|

市場調查報告書

商品編碼

1644436

歐洲 POS 終端:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

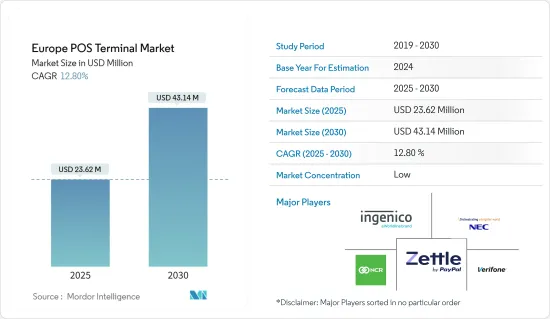

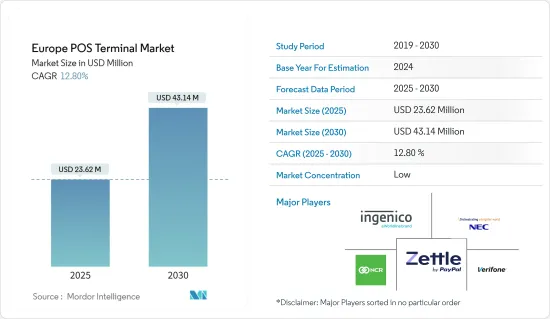

預計 2025 年歐洲 POS 終端市場規模為 2,362 萬美元,到 2030 年將達到 4,314 萬美元,預測期內(2025-2030 年)的複合年成長率為 12.8%。

隨著所提供的技術的轉變,歐洲 POS 終端市場正在發生重大變化,使企業能夠提高投資回報率並改善可近性。歐洲 POS 終端機正在部署,以幫助各行各業的企業促進越來越多的交易。

主要亮點

- 與其他付款管道相比,較低的整體擁有成本,加上對非接觸式和行動 POS 終端的需求顯著增加,預計將推動歐洲市場的成長。

- 在當前的市場情勢下,POS終端系統正在從以交易為導向的設備發展為支援和整合企業CRM和其他金融解決方案的系統。本案例使企業能夠利用透過POS終端獲得的交易資料進行商業智慧。

- 此外,歐盟委員會為簡化商家支付接受設施所做的努力也推動了市場的成長。作為零售付款策略的一部分,歐盟委員會正在製定明年行動計劃,幫助歐盟商家實現付款接受設施的現代化和簡化。這種支持可以透過指導和提高零售商的意識提升來實現。

- 地方和國家安全法規的實施也產生了對新的和維修的POS 終端的需求。例如,PSD2 法規已製定多項要求以增強店內和實體付款。

- 然而,由於對非接觸式付款的好處認知不足,消費者對透過行動裝置進行交易缺乏適當的了解,這使得他們很難使用行動錢包和相關應用程式收發資金。這可能會導致使用行動錢包和相關應用程式發送和接收匯款的困難,從而阻礙全部區域的市場成長。

- 新冠疫情也催生了非接觸式付款的需求,增加了配備NFC、RFID等技術的POS終端的需求,以接受非接觸式晶片卡和數位介面卡的付款。

歐洲POS終端市場趨勢

非接觸式付款的普及正在推動市場

- 隨著NFC的出現,市場正迅速採用「點擊支付」等非接觸式付款方式。用戶數量正在迅速增加。例如,根據郵政銀行提供的調查資料,大多數新的 POS 終端機都配備了 NFC,以支援非接觸式付款以及其他替代方案。

- 對付款和無現金付款的日益成長的需求也推動了市場成長。數位化程度的提高、電子付款管道的採用、以及由於多起金融詐騙案件而導致的對安全付款的監管干預不斷增加,推動了該地區付款終端市場的成長。

- 根據歐洲央行(ECB)預測,2023年上半年歐洲非接觸感應卡付款筆數將比2022年同期成長24.3%,達到209億筆,總金額將成長25.9%,達到5,400億美元。

