|

市場調查報告書

商品編碼

1636460

中東和非洲電動車電池分離器市場佔有率分析、產業趨勢、統計和成長預測(2025-2030)Middle East And Africa Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

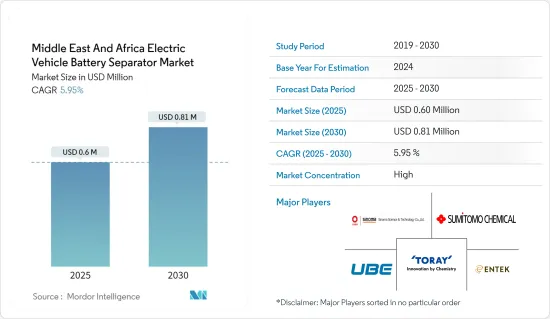

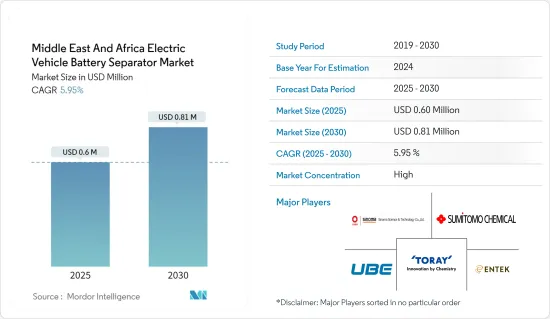

中東和非洲電動車電池隔膜市場規模預計到2025年為60萬美元,預計到2030年將達到81萬美元,預測期內(2025-2030年)複合年成長率為5.95%。

主要亮點

- 從中期來看,電動車的普及和鋰離子電池價格的下降預計將在預測期內推動市場發展。

- 另一方面,該地區原料供需缺口預計將抑制未來市場成長。

- 新興電池技術的不斷進步預計將為中東和非洲電動車電池隔膜市場創造機會。

- 在該地區所有國家中,由於電動車的普及,預計阿拉伯聯合大公國將顯著成長。

中東和非洲電動車電池隔膜市場趨勢

鋰離子電池領域成長迅速

- 在鋰離子電池(LIB)領域的帶動下,中東和非洲的電動車(EV)電池隔離膜市場預計將顯著成長。鋰離子電池因其優越的容量重量比、改進的性能、延長的保存期限和持續下降的價格而變得越來越受歡迎。

- 與鉛酸電池相比,鋰離子(Li-ion)電池具有顯著的技術優勢。鋰離子電池的平均壽命超過 5,000 次循環,而典型鉛酸電池的平均壽命為 400 至 500 次循環。此外,鋰離子電池需要較少的維護和更換,並且在整個放電週期中保持恆定電壓。

- 行業主要企業正在大力投資研發和擴張,以進一步提高績效。競爭的加劇,加上技術的進步和原料成本的降低,大大降低了鋰離子電池的體積加權平均價格。價格從 2013 年的 780 美元/千瓦時暴跌至 2023 年的 139 美元/千瓦時。雄心勃勃的預測稱,2025 年將降至 113 美元/千瓦時,2030 年將降至 80 美元/千瓦時。這些成本降低增加了鋰離子電池在電動車市場的吸引力,並刺激了對電動車電池隔膜的需求。

- 鋰離子電池歷來與家用電子電器產品聯繫在一起,但它們在電動車上的應用正在發生巨大變化。中東和非洲仍處於鋰離子電池製造能力發展的早期階段,落後於中國、美國和歐洲等全球領跑者,但投資領先阿拉伯聯合大公國和沙烏地阿拉伯等國家。這些戰略投資不僅旨在實現經濟多元化,還滿足了對電動車快速成長的需求,為電池材料(包括電動車電池隔膜)的蓬勃發展鋪平了道路。

- 例如,Titan Lithium 與阿布達比哈利法經濟區 (KEZAD) 集團合作,在阿布達比建立了最先進的鋰加工設施,這是一項具有里程碑意義的舉措。這家耗資 50 億澳元的合資企業將在 KEZAD Al Mamorah 建立一座佔地 290,000平方公尺的大型工廠,為電動車行業生產關鍵的電池級碳酸鋰和氫氧化鋰。這些措施將加強該地區的電動車電池供應鏈,並為隔板等電池組件提供利潤豐厚的機會。

