|

市場調查報告書

商品編碼

1636444

中國電動汽車電池隔膜:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

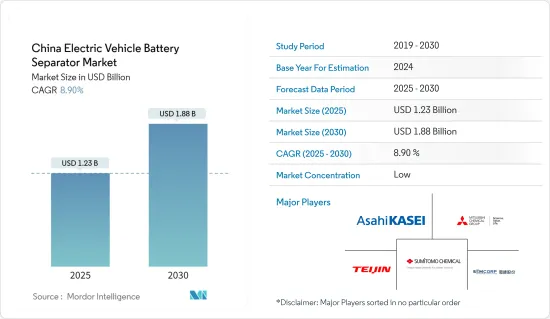

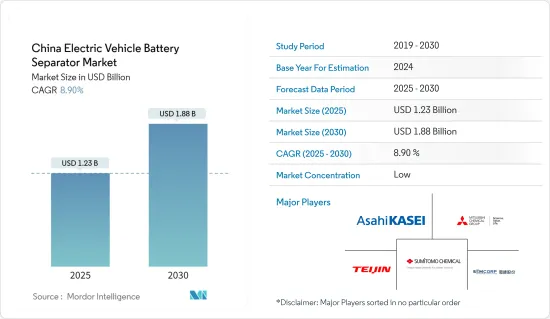

預計2025年中國電動車電池隔膜市場規模為12.3億美元,2030年將達18.8億美元,預測期間(2025-2030年)複合年成長率為8.9%。

主要亮點

- 從中期來看,電動車需求增加和政府支持措施等因素預計將在預測期內推動市場發展。

- 另一方面,供應鏈挑戰可能會阻礙預測期內的市場成長。

- 也就是說,技術創新和永續材料的開發預計將在未來幾年為市場帶來重大機會。

中國電動車電池隔膜市場趨勢

電動車需求增加

- 中國是全球最大的電動車(EV)市場,電動車電池需求的快速成長正在推動電池隔膜市場的成長。根據國際能源總署(IEA)的報告,2023年中國將銷售810萬輛電動車,包括純電動車(BEV)和插電式混合動力車(PHEV)。

- 隨著電動車需求的增加,對提高電池性能的高性能隔膜的需求也在增加。這些隔膜在防止短路和確保電池穩定性方面發揮關鍵作用,特別是當汽車製造商專注於提高續航里程、效率和安全性時。

- 中國的電動車產量佔全球一半以上,並且正在超額完成 2025 年新能源車 (NEV) 的銷售目標。這一飛躍是由政府獎勵和支持政策推動的。

- 例如,2023年6月,為進一步刺激國內電動車銷售,財政部、國家稅務總局、工業和資訊化部聯合成立公佈新的汽車購置稅減免稅政策。該免稅政策將從2024年1月1日起適用,一直持續到2027年12月31日。

- 此外,在政府的大力支持下,中國雄心勃勃的電動車採用目標正在刺激電池製造業的成長。這種快速成長體現在擴大產能、開創性研發以及突破電池技術極限方面的大量投資。

- 2024 年 8 月,中國著名高科技公司小米在北京的第二家電動車工廠破土動工,這是一項引人注目的舉措。根據北京市政府文件顯示,已經在智慧型手機領域佔據主導地位的小米於7月25日拿下土地,並於次日動工。從戰略上講,這個新工廠位於小米第一家電動汽車工廠旁邊。隨著製造商提高產量以滿足電動車不斷成長的需求,電池隔膜的重要性變得越來越明顯。

- 因此,隨著電動車產業以創新和性能為重點的發展,電池隔膜已成為關鍵參與者,推動了中國市場的成長。隨著電動車市場的持續成長,對這些重要電池組件的需求預計將迅速增加。

鋰離子電池領域佔市場主導地位

- 在中國,鋰離子電池領域在快速發展的電動車(EV)生態系統中發揮關鍵作用。到2023年,中國將佔新電動車註冊量的60%。作為全球領先的電動車生產國和消費國之一,中國在鋰離子電池的發展和接受度方面具有至關重要的影響力,而鋰離子電池是電動車的重要能源來源。