- 去年,Worldline 建立了夥伴關係,以智慧管理公司卡消費政策。此次夥伴關係將 Worldline 的泛歐卡發行和處理平台與該經理的業務費用管理專業知識結合在一起。

- 為了接受付款,全國各地的企業和服務正在迅速整合和採用各種行動付款系統,包括PayPal 、Samsung Pay 和 Apple Pay。由於生活方式的重大改變、日常商業活動以及網路購物的迅速興起,預計這一趨勢將長期持續下去。

零售業預計將大幅成長

- 在歐洲,傳統和新型零售業態正在興起。都市化、可支配所得的增加和消費者生活方式的改變都是推動這一成長的因素。隨著越來越多的零售企業開業,對實現無縫交易和增強購物體驗的 POS 終端的需求也日益增加。

- 隨著越來越多的公司採用先進的工具來改善工作流程和消費者體驗,歐洲零售業正在經歷重大的數位轉型。這項變更融合了全通路零售、行動付款、非接觸式付款、雲端基礎的POS 系統和行動付款。這些改進推動了對接受多種付款方式並提供即時分析的先進 POS 終端的需求。

- 全通路零售和電子商務的出現改變了零售環境。如今,顧客要求在所有管道(包括線上和店內)獲得無縫的購物體驗。為了滿足這些期望,零售商需要整合的 POS 解決方案,以實現庫存管理、消費者資料追蹤和跨多通路的統一付款。

- 據歐洲中央銀行(ECB)稱,歐洲的零售付款系統針對的是個人和企業進行的小額、大批量的付款。 2023 年上半年,歐元區 30 個零售付款系統處理了約 298 億筆交易。在 2023 年上半年歐元區零售付款系統處理的所有交易中,三大系統(STEP2-T、法國的 CORE 和德國的 RPS)處理的交易量佔總交易量的 62%,價值佔總交易量的 71%。

- 零售商越來越認知到資料驅動洞察力的重要性,以增強日常業務、簡化庫存管理和客製化消費者體驗。配備進階分析功能的 POS 終端為企業提供有關庫存趨勢、消費行為和銷售模式的有用資料。這些見解使零售商能夠提高營運效率、增加銷售額並做出基於資料的決定。

歐洲POS終端產業概況

歐洲 POS 終端市場較為分散,競爭激烈,主要有幾個國內和國際參與者。市場的主要參與者包括 Ingenico Group(Worldline)、NEC Corporation、NCR Corporation、Izettle UK(Paypal)和 Verifone Inc.市場上的技術進步也為企業提供了顯著的競爭優勢,市場上出現了多種聯盟。

- 2023 年 6 月以付款解決方案聞名的金融科技公司 Payabl 推出了一款新的 POS 系統,專注於幫助歐洲零售商拓展業務。此 POS 解決方案是為了滿足全通路購物日益成長的趨勢而開發的。

- 2023 年 3 月,在全球旅遊目的地經營餐飲店的 SSP 選擇了 Worldline 的付款解決方案與 Oracle MICROS Simphony POS(一種全面的軟體和硬體解決方案)整合作為其在德國的付款系統。該解決方案允許消費者使用所有主要付款品牌和貨幣進行支付。該解決方案將滿足國際旅客的需求,並將在 DACH 地區推廣,首先在德國部署 POS 終端。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對 POS 系統市場的影響評估

第5章 市場動態

- 市場促進因素

- 與其他付款管道相比,總擁有成本較低

- 非接觸式和行動 POS 終端需求大幅增加

- 市場挑戰

- 由於使用重要資訊而產生的安全問題

第6章 市場細分

- 按類型

- 固定POS系統

- 行動/可攜式POS 系統

- 按最終用戶產業

- 零售

- 娛樂

- 衛生保健

- 飯店業

- 其他最終用戶產業

- 按國家

- 義大利

- 英國

- 法國

- 西班牙

- 德國

- 荷蘭

- 葡萄牙

- 波蘭

- 希臘

- 匈牙利

- 捷克共和國

- 羅馬尼亞

- 烏克蘭

- 斯洛伐克

- 其他歐洲國家(克羅埃西亞、斯洛維尼亞)

第7章 競爭格局

- 公司簡介

- Ingenico Group(Worldline)

- NEC Corporation

- NCR Corporation

- Izettle UK(Paypal)

- Verifone Inc

- Sumup Inc.

