|

市場調查報告書

商品編碼

1635445

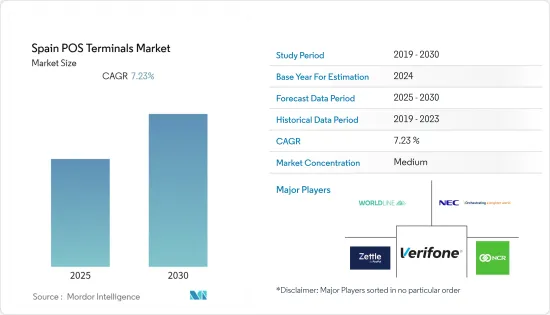

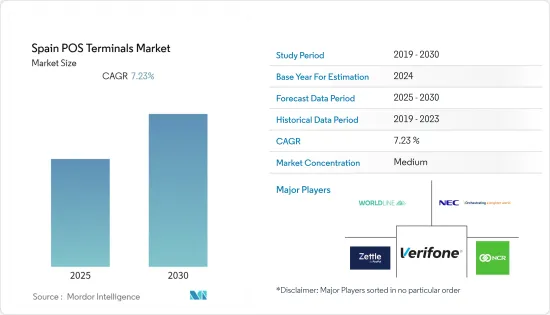

西班牙 POS 終端 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Spain POS Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

西班牙POS終端市場預計在預測期間內複合年成長率為7.23%

主要亮點

- 銀行轉帳是西班牙市場上商品和服務的常見付款方式。銀行轉帳的直接性使其對想要保證和保護付款的企業具有吸引力。此外,銀行轉帳可加快付款處理速度,並為沒有傳統簽帳金融卡的人提供協助。 Trustly 是使用網路銀行時流行的付款方式。此外,還有許多西班牙專用的匯款應用程式,例如 Bizum 和 Teleingreso。

- 銀行轉帳是西班牙市場典型的付款方式。由於銀行轉帳是直接的,因此對於想要保證付款的企業很有吸引力。它還使付款處理變得更加容易,對於沒有標準簽帳金融卡的人來說非常有用。使用網路銀行時,一種流行的付款方式是 Trustly。還有一些針對西班牙的匯款計劃,例如 Teleingreso 和 Bizum。

- 隨著小額現金交易繼續轉向簽帳金融卡簽帳金融卡的付款使用頻率高於 ATM 提款。因此,簽帳金融卡的卡片付款數量和金額均顯著增加。向專業市場供應卡以及在合作零售商處提供折扣的銀行也促進了使用量的增加。

- 信用卡的使用也在增加。銀行將信用卡納入捆綁帳戶包裝是使用量增加的一個主要因素。然而,在西班牙,簽帳卡比信用卡使用更廣泛。 2017年至2021年,簽帳卡使用數量大幅增加。

- 該國將非接觸式付款限額從 20 歐元(24.46 美元)提高到 50 歐元(61.14 美元),以鼓勵使用非接觸式付款。此外,2021年9月,運輸部和Renfe在萬事達卡和桑坦德銀行的支持下,在Cercanas車站安裝了POS終端,允許用戶使用卡片或行動裝置進行非接觸式車票付款,我們宣布啟動Cronos計劃。

- 與其他付款方式相比,整體擁有成本較低,對非接觸式和行動 POS 終端的需求快速成長是推動市場成長的關鍵因素。然而,mPOS 中使用敏感資料可能導致資料外洩的安全問題限制了市場的成長。

- 由於 COVID-19 大流行,西班牙卡和電子付款的使用終於開始增加,但並非所有人都對這種轉變感到滿意。在西班牙,2020 年銀行現金提領下降了 33%。相較之下,POS(銷售點)機的數量比三年前增加了約 50%。

西班牙POS終端市場趨勢

零售業佔較大佔有率

- 西班牙政府強制零售商接受現金。法律要求零售商接受現金。由於2022年6月頒布的《消費者保護法》,顧客現在可以選擇用現金付款。當局將對拒絕接受現金付款的零售商處以罰款。

- 2021 年 9 月,Plataforma Denaria 委託進行了一項關於使現金永久化的必要性的研究。超過 70% 的西班牙人支持需要現金作為付款手段,77% 的人認為現金是公共財。 90% 的西班牙人認為需要現金作為付款方式。

