|

市場調查報告書

商品編碼

1644892

印度 POS 終端:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India POS Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

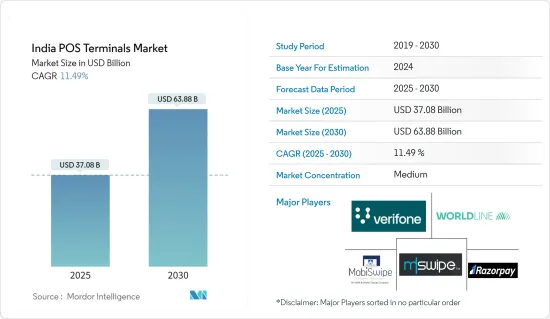

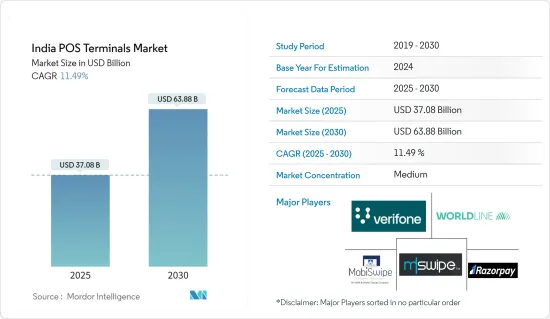

印度 POS 終端市場規模預計在 2025 年為 370.8 億美元,預計到 2030 年將達到 638.8 億美元,預測期內(2025-2030 年)的複合年成長率為 11.49%。

多種因素推動了印度 POS 終端市場的發展,包括行動 POS 終端需求激增、行動錢包的普及、支援法規、電子商務的成長、新企業的湧入、都市化和技術進步。

主要亮點

- 由於消費者偏好的變化、技術進步和監管變化,付款領域正在經歷巨大的變化。在數位交易激增的推動下,印度正在經歷巨大的成長,並正在重塑其付款格局。

- 受零售店激增和消費者支出不斷成長的推動,印度零售業正在快速成長。因此,對付款處理機器的需求日益成長。隨著印度消費者越來越偏好數位交易而非現金交易,這些機器已成為零售商的重要組成部分。

- 印度的 POS 終端市場十分強勁。這些終端促進了無現金交易,允許消費者使用行動電話或卡片付款。隨著數位付款逐漸取代現金支付,印度 POS 終端市場正在不斷擴大。這種轉變導致企業和商店對專用 POS 終端的需求增加。過去幾年,印度的卡片付款機使用量激增,使企業能夠接受數位付款。

- 印度儲備銀行 (RBI) 與政府及其他部門一直孜孜不倦地主導數位付款的大規模成長。其中一些措施已獲得國際認可。卡片付款、支援 Aadhaar 的支付系統 (AePS)、統一支付介面 (UPI)、即時支付服務 (IMPS)、基於2D碼的付款和國家電子收費 (NETC) 在印度從以現金為中心的經濟向日益依賴數位交易的經濟的逐步轉變中發揮了關鍵作用。

- 2023年10月,金融科技產業參與者Paytm推出了其最新創新-Paytm Card Soundbox。此先進設備不僅為 UPI 交易提供語音提醒,還促進覆蓋 Visa、Mastercard、Amex 和 RuPay 等主要網路的「點擊支付」卡交易。 Pine Labs 也推出了其傳統 POS(銷售點)終端的經濟高效的版本,稱為「Mini」。 Mini' 終端機能夠處理 UPI 交易和廣域網路「點擊即付」卡片付款。

- 然而,POS終端的短缺阻礙了該行業的發展。市場面臨著高安裝和維護成本、安全問題和相關費用等挑戰,所有這些都阻礙了其擴張。

印度POS終端市場趨勢

零售領域可望佔據主要市場佔有率

- 印度零售業的幾個關鍵因素正在推動 POS 終端市場的成長。有組織的零售連鎖店的擴張和獨立商店的增加正在推動印度對高效交易處理系統的需求。隨著零售商尋求改善客戶體驗和業務效率,採用 POS 終端已變得至關重要。

- 此外,數位印度等政府舉措正在推動零售商採用數位付款解決方案。貨幣廢止和商品及服務稅的引入進一步增強了這一勢頭,刺激企業接受正規的數位交易。

- 根據印度電訊監管局的數據,截至 2023 年 12 月,Reliance Jio Infocomm 資訊通訊是網路用戶數量最多的服務供應商,擁有超過 4.7 億用戶,佔超過 50% 的市場佔有率。

