|

市場調查報告書

商品編碼

1635442

法國容器玻璃市場:市場佔有率分析、產業趨勢、成長預測(2025-2030)France Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

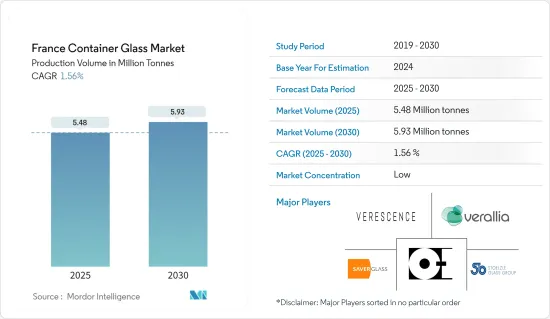

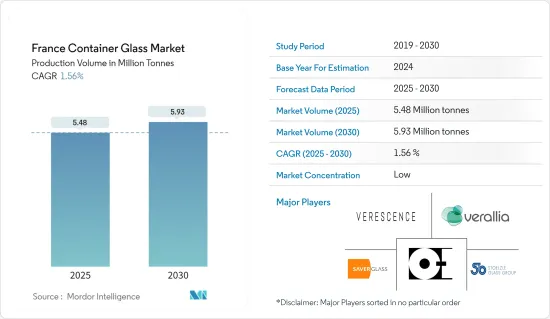

就產量而言,法國容器玻璃市場規模預計將從2025年的548萬噸擴大到2030年的593萬噸,預測期內(2025-2030年)複合年成長率為1.56%。

主要亮點

- 隨著飲料需求的飆升和化妝品行業的持續蓬勃發展,容器玻璃市場正處於擴張的邊緣。

- 法國是歐盟主要飲料生產國,由於其多樣化的環境,本土酒精生產蓬勃發展。這也包括香檳和干邑白蘭地等優質烈酒,它們主要包裝在玻璃容器中。

- 此外,酒精飲料(尤其是啤酒和葡萄酒)消費量的增加正在推動該市場的成長。玻璃不會與飲料化學品發生反應,可保持強度、香氣和風味,鞏固其作為首選包裝選擇的地位。值得注意的是,用玻璃容器運送啤酒的趨勢將持續下去。

- 支持回收和永續性的國家法規正在引導企業轉向玻璃包裝。法國計劃在未來兩年內引入玻璃存放系統,以打擊塑膠廢棄物並促進回收。該舉措將要求超級市場接受空玻璃容器,並符合政府雄心勃勃的 2040 年消除一次性塑膠的目標。

- 包括歐文斯伊利諾伊玻璃公司在內的領先公司正在積極塑造法國市場的格局。該公司在貝濟耶、吉龍古、拉古德、多姆紀堯姆和蘭斯等城市開展業務,並取得了長足的進步。 2024 年 2 月,歐文斯伊利諾州宣布對法國的兩家玻璃包裝廠投資 9,500 萬歐元(1.0281 億美元)。這些投資是更廣泛的現代化議程的一部分,旨在加強維萊訥河畔吉龍庫爾和蘭斯的永續性、靈活性和生產力,並進一步推動該國的容器玻璃市場,這就是我的意思。

- 然而,容器玻璃市場面臨金屬和生物分解性材料等替代包裝解決方案的挑戰。這些輕質、經濟高效且多功能的選擇吸引了製造商和消費者的注意。此外,玻璃製造是一個能源密集型過程,因此能源價格的波動對生產商的盈利產生重大影響。

法國容器玻璃市場趨勢

化妝品板塊有望大幅成長

- 法國容器玻璃產業深受化妝品、個人保健產品和奢華香水產業的影響。這些部門積極促進包裝中玻璃容器的回收和永續利用。

- 為了表現出團結一致,法國化妝品和香水產業已採取措施加強其玻璃工業。美容行業的 12 家公司簽署了一份聲明,強調他們將優先考慮法國供應商。該聯盟包括美容企業聯合會(FEBEA),其中包括美容市場的主要企業。

- 法國化妝品出口聯合會(Febea)的資料顯示,法國化妝品出口大幅成長。 2023年出口額為213億歐元(230.5億美元),與前一年同期比較成長10.8%。法國化妝品界的吸引力依然強勁。該行業不斷發展以滿足現代消費者的需求,並強調永續性和環境友善性。

- 法國是全球美容和奢侈品中心,擁有香奈兒、迪奧和歐萊雅等標誌性品牌,在塑造國內外市場趨勢方面發揮關鍵作用。根據歐盟統計局資料,2020年法國香水和化妝品批發銷售額為41.2175億美元,預計2024年將達到43.1025億美元。

- 隨著消費者尋求適合自己皮膚類型和偏好的美容產品,市場正經歷一波技術創新浪潮。該品牌不僅注重環保包裝和道德採購成分,還透過與具有環保意識的消費者產生共鳴來培養品牌忠誠度。

不斷成長的飲料行業預計將推動市場成長

- 在法國,酒精飲料,尤其是葡萄酒,深深融入了文化結構。包括波爾多和香檳在內的著名葡萄酒產區不僅僅是地理位置,它們還代表著一個國家的身份和烹飪傳統。法國既是葡萄酒的主要生產國,也是葡萄酒的消費國。

