|

市場調查報告書

商品編碼

1635398

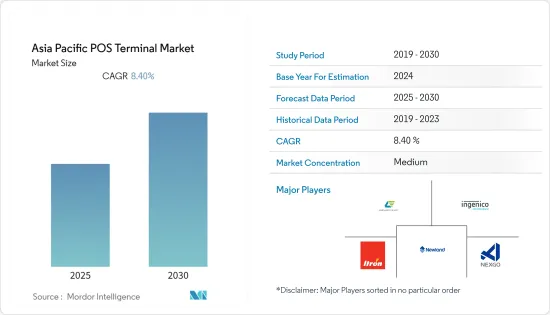

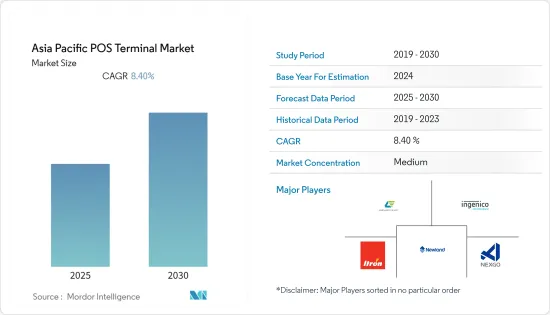

亞太地區 POS 終端 -市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Asia Pacific POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太地區 POS 終端市場預計在預測期內複合年成長率為 8.4%

主要亮點

- 由於全球金融詐騙行為的增加,政府監管機構近年來提高了付款交易的安全性。隨著客戶要求安全可靠的數位交易,使用安全付款流程的需求不斷增加。因此,這些監管機構對 POS 終端的採用有正面影響。隨著全球行動趨勢的增強,行動 POS 終端機越來越受歡迎。隨著無現金交易技術的出現,POS 的採用率不斷提高。

- 亞太地區電子商務的成長也是為POS終端市場創造新機會的因素。谷歌在 2021 年上半年進行的一項調查顯示,該地區經常進行的網路購物「每月數次」超過線下購物者數量 42% 至 31%,並且「每隔幾個月」一次,網路購物購物者數量超過線下購物者。研究還表明,該地區已經實現了 2025 年的預測,實現了五倍的飛躍 (n=13,000)。

- 由於客戶對快速、輕鬆付款的需求不斷增加,卡片詐騙行為正在顯著發展。冠狀病毒大流行也助長了銀行卡詐欺行為的激增。銷售點詐欺主要是由於商家沒有利用點對點加密 (P2PE) 解決方案來保護其 POS資料。一些商家依靠傳輸級加密來進行 POS 交易,其中卡片資料在從 POS 終端傳輸到支付處理器時會被加密。卡資料未加密,引發安全性問題並增加交易風險因素。

- 各種企業正在推出非接觸式付款選項,以回應社交距離要求和消費者不使用現金的偏好,並為客戶提供非接觸式支付選擇。客戶越來越習慣使用這些支付方式,並期望更多的企業提供這些支付方式。

- 2021 年 3 月,印度國家付款公司 (NPCI) 與 SBI Payments 合作,為印度商家推出 RuPay SoftPoSsolution。該解決方案將支援 NFC 的智慧型手機轉變為零售店的 PoS 終端。該解決方案使商家能夠透過智慧型手機上簡單的觸碰付款機制接受高達 5,000 印度盧比的非接觸式付款。這些政府措施也支持非接觸式付款的成長。

- 此外,2021 年 8 月,BharatPe 與 Axis Bank 建立了策略合作夥伴關係,根據該合作夥伴關係,Axis Bank 將擔任 BharatPe 銷售點 (POS) 業務 BharatSwipe 的收單銀行。此次合作將使 BharatPe 能夠利用 Axis Bank 提供的先進技術平台來增強商家體驗。

亞太地區POS終端市場趨勢

醫療領域對市場成長做出了重大貢獻

- POS 終端的採用在醫療產業中引人注目。由於多種因素,包括政府措施和供應商活動,該細分市場預計將成長。醫療保健產業 POS 終端的主要驅動力之一是保護病患資訊的需求。據厚生勞動省稱,截至2021年1月,日本醫療業者設立的醫院總數為5,686家。如此龐大的醫院數量預計將推動付款方式研究市場。

- 隨著全球醫療保健領域迅速數位化,對最先進的 POS 終端機處理流行病相關資訊、處理付款、管理患者資訊等的需求也不斷增加。此外,該地區眾多醫療設施的存在也促進了市場的成長。據日本厚生勞動省稱,2021年日本將出現醫療法人。

