|

市場調查報告書

商品編碼

1642124

印度容器玻璃:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)India Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

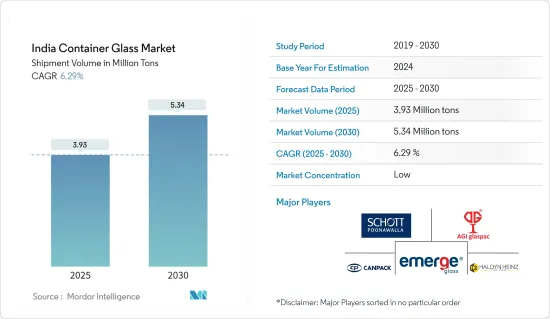

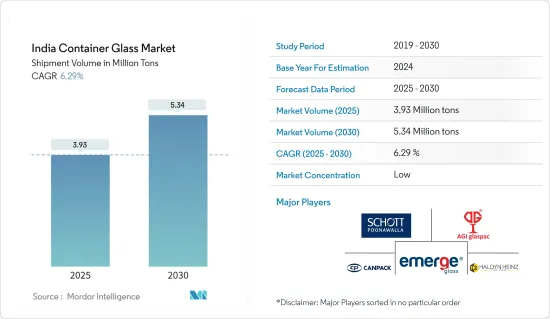

以出貨量為準,印度容器玻璃市場規模預計將從 2025 年的 393 萬噸成長到 2030 年的 534 萬噸,預測期內(2025-2030 年)的複合年成長率為 6.29%。

關鍵亮點

- 由於酒精消費量的增加,印度的包裝玻璃市場正在經歷顯著的成長。對玻璃容器依賴程度較高的白酒產業,直接影響市場的成長速度。

- 據加拿大農業和食品部稱,印度的啤酒消費量正在上升。預計2022年啤酒消費量將達27.8億公升,2026年將上升至36億公升。深色玻璃瓶適合用來包裝啤酒,因為它們可以保護啤酒免受紫外線造成的腐敗。

- 印度軟性飲料市場預計將保持強勁成長。根據百事印度公司瓶裝合作夥伴 Varun Beverages Ltd 的報告,到 2021 年,印度人均年瓶裝飲料消費量預計將達到 84 瓶左右,並在 2022 年進一步成長。百事公司致力於減少軟性飲料的塑膠包裝,到 2025 年將消除多達 670 億個寶特瓶。收購 SodaStream 預計將導致該公司產品的玻璃瓶包裝的使用增加。

- 印度和其他國家的塑膠禁令極大地促進了玻璃容器使用量的增加。作為塑膠容器的直接替代品,玻璃已成為領先的替代包裝材料。儘管人均消費量較低,但由於當地飲料、酒精、食品、製藥和化妝品行業的需求,市場正在經歷強勁成長。

- 市場成長的主要障礙是玻璃生產產生的高二氧化碳排放。玻璃製造需要密集型過程,爐溫範圍為 1,300°C 至 1,650°C,火焰溫度高達 2,000°C。此外,玻璃包裝比紙盒包裝重 12 倍。根據 Thinkstep 的一項研究,材料重量對從生產到零售分銷的碳足跡有很大影響。

印度玻璃容器市場趨勢

酒精飲料佔了很大的市場佔有率

- 葡萄酒和烈酒等酒精飲料通常儲存在玻璃杯中。玻璃瓶是包裝葡萄酒的最受歡迎的方式,尤其是彩色玻璃瓶,因為葡萄酒不應該暴露在陽光下。暴露在陽光下會導致葡萄酒變質。預測期內,葡萄酒消費量的增加預計將帶動玻璃包裝的需求。

- 過去十年來,印度的酒精消費量增加了一倍。市場有兩個主要優先事項:擴大高階市場以增加人均消費量,以及擴大日常類別的滲透率。供應商注意到葡萄酒和烈酒行業的需求日益成長。例如,為帝亞吉歐、百加得和保樂力加等知名品牌提供產品的皮拉馬爾玻璃公司 (Piramal Glass) 報告稱,對快速週轉烈酒專用瓶的需求有所增加。

