|

市場調查報告書

商品編碼

1636443

印度電動車電池分離器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

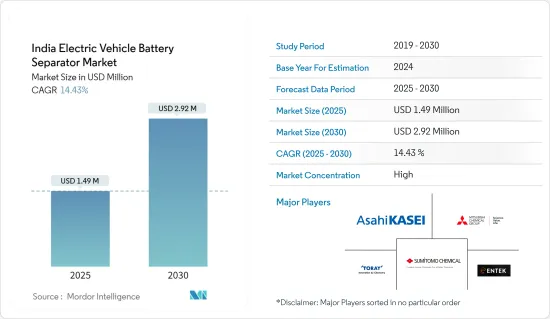

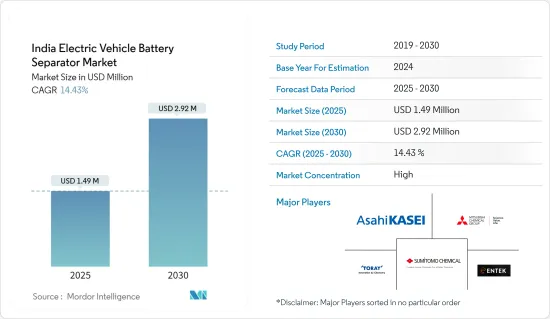

印度電動車電池隔膜市場規模預計到2025年為149萬美元,預計2030年將達到292萬美元,預測期內(2025-2030年)複合年成長率為14.43%。

主要亮點

- 從中期來看,電動車需求增加和政府支持措施等因素預計將在預測期內推動市場發展。

- 另一方面,國內參與者的有限參與可能會阻礙預測期內的市場成長。

- 技術創新和永續材料的開發預計將在未來幾年為市場帶來重大機會。

印度電動車電池隔膜市場趨勢

電動車需求增加

- 印度是世界上排名前五的二氧化碳排放國之一。為了解決緊迫的空氣污染問題,印度政府正積極推行促進電動車(EV)普及的措施。電動車製造商協會 (SMEV) 報告稱,2023 年印度電動車銷量將達到 167 萬輛。

- 希望安裝充電站的企業正在從政府得到明確的訊息。此外,政府還制定了一個雄心勃勃的目標,即到 2030 年所有新車銷售均實現純電動化。

- 到2030年,印度政府的目標是電動車佔私家車銷量的30%、商用車銷量的70%、兩輪和三輪車銷量的80%。這些雄心勃勃的目標正在增加印度對電池的需求,並增加對高品質電池隔離膜的需求,這對於確保電池效率和壽命至關重要。

- 2019年4月,印度啟動了「印度電動車快速採用和製造」(FAME India)計畫第二階段。該措施旨在降低混合動力汽車和電動車的購買價格,特別關注公共運輸(巴士、人力車、計程車等)和私人二輪車。

- 2024年2月,政府宣布FAME II計畫的投資額將從1,000億印度盧比(12.065億美元)增加到1,150億印度盧比(13.874億美元)。該計劃不僅著重於促進電動車的普及,還注重提供必要的充電基礎設施。此外,政府還將補貼獎勵從每千瓦時 10,000 印度盧比提高到 15,000 印度盧比。這些措施預計將顯著加速印度電動車的普及,導致鋰離子電池的需求相應增加。

- 為了應對這種快速成長的需求,電池製造商正在積極安裝電池零件生產設備。例如,印度Himadri Specialty Chemicals於2024年2月宣布計畫興建一座2,000噸/年的鋰離子電池零件製造工廠。該計劃預計耗資 480 億印度盧比(5.791 億美元),預計將在約六年內推出。

- 鑑於電動車產業的動態發展以及對創新和性能的高度重視,電池隔離膜已成為推動印度市場成長的關鍵參與企業。隨著電動車市場繼續呈上升趨勢,對這些關鍵電池組件的需求預計將激增。

鋰離子電池領域佔市場主導地位

- 傳統上,鋰離子電池為行動電話和電腦等家用電子電器產品提供電力。然而,它的作用已經發生了變化,並已成為混合動力汽車和全電動汽車 (EV) 的首選動力源。這種變化很大程度上歸功於電動車的環境效益,它不排放二氧化碳和氮氧化物等溫室氣體。

- 由於其良好的容量重量比,鋰離子電池比其他類型的電池更受歡迎。優越的性能、較長的使用壽命和不斷下降的價格進一步推動了鋰離子電池的採用。鋰離子電池具有高能量密度和長循環壽命,使其成為電動車製造商的首選。在引領全球電動車市場的印度,對鋰離子電池和電池隔離膜的需求正在增加。

- 推動這一趨勢的一個主要因素是鋰離子電池價格的持續下降。在過去的十年中,技術進步、規模經濟和製造流程的改進降低了成本。

- 在全球範圍內,鋰離子電池的價格在過去十年中大幅下降。到2023年,鋰離子電池平均價格將達到每千瓦時139美元左右,比2013年下降82%。

- 彭博新能源財經預測,2025年後電池成本將再次下降。這是因為新的採礦和精製能開始發揮作用,鋰價格走軟。該公司的 2023 年電池價格研究預測,到 2025 年,平均電池組價格將降至 113 美元/千瓦時以下,到 2030 年進一步降至 80 美元/kWh。

- 價格的下降使得在預算內購買電動車變得更加容易,並推動了電動車在印度的普及。隨著越來越多的消費者和企業採用電動車,鋰離子電池的產量和需求迅速增加,進一步激發了電池隔離膜市場的活力。

- 因此,鋰離子電池仍然是印度電動車電池的支柱,推動了對尖端隔膜的需求並鞏固了其市場主導地位。

印度電動汽車電池隔膜產業概況

印度電動車電池隔膜市場正走向半固體。主要參與企業(排名不分先後)包括住友化學、三菱化學集團公司、旭化成公司、東麗工業公司和 Entek International LLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車需求增加

- 政府支持措施

- 抑制因素

- 有限公司的參與

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- Mitsubishi Chemical Group Corporation

- Entek International

- Toray Industries Inc.