- Square 是一家專門為所有企業提供硬體、軟體和付款解決方案的公司,在實施搶先體驗計畫後已開始在西班牙開展業務。該計劃於 2021 年 9 月推出,僅限數量有限的 Beta 測試人員,來自餐廳、餐旅服務業、專業服務、美容、零售以及健康和保健等行業的公司和自營業者將能夠參與該公司的早期測試。加入Access 計畫。 Pastelera Tallon、Valentine 和 Hop Hop Hurray 是之前領先獲得 Square 服務的一些西班牙公司。

- 除了完全整合的 WisePad 3 讀卡機之外,Shopify Payments 現已從 2022 年 2 月起向西班牙零售業主開放。現在,Shopify POS 已輕鬆連接,用戶可以隨時隨地接受所有最受歡迎的付款方式。

- 西班牙國家統計局(INE)資料顯示,2022年5月西班牙零售額將比去年同月成長1.4%,下調了4月1.6%的增幅,而市場預期為1.4%。非食品銷售額成長 0.8%,因為個人設備購買量的成長(成長 24.1%)超過了家用電器(下降 2.9%)和雜貨(下降 1.3%)的下降。同時,食品銷售額下降了2%。零售額較上月持平,上個月成長 5.4%。

無現金付款市場預計將大幅成長

- 未來幾年,隨著越來越多的商店接受付款卡以及消費者採用非接觸式技術,卡片付款預計將變得更加普遍,經濟對現金的依賴程度也會降低。

- 根據付款服務公司Minsait Payments的數據,2021年西班牙非接觸感應卡付款總額成長了10%,創下歐洲最高成長率。

- 然而,根據同一項研究,西班牙仍然是歐洲使用現金進行交易的銀行用戶比例最高的國家(85%),而酒吧和餐廳(36%)以及公共運輸現金付款的比例較低( 31%) % ),與中小企業的交易則較高(45%)。

- 西班牙銀行發布的一項研究顯示,在新冠肺炎 (COVID-19) 疫情期間,西班牙人避免將現金作為主要付款方式,而是選擇簽帳金融卡。 2020年,54.1%的西班牙人選擇使用簽帳金融卡付款,而使用現金付款的比例為359.7%。然而,在人口少於10萬的西班牙社區,現金使用率上升至37.5%。

- 根據2022年6月發布的歐洲央行支付統計報告,2021年電子貨幣領域的信貸交易金額約為68.638億歐元,較前一年2020年錄得18.96%的成長率。 2014年至2021年沒有記錄電子貨幣交易。

西班牙POS終端產業概況

西班牙 POS 終端市場競爭適中,有大量區域性參與企業。公司正在利用策略合作計劃和收購來增加市場佔有率和盈利。

- 2022 年 3 月 - 行業酒店雲端 Mews 最近宣布收購 POS 軟體創建者 Bizzon,以擴展其為酒店及其餐飲團隊提供的金融服務。 Mews Payments 產品組合現在將包括 Bizzon POS 產品系列。對於旅館經營者及其員工來說,此次收購將簡化 PMS 和 POS 體驗。 Mews 相信,透過整合彙報和集中客人檔案,客戶將能夠透過將這兩種技術添加到他們的產品組合中,為他們的客人做出更好的決策。

- 2021 年 8 月 - Avalon Informatica y Servicios Group(「Avalon」)被 Juniper Group(Vela Software 和 Constellation Software, Inc. 旗下子公司)完全收購。 Avalon 成立於馬德里,為西班牙和拉丁美洲的加油站、便利商店和汽油配送設施建造先進的 POS 和 ERP 系統。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 西班牙POS終端市場規模及預估

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 改善無線網路基礎設施

- 使用雲端 POS 系統提高資料可見性

- 改善服務提供

- 市場限制因素

- 資料安全問題可能會限制經濟成長

- 對舊有系統的高度依賴

- 市場機會

- 消費者對非現金交易的興趣日益濃厚

- POS終端主要法規及申訴標準

- 2017-2027年POS終端市場預測

- 2017年至2027年每台POS終端機付款筆數市場預測

- 2017年至2027年每台POS終端付款金額市場預測

- 非接觸式付款使用擴展及其對行業影響的說明

- 重大案例分析

第6章 市場細分

- 按付款方式

- 接觸式

- 非接觸式

- 按類型

- 固定POS系統

- 行動/可攜式POS 系統

- 按最終用戶產業

- 零售

- 款待

- 醫療保健

- 其他

第7章 競爭格局

- 公司簡介

- Worldline

- NEC Iberica SL

- NCR Corporation

- PayPal Zettle

- VeriFone, Inc.

