|

市場調查報告書

商品編碼

1639366

中東和非洲玻璃瓶和容器市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Middle East & Africa Glass Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

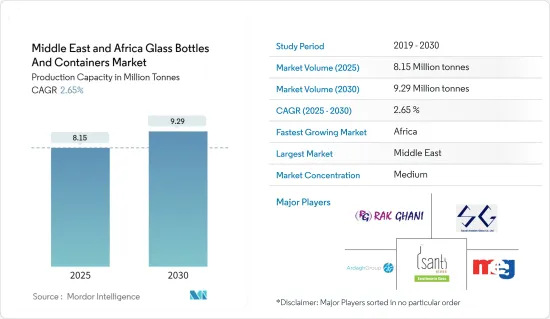

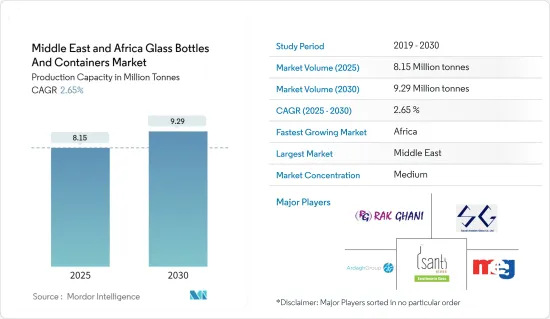

根據產能計算,中東和非洲玻璃瓶及容器市場規模預計將從2025年的815萬噸擴大到2030年的929萬噸,預測期間(2025-2030年)複合年成長率為2.65%。

玻璃容器是透明的,使消費者能夠看到產品,同時保留其感官和營養品質。這一特性鞏固了其作為該地區飲料和藥品包裝首選的地位。

主要亮點

- 在中東和非洲,由於沙烏地阿拉伯和南非的飲料消費量增加,對玻璃容器的需求迅速增加。飲料消費的成長歸因於旅遊業的蓬勃發展、可支配收入的增加以及消費者偏好的不斷變化。

- 消費者越來越意識到環境問題和永續性,這促使人們更喜歡玻璃包裝而不是塑膠包裝。這項變化主要是由於人們認知到玻璃是一種更環保的選擇,因為它是可回收的。

- 在強勁的經濟成長和國內消費成長的推動下,該地區各國的食品和飲料產業正在蓬勃發展。根據美國農業部(USDA)的報告,阿拉伯聯合大公國有2,000多家食品和飲料製造公司,年收益總計76.3億美元。

- 隨著消費者要求更安全、更健康的包裝,玻璃包裝在各個類別中都在經歷成長。壓花、成型和藝術飾面等創新技術正在增加玻璃包裝對最終用戶的吸引力。此外,疫情後市場的復甦歸因於對環保產品的需求不斷成長以及食品和飲料行業的興趣日益濃厚。

- 玻璃產業出版商 Glass Online 的研究顯示,目前非洲人口約佔世界人口的 16%,預計到 2030 年將達到 20%,對於玻璃製造商而言,非洲代表著巨大的機會。非洲大陸擁有一個尚未開發的市場,消費者的選擇有限。南非是非洲大陸第二大經濟體,是容器玻璃的主要生產國。南非的年產能超過100萬噸,是非洲領先的玻璃容器生產國之一。

- 然而,市場面臨挑戰。人們對塑膠包裝的日益偏好是一個主要的障礙,因為塑膠包裝因其成本效益和比玻璃更輕的重量而受到重視。此外,與塑膠相比,玻璃更脆弱,這增加了運輸成本和運輸過程中破損的風險,這可能會阻礙中東和非洲的市場成長。

中東和非洲玻璃瓶市場趨勢

製藥領域預計將創下最高市場佔有率

- 在中東和非洲,醫療產業正在收緊有關給藥產品的法規,增加了生物技術和成本敏感型藥品的重要性。藥用玻璃製造商擴大投資於包裝解決方案,旨在延長其產品的保存期限。

- 該地區各國政府正在促進公私合營,以加強衛生基礎設施和服務。領先的製藥公司正在擴大在中東的足跡,特別是在沙烏地阿拉伯 (KSA)、阿拉伯聯合大公國和南非,推動市場成長。財務諮詢公司 Alpen Capital 報告稱,2020 年阿拉伯聯合大公國的醫療保健支出為 197 億美元,預計 2025 年將達到 269 億美元。醫療保健支出的增加可能會為該領域的容器玻璃創造機會。

- 正如世界經濟論壇2023年3月指出的那樣,面臨疫苗分配不平等和依賴進口藥品等挑戰的非洲國家已經認知到發展強大的國內製藥業的重要性。隨著非洲大陸自由貿易區(AfCFTA)協定的生效,非洲的藥品貿易可能會得到顯著的推動,主要是透過非洲內部貿易。