- 印度是世界上成長最快的酒精飲料市場之一。此外,印度國際經濟關係研究理事會 (ICRIER) 預測,未來 10 年,印度酒精消費成長的 70% 以上將由中低收入和高所得階層推動,而且趨勢產品的優質化趨勢將持續下去。這種趨勢正在變得更加強勁。

- 該領域也向外國投資開放,許多邦為國內生產提供補貼(例如馬哈拉斯特拉邦和卡納塔克邦為葡萄酒提供補貼)。在需求方面,快速的都市化、消費者偏好的變化以及購買力增強的中階人口的成長都推動了對酒精飲料的需求不斷成長。

- 此外,政府應致力於逐步降低關稅和其他稅費,印度企業應鼓勵出口以改善貿易平衡。降低中間產品的關稅可以增加印度的附加價值並增強國內製造業的潛力。

- 酒精飲料,尤其是高級酒精飲料,通常使用玻璃容器,因為玻璃美觀、耐用,且具有惰性,能保持內容物的品質。隨著出口量的增加,對於烈酒、葡萄酒和啤酒的高品質玻璃瓶的需求預計將增加,以滿足國際標準和消費者偏好。

- 據印度農業和加工食品出口發展局(APEDA)稱,2024 會計年度印度酒精飲料出口額將達 3.75 億美元,高於上年度。

製藥業正在快速成長

- 印度是世界領先的學名藥供應國之一。隨著出口的增加,符合國際標準的高品質玻璃包裝的需求也日益增加。這促使製造商擴大生產以滿足國內和全球市場的需求,從而推動玻璃容器市場的成長。

- 醫療產業的成長推動了研發的投資,特別是在永續、輕質和耐用的玻璃包裝解決方案方面。這與醫療產業對於高效、安全包裝的需求相吻合,推動了玻璃容器市場先進包裝的發展。

- 根據印度品牌資產基金會統計,2023年印度醫療保健產業的市場規模約為3,720億美元。與 2020 年相比,這是一個成長,表明成長顯著。該行業是該國收入和就業最大的貢獻者之一。

- 此外,印度已成為醫療旅遊中心,透過多項具有里程碑意義的改革和規定,提供最先進、經濟高效的治療。印度是世界領先的低成本藥品供應國之一。印度藥品因其價格低廉、品質優良,受到全球青睞,堪稱名副其實的「世界藥局」。

- 醫療服務和製藥業的擴張直接推動了對玻璃容器的需求,特別是用於包裝藥品、疫苗和醫用管瓶的需求。玻璃通常用於這些應用,因為它不具有反應性,有助於保持藥物的品質和效力,這對醫療行業至關重要。

印度玻璃容器產業概況

印度玻璃包裝市場由幾家主要企業組成。製造商包括 SCHOTT POONAWALLA PRIVATE LIMITED、AGI glaspac(HSIL 公司旗下一家公司)、CANPACK SA、Emerge Glass India Pvt Ltd。這些公司對市場動態有重大影響。為了保持競爭力,印度包裝玻璃市場的供應商正在採取各種策略,包括業務擴張、併購和產品創新。

這些活動旨在加強我們在印度市場的地位,滿足當地需求並適應當地監管和永續性要求。印度容器玻璃製造商也致力於提高生產能力和開發環保玻璃解決方案,以解決日益嚴重的環境問題。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 容器玻璃進出口資料

- PESTEL 分析 – 印度容器玻璃產業

- 包裝玻璃容器行業標準及法規

- 包裝玻璃的原料分析及材料考量

- 玻璃包裝的永續性趨勢

- 印度容器玻璃熔爐的產能和位置

第5章 市場動態

- 市場促進因素

- 酒精消費量增加,玻璃瓶裝飲料偏好

- 嚴格的監管促使印度採用玻璃作為永續替代品

- 市場問題

- 由於玻璃容器易碎且物流複雜,運輸成本較高

- 印度亞太容器玻璃市場現況分析

- 貿易情景-印度容器玻璃產業進出口模式的歷史與現況分析

第6章 市場細分

- 按最終用戶產業

- 飲料

- 酒精飲料

- 啤酒和蘋果酒

- 葡萄酒和烈酒

- 非酒精飲料

- 碳酸飲料

- 汁

- 水

- 乳類飲料

- 調味飲料

- 化妝品

- 藥品

- 其他最終用戶產業

- 飲料

第7章 競爭格局

- 公司簡介

- SCHOTT POONAWALLA PRIVATE LIMITED

- AGI glaspac(A HSIL Company)

- CANPACK SA

- Emerge Glass India Pvt Ltd.

