages

- 6.1.1.2.1 Carbonated Drinks

- 6.1.1.2.2 Water

- 6.1.1.2.3 Dairy-Based

- 6.1.1.2.4 Other Non-Alcoholic Beverages

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceuticals

- 6.1.5 Other End user verticals

- 6.1.1 Beverage

- 6.2 By Country

- 6.2.1 Brazil

- 6.2.2 Mexico

- 6.2.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vitro, S.A.B. de CV

- 7.1.2 Wheaton Brasil Group

- 7.1.3 Orora Limited

- 7.1.4 Saverglass SAS

- 7.1.5 Owens-illinois Inc.

- 7.1.6 Ardagh Group S.A.

- 7.1.7 Verallia SA

- 7.1.8 Gerresheimer AG