- 此外,電子商務和全通路零售的激增正在推動對能夠順利管理線上和線下交易的整合 POS 系統的需求。為了保持競爭力,零售商現在優先考慮複雜的 POS 解決方案,專注於庫存管理、客戶關係管理 (CRM) 和資料分析等功能。

- 可支配收入的增加推動了中階的擴大,刺激了個人消費的成長。這種激增與零售額的激增直接相關,凸顯了簡化付款系統的必要性。

- 2024 年 2 月,Zoho Corporation 宣布其在印度的最新舉措,推出 Zakya 品牌。 Zakya 的主要重點是為零售商提供客製化的現代化銷售點 (POS) 解決方案。這些解決方案旨在簡化日常業務並提供集中監控功能。值得注意的是,Zakya 的雲端運行的 POS 系統擁有快速的部署流程和使用者友好的介面。此功能集旨在使中小型零售商能夠在設定後一小時內快速遷移、運作並開始收費。

行動 POS 預計將大幅成長

- 卡片付款和行動付款正迅速變得比 ATM 提款更受歡迎。這種轉變是由人們對數位付款的日益成長的偏好所推動的。這項變化的催化劑是新冠肺炎疫情,它引發了人們對處理現金的擔憂,並促使人們轉向數位交易。預計這一趨勢將持續下去,店內卡片付款的普及率不斷提高就是明證。

- 在印度,使用統一付款介面(UPI)透過智慧型手機進行店內購物的趨勢正在興起。為了進一步簡化這個流程,人們正在努力近距離場通訊技術融入UPI。這項進步不僅可以最大限度地減少交易過程中的身體接觸,而且還將鼓勵參與的商家更廣泛地採用 UPI。此外,UPI 將為先前採用有限的零售商增強數位付款環境。

- 2024 年 4 月,印度金融科技領域參與者 BharatPe 推出了針對印度的一體化付款解決方案「BharatPe One」。這款創新產品將 POS、QR 和揚聲器功能集於一體。這款創新產品旨在簡化商家的交易。提供多種付款選項,包括動態和靜態2D碼、點擊付款和傳統卡片付款。這些選項涵蓋了大量的簽帳金融卡和信用卡。

- 此外,在 POS 公司舉措的推動下,印度的 mPOS 格局正在改變。 RapiPay 提供可用作行動銷售點 (mPOS) 機的混合微型 ATM。這項創新允許客戶在 RapiPay 站使用信用卡和簽帳金融卡。與傳統 ATM 不同,RapiPay 微型 ATM 提供了額外的便利,允許用戶不僅可以提取現金,還可以透過 RapiPay Direct Business Outlet 進行各種銀行業務。

印度POS終端產業概況

印度 POS 終端市場競爭激烈,地區性參與者人數眾多。市場的一些主要企業包括 VeriFone Inc.、Worldline、Ezetap(Razorpay)、MobiSwipe Technologies Private Limited 和 Mswipe Technologies Pvt Ltd。公司正在進行策略聯盟和收購,以增加市場佔有率和盈利。

- 2024年6月,QueueBuster與Otipy建立策略夥伴關係。將 Cubastar 先進的 POS 技術與 Otipy 在生鮮農產品零售領域率先使用電動代步車的技術結合。 Cubaster 先進的 POS 技術將無縫整合到 Otipy 最近推出的實體電動代步車中,以提高業務效率並提高客戶滿意度。

- 2024 年 2 月,印度 CSB 銀行宣布與金融科技公司 Bijlipay 建立策略夥伴關係。該合作旨在透過提供全面的 POS 解決方案來加強銀行的付款生態系統。此次合作旨在透過利用 Bijlipay 在整個銀行網路中的無縫整合解決方案來提高客戶滿意度並簡化服務交付。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 快速數位化推動印度 POS 終端機成長

- 實施各種政府措施以促進市場成長

- 行動 POS 系統需求不斷成長

- 市場限制

- 資料安全問題可能損害經濟成長

- 每台設備的合規成本和認證更新成本高昂

- 市場機會

- 非接觸式付款的興起

- POS終端主要法規及申訴標準

- 關於非接觸式付款的普及及其對產業影響的說明

- 重點案例分析

第6章 市場細分

- 按付款方式

- 接觸類型

- 非接觸式

- 按類型

- 固定POS系統

- 行動/可攜式POS 系統

- 按最終用戶產業

- 零售

- 飯店業

- 衛生保健

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- VeriFone Inc.