- 此外,COVID-19 大流行引發了醫院接受無現金付款的需求增加,刺激了醫療保健產業對 POS 終端的需求。 2021 年 9 月,Mswipe 在所有 675,000 個 POS 和 110 萬 QR 商家中與 e-RUPI 一起運作,以促進印度各地中小微企業接受數位付款。 Mswipe 使醫院和醫療機構能夠接收受益人的數位代金券,從而促進 COVID-19 的疫苗接種。

- 此外,2021 年 7 月,錫蘭商業銀行在科倫坡 Durdans 醫院部署了一款基於 Android 的一體化 POS 終端,讓客戶能夠方便、安全地進行感應式支付和掃描付款。這些新終端將使 Durdans 醫院能夠在一個終端中採用基於2D碼的錢包付款和 LANKAQR 下的安全近距離場通訊(NFC) 技術,透過非接觸式付款選項最大限度地減少接觸點,從而將客戶的接觸點保持在最低限度。

- 此外,隨著醫院患者數量的增加,醫院食品管理公司正在努力克服提供客房用餐選擇的聲譽。隨著該地區不斷強調醫院的優質食品服務對於健康和康復過程至關重要,醫院 POS 現代化正在脫穎而出。

無現金付款推動市場成長

- 亞太地區是技術採用最前沿的地區,也影響 POS 終端市場的成長。無現金付款在各國的普及也是創造市場新機會的因素。

- 根據 Worldpay 的數據,數位或行動錢包在亞太地區銷售點付款方式中所佔佔有率最大,2021 年約佔付款的 40%。同時,2021 年亞太地區 16% 的商店交易以現金付款進行。

- 根據《南華早報》2022 年 2 月發表的報道,中國兩家小型私人銀行上個月宣布將終止紙幣和硬幣服務,推動中國向完全無現金經濟邁進了兩步。北京中關村銀行將於2022年4月停止現金服務,包括商店存取款和ATM現金服務,遼寧新上銀行將於2022年3月停止現金服務。

- 此外,該地區的政府機構正在主動加強數位付款解決方案。此外,根據 Worldpay 的數據,在亞太地區,數位和行動錢包在 2021 年 POS付款中佔據最大佔有率,佔交易量的 40% 以上。同時,2021 年亞太地區 16% 的 POS付款以現金方式進行。

- 由於COVID-19的傳播,政府推出了運動控制令(MCO),以加速馬來西亞向無現金社會的過渡。例如,GrabPayMalaysia 的無現金交易增加了約 1.7 倍。馬來西亞最大的銀行馬來亞銀行 (Maybank) 的電子錢包 MAE 註冊用戶數量是平時的兩倍。

亞太地區POS終端產業概況

亞太地區 POS 終端市場適度整合,僅有幾個主要參與者。公司不斷投資於策略聯盟和產品開發,以增加市場佔有率。我們將介紹一些最近的市場發展趨勢。

- 2022 年 3 月 - Worldline 品牌 Ingenico 和印度發展最快的金融科技公司之一 BharatPe 最近宣布了一項為期五年的策略協議,以加速 POS 設備的採用。作為合作的一部分,Ingenico 將在未來 12 個月內向 BharatPe 在印度的商業網路部署 100,000 個 Axium 系列 Android 智慧 POS 和 PPaaS(Ingenico 的支付平台即服務)。 Axium DX8,000 基於 Android 的裝置和 PPaaS 已列出德里獨角獸公司 BharatPe 的技術堆疊,以滿足快速擴張和變化的市場需求。

- 2022 年 3 月 - 新的全像POS 系統目前正在日本各地的 7-11 商店進行測試。該設備允許消費者透過自助結帳終端投射的全像螢幕進行非接觸式付款。由東芝公司開發的Digi POS系統給人的印像是觸控螢幕介面吊掛在顧客眼前。透過 Neonode 的觸控感應器模組,您可以與投影在全像顯示器上的虛擬觸控螢幕圖形互動。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 市場評估

第5章市場動態

- 市場促進因素

- 小型零售店和快餐店擴大採用設備

- 對行動POS終端和無線通訊技術的需求增加

- 市場限制因素

- 資料安全問題、網路連線問題、技術故障

- 市場機會

- 無現金交易增加

- POS終端主要法規及申訴標準

- 重大案例分析

第6章 市場細分

- 按類型

- 固定POS系統

- 行動/可攜式POS 系統

- 按最終用戶產業

- 零售

- 款待

- 醫療保健

- 其他

- 按國家/地區

- 中國

- 印度

- 日本

- 韓國

- 台灣

- 新加坡

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Fujian Newland Payment Technology Co., Ltd.(Newland Technology Group)

- Shenzhen Xinguodu Technology Co., Ltd.