- 鋰離子電池以其能量密度和效率而聞名,並依靠高性能隔膜來確保安全性和可靠性。這些隔膜不僅可以防止負極和正極之間的短路,而且可以促進充電和放電過程中的有效離子運動。

- 在中國,聚乙烯(PE)和聚丙烯(PP)等隔膜材料的進步正在提高鋰離子電池的性能、耐用性和熱穩定性。

- 例如,2024年1月,中國科學院近代物理研究所(IMP)和廣東先進能源科學技術研究院(CAS)的團隊推出了一種新型聚對苯二甲酸乙二醇酯(PET)隔膜。該隔膜專為鋰離子電池設計,可承受高溫,直接增強電動車性能和消費者吸引力。

- 值得注意的是,鋰離子電池的平均價格一直在下降,到2023年將達到每度約139美元。自 2013 年以來下降了 82% 以上。預計這一趨勢將持續下去,到 2025 年將降至 113 美元/千瓦時以下,並可能在 2030 年達到 80 美元/千瓦時。隨著鋰離子電池價格的下降和電動車的普及,電池隔膜的需求將會激增。這種需求是由熱衷於最佳化成本和提高性能的製造商所推動的。

- 此外,中國希望將其汽車銷量的 40% 變成電動車,這進一步凸顯了對電動車電池及其零件(包括隔膜)日益成長的需求。

- 因此,由於技術進步、電動車市場的快速成長以及電池價格的暴跌,中國電池隔膜市場預計將大幅擴張。

中國電動汽車電池隔膜產業概況

中國電動車電池隔膜市場較為分散。主要參與者(排名不分先後)包括上海能源新材料科技有限公司(SEMCORP)、帝人株式會社、住友化學株式會社、三菱化學株式會社和旭化成株式會社。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車需求增加

- 政府支持措施

- 抑制因素

- 供應鏈挑戰

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 依電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 依材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Shanghai Energy New Materials Technology Co., Ltd.(SEMCORP)

- Teijin Limited

- Sumitomo Chemical Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Asahi Kasei Corporation

- Entek International

- Shanghai PTL New Energy Technology Co., Ltd.

- Toray Industries Inc.

- UBE Corp

- SK Innovation Co. Ltd

- 市場排名/佔有率分析

- 其他知名企業名單

第7章 市場機會及未來趨勢

- 新興電池材料的擴展

簡介目錄

Product Code: 50003711

The China Electric Vehicle Battery Separator Market size is estimated at USD 1.23 billion in 2025, and is expected to reach USD 1.88 billion by 2030, at a CAGR of 8.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and suppotive government initiatives are expected to drive the market during the forecast period.

- On the other hand, supply chain challanges are likely to hinder the market growth during the forecast period.

- Nevertheless, technological innovations and development of sustainable materials are expected to provide significant opportunities for the market in the coming years.

China Electric Vehicle Battery Separator Market Trends

Increasing Demand for Electric Vehicles

- China stands as the world's largest electric vehicle (EV) market, with the surging demand for EV batteries propelling the growth of the battery separator market. The International Energy Agency reported that in 2023, China sold 8.1 million electric vehicles, encompassing both Battery Electric Vehicles (BEV) and Plug-in Hybrid Electric Vehicles (PHEV).

- With the rising demand for EVs comes an increased need for sophisticated separators that enhance battery performance. These separators play a crucial role in preventing short circuits and ensuring battery stability, especially as automakers focus on improving vehicle range, efficiency, and safety.

- China dominates the global EV landscape, boasting over half of the world's electric automobiles and surpassing its 2025 sales target for new energy vehicles (NEVs). This surge is bolstered by government incentives and supportive policies.