- 此外,許多公司正在尋求向中東國家擴張,增加關鍵藥品的本地生產並增加對容器玻璃的需求。 2024年9月,阿斯特捷利康埃及公司宣布投資5,000萬美元用於藥品生產。阿斯特捷利康目前年產量為 9 億片,目標是將產量增加至 12.9 億片,從而增加該地區對玻璃容器的需求。

- 此外,沙烏地食品藥物管理局(SFDA) 的資料強調,臨床測試的進步和製造業中人工智慧的引入是沙烏地阿拉伯醫藥市場擴張的關鍵催化劑。由於人口成長和慢性病治療需求的增加,該市場的市場規模將從2021年的54億美元快速成長至2023年的85億美元。

南非預計將出現顯著成長

- 隨著對酒精和非酒精飲料的需求增加,對玻璃包裝的需求也增加。玻璃通常是首選,因為它具有卓越的保留風味和新鮮度的能力。人們越來越關注永續性,消費者被環保的包裝解決方案所吸引。許多公司正在轉向玻璃包裝,因為玻璃是可回收的,並且被認為比塑膠更環保。

- 兩家公司在南非容器玻璃產業佔據主導地位。康索爾玻璃在國內市場佔有壓倒性的佔有率,約75-80%。另一方面,Nampak Glass保證了國內玻璃容器需求的20-25%。 (參考來源:Glass Online)。

- 2023 年 11 月,Ardagh Glass Packaging-Africa (AGP-Africa) 點燃了位於南非豪登省奈傑爾生產工廠的 N3 熔爐。這個耗資 15 億雷亞爾(8000 萬美元)的大型計劃在核准後僅一年多時間就按時按預算完成,對於所有相關人員來說都是一項值得稱讚的壯舉。 Nigel 3 (N3) 擴建工程的揭幕儀式是在同一地點的 N2 擴建計劃運作之後進行的。這個新熔爐加上 4 條生產線,使工廠的產量提高了 50%。因此,奈傑爾已成為非洲最大的玻璃包裝生產基地,也是世界上最廣泛、最高效的設施之一。

- 此外,南非酒精飲料消費量的增加在推動這一需求方面發揮關鍵作用。總部位於倫敦的資訊服務公司 IWSR 的資料顯示,2023 年南非的啤酒消費量將成長 9%。這種成長與城市的快速擴張和年輕人向大城市的遷移有關,這增加了獲得酒精飲料的機會。

- 此外,根據南非統計局的數據,酒精飲料和菸草的消費者物價指數 (CPI) 從 2023 年 9 月的 111.1 升至 2024 年 7 月的 115.7。飲料價格的上漲,加上全國平均需求,支持了包裝玻璃需求的成長。

- 南非餐廳和咖啡館消費者支出的增加刺激了對玻璃容器(包括瓶子和碗)的需求。根據南非統計局的數據,餐廳和咖啡店的食品銷售額不斷上升,從 2024 年 1 月的 1.4387 億美元躍升至 2024 年 3 月的 1.5604 億美元。

中東和非洲玻璃瓶和容器市場的主要企業

中東和非洲玻璃瓶及容器市場的特徵是競爭激烈、整合適度。主要企業正在國內和國際舞台上爭奪更大的市場佔有率,例如 RAK Ghani Glass LLC、Isanti Glass、Ardagh Group SA 和 East Glass Manufacturing Company。這些公司奉行新產品開發、業務擴張和併購等策略,以改善產品功能並擴大其在中東國家的地理影響力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 容器玻璃進出口貿易資料

- PESTLE分析

- 包裝玻璃行業標準及法規

- 容器和包裝的永續性趨勢

- 中東和非洲貨櫃玻璃熔爐的產能和位置

第5章市場動態

- 市場促進因素

- 該地區各種食品和飲料的消費量增加

- 製藥業對玻璃容器的需求不斷成長

- 市場限制因素

- 對塑膠容器的需求超過玻璃容器可能會阻礙市場成長

- 貿易概況:中東容器玻璃產業進出口模式的歷史與現況分析

第6章 市場細分

- 按最終用戶產業

- 飲料

- 酒精飲料(計劃提供定性分析)

- 葡萄酒和烈酒

- 啤酒/蘋果酒

- 其他酒精飲料

- 非酒精飲料(計劃提供定性分析)

- 碳酸飲料

- 果汁

- 水

- 乳類飲料

- 調味飲料

- 其他非酒精飲料

- 食物

- 化妝品

- 醫藥產品(不包括管瓶和安瓿)

- 其他

- 飲料

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 南非

- 奈及利亞

- 科威特

第7章 競爭格局

- 公司簡介

- RAK Ghani Glass LLC

- Isanti Glass

- Ardagh Group SA

- Saudi Arabian Glass Company Ltd

- Middle East Glass Manufacturing Company

- Altajir Glass Industries

- Nafis Glass

- Mahmood Saeed Glass Industry Co.