- 沙烏地阿拉伯在全球二次電池領域取得了長足的進步。 2023年6月,奧貝坎投資集團與澳洲新興企業European Lithium合作,在沙烏地阿拉伯建立氫氧化鋰精製。此外,國營礦業巨頭 Maaden 正在與美國艾芬豪電氣公司合作,在阿拉伯地盾廣闊的未探勘地區尋找鋰和其他稀有金屬。隨著該地區鋰離子電池供應鏈和製造能力的擴大,這些策略措施將增加對電動車電池隔膜的需求。

- 2023 年 9 月,沙烏地阿拉伯宣布當地投資公司 Energy Capital Group 已與美國科技新興企業Pure Lithium 合作。兩家公司的合資企業將專注於開發來自油田鹵水的鋰電池,初始投資為5,000萬美元。該舉措旨在應對鋰離子電池金屬快速成長的需求,並進一步激活電動車電池隔膜市場。此外,該地區致力於建立永續的鋰離子電池供應鏈,其成為全球電池聯盟的成員凸顯了這一點,這表明電動車電池隔膜的強勁成長軌跡。

- 為了加強非洲的鋰離子電池供應鏈,金屬提煉和回收公司 ReElement Technologies 於 2024 年 2 月與 Afrivolt 簽署了合作備忘錄。該夥伴關係將在非洲創建閉合迴路鋰電池和電動車製造生態系統,重點是由 ReElement Technologies Africa 及其子公司精製的在地採購的關鍵礦物。在可預見的未來,這樣的生態系統有望加強鋰離子電池組件(包括隔膜)的成長。

- Afrivolt(原名 Aqora)正在該生態系統內主導創建鋰離子電池超級工廠。與 ReElement Technologies 的合作備忘錄預計將轉化為強而有力的承購協議,永續支持非洲超級工廠的營運。這些舉措,加上發展當地人才庫的努力,將推動該地區的鋰離子電池產業的發展。

- 鑑於這些動態發展,鋰離子電池產業正在中東和非洲的電動車電池製造中確立主導地位,而電動車電池隔離膜市場預計在未來幾年將大幅成長。

阿拉伯聯合大公國經歷了顯著的成長

- 阿拉伯聯合大公國準備實現電動車 (EV) 電池產業的顯著成長,包括隔膜等重要材料。快速的工業化、電動車採用的快速成長以及阿拉伯聯合大公國的戰略經濟定位正在為強勁的電池採用和創新奠定基礎。

- 近年來,電動車在阿拉伯聯合大公國的普及率迅速提高。根據國際能源總署(IEA)的報告,2023年電動車銷量約28,900輛,較2022年的約18,900輛大幅成長。這種上升趨勢,加上阿拉伯聯合大公國雄心勃勃的目標,即到 2050 年使電動和混合動力汽車佔其保有量的 50%,正在推動電動車電池的需求,特別是關鍵的隔膜材料刺激了需求。

- 根據其永續性目標,阿拉伯聯合大公國正在大力投資電動車基礎設施,以推動電動車的採用。這些努力旨在應對氣候變遷並減少對石化燃料的依賴。因此,對高容量、耐用的電動車電池的需求不斷增加,對高效能電池隔膜的需求也在增加。

- 此外,電池技術的進步,特別是固體電池的出現,正在提高電動車電池的效率、安全性和整體性能。 2024年4月,美國Statevolt宣布計畫在哈伊馬角興建一座耗資32億美元的超級工廠。這項策略性舉措旨在滿足中東/非洲和印度快速成長的電池儲存和電動車市場的需求,並為電動車電池隔膜製造商開闢新的途徑。

- 2022 年初 M Glory Holding Group 宣布成立,進一步凸顯了阿拉伯聯合大公國對電動車製造的承諾。他們計劃在杜拜工業城開設一家大型電動車製造工廠。這座佔地 93,000平方公尺的工廠投資 15 億迪拉姆,目標是每年生產 55,000 輛電動車,增加了對電動車電池及其隔膜的需求。

- 這些戰略舉措使阿拉伯聯合大公國在中東和非洲快速成長的電動車電池製造業中發揮至關重要的作用,凸顯了電動車電池隔膜的關鍵作用。

中東和非洲電動汽車電池隔膜產業概況

中東和非洲的電動車電池隔膜市場正在變得半固體。市場主要企業包括(排名不分先後)Entek International LLC、Toray International Inc.、中材科技、UBE Corporation 和住友化學。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 鋰離子電池價格下降

- 抑制因素

- 原料供需缺口

- 促進因素

- 供應鏈分析

- 產業吸引力-五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料類型

- 聚丙烯

- 聚乙烯

- 其他材料類型

- 地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 奈及利亞

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Entek International LLC

- Toray International Inc.