- For example, in June 2023, aiming to further stimulate domestic EV sales, a coalition of the Ministry of Finance (MOF), State Taxation Administration (STA), and Ministry of Industry and Information Technology (MIIT) announced an extension of the "Vehicle Purchase Tax Reduction and Exemption Policy for New Energy Vehicles." This tax exemption, effective from January 1, 2024, is set to continue until December 31, 2027.

- Furthermore, China's ambitious EV adoption targets, underpinned by robust government backing, have catalyzed the growth of its battery manufacturing sector. This surge is evident in substantial investments directed towards expanding production capacities, pioneering research & development, and pushing the boundaries of battery technologies.

- In a notable move, in August 2024, Xiaomi, the renowned Chinese tech titan, broke ground on its second EV plant in Beijing. Documents from the Beijing city authorities reveal that Xiaomi, already a dominant player in the smartphone arena, secured the land on July 25 and promptly initiated construction the very next day. Strategically, this new facility is rising right next to Xiaomi's inaugural EV plant. As manufacturers ramp up to cater to the escalating EV demand, the significance of battery separators becomes increasingly evident.

- Thus, as the EV industry evolves with a keen focus on innovation and performance, battery separators emerge as pivotal players, fueling market growth in China. With the EV market on an upward trajectory, the demand for these critical battery components is set to soar.

Lithium-Ion Batteries Segment to Dominate the Market

- In China, the lithium-ion battery segment plays a crucial role in the burgeoning electric vehicle (EV) ecosystem. In 2023, China accounted for 60% of all new electric car registrations. As a leading global producer and consumer of electric vehicles, China's influence is paramount in the evolution and acceptance of lithium-ion batteries, which are indispensable for energizing these vehicles.

- Lithium-ion batteries, known for their energy density and efficiency, depend on high-performance separators for safety and reliability. These separators not only prevent short circuits between the anode and cathode but also facilitate efficient ion transfer during charging and discharging.

- In China, advancements in separator materials like polyethylene (PE) and polypropylene (PP) have enhanced the performance, durability, and thermal stability of lithium-ion batteries.

- For example, in January 2024, a team from the Institute of Modern Physics (IMP) at the Chinese Academy of Sciences (CAS) and the Advanced Energy Science and Technology Guangdong Laboratory unveiled new polyethylene terephthalate (PET) separators. These separators, designed for lithium-ion batteries, can endure high temperatures, directly boosting electric vehicle performance and consumer appeal.

- Notably, the average price of lithium-ion batteries has consistently fallen, hitting approximately USD 139 per kWh in 2023. This marks an over 82% drop since 2013. Projections suggest this trend will persist, with prices potentially dipping below USD 113/kWh by 2025 and reaching USD 80/kWh by 2030. As lithium-ion battery prices decline, making electric vehicles more accessible, there's a corresponding surge in demand for battery separators. Manufacturers, keen on optimizing costs and boosting performance, are driving this demand.

- Moreover, China's ambition to have 40% of all vehicle sales be electric further underscores the rising demand for EV batteries and their components, including separators.

- Thus, with technological strides, a burgeoning EV market, and plummeting battery prices, China's battery separator landscape is set for significant expansion.

China Electric Vehicle Battery Separator Industry Overview

The Chinese electric vehicle battery separator market is semi-fragmented. Some of the major players (not in particular order) include Shanghai Energy New Materials Technology Co., Ltd. (SEMCORP), Teijin Limited, Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, and Asahi Kasei Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Challanges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shanghai Energy New Materials Technology Co., Ltd. (SEMCORP)

- 6.3.2 Teijin Limited

- 6.3.3 Sumitomo Chemical Co., Ltd.

- 6.3.4 Mitsubishi Chemical Group Corporation

- 6.3.5 Asahi Kasei Corporation

- 6.3.6 Entek International

- 6.3.7 Shanghai PTL New Energy Technology Co., Ltd.

- 6.3.8 Toray Industries Inc.

- 6.3.9 UBE Corp

- 6.3.10 SK Innovation Co. Ltd

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Battery Materials

02-2729-4219

+886-2-2729-4219