- 24M Technologies

- Celgard LLC

- SK Innovation Co. Ltd

- UBE Corp

- LG Chem Ltd.

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 新興電池材料的擴展

簡介目錄

Product Code: 50003710

The India Electric Vehicle Battery Separator Market size is estimated at USD 1.49 million in 2025, and is expected to reach USD 2.92 million by 2030, at a CAGR of 14.43% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, limited domestic company participation is likely to hinder market growth during the forecast period.

- Nevertheless, technological innovations and the development of sustainable materials are expected to provide significant opportunities for the market in the coming years.

India Electric Vehicle Battery Separator Market Trends

Increasing Demand for Electric Vehicles

- India ranks among the world's top five CO2 emitters. In response to the pressing issue of air pollution, the Indian government is actively promoting policies to boost the number of electric vehicles (EVs) on the roads. The Society of Manufacturers of Electric Vehicles (SMEV) reported that India achieved sales of 1.67 million EVs in 2023.

- Entities looking to establish charging stations have received clarity from the government: licensing from the ministry may not be necessary. Furthermore, the government has set an ambitious goal: by 2030, all new vehicle sales will be fully electric.

- By 2030, the Indian government aims for electric vehicles to make up 30% of private car sales, 70% of commercial vehicle sales, and a remarkable 80% of sales for two-and three-wheelers. These ambitious targets are poised to boost the demand for batteries in India and heightened the need for high-quality battery separators, which are crucial for ensuring battery efficiency and longevity.

- In April 2019, India rolled out the second phase of its "Faster Adoption and Manufacturing of Electric Vehicles in India" (FAME India) scheme. This initiative aims to lower the purchase price of hybrid and electric vehicles, particularly focusing on public transportation (like buses, rickshaws, and taxis) and private two-wheelers.

- In February 2024, the government announced a boost in investment for the FAME II scheme, raising it from INR 10,000 crore (USD 1206.5 million) to INR 11,500 crore (USD 1387.4 million). This scheme not only focuses on enhancing the adoption of electric vehicles but also emphasizes the establishment of essential charging infrastructure. Additionally, the government has upped the subsidy incentives from Rs 10,000 per kWh to Rs 15,000 per kWh. Such measures are anticipated to significantly bolster the adoption of electric vehicles in India, subsequently driving up the demand for lithium-ion batteries.

- In light of this surging demand, battery manufacturers are proactively setting up facilities for battery component production. For example, in February 2024, Himadri Speciality Chemicals, an Indian firm, unveiled plans for a lithium-ion battery component manufacturing facility, boasting a capacity of 2 lakh tonnes per annum. The project, estimated at INR 4,800 crore (USD 579.1 million), is set to unfold over approximately six years.

- Given the dynamic evolution of the EV industry, with its strong focus on innovation and performance, battery separators are emerging as pivotal players, propelling market growth in India. As the EV market continues its upward trajectory, the demand for these vital battery components is set to surge.

Lithium-Ion Batteries Segment to Dominate the Market

- Traditionally, lithium-ion batteries powered consumer electronics like mobile phones and PCs. However, their role has evolved, becoming the preferred power source for hybrid and fully electric vehicles (EVs). This shift is largely attributed to the environmental benefits of EVs, which produce no CO2, nitrogen oxides, or other greenhouse gases.

- Lithium-ion batteries are outpacing other battery types in popularity, thanks to their favorable capacity-to-weight ratio. Their adoption is further fueled by superior performance, extended shelf life, and plummeting prices. With high energy density and long cycle life, lithium-ion batteries have become the go-to choice for EV manufacturers. As India spearheads the global EV market, the demand for lithium-ion batteries-and by extension, battery separators-is on the rise.

- A major factor bolstering this trend is the consistent drop in lithium-ion battery prices. Over the last decade, technological advancements, economies of scale, and refined manufacturing processes have driven down costs.

- On a global scale, lithium-ion battery prices have seen a dramatic decline over the past decade. In 2023, an average lithium-ion battery was priced at approximately USD 139 per kWh, marking an impressive 82% drop from 2013 levels.

- Looking ahead, BloombergNEF projects a renewed decline in battery costs starting 2025. This is attributed to the activation of new extraction and refinery capacities, leading to a softening of lithium prices. Their 2023 Battery Price Survey forecasts the average pack price to dip below USD 113/kWh by 2025 and further down to USD 80/kWh by 2030.

- This price reduction has made electric vehicles more budget-friendly, spurring their widespread adoption in India. With a growing number of consumers and businesses embracing EVs, the surge in lithium-ion battery production and demand has further bolstered the market for battery separators.

- Consequently, lithium-ion batteries remain central to India's EV battery landscape, propelling the demand for cutting-edge separators and solidifying their dominant market position.

India Electric Vehicle Battery Separator Industry Overview

The Indian electric vehicle battery separator market is semi-consolidated. Some of the major players (not in particular order) include Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, Asahi Kasei Corporation, Toray Industries, Inc., and Entek International LLC among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Limited Company Participation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 Asahi Kasei Corporation

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Entek International

- 6.3.5 Toray Industries Inc.

- 6.3.6 24M Technologies

- 6.3.7 Celgard LLC

- 6.3.8 SK Innovation Co. Ltd

- 6.3.9 UBE Corp

- 6.3.10 LG Chem Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Battery Materials

02-2729-4219

+886-2-2729-4219