- Shenzhen Itron Electronics Co., Ltd.

- Beijing Shenzhou Anfu Technology Co. Ltd

- Ingenico Group(WorldLine)

- Fujian Centerm Information CO.,Ltd.

- PAX Technology Limited

- Fujian Morefun Electronic Tech. Co. Ltd.

- Wuhan Tianyu Information Industry Co., Ltd.

- VeriFone, Inc.

- BBPOS Limited

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91651

The Asia Pacific POS Terminal Market is expected to register a CAGR of 8.4% during the forecast period.

Key Highlights

- The rising financial frauds worldwide have influenced the government regulatory bodies to secure payment transactions over the past few years. With customers demanding safe and reliable digital transactions, the need for using secure payment processes has increased. Therefore, these regulatory bodies have positively impacted the adoption of POS terminals. With the increasing mobility trends worldwide, mobile POS terminals are gaining traction. With the advent of cashless transactional technologies, POS has witnessed an increase in adoption rates.

- The growth in e-commerce in the Asia Pacific region is also a factor that presents new opportunities for the POS terminals market. According to a study by Google conducted in the first half of 2021, in the region, regular 'a few times a month' online shoppers are now outpacing their offline counterparts by 42% vs. 31%, and those who shop online 'once every few months' leapfrog offline shoppers by 66%. Also, according to the study, the region has leapfrogged as much as five times, already meeting projections for 2025 (n=13,000).

- Card fraud is evolving heavily, driven by increased customer demands for fast and easy payments. The coronavirus pandemic is also fueling explosive growth in card fraud activity. Point-of-Sale fraud is largely caused by merchants failing to leverage point-to-point encryption (P2PE) solutions to safeguard POS data. Several merchants depend on transmission-level encryption for POS transactions, where card data is encrypted while moving from the POS terminal to the payment processor. The lack of encryption of the card data drives security concerns and adds a risk factor in transactions.

- Various businesses have deployed contactless payment options to offer customers touch-free alternatives in response to social distancing requirements and consumer preference for not using cash. As customers are becoming more used to using these payment options, they expect more firms to provide them with these options.

- In March 2021, the National Payments Corporation of India (NPCI) partnered with SBI Payments to launch a RuPay SoftPoSsolution for Indian merchants. The solution turns NFC-enabled smartphones into PoSterminals for retailers. With the solution, merchants can accept contactless payments of up to INR 5000 through simple tap and pay mechanisms on smartphones. Such efforts by the government are also pushing the growth of contactless payment.

- Also, in August 2021, BharatPe formed a strategic partnership with Axis Bank, under which the private lender will act as the acquiring bank for BharatPe's point of sale (PoS) business BharatSwipe. This partnership will help BharatPe enhance the merchant experience by leveraging the advanced technology platform Axis Bank offers.

APAC POS Terminal Market Trends

Healthcare Segment will Significantly Contribute to the Growth of Market

- The healthcare industry is a prominent adopter of POS terminals. The segment is expected to grow due to several factors, such as government initiatives and vendor activities. The demand for securing information of patients is one of the significant drivers of POS terminals in the healthcare industry. According to MHLW (Japan), the overall number of hospitals established by medical businesses in Japan as of January 2021 was 5,686 facilities. Such a huge number of hospitals will drive the studied market for payment methods.

- With the rapid digitization of the healthcare sector in different parts of the world, the need for modern POS terminals is also increasing to process pandemic-related information, payment processes, and manage patient information. Furthermore, the region's large presence of healthcare facilities has aided the market's growth. According to the Ministry of Health, Labour, and Welfare of Japan, there were medical corporations in Japan in 2021.

- Furthermore, the Covid-19 pandemic has triggered the demand for acceptance of cashless payments at the hospitals, stimulating the demand for POS terminals in the healthcare industry. In September 2021, Mswipe went live with e-RUPI for all its 675 thousand POS and 1.1 million QR merchants to boost digital payment acceptance by MSMEs across India. Mswipehas powered hospitals and healthcare facilities to accept digital vouchers from beneficiaries, thereby increasing the vaccination drive against COVID-19.

- Also, in July 2021, the Commercial Bank of Ceylon deployed all-in-one, Android-powered Point-of-Sale terminals to DurdansHospital in Colombo to enable customers to make convenient and secure tap-and-go and scan-and-pay payments. With these new devices, DurdansHospital can adopt QR-based wallet payments under LANKAQR and secure Near Field Communication (NFC) technology at its premises in a single device to offer safety to its customers in terms of minimizing touch points through contactless-payment options.