- 消費者物價指數(CPI)的上升表明消費者越來越重視無酒精飲料,並願意為此支付溢價。將這些飲料包裝在玻璃瓶中可以進一步增加其價值。因為玻璃是優質的代名詞,可以增強產品的整體外觀。法國國家統計與經濟研究所的資料顯示,2022年終無酒精飲料CPI將升至114.32,2023年7月將升至123.39。

- 法國也在實現飲料生產的多元化。根據歐盟統計局的報告,2020年法國飲料製造業銷售額為240.6億美元,預計2023年將達到300.3億美元。此外,消費行為向節制和健康意識發生了重大轉變,許多人選擇低酒精和無酒精飲料。

- 旅遊業是法國飲料需求的主要動力。法國向各地區出口包括容器在內的玻璃包裝產品。資料顯示,玻璃製品出口額將從2020年的724,727,000美元躍升至2023年的925,225,000美元。

- 此外,隨著人們健康意識的增強,對調味水、果汁、冰茶和草藥飲料等非酒精飲料的需求也增加。市場的創新精神在機能飲料(例如添加益生菌的飲料)的採用中得到體現,凸顯了獨特口味和健康成分的趨勢。

法國容器玻璃產業概況

法國容器玻璃市場是細分的,包括大量的區域和全球參與者。該市場中的公司正在利用戰略協作計劃來提高市場佔有率和盈利。此外,人們對大大小小的啤酒廠本地釀造的精釀啤酒的日益偏好,迫使玻璃容器製造商調整生產,在某些情況下,將生產轉移到食品、飲料和化妝品等其他成長領域。改變。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- PESTEL分析

- 包裝玻璃行業標準及法規

- 容器玻璃進出口資料

- 包裝玻璃的原料分析及材質注意事項

- 容器和包裝的永續性趨勢

- 法國貨櫃玻璃熔爐的容量和位置

第5章市場動態

- 市場促進因素

- 酒精飲料消費量增加

- 透過永續性和回收努力,品牌過渡到玻璃包裝

- 市場限制因素

- 玻璃製造過程中的高碳足跡

- 法國歐洲容器玻璃市場現況分析

- 貿易情景—法國容器玻璃產業進出口模式的歷史與現狀分析

第6章 市場細分

- 按最終用戶產業

- 飲料

- 酒精飲料

- 非酒精飲料

- 食物

- 化妝品

- 醫藥產品(不包括管瓶和安瓿)

- 其他最終用戶垂直市場

- 飲料

第7章 競爭格局

- 公司簡介

- CANPACK France SAS

- OI Glass, Inc.

- Ardagh Packaging Group PLC

- Verallia Packaging

- Gerresheimer AG

- Bormioli Pharma SpA

- Saver Glass Inc.

- Stoelzle Glass Group

- Verescence France

第8章投資分析

第9章 市場的未來

The France Container Glass Market size in terms of production volume is expected to grow from 5.48 million tonnes in 2025 to 5.93 million tonnes by 2030, at a CAGR of 1.56% during the forecast period (2025-2030).

Key Highlights

- As demand surges for beverages and the cosmetics industry continues to thrive, the container glass market stands on the brink of expansion.

- France, a leading beverage producer in the European Union, benefits from its diverse environment, fostering the creation of indigenous alcohols. This includes premium offerings like champagne and cognac, which are predominantly packaged in glass containers.

- Moreover, the rising consumption of alcoholic drinks, notably beer and wine, fuels this market's growth. Glass's non-reactive nature with drink chemicals ensures the preservation of strength, aroma, and flavor, solidifying its status as a preferred packaging choice. Notably, beer's transportation in glass containers is a trend set to persist.

- National regulations championing recycling and sustainability are steering companies towards glass packaging. In a bid to combat plastic waste and bolster recycling, France plans to introduce a glass deposit system in the next two years. This initiative mandates supermarkets to accept empty glass containers, aligning with the government's ambitious 2040 goal to eradicate single-use plastics.

- Major players, including Owens-Illinois Glass Inc, are actively shaping the market landscape in France. With operations spanning cities like Beziers, Gironcourt, Labegude, Puy-Guillaume, and Reims, the company is making significant strides. In February 2024, Owens-Illinois announced a substantial EUR 95 million (USD 102.81 million) investment across its two glass packaging facilities in France. These investments, part of a broader modernization agenda, aim to bolster sustainability, flexibility, and productivity in Gironcourt-sur-Vraine and Reims, further propelling the container glass market in the nation.

- However, the container glass market faces challenges from alternative packaging solutions like metals and biodegradable materials. These lighter, cost-effective, and versatile options have caught the attention of both manufacturers and consumers. Additionally, the energy-intensive process of glass manufacturing means that any fluctuations in energy prices can have a pronounced impact on producer profitability.

France Container Glass Market Trends

Cosmetics Segment is Expected to Witness Significant Growth

- The French container glass industry is significantly influenced by the cosmetics, personal care products, and luxury perfumes sectors. These sectors are actively promoting recycling and the sustained use of glass containers in their packaging practices.