第8章補充資料:區域內主要容器玻璃廠主要加熱爐供應商分析

第9章 市場未來展望

The Middle East & Africa Glass Bottles And Containers Market size in terms of production capacity is expected to grow from 8.15 million tonnes in 2025 to 9.29 million tonnes by 2030, at a CAGR of 2.65% during the forecast period (2025-2030).

Glass containers offer transparency, enabling consumers to see the product while safeguarding its sensory and nutritional qualities. This attribute has solidified their status as the region's preferred choice for packaging beverages and pharmaceuticals.

Key Highlights

- The demand for glass containers surges in the Middle East and Africa, driven by increasing beverage consumption in Saudi Arabia and South Africa. This uptick in beverage consumption is witnessed owing to a booming tourism industry, rising disposable incomes, and evolving consumer preferences.

- Heightened awareness of environmental issues and sustainability among consumers has spurred a preference for glass packaging over plastic. This shift is mainly because glass is perceived as a more environmentally friendly option, thanks to its recyclability.

- Countries in the region are witnessing a thriving food and beverage industry fueled by strong economic growth and heightened domestic consumption. Highlighting this growth, the US Department of Agriculture (USDA) reports that the United Arab Emirates is home to more than 2,000 food and beverage manufacturing companies, collectively raking in an impressive USD 7.63 billion in annual revenue.

- As consumers increasingly demand safer and healthier packaging, glass packaging is witnessing growth across various categories. Innovative technologies, such as embossing, shaping, and artistic finishes, enhance the appeal of glass packaging among end-users. Additionally, the post-pandemic resurgence of the market can be attributed to the rising demand for eco-friendly products and heightened interest from the food and beverage sector.

- Accordiung to a study by Glass Online, a publisher for the glass industry, Africa, currently home to about 16% of the global population and projected to reach 20% by 2030, presents a significant opportunity for glass producers. The continent boasts untapped markets where consumers face limited choices. South Africa, the continent's second-largest economy, is a leading nation in container glass production. With a production capacity surpassing 1 million tons annually, South Africa has become one of Africa's advanced container glass producers.

- However, the market faces challenges. The rising preference for plastic packaging, lauded for its cost-effectiveness and lighter weight than glass, poses a significant hurdle. Furthermore, glass' fragility, in contrast to plastic, results in higher freight costs and risks of breakage during transit, potentially hindering market growth in the Middle East and Africa.

Middle East and Africa Glass Bottles Market Trends

Pharmaceuticals Segment is Expected to Register the Highest Market Share

- In the MENA region, the healthcare industry has tightened regulations on drug delivery products, highlighting the growing importance of biotech and cost-sensitive medications. Pharmaceutical glass manufacturers are increasingly investing in packaging solutions aimed at extending product shelf life.

- Governments in the region are promoting public-private partnerships to enhance healthcare infrastructure and services. Key pharmaceutical companies are expanding their footprint in the Middle East, particularly in Saudi Arabia (KSA), the United Arab Emirates (UAE), and South Africa, driving market growth. Alpen Capital, a financial advisory firm, reported that healthcare spending in the UAE was USD 19.7 billion in 2020 and is projected to hit USD 26.9 billion by 2025. This uptick in healthcare spending could present opportunities for container glass in the sector.

- As noted by the World Economic Forum in March 2023, African countries, which have faced challenges like unequal vaccine distribution and a dependence on imported medicines, recognize the importance of developing a strong domestic pharmaceutical industry. With the African Continental Free Trade Area (AfCFTA) agreement now active, there's potential for a significant boost in Africa's pharmaceutical trade, largely driven by intra-African commerce.

- Additionally, many companies are looking to expand in Middle Eastern countries to increase local production of vital medications, thereby heightening the demand for container glass. In September 2024, AstraZeneca Egypt announced a USD 50 million investment in pharmaceutical production. Currently producing 900 million tablets yearly, AstraZeneca has set its sights on increasing output to 1.29 billion, subsequently driving up the demand for glass containers in the area.

- Moreover, data from the Saudi Food & Drug Authority (SFDA) highlights that advancements in clinical trials and the adoption of artificial intelligence in manufacturing are key catalysts for Saudi Arabia's expanding pharmaceutical market. The market's value jumped from USD 5.4 billion in 2021 to USD 8.5 billion in 2023, driven by a growing population and rising demand for chronic disease treatments.