- Worldline

- Ezetap(Razorpay)

- MobiSwipe Technologies Private Limited

- Mswipe Technologies Pvt Ltd

- ePaisa

- NGX Technologies

- PayU

- Payswiff

- PAX Technologies Pvt. Ltd

第8章投資分析

第9章:未來市場展望

The India POS Terminals Market size is estimated at USD 37.08 billion in 2025, and is expected to reach USD 63.88 billion by 2030, at a CAGR of 11.49% during the forecast period (2025-2030).

Several factors are propelling India's POS terminal market, such as the surging demand for mobile POS terminals, increasing adoption of mobile wallets, supportive regulations, the growth of e-commerce, the influx of new enterprises, urbanization, and technological advancements.

Key Highlights

- The world of payments is undergoing dramatic changes, driven by evolving consumer preferences, technological advancements, and regulatory shifts. India, propelled by the surge in digital transactions, is witnessing remarkable growth, reshaping its payment landscape.

- The Indian retail sector is witnessing a surge, driven by a proliferation of retail outlets and heightened consumer spending. Consequently, there is a growing demand for payment processing machines. With a rising preference for digital transactions over cash among Indian consumers, these machines have become an essential element for retailers.

- India boasts a robust market for point-of-sale (POS) terminals. These devices facilitate cashless transactions, allowing consumers to make payments via their phones or cards. The Indian market for these machines is expanding due to the extended adoption of digital payments over cash. With this shift, there's a growing demand from businesses and stores for specialized POS terminals. Over the last few years, India has witnessed a significant surge in the adoption of card payment machines, enabling businesses to accept digital payments.

- The Reserve Bank of India (RBI), in addition to the government and other ministries, has diligently spearheaded efforts that have led to a significant surge in digital payments. Several of these initiatives have garnered international recognition. Card payments, alongside the Aadhaar-enabled Payment System (AePS), Unified Payments Interface (UPI), Immediate Payment Service (IMPS), QR-based payments, and National Electronic Toll Collection (NETC), have played pivotal roles in the gradual shift from a cash-centric economy to one that is increasingly reliant on digital transactions.

- In October 2023, Paytm, a player in the fintech industry, unveiled its latest innovation: the Paytm Card Soundbox. This advanced device not only offers audio alerts for UPI transactions but also facilitates 'tap-and-pay' card transactions, covering major networks like Visa, Mastercard, Amex, and RuPay. Pine Labs also introduced a cost-effective iteration of its traditional point-of-sale (PoS) terminal, dubbed 'Mini'. The 'Mini' terminal is equipped to process UPI transactions and 'tap-and-pay' card payments across a wide array of networks.

- However, the industry's growth is hampered by a scarcity of PoS terminals. The market faces challenges such as steep installation and maintenance costs, security concerns, and related expenses, all hindering its expansion.

India POS Terminals Market Trends

Retail Segment Expected to Hold Significant Market Share

- Several key factors in India's retail sector are propelling the growth of the POS terminals market. The expansion of organized retail chains and a rising number of independent stores are boosting the demand for efficient transaction processing systems in India. As retailers aim to elevate customer experiences and operational efficiency, the adoption of POS terminals is becoming essential.

- Moreover, the government's initiatives, such as Digital India, are propelling retailers toward digital payment solutions. This momentum is reinforced by both demonetization and the GST implementation, which have spurred businesses to embrace formalized digital transactions.

- As per the Telecom Regulatory Authority of India, as of December 2023, Reliance Jio Infocomm Limited held the most significant service provider of internet subscribers, boasting more than 470 million subscribers, equating to a dominant market share exceeding 50%.

- Furthermore, the surge in e-commerce and omnichannel retailing is driving demand for unified POS systems capable of managing both online and offline transactions effortlessly. Retailers are now prioritizing sophisticated POS solutions, emphasizing features like inventory management, customer relationship management (CRM), and data analytics to maintain their competitive edge.

- The expanding middle class, bolstered by rising disposable incomes, is fuelling the rising consumer spending. This surge is directly translating into a spike in retail sales, underscoring the necessity for streamlined payment systems.