- In a show of solidarity, the French cosmetics and perfume sector has taken steps to bolster the glass industry. A group of 12 companies from the beauty sector has collectively signed a declaration, underscoring their commitment to prioritize suppliers from France. This coalition features major players in the beauty market, all members of the Federation of Beauty Companies (FEBEA), including Biologique Recherche, Chanel, Clarins, Coty, Guerlain, Hermes, Kenzo Parfums, Interparfums, L'Oreal, Parfums Christian Dior, Parfums Givenchy, Puig, Shiseido, Sisley, Sarbec, and Sothys.

- According to data from the Federation des Entreprises de la beaute (Febea), French cosmetics exports have seen a significant rise. In 2023, these exports grew by 10.8% year-on-year, totaling an impressive EUR 21.3 billion (USD 23.05 billion). The global allure of French cosmetics remains strong. The industry is evolving, placing a premium on sustainability and environmental awareness, in tune with modern consumer demands.

- France, a global hub for beauty and luxury, boasts iconic brands like Chanel, Dior, and L'Oreal, which play a pivotal role in shaping both domestic and international market trends. Eurostat data indicates that the wholesale revenue for perfumes and cosmetics in France was USD 4,121.75 million in 2020, with projections to hit USD 4,310.25 million by 2024.

- As consumers increasingly demand beauty products tailored to their individual skin types and preferences, the market is witnessing a surge in innovation. Brands are not only focusing on eco-friendly packaging and ethically sourced ingredients but are also cultivating brand loyalty by resonating with environmentally-conscious consumers.

Growing Beverage Industry is Expected to Promote Market Growth

- In France, alcoholic beverages, particularly wine, are deeply woven into the cultural fabric. Esteemed wine regions, including Bordeaux and Champagne, are not just geographical locations but are emblematic of the nation's identity and its culinary heritage. France is both a leading producer and a prominent consumer of wine.

- The rising Consumer Price Index (CPI) indicates that consumers are increasingly valuing alcohol-free drinks, willing to pay a premium for them. Packaging these beverages in glass bottles can further elevate their perceived worth, as glass is synonymous with premium quality and enhances the product's overall presentation. Data from the National Institute of Statistics and Economic Studies France reveals that the CPI for alcohol-free drinks was 114.32 at the close of 2022, climbing to 123.39 by July 2023.

- France is also diversifying its beverage manufacturing. Eurostat reports that beverage manufacturing revenue in France was USD 24.06 billion in 2020, with projections to hit USD 30.03 billion by 2023. Additionally, there's a noticeable shift in consumer behavior towards moderation and health, leading many to choose low-alcohol or non-alcoholic options.

- Tourism significantly fuels the demand for beverages in France. The nation exports glass packaging products, including containers, to various regions. Data indicates that the export value for glass products surged from USD 724,727 thousand in 2020 to USD 925,225 thousand in 2023.

- Furthermore, with a growing emphasis on health and wellness, there's a rising demand for non-alcoholic beverages such as flavored waters, fruit juices, iced teas, and herbal drinks. The market's innovative spirit is evident with the introduction of functional beverages, like those infused with probiotics, highlighting a trend towards unique flavors and health-centric ingredients.

France Container Glass Industry Overview

The French container glass market is fragmented, with numerous regional and global players. Companies in the market are leveraging strategic collaborative initiatives to increase their market share and profitability. Additionally, the increasing preference for craft beer brewed locally by small and large breweries is forcing glass packaging manufacturers to adjust their production and, in some cases, switch to other growth areas, such as food and beverage and cosmetics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 PESTEL ANALYSIS

- 4.3 Industry Standards and Regulations for Container Glass Use for Packaging

- 4.4 Export Import Data for Container Glass

- 4.5 Raw Material Analysis & Material Considerations for Packaging

- 4.6 Sustainability Trends for Packaging

- 4.7 Container Glass Furnace Capacity and Location in France

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Alcoholic Beverages

- 5.1.2 Sustainability and Recyclability Initiatives Moving Brands to Glass Packaging

- 5.2 Market Restraint

- 5.2.1 High Carbon Footprint in The Glass Manufacturing Process

- 5.3 Analysis of the Current Positioning of France in the European Container Glass Market

- 5.4 Trade Scenario - Analysis of the Historical and Current Export-Import Paradigm for Container Glass Industry in France

6 MARKET SEGMENTATION

- 6.1 By End-User Industry

- 6.1.1 Beverage

- 6.1.1.1 Alcoholic Beverages

- 6.1.1.2 Non-Alcoholic Beverages

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceuticals (Excluding Vials and Ampoules)

- 6.1.5 Other End-user verticals

- 6.1.1 Beverage

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CANPACK France SAS

- 7.1.2 O-I Glass, Inc.

- 7.1.3 Ardagh Packaging Group PLC

- 7.1.4 Verallia Packaging

- 7.1.5 Gerresheimer AG

- 7.1.6 Bormioli Pharma S.p.A

- 7.1.7 Saver Glass Inc.

- 7.1.8 Stoelzle Glass Group

- 7.1.9 Verescence France