South Africa is Expected to Experience Significant Growth

- As the demand for both alcoholic and non-alcoholic beverages rises, so does the need for glass packaging. Glass is often preferred for its superior ability to preserve flavor and freshness. With a growing emphasis on sustainability, consumers are gravitating towards eco-friendly packaging solutions. Given that glass is recyclable and considered more environmentally friendly than plastics, many companies are making the switch to glass packaging.

- In South Africa's container glass industry, two dominant players hold sway. Consol Glass, the more prominent of the duo, boasts a commanding share of approximately 75-80% of the domestic market. In contrast, Nampak Glass secures 20-25% of the nation's container glass demand. (Source: Glass Online).

- In November 2023, Ardagh Glass Packaging-Africa (AGP-Africa) ignited the N3 furnace at its production facility located in Nigel, Gauteng, South Africa. Completing a significant R 1.5 billion (USD 0.08 billion) mega-project on schedule and within budget, just over a year post-approval, is a commendable feat for all stakeholders. The unveiling of the Nigel 3 (N3) expansion followed the operational commencement of the N2 expansion project at the same site. This new furnace, coupled with four production lines, amplifies the facility's output by 50%. As a result, Nigel now stands as Africa's largest glass container production site and ranks among the world's most extensive and efficient facilities.

- Additionally, the rising consumption of alcoholic beverages in South Africa plays a crucial role in driving this demand. Data from IWSR, a London-based information services firm, highlighted a 9% surge in beer consumption in South Africa for 2023. This increase is linked to rapid urban expansion and younger populations migrating to major cities, enhancing accessibility to alcoholic beverages.

- Moreover, Statistics South Africa indicates that the Consumer Price Index (CPI) for alcoholic beverages and tobacco rose from 111.1 in September 2023 to 115.7 in July 2024. This uptick in beverage prices, coupled with average demand across the nation, underscores the growing appetite for container glass.

- Increased consumer spending in South African restaurants and cafes has spurred demand for container glass products, including bottles and bowls. Statistics South Africa notes a rise in food sales from restaurants and coffee shops, jumping from USD 143.87 million in January 2024 to USD 156.04 million in March 2024.

Middle East and Africa Glass Bottles Market Leaders

The container glass market is characterized by intense competition and moderate consolidation in the Middle East and Africa. Key players compete in domestic and international arenas to capture a larger market share, including RAK Ghani Glass LLC, Isanti Glass, Ardagh Group SA, and East Glass Manufacturing Company. These companies are pursuing strategies such as new product development, expansion, and mergers and acquisitions to enhance product functionality and broaden their geographic presence in Middle Eastern nations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Import Export Trade Data of Container Glass

- 4.3 PESTLE Analysis

- 4.4 Industry Standards and Regulations for Container Glass Use for Packaging

- 4.5 Sustainability Trends for Packaging

- 4.6 Container Glass Furnace Capacity and Location In Middle East & Africa

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Consumption of Variety of Food and Beverages in the Region

- 5.1.2 Growing Demand of Glass Containers in the Pharmaceutical Industry

- 5.2 Market Restraint

- 5.2.1 Demand of Plastic Packaging Over Glass Can Hamper Market Growth

- 5.3 Trade Scenerio: Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in Middle East

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Beverages

- 6.1.1.1 Alcoholic Beverages (Qualitative Analysis to be Provided)

- 6.1.1.1.1 Wins and Spirits

- 6.1.1.1.2 Beer and Cider

- 6.1.1.1.3 Other Alcoholic-Beverages

- 6.1.1.2 Non-alcoholic Beverages (Qualitative Analysis to be Provided)

- 6.1.1.2.1 Carbonated Drinks

- 6.1.1.2.2 Juices

- 6.1.1.2.3 Water

- 6.1.1.2.4 Dairy-Based

- 6.1.1.2.5 Flavored Drinks

- 6.1.1.2.6 Other Non-Alcoholic Drinks

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceutical (Excluding Vials and Ampoules)

- 6.1.5 Other End-user Industries

- 6.1.1 Beverages

- 6.2 By Country

- 6.2.1 United Arab Emirates

- 6.2.2 Saudi Arabia

- 6.2.3 Egypt

- 6.2.4 South Africa

- 6.2.5 Nigeria

- 6.2.6 Kuwait

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 RAK Ghani Glass LLC

- 7.1.2 Isanti Glass

- 7.1.3 Ardagh Group SA

- 7.1.4 Saudi Arabian Glass Company Ltd

- 7.1.5 Middle East Glass Manufacturing Company

- 7.1.6 Altajir Glass Industries

- 7.1.7 Nafis Glass

- 7.1.8 Mahmood Saeed Glass Industry Co.