- Haldyn Heinz Fine Glass Pvt Ltd

- Hindustan National Glass & Industries Limited

- PGP Glass Private Limited

- Haldyn Glass Ltd

- Sunrise Glass Industries Pvt. Ltd.

- Ajanta Bottle Pvt. Ltd.

第8章 補充資料-印度主要玻璃容器工廠的主要窯爐供應商分析

第9章:未來市場展望

The India Container Glass Market size in terms of shipment volume is expected to grow from 3.93 million tons in 2025 to 5.34 million tons by 2030, at a CAGR of 6.29% during the forecast period (2025-2030).

Key Highlights

- The container glass market in India has experienced substantial growth due to increased alcohol consumption. The liquor industry, which heavily relies on glass containers, directly influences the market's growth rate.

- According to Agriculture and Agrifood Canada, beer consumption in India has been rising. In 2022, beer consumption reached 2.78 billion liters, with projections indicating an increase to 3.6 billion liters by 2026. Dark-colored glass bottles are preferred for beer packaging to protect contents from UV light spoilage.

- The Indian soft drink market is expected to maintain strong growth. Varun Beverages Ltd, PepsiCo India's bottling partner, reported that annual per-capita bottle consumption was anticipated to reach approximately 84 by 2021, with further increases in 2022. PepsiCo aims to reduce plastic packaging in its soft drinks, targeting a reduction of up to 67 billion plastic bottles by 2025. The company's acquisition of SodaStream is expected to increase the use of glass bottle packaging in its product offerings.

- Plastic bans in India and other countries have significantly contributed to increased glass container usage. As a direct substitute for plastic containers, glass has become a primary alternative packaging material. Despite low per capita consumption, the market is experiencing robust growth due to demand from local beverage, alcohol, food, pharmaceutical, and cosmetic industries.

- The main obstacle to market growth is the higher carbon footprint associated with glass production. Glass manufacturing requires an energy-intensive process with furnace temperatures ranging from 1,300°C to 1,650°C and flames up to 2,000°C. Additionally, glass packaging is 12 times heavier than carton-based alternatives. A Thinkstep study revealed that material weight significantly contributes to the carbon footprint from production to retail distribution.

India Glass Container Market Trends

Alcoholic Segment to Hold Significant Market Share

- Alcohol, such as wine and spirits, is usually stored in glass. The glass bottle is most favored in wine packaging, especially colored glass because wine should not be exposed to sunlight. If exposed to sunlight, the wine will get spoiled. The increasing consumption of wine is expected to spearhead the glass packaging demand during the forecast period.

- India's alcohol consumption has doubled over the past decade. The market is experiencing a dual focus: expansion of the premium segment and increased penetration of the routine category, both aimed at boosting per capita consumption. Vendors are noting a growing demand from the wine and spirits industry. For example, Piramal Glass, which supplies to major brands like Diageo, Bacardi, and Pernod Ricard, reports an uptick in demand for short-run specialty bottles for spirits.

- India is one of the fastest-growing alcoholic beverage markets globally. Moreover, ICRIER (Indian Council for Research on International Economic Relations) said that over 70% of the growth in alcoholic beverage consumption in India in the next decade would be driven by the lower middle and upper middle-income groups, and there is a growing trend toward product premiumization.

- The sector is open to foreign investments, and many states offer subsidies for local manufacturing (for example, Maharashtra and Karnataka for wines). From the demand side, factors such as rapid urbanization, changing consumer preferences, and a sizeable and growing middle-class population with increased purchasing power have contributed to the growth in demand for alcoholic beverages.

- In addition, the government should focus on phased tariffs and other duties reductions, and Indian companies should be encouraged to export to improve the trade balance. Duty reduction for intermediate products can enhance value addition in India and boost domestic manufacturing potential.