- SumUp Limited

- PAX Technology

- Sharp Electronics

- Asseco Group

- 主要企業市場佔有率

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91848

The Spain POS Terminals Market is expected to register a CAGR of 7.23% during the forecast period.

Key Highlights

- Bank transfers are a common way to pay for goods and services in the Spanish market. Because bank transfers are direct, they appeal to businesses that wish to guarantee and safeguard their payments. Additionally, it expedites payment processing and aids people without common debit or credit cards. Trustly is a well-liked way to pay while using online banking. Additionally, there is a tonne of Spanish-specific money transfer applications like Bizum and Teleingreso.

- In the Spanish market, bank transfers are a typical method of payment. Bank transfers are appealing to companies who want to guarantee and secure their payments because they are direct. It also facilitates payment processing and helps those who lack typical debit or credit cards. A popular method of payment while utilizing internet banking is Trustly. There is also a tonne of Spanish-specific money transfer programs like Teleingreso and Bizum.

- Debit cards are being used for payments more frequently than ATM withdrawals as low-value cash transactions continue to move to them. Debit cards thus saw a large increase in both the number and value of card payments. Banks supplying cards for specialized markets and providing discounts at partner retailers are partially to blame for the increase in usage.

- Credit cards are being used more often as well. Banks' inclusion of credit cards in packages of bundled accounts was a major factor in this expansion. Charge cards, however, are more widely used in Spain than credit cards. Between 2017 and 2021, there was a huge growth in the number of charge cards in use.

- The country's contactless payment limit was raised from EUR 20 (USD 24.46) to EUR 50 to encourage the usage of contactless payments (USD 61.14). Additionally, in September 2021, the Ministry of Transport and Renfe, with assistance from Mastercard and Santander, announced the beginning of the Cronos project, which aims to install POS terminals in Cercanas train stations so that users can make contactless payments for tickets using cards and mobile devices.

- The lower total cost of ownership in comparison to alternative payment methods, as well as a sharp increase in demand for contactless and mobile POS terminals, are the main factors propelling the market's growth. However, security concerns caused by the use of sensitive data that might result in data breaches on mPOS restrict the market growth.

- The COVID-19 epidemic has compelled Spain to finally start utilizing cards and electronic payments more, but not everyone is pleased with the shift. In Spain, bank cash withdrawals decreased by 33% in 2020. In contrast, the number of point-of-sale (POS) machines has surged by approximately 50% since three years ago.

Spain POS Terminals Market Trends

Retail Sector to Hold a Significant Share

- The Spain government imposed laws on retail finances to accept cash; failing to do so is now illegal in Spain. Retailers are now required by law to accept cash. Customers have the choice to pay with cash due to the passed Consumer Protection Law of June 2022. Authorities will penalize merchants that refuse to accept cash payments.

- In September 2021, Plataforma Denaria commissioned a study on the necessity for cash's permanency. More than 70% of Spaniards support the necessity for cash as a form of payment, and 77 percent view it as a public benefit. 90 percent of Spaniards defend the need for cash as a payment method.

- Square, a firm that specializes in hardware, software, and payment solutions for companies of all kinds, has begun operating in Spain following an Early Access Program. Companies and self-employed individuals from a variety of industries, including restaurants and hospitality, professional services, beauty, retail, as well as health and wellness, registered for the company's Early Access Program, which launched in September 2021 with a limited number of beta tester spots. Pastelera Tallon, Valentine, and Hop Hop Hurrah are a few of the businesses in Spain that have previously had access to Square's services in advance.

- In addition to the fully integrated WisePad 3 card reader, Shopify Payments was made available to retail business owners in Spain from February 2022. Now that Shopify POS is easily connected, users may accept all of the most popular payment methods whenever and wherever they choose.

