|

市場調查報告書

商品編碼

1636445

南美洲電動車電池分離器:市場佔有率分析、產業趨勢與成長預測(2025-2030)South America Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

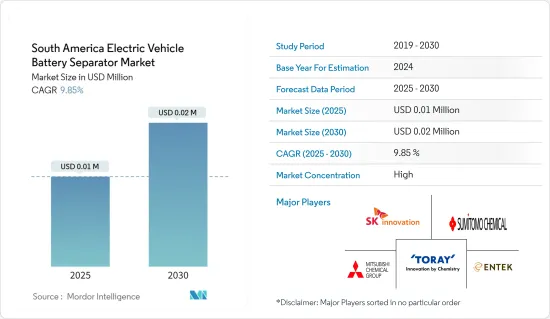

南美洲電動車電池分離器市場規模預計到2025年為1000萬美元,預計2030年將達到2000萬美元,預測期內(2025-2030年)複合年成長率為9.85%。

主要亮點

- 從中期來看,電動車的普及和鋰離子電池價格的下降預計將在預測期內推動市場發展。

- 另一方面,一些國家的壟斷造成的電池材料供應鏈的差異(例如原料短缺和分銷瓶頸)預計將抑制未來的市場成長。

- 其他電池化學材料(例如固體電池、先進鋰離子化學材料和鈉離子電池)的研發進展預計將為未來的市場提供機會。

- 預計巴西市場在預測期內將出現顯著成長,大部分需求來自聖保羅、里約熱內盧和薩爾瓦多等城市。

南美洲電動汽車電池隔膜市場趨勢

鋰離子電池領域可望主導市場

- 電池隔膜是一種多孔膜,對於鋰離子電池至關重要。將正極和負極分開並僅允許鋰離子通過可防止電氣短路。鋰離子電池由於具有能量密度高、循環壽命相對較長、效率高等優點,已成為電動車的主流。

- 近年來,南美洲已成為全球60%以上鋰蘊藏量的樞紐。這導致各國和跨國公司投資在電子設備、行動裝置和電動車電池中使用鋰。

- 根據美國地質調查局的資料,智利、阿根廷和玻利維亞的鋰儲量合計約佔全球鋰蘊藏量的58%。巴西、智利和阿根廷等國家正在迅速增加可再生能源的採用,特別是太陽能。這種再生能源來源需要以鋰離子電池為中心的能源儲存系統,其中隔膜發揮關鍵作用。

- 2023年,阿根廷鋰產量創歷史新高,達9,600噸,與前一年同期比較增加46%。作為全球領先的鋰生產國,阿根廷走在前面。該地區的電動車(EV)正在經歷成長機會,並且存在擴大鋰離子電池和隔膜生產的重大機會。

- 此外,隨著鋰離子電池價格的下降,其在電動車中的採用增加,從而增加了對鋰離子電池隔離膜的需求。 2023年,鋰離子電池組價格將比前一年下降14%,達到139美元/kWh。

- 隨著研究和開發的重點是為電動車開發更穩定、更有效率的電池隔膜,對鋰離子電池隔膜的需求正在上升。

- 鑑於這些動態,鋰離子電池領域預計將在未來幾年引領南美洲電動車電池隔膜市場。

巴西可望主導市場

- 巴西是南美洲最大的經濟體之一,位居世界第13名。從歷史上看,巴西嚴重依賴石油和水力發電來滿足其能源需求,但這種依賴近年來有所發展。

- 近期,巴西政府免除了混合動力汽車和電動車對國產或進口工業產品徵收的IPI(Imposto Sobre Produtos Industrializados)稅。這項措施有望重振電動車市場,並增加對鋰離子電池(LIB)關鍵組件隔膜的需求。

- 由巴西政府主導的Rota 2030計畫旨在提高交通部門的能源效率,並進一步刺激該國的電動車市場。在預測期內,由於製造業對鋰離子電池的需求不斷增加,電動車的採用迅速增加,巴西鋰離子電池市場預計將顯著增強。

- 此外,2023 年巴西電動和混合動力汽車銷量大幅成長。巴西銷量突破94,000輛,與前一年同期比較成長驚人的88.7%。自2006年以來,巴西的銷量已達到222,608輛。這一趨勢預計將推動電動車電池隔膜的需求並推動進一步成長。

- 2024 年 4 月,Sigma Lithium 最終決定將其標誌性「五元零綠鋰」的產量提高一倍,從而成為頭條新聞。產量將從目前的27萬噸/年躍升至驚人的52萬噸/年。本月,該公司開始現場建設活動,調動設備和約 200 名工人,專注於土木工程、地基工程和基礎設施安裝。 Sigma Lithium 計劃在 2024年終將其二期工業運作,並於 2025 年第一季開始生產。

- 透過這些發展,巴西有望引領南美洲電動車電池隔膜市場。

南美洲電動汽車電池隔膜產業概況

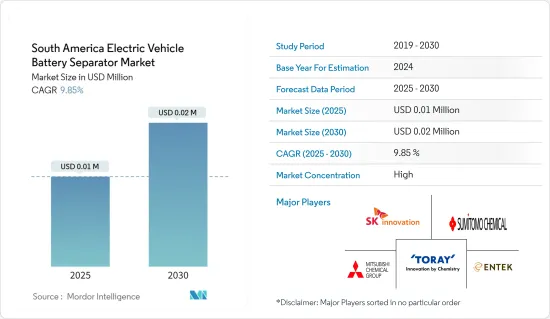

電動車電池隔膜市場正在變得半固體。市場的主要企業包括(排名不分先後)Entek Manufacturing LLC、SK Innovation、三菱化學集團公司、東麗工業公司和住友化學。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 鋰離子電池價格下降

- 抑制因素

- 供應鏈缺口

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 材料

- 聚丙烯

- 聚乙烯

- 其他

- 地區

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Entek Manufacturing LLC

- SK Innovation Co. Ltd

- Mitsubishi Chemical Group Corporation

- Hitachi Chemical Company Ltd

- Toray Industries Inc.