- Sinoma Science & Technology Co., Ltd.

- UBE Corporation

- Celgard LLC.

- Sumitomo Chemical Co., Ltd.

- Abu Dhabi Polymers Co Ltd(Borouge)

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 新興電池技術的進步

The Middle East And Africa Electric Vehicle Battery Separator Market size is estimated at USD 0.60 million in 2025, and is expected to reach USD 0.81 million by 2030, at a CAGR of 5.95% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the demand-supply gap of raw materials in the region is expected to restrain market growth in the future.

- Nevertheless, the growing progress in emerging battery technologies is likely to create opportunities for the Middle East and Africa electric vehicle battery separator market.

- Among all the countries in the region, the United Arab Emirates is expected to have significant growth due to the increasing adoption of electric vehicles.

Middle East And Africa Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment to Witness Fastest Growth

- The electric vehicle (EV) battery separator market in the Middle East & Africa is poised for notable growth, spearheaded by the lithium-ion battery (LIB) segment. The rising popularity of lithium-ion batteries can be attributed to their superior capacity-to-weight ratio, enhanced performance, extended shelf life, and a consistent trend of decreasing prices.

- When compared to lead-acid batteries, lithium-ion (Li-ion) batteries present significant technical advantages. They boast a lifespan averaging over 5,000 cycles, a stark contrast to the 400-500 cycles typical of lead-acid batteries. Furthermore, Li-ion batteries demand less frequent maintenance and replacements, and they maintain a consistent voltage throughout their discharge cycle-an essential feature for the efficient operation of electrical components.

- Key industry players are channeling substantial investments into R&D and operational expansions to further enhance performance. This surge in competition, combined with technological advancements and declining raw material costs, has driven a notable decrease in the volume-weighted average price of lithium-ion batteries. From USD 780/kWh in 2013, the price plummeted to USD 139/kWh in 2023. Projections suggest a further dip to around USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030. Such cost reductions bolster the appeal of lithium-ion batteries in the EV market, subsequently fueling the demand for EV battery separators.

- Historically linked to consumer electronics, lithium-ion batteries have seen a significant shift in application towards electric vehicles. While the Middle East and Africa are still in the nascent stages of developing their lithium-ion battery manufacturing capabilities-trailing behind global frontrunners like China, the United States, and Europe-nations like the United Arab Emirates and Saudi Arabia are making hefty investments in this domain. These strategic investments not only aim to diversify their economies but also seek to cater to the surging demand for electric vehicles, paving the way for a thriving market for battery materials, including EV battery separators.

- For instance, in a landmark move, Titan Lithium has teamed up with the Khalifa Economic Zones Abu Dhabi (KEZAD) Group to set up a cutting-edge lithium processing facility in Abu Dhabi. This AED 5 billion venture will see the establishment of a sprawling 290,000 square meter plant in KEZAD Al Mamourah, dedicated to producing vital battery-grade lithium carbonate and hydroxide for the EV sector. Such initiatives are poised to bolster the EV battery supply chain in the region, presenting lucrative opportunities for battery components like separators.

- Saudi Arabia is making strides in the global rechargeable battery arena. In June 2023, Obeikan Investment Group joined forces with Australian startup European Lithium to set up a lithium hydroxide refinery in the kingdom. Furthermore, Ma'aden, the state mining giant, has collaborated with US's Ivanhoe Electric to scout vast, under-explored territories in the Arabian Shield for lithium and other rare metals. These strategic moves are set to amplify the demand for EV battery separators as the region's Li-ion battery supply chain and manufacturing capabilities expand.