- Alcoholic beverages, particularly premium products, often use glass containers due to their aesthetic appeal, durability, and inert nature, which preserves the quality of the contents. As export volumes rise, demand for high-quality glass bottles for spirits, wines, and beers will likely increase to meet international standards and consumer preferences.

- According to the Agricultural and Processed Food Products Export Development Authority (APEDA), in financial year 2024, the export value of alcoholic beverages from India reached USD 375 million, marking an increase from the previous year.

Pharmaceutical Industry to Register Significant Growth

- India is one of the major suppliers of generic medicines worldwide. As exports increase, demand for high-quality glass packaging that meets international standards also rises. This stimulates growth in the glass container market, as manufacturers ramp up production to cater to both domestic and global markets.

- The healthcare sector's growth encourages investments in R&D, especially for more sustainable, lightweight, and durable glass packaging solutions. This aligns with the healthcare industry's need for efficient and safe packaging, promoting advancements in the glass container market.

- According to India Brand Equity Foundation, in 2023, India's healthcare sector was valued at roughly USD 372 billion. It was an increase in comparison to 2020, showcasing significant growth. The sector is one of the largest contributors in terms of revenue and employment in the country.

- Moreover, India has emerged as a medical tourism hub, providing cost-effective treatments with the latest technology enabled by several pathbreaking reforms and provisions. India is one of the biggest suppliers of low-cost medicines in the world. Because of their low price and high quality, Indian medicines are preferred worldwide, rightly making the country the 'Pharmacy of the World'.

- The expansion in healthcare services and pharmaceuticals directly boosts demand for glass containers, especially for packaging medicines, vaccines, and medical vials. Glass is commonly used in these applications due to its non-reactive nature, helping preserve the quality and efficacy of medicines, which is crucial for the healthcare industry.

India Glass Container Industry Overview

The glass packaging market in India is fragmented, featuring several key players. Manufacturers include SCHOTT POONAWALLA PRIVATE LIMITED, AGI glaspac (A HSIL Company), CANPACK S.A., and Emerge Glass India Pvt Ltd. These companies significantly influence market dynamics. To maintain their competitive edge, vendors in the Indian container glass market are pursuing various strategies such as expansion, mergers and acquisitions, and product innovations.

These activities aim to strengthen their positions within the Indian market, address local demand, and adapt to regional regulations and sustainability requirements. Indian container glass manufacturers are also focusing on enhancing their production capabilities and developing eco-friendly glass solutions to meet the country's growing environmental concerns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL ANALYSIS - Container Glass Industry in India

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace Capacity and Location in India

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Alcohol Consumption and the Growing Preference for Glass Bottles

- 5.1.2 Regulatory Push Drives Adoption of Glass as a Sustainable Alternative in India

- 5.2 Market Challenges

- 5.2.1 Fragility and Complex Logistics Increase Transportation Costs for Glass Containers

- 5.3 Analysis of the Current Positioning of India in the Asia Pacific Container Glass Market

- 5.4 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in India

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Beverages

- 6.1.1.1 Alcoholic Beverages

- 6.1.1.1.1 Beer and Cider

- 6.1.1.1.2 Wine and Spirits

- 6.1.1.2 Non-alcoholic Beverages

- 6.1.1.2.1 Carbonated Soft Drinks

- 6.1.1.2.2 Juices

- 6.1.1.2.3 Water

- 6.1.1.2.4 Dairy Based Drinks

- 6.1.1.2.5 Flavored Drinks

- 6.1.2 Cosmetics

- 6.1.3 Pharmaceutical

- 6.1.4 Other End-user Verticals

- 6.1.1 Beverages

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SCHOTT POONAWALLA PRIVATE LIMITED

- 7.1.2 AGI glaspac (A HSIL Company)

- 7.1.3 CANPACK S.A.

- 7.1.4 Emerge Glass India Pvt Ltd.

- 7.1.5 Haldyn Heinz Fine Glass Pvt Ltd

- 7.1.6 Hindustan National Glass & Industries Limited

- 7.1.7 PGP Glass Private Limited

- 7.1.8 Haldyn Glass Ltd

- 7.1.9 Sunrise Glass Industries Pvt. Ltd.

- 7.1.10 Ajanta Bottle Pvt. Ltd.