- In February 2024, Zoho Corporation unveiled its latest venture in India, introducing the Zakya brand. Zakya's primary focus is on providing modern Point of Sale (POS) solutions tailored for retail establishments. These solutions aim to simplify daily operations and offer centralized monitoring capabilities. Notably, Zakya's POS system, operating on the cloud, boasts a swift implementation process and a user-friendly interface. This feature set is designed to enable small- and medium-sized retailers to swiftly transition, go live, and initiate billing within an hour of setup.

Mobile Point-of-Sale Anticipated to Register Significant Growth

- Card and mobile payments are surpassing ATM withdrawals in popularity. The shift is driven by a growing preference for digital payment methods. The impetus for this change was the COVID-19 pandemic, which heightened concerns about cash handling, prompting a pivot toward digital transactions. This trajectory is poised to persist, which is evident in the rising adoption of store card payments.

- In India, the trend of utilizing the Unified Payment Interface (UPI) for in-store purchases via smartphones is gaining momentum. To further streamline this process, there is a push toward integrating near-field communication technology with UPI. This advancement not only minimizes physical contact during transactions but also encourages wider UPI adoption among merchants. Additionally, it enhances the digital payment landscape for retailers, an area where UPI has historically seen limited penetration.

- In April 2024, BharatPe, a player in India's fintech sector, unveiled 'BharatPe One,' marking India's all-in-one payment solution. This innovative product combines POS, QR, and speaker functionalities into a single device. This innovative product aims to simplify merchant transactions. It provides a variety of payment acceptance options, such as dynamic and static QR codes, tap-and-pay, and traditional card payments. These options cater to a vast spectrum of debit and credit cards.

- Moreover, India's mPOS landscape is evolving, spurred by initiatives from POS companies. RapiPay stands out, offering hybrid micro-ATMs that function as mobile point-of-sale (mPOS) machines. This innovation enables customers to use credit cards alongside debit cards at RapiPay stations. Unlike conventional ATMs, RapiPay's Micro ATMs offer enhanced convenience, allowing users to not only withdraw cash but also conduct a range of banking operations at any RapiPay Direct Business Outlet.

India POS Terminals Industry Overview

The Indian POS terminal market is moderately competitive, with a considerable number of regional players. Some of the major players in the market are VeriFone Inc., Worldline, Ezetap (Razorpay), MobiSwipe Technologies Private Limited, and Mswipe Technologies Pvt Ltd. Companies are strategically collaborating and acquiring businesses to boost their market share and profitability.

- June 2024: QueueBuster and Otipy entered a strategic partnership. The alliance merges QueueBuster's advanced POS technology with Otipy's pioneering use of Electric Carts in fresh produce retailing. QueueBuster's advanced POS technology would be seamlessly integrated into Otipy's recently introduced physical electric carts, bolstering operational efficiency and elevating customer satisfaction.

- February 2024: CSB Bank, headquartered in India, unveiled a strategic collaboration with fintech firm Bijlipay. This partnership is designed to bolster the bank's payment ecosystem by offering comprehensive POS solutions. Beyond this, the alliance is set to enhance customer satisfaction and streamline service delivery, leveraging Bijlipay's seamlessly integrated solutions across the bank's network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Digitization Drives the Growth of POS Terminals in India

- 5.1.2 Implementation of Various Government Initiatives to Improve Market Growth

- 5.1.3 Growing Demand for Mobile Point-of-Sale Systems

- 5.2 Market Restraints

- 5.2.1 Concerns Over Data Security Might Restrict Economic Growth

- 5.2.2 High Compliance Costs per Device and Certification Renewal Costs

- 5.3 Market Opportunities

- 5.3.1 Rise in Contactless Payment Adoption

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Commentary on the Rising Use of Contactless Payment and its Impact on the Industry

- 5.6 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Mode of Payment Acceptance

- 6.1.1 Contact-based

- 6.1.2 Contactless

- 6.2 By Type

- 6.2.1 Fixed Point-of-sale Systems

- 6.2.2 Mobile/Portable Point-of-sale Systems

- 6.3 By End-User Industry

- 6.3.1 Retail

- 6.3.2 Hospitality

- 6.3.3 Healthcare

- 6.3.4 Other End-User Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 VeriFone Inc.

- 7.1.2 Worldline

- 7.1.3 Ezetap (Razorpay)

- 7.1.4 MobiSwipe Technologies Private Limited

- 7.1.5 Mswipe Technologies Pvt Ltd

- 7.1.6 ePaisa

- 7.1.7 NGX Technologies

- 7.1.8 PayU

- 7.1.9 Payswiff

- 7.1.10 PAX Technologies Pvt. Ltd