- As per National Statistics Institute (INE) data, May 2022 saw a 1.4% year-over-year growth in retail sales in Spain, following a downwardly revised 1.6 percent increase in the previous month April 2022 and marginally exceeding market expectations of a 1.3 percent increase. Sales of non-food items increased by 0.8 percent as increases in personal equipment purchases (up 24.1%) more than offset decreases in sales of domestic equipment (down 2.9%) and miscellaneous goods (-1.3 %). In the meantime, food sales dropped by 2%. Retail sales were flat every month after increasing by an upwardly revised 5.4 percent the month before.

Cashless Payments are Expected to Register Significant Market Growth

- Card payments are expected to become more prevalent and the economy's reliance on cash will decrease as a result of shops accepting more payment cards and consumers adopting contactless technologies in the upcoming years.

- According to payment services firm Minsait Payments, the total amount of contactless card payments done in Spain rose by 10% in 2021, the highest growth rate recorded in Europe.

- However, the study also discovered that Spain continues to be the European nation with the highest proportion of bank users who still conduct cash transactions (85%) and that the proportion of cash payments is higher for dealings with small and medium-sized businesses (45%) compared to those with bars and restaurants (36%), as well as with public transportation (31 percent ).

- According to a survey released by the Bank of Spain, Spaniards dismissed cash as the primary method of payment during the COVID-19 outbreak and chose debit cards instead. Debit cards were the favoured method of payment for 54.1% of Spaniards in 2020, compared to cash for 359,7% of purchases. However, in Spanish communities with fewer than 100,000 residents, the use of cash increased to 37.5%.

- As per European Central Bank Payments Statistics Report published on June 2022, the credits transfers in initiated electronics segment value around EUR 6.8638 billions in 2021, recorded a growth rate of 18.96% compared to previous year 2020. While there were no e-money transactions recorded from 2014 - 2021.

Spain POS Terminals Industry Overview

The Spain POS Terminals Market is moderately competitive, with a considerable number of regional players. The companies are leveraging strategic collaborative initiatives, and acquisitions to increase market share and profitability.

- March 2022 - Mews, the industry hospitality cloud, recently announced the purchase of POS software creator Bizzon in order to broaden its financial services for hotels and their F&B teams. The Mews Payments product range will now include the Bizzon POS family of products. For hoteliers and their personnel, the purchase, according to the firm, would simplify the PMS and POS experience. Mews believes that by combining reporting and centralizing visitor profiles, its clients would be able to make better judgments regarding their guests as a result of having both technologies in their portfolio.

- August 2021 - Avalon Informatica y Servicios Group ("Avalon") has been fully acquired by Juniper Group, a part of Vela Software and Constellation Software, Inc. Avalon, established in Madrid, creates advanced PoS and ERP systems for gas stations, convenience stores, and gasoline distribution facilities throughout Spain and Latin America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates Of Spain POS Terminals Market

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Improved Wireless Network Infrastructure

- 5.1.2 Increased Data Visibility Due to Cloud POS systems

- 5.1.3 Improved Service Delivery.

- 5.2 Market Restraints

- 5.2.1 Concerns Over Data Security might Restrict Economic Growth.

- 5.2.2 High reliance on Legacy systems

- 5.3 Market Opportunities

- 5.3.1 Rising Consumer Interest in Non-cash Transactions

- 5.4 Key Regulations and Complaince Standards of PoS Terminals

- 5.5 Market Estimates of Number Of POS Terminal for the period of 2017-2027

- 5.6 Market Estimates of Number Of Payments Per POS Terminal for the period of 2017-2027

- 5.7 Market Estimates of Value Of Payments Per POS Terminal for the period of 2017-2027

- 5.8 Commentary on the rising use of contactless payment and its impact on the industry

- 5.9 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Mode of Payment Acceptance

- 6.1.1 Contact-based

- 6.1.2 Contactless

- 6.2 By Type

- 6.2.1 Fixed Point-of-sale Systems

- 6.2.2 Mobile/Portable Point-of-sale Systems

- 6.3 By End-User Industry

- 6.3.1 Retail

- 6.3.2 Hospitality

- 6.3.3 Healthcare

- 6.3.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Worldline

- 7.1.2 NEC Iberica SL

- 7.1.3 NCR Corporation

- 7.1.4 PayPal Zettle

- 7.1.5 VeriFone, Inc.

- 7.1.6 SumUp Limited

- 7.1.7 PAX Technology

- 7.1.8 Sharp Electronics

- 7.1.9 Asseco Group

- 7.2 Market Share of Key Players

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219