- PAX Technology Ltd

- Sharp Electronics

- myPOS World Ltd

- Asseco South Eastern Europe SA

- Concardis GmbH(Nets Group)

- Vectron System AG

- POSBank Co. Ltd

- Aures Technologies SA

第8章投資分析

第9章:市場的未來

The Europe POS Terminal Market size is estimated at USD 23.62 million in 2025, and is expected to reach USD 43.14 million by 2030, at a CAGR of 12.8% during the forecast period (2025-2030).

The European POS terminal market has evolved significantly due to the shifts in technology offered, which allowed the business to raise the ROI and improve the ease of access. POS terminals in Europe are deployed to help companies across industries to facilitate the increasing number of transactions.

Key Highlights

- A significant rise in the demand for contactless and mobile POS terminals, along with a low total cost of ownership compared to other channels of payments, is expected to drive market growth in Europe.

- In the current market scenario, POS terminal systems have evolved from transaction-oriented devices to systems that support and integrate into businesses' CRM and other financial solutions. This instance allowed companies to leverage captured transactional data through POS terminals to business intelligence.

- Moreover, the efforts by the European Commission to simplify merchant payment acceptance facilities are also triggering the market's growth. By next year, as part of the retail payments strategy, the European Commission has an action plan to support the modernization and simplification of EU merchants' payment acceptance facilities. This support could be achieved by guidance and by raising awareness amongst retailers.

- Introducing regional and country-level security regulations also creates a need for new or retrofits of POS terminals. For instance, the PSD2 rule has created several requirements reinforcing in-store and in-person payments.

- However, due to less awareness of the benefits of using contactless payments, consumers do not have proper knowledge regarding transactions through mobile devices, which results in difficulty in using mobile wallets or related apps to send and receive money. This can hamper the market's growth across the region.

- The COVID-19 pandemic also created a demand for contactless payments, increasing the need for POS terminals with NFC, RFID, and other technologies accepting payments from contactless chip cards or digital interface cards.

Europe POS Terminal Market Trends

Increasing Adoption of Contactless Payments Driving the Market

- With the advent of NFC, the market is seeing rapid adoption of contactless payment methods like "tap-to-pay." Users are becoming more prevalent at a fast rate. For instance, most of the new POS terminals are outfitted with NFC as an option to support contactless payments, along with alternatives, according to the study data provided by Postbank.

- The growing desire for contactless and cashless payments has also fueled market growth. The rise in digitalization, the use of e-payment platforms, and the rising regulatory intervention on secure payments due to multiple financial fraud cases have led to the growth of the payment terminal market in the region.

- According to the European Central Bank (ECB), the number of contactless card payments in Europe in the first half of 2023 increased by 24.3% to 20.9 billion compared to the same period in 2022, with total value rising by 25.9% to USD 0.54 trillion.

- In the previous year, Worldline signed a partnership to smartly manage expense policies on corporate cards. The partnership will combine Worldline's pan-European card issuing processing platform and its manager, who has expertise in business expense management.

- To accept payments, businesses and services nationwide quickly integrate and embrace various mobile payment systems, including PayPal, Samsung Pay, and Apple Pay. This tendency is anticipated to persist over time due to the enormous changes in lifestyles, daily commerce, and the quick rise of internet shopping.

Retail Sector Expected to Witness Significant Growth

- Traditional and new formats of retail establishments have increased in number across Europe. Urbanization, increased disposable incomes, and evolving consumer lifestyles are some causes of this growth. The demand for POS terminals to enable seamless transactions and improve the shopping experience has increased as more retail firms open for business.