- Sumitomo Chemical Co. Ltd

- UBE Corp

- Teijin Ltd

- Yunnan Enjie New Materials Co. Ltd

- Cangzhou Mingzhu Plastic Co. Ltd

- 市場排名/佔有率(%)分析

第7章 市場機會及未來趨勢

- 活性化其他電池化學研究和開發

簡介目錄

Product Code: 50003712

The South America Electric Vehicle Battery Separator Market size is estimated at USD 0.01 million in 2025, and is expected to reach USD 0.02 million by 2030, at a CAGR of 9.85% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

- Brazil is expected to have significant growth in the market during the forecast period, with most of the demand coming from cities like Sao Paulo, Rio de Janeiro and Salvador.

South America Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- A battery separator, a porous membrane, is vital in lithium-ion batteries. It prevents electrical short circuits by isolating the cathode and anode, allowing only lithium ions to pass through. Due to advantages like high energy density, a relatively long cycle life, and efficiency, lithium-ion batteries have become the predominant choice for electric vehicles.

- In recent years, South America has emerged as a hub, boasting over 60% of the world's lithium reserves. This has attracted investments from various countries and multinational corporations, all keen on harnessing lithium for batteries in electronics, mobile devices, and electric vehicles.

- Data from the United States Geological Survey highlights that Chile, Argentina, and Bolivia together hold about 58% of global lithium reserves. Countries like Brazil, Chile, and Argentina have seen a surge in renewable energy installations, particularly solar. These renewable sources necessitate energy storage systems, prominently featuring lithium-ion batteries, where separators play a crucial role.

- In 2023, lithium production in Argentina hit a record 9,600 metric tons, marking a 46% increase from the previous year. As a leading global lithium producer, Argentina stands at the forefront. With the region's electric vehicles (EVs) poised for growth, there's a significant opportunity to ramp up lithium-ion battery and separator production.

- Moreover, as lithium-ion battery prices decline, their adoption in electric vehicles is set to rise, subsequently amplifying the demand for lithium-ion battery separators. In 2023, lithium-ion battery pack prices dropped 14% from the prior year, settling at USD139/kWh.

- With ongoing research and development focused on creating more stable and efficient battery separators for electric vehicles, the demand for lithium-ion battery separators is on an upward trajectory.

- Given these dynamics, the lithium-ion battery segment is poised to lead the South American Electric Vehicle Battery Separator Market in the coming years.

Brazil is expected to Dominate the Market

- Brazil stands as one of South America's largest economies and ranks as the 13th-largest globally. Historically, the nation leaned heavily on oil and hydroelectricity for its energy needs, but this reliance has evolved in recent years.

- Recently, the Brazilian government exempted hybrid and electric vehicles from the Imposto Sobre Produtos Industrializados (IPI) tax, a levy on domestically produced or imported industrial products. This initiative is poised to invigorate the EV market, subsequently boosting demand for separators, a crucial component of lithium-ion batteries (LIB).

- The Rota 2030 program, spearheaded by the Brazilian government, seeks to enhance energy efficiency in the transportation sector, further energizing the nation's electric vehicle market. As electric vehicle adoption surges, it's set to significantly bolster Brazil's LIB market, given the rising need for LIBs in manufacturing during the forecast period.

- Moreover, 2023 witnessed a remarkable surge in electric and hybrid vehicle sales in Brazil. The nation recorded sales of over 94,000 units, marking an impressive 88.7 percent increase from the previous year. Cumulatively, since 2006, Brazil has seen sales touch 222,608 units. This trend is anticipated to drive demand for electric vehicle battery separators, fueling further growth.

- In April 2024, Sigma Lithium made headlines by finalizing its decision to double the production of its distinctive Quintuple Zero Green Lithium. The production will leap from the current 270,000 tons per year to a staggering 520,000 tons per year. The company has commenced on-site construction activities this month, focusing on earth civil works, foundation, and infrastructure installation, with mobilization of equipment and around 200 workers. Sigma Lithium aims to have its Phase 2 Industrial Plant operational by the end of 2024, with the inaugural production slated for the first quarter of 2025.

- Given these developments, Brazil is poised to lead the Electric Vehicle Battery Separator Market in South America.

South America Electric Vehicle Battery Separator Industry Overview

The electric vehicle battery separator market is semi-consolidated. Some of the major players in the market (in no particular order) include Entek Manufacturing LLC, SK Innovation Co. Ltd, Mitsubishi Chemical Group Corporation, Toray Industries Inc., and Sumitomo Chemical Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other type of Batteries

- 5.2 Material

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek Manufacturing LLC

- 6.3.2 SK Innovation Co. Ltd

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Toray Industries Inc.

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 UBE Corp

- 6.3.8 Teijin Ltd

- 6.3.9 Yunnan Enjie New Materials Co. Ltd

- 6.3.10 Cangzhou Mingzhu Plastic Co. Ltd

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

02-2729-4219

+886-2-2729-4219