- Furthermore, with the rise in the number of patients across the hospitals, hospital food service management companies are working to overcome their reputation of having in-room dining options. Modernization of hospital POS has come to the forefront in the region, as the light continues to shed on quality food service in hospitals as essential to the health and healing process.

Cashless Payment is Driving the Market Growth

- Asia Pacific is a region that is at the forefront of technology adoption, which is influencing the growth of the market for POS terminals as well. The prominence of cashless payments in different countries is also a factor that is creating new opportunities for the market.

- According to Worldpay, with almost 40% of payments in 2021, digital or mobile wallets held the biggest share of point-of-sale payment methods in the Asia-Pacific region. In contrast, 16% of point-of-sale transactions in the Asia-Pacific area in 2021 used cash payments.

- According to the South China Morning Post report published in February 2022, China has taken two steps closer to a fully cashless economy after two small private Chinese banks announced last month that they would end services related to banknotes and coins. Beijing-based ZhongguancunBank will end cash services, including over-the-counter deposits and withdrawals and cash services on ATMs, in April 2022, while NewUpBank of Liaoning will end its cash services in March 2022.

- Further, government bodies in the region are taking the initiative to enhance the digital payment solution. Moreover, according to Worldpay, In Asia-Pacific, digital or mobile wallets accounted for the biggest percentage of point-of-sale payment methods in 2021, with over 40% of transactions. Comparatively, in the Asia-Pacific area in 2021, 16% of point-of-sale payments were made in cash.

- Due to the spread of the COVID-19 pandemic, the government introduced the Movement Control order (MCO), accelerating Malaysia's cashless push. For instance, GrabPayMalaysia's cashless transactions have grown by about 1.7 times. Maybank, the top Malaysian bank, has registered twice as many users as usual for its MAE e-wallet.

APAC POS Terminal Industry Overview

The Asia Pacific POS terminal market is moderately consolidated, with the presence of a few major companies. The companies continuously invest in strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- March 2022 - Ingenico, a Worldline brand, and BharatPe, one of India's fastest-growing Fintech businesses, recently announced a five-year strategic agreement to accelerate the use of POS devices. As part of the collaboration, Ingenico will roll out 100,000 of its Axium line of Android Smart POS and PPaaS (Ingenico's Payments Platform as a Service) to the merchant network of BharatPe in India over the course of the following 12 months. Axium DX8000 Android-based terminals and PPaaS give BharatPe, the unicorn company based in Delhi, a technology stack that is intended to meet the demands of a quickly expanding and changing market.

- March 2022 - A new holographic point-of-sale system is currently being tested in 7-Eleven stores around Japan. This device enables consumers to make contactless payments via a holographic screen that is projected from the self-checkout terminal. The Digi POS system, created by Toshiba, gives the impression that a touchscreen interface is suspended in front of a customer. The virtual touchscreen graphics that are shown on the holographic displays can be interacted with thanks to Neonode's Touch Sensor Modules.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assesment of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Terminals by Small-size retailers and Quick service restaurants

- 5.1.2 Increasing Demand for Mobile POS Terminals and Wireless Communication Technology

- 5.2 Market Restrains

- 5.2.1 Data Security Concerns, Internet Connectivity Issues and Technical Hindrage

- 5.3 Market Opportunities

- 5.3.1 Increase in Number of Cashlesss Transactions

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By End-user Industries

- 6.2.1 Retail

- 6.2.2 Hospitality

- 6.2.3 Healthcare

- 6.2.4 Others

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Taiwan

- 6.3.6 Singapore

- 6.3.7 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujian Newland Payment Technology Co., Ltd. (Newland Technology Group)

- 7.1.2 Shenzhen Xinguodu Technology Co., Ltd.

- 7.1.3 Shenzhen Itron Electronics Co., Ltd.

- 7.1.4 Beijing Shenzhou Anfu Technology Co. Ltd

- 7.1.5 Ingenico Group(WorldLine)

- 7.1.6 Fujian Centerm Information CO.,Ltd.

- 7.1.7 PAX Technology Limited

- 7.1.8 Fujian Morefun Electronic Tech. Co. Ltd.

- 7.1.9 Wuhan Tianyu Information Industry Co., Ltd.

- 7.1.10 VeriFone, Inc.

- 7.1.11 BBPOS Limited

8 INVESTMNET ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219