- The European retail sector has seen tremendous digital change as companies have embraced advanced tools to improve workflow and consumer experience. This shift incorporates omnichannel retailing, mobile payments, contactless payments, cloud-based POS systems, and mobile payments. These improvements call for advanced POS terminals to handle a variety of payment methods and offer real-time analytics.

- The emergence of omnichannel retail techniques and e-commerce have changed the retail environment. Nowadays, customers need a seamless shopping experience across all channels, including online and physical stores. Retailers need integrated POS solutions to manage inventory, track consumer data, and enable unified payments across several channels to meet these expectations.

- According to the European Central Bank (ECB), retail payment systems in Europe cover payments made by individuals and businesses with low value and high volume. Thirty retail payment systems within the Euro area processed around 29.8 billion transactions in the first half of 2023. The three largest systems (STEP2-T, CORE in France, and RPS in Germany) processed 62% of the volume and 71% of the value of all transactions processed by Euro area retail payment systems in the first half of 2023.

- Retailers are becoming increasingly aware of the importance of data-driven insights for enhancing daily operations, streamlining inventory control, and customizing consumer experiences. With sophisticated analytics capabilities, POS terminals give businesses valid data on inventory trends, consumer behavior, and sales patterns. Retailers can increase operational effectiveness, increase sales, and make data-backed decisions based on these insights.

Europe POS Terminal Industry Overview

The European POS Terminal market is fragmented and primarily comprises multiple domestic and international players in a highly competitive environment. Major players in the market include Ingenico Group (Worldline), NEC Corporation, NCR Corporation, Izettle UK (Paypal), and Verifone Inc. Technological advancements in the market are also bringing considerable competitive advantage to the companies, and the market is also witnessing multiple partnerships.

- June 2023: A new point-of-sale (POS) system from Payabl, an established FinTech company known for its payment solutions, was presented with a focus on supporting the expansion of European retailers. The POS solution was created to react to the expanding omnichannel shopping trend.

- March 2023: SSP, a food and beverage outlet operator in travel locations worldwide, selected Worldline's payment solution integrated with Oracle MICROS Simphony POS, a comprehensive software and hardware solution, as their payment system for Germany. The solution enables consumers to pay with all major payment brands and currencies. It caters to international travelers' needs and will be rolled out in the DACH region, starting with deploying POS terminals in Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the POS System Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Low Total Cost of Ownership Compared to Other Channels of Payments

- 5.1.2 Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 5.2 Market Challenges

- 5.2.1 Security Concerns Due to the Usage of Critical Information

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of -Sale Systems

- 6.1.2 Mobile/Portable Point-of-Sale Systems

- 6.2 By End-User Industry

- 6.2.1 Retail

- 6.2.2 Entertainment

- 6.2.3 Healthcare

- 6.2.4 Hospitality

- 6.2.5 Other End-User Industry

- 6.3 By Country

- 6.3.1 Italy

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Germany

- 6.3.6 Netherlands

- 6.3.7 Portugal

- 6.3.8 Poland

- 6.3.9 Greece

- 6.3.10 Hungary

- 6.3.11 Czech Republic

- 6.3.12 Romania

- 6.3.13 Ukraine

- 6.3.14 Slovakia

- 6.3.15 Rest of Europe (Croatia and Slovenia)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ingenico Group (Worldline)

- 7.1.2 NEC Corporation

- 7.1.3 NCR Corporation

- 7.1.4 Izettle UK (Paypal)

- 7.1.5 Verifone Inc

- 7.1.6 Sumup Inc.

- 7.1.7 PAX Technology Ltd

- 7.1.8 Sharp Electronics

- 7.1.9 myPOS World Ltd

- 7.1.10 Asseco South Eastern Europe SA

- 7.1.11 Concardis GmbH (Nets Group)

- 7.1.12 Vectron System AG

- 7.1.13 POSBank Co. Ltd

- 7.1.14 Aures Technologies SA