- Demonstrating its commitment, Saudi Arabia, in September 2023, saw Energy Capital Group, a local investment firm, partner with US tech startup Pure Lithium. Their joint venture focuses on developing batteries from lithium sourced from oilfield brines, backed by an initial USD 50 million investment. This initiative aims to cater to the surging demand for lithium-ion battery metals, further energizing the EV battery separator market. Moreover, the region's dedication to building a sustainable lithium-ion battery supply chain is underscored by its membership in the Global Battery Alliance, signaling a robust growth trajectory for EV battery separators.

- In a bid to fortify Africa's lithium-ion battery supply chains, METALS refining and recycling firm ReElement Technologies inked an MoU with Afrivolt in February 2024. This partnership seeks to craft a closed-loop lithium battery and electric vehicle manufacturing ecosystem in Africa, emphasizing locally sourced critical minerals refined by ReElement Technologies Africa and its subsidiaries. Such an ecosystem is poised to bolster the growth of lithium-ion battery components, including separators, in the foreseeable future.

- Afrivolt, previously known as Aqora, is spearheading the establishment of a lithium-ion cell gigafactory within this ecosystem. The MoU with ReElement Technologies is anticipated to transition into a robust offtake agreement, ensuring sustained support for the operations of African gigafactories. These initiatives, coupled with efforts to nurture a local talent pool, are set to propel the lithium-ion battery industry in the region.

- Given these dynamic developments, the lithium-ion battery segment is on track to emerge as the dominant player in the Middle East and Africa's EV battery manufacturing landscape, heralding a thriving market for EV battery separators in the years to come.

United Arab Emirates to Witness Significant Growth

- The United Arab Emirates (UAE) is on track for significant growth in its electric vehicle (EV) battery industry, encompassing essential materials like separators. Rapid industrialization, a surge in EV adoption, and the UAE's strategic economic positioning are setting the stage for robust battery adoption and innovation.

- EV adoption in the UAE has seen a sharp uptick in recent years. In 2023, the country recorded around 28,900 electric vehicle sales, a notable rise from approximately 18,900 in 2022, as reported by the International Energy Agency (IEA). This upward trend, combined with the UAE's ambitious target of having electric and hybrid vehicles make up 50% of its total vehicles by 2050, is set to fuel the demand for EV batteries, especially critical separator materials.

- In line with its sustainability goals, the UAE is making substantial investments in EV infrastructure and championing EV adoption. These efforts aim to combat climate change and lessen dependence on fossil fuels. Consequently, there's a rising demand for high-capacity, durable EV batteries, which subsequently boosts the need for efficient battery separators.

- Moreover, technological advancements in batteries, especially the emergence of solid-state batteries, are elevating the efficiency, safety, and overall performance of EV batteries. A case in point: In April 2024, US-based Statevolt unveiled plans for a USD 3.2 billion gigafactory in Ras Al Khaimah, targeting an annual output of up to 40 gigawatt-hours. This strategic move is designed to serve the burgeoning battery storage and electric mobility markets spanning the Middle East, Africa, and India, thereby opening new avenues for EV battery separator manufacturers.

- The UAE's commitment to EV manufacturing is further underscored by M Glory Holding Group's announcement in early 2022. They plan to inaugurate a sizable EV manufacturing facility in Dubai Industrial City. With a hefty investment of AED 1.5 billion, this 93,000 square meter plant aims for an annual output of 55,000 EVs, amplifying the demand for both EV batteries and their separators.

- These strategic moves position the UAE as a pivotal player in the burgeoning EV battery manufacturing landscape of the Middle East and Africa, highlighting the crucial role of EV battery separators.

Middle East And Africa Electric Vehicle Battery Separator Industry Overview

The Middle East And Africa electric vehicle battery separator market is semi-consolidated. Some of the key players in the market (not in any particular order) include Entek International LLC, Toray International Inc., Sinoma Science & Technology Co., Ltd., UBE Corporation, and Sumitomo Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Gap of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Force

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Battery Types

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Egypt

- 5.3.5 Nigeria

- 5.3.6 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek International LLC

- 6.3.2 Toray International Inc.

- 6.3.3 Sinoma Science & Technology Co., Ltd.

- 6.3.4 UBE Corporation

- 6.3.5 Celgard LLC.

- 6.3.6 Sumitomo Chemical Co., Ltd.

- 6.3.7 Abu Dhabi Polymers Co Ltd (Borouge)

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Progress in